Great News Gen-Zers: "Silver Tsunami" Will Trigger Housing Supply As Baby Boomers Die

Image Source: Unsplash

Millennials and Generation Z have been battered by a persistent housing shortage, with the US market currently short 7.2 million homes. However, there may be light at the end of the tunnel for those struggling to afford or even find a home, thanks to an emerging trend known as the "silver tsunami."

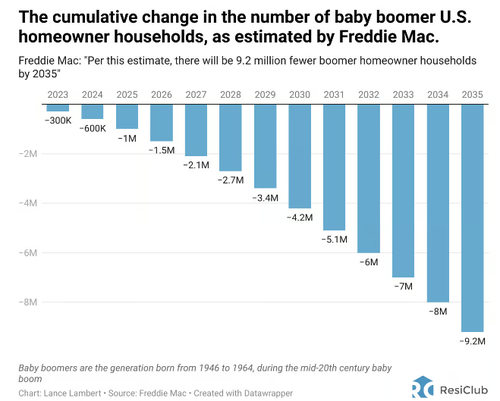

A new report from Freddie Mac estimates homeowners aged 60-plus years (baby boomers) increasingly put their homes on the market as they enter retirement facilities, downsize, and/or estates sell off assets after death. This means the cohort, comprised of about 29% of the adult population and 44% of homeowners, could free up a whopping 9.2 million homes by 2035.

"Over the next five years, the decline is more modest, and we only see a reduction of 2.7 million households by 2028. In this sense, the silver tsunami is more like a tide, with a gradual reduction phasing in over several years. While the number of people aging out of homeownership will increase in the coming years, it is more of an upward sloping trend than a disruptive spike," Freddie Mac economists wrote in the report.

Freddie Mac estimates the silver tsunami will only begin to accelerate by the end of the decade. In 2029, they expect 3.4 million net decline in the number of baby boomer homeowner households. By 2035, the figure could reach well over 9 million.

The report noted: "Given that the housing market is facing a shortage of available single-family homes, the housing decisions Boomers will make in the coming years will have an outsized impact."

More By This Author:

US Bank Crisis Looms As Deposit Outflows Accelerated Last Week, Loan Volumes StagnateBank of America, Wells Fargo Offer Spot Bitcoin ETFs To Clients

Wendy's Walks Back 'Surge Pricing' Report After CEO Comments

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more