FRT: A Retail REIT Targeting Markets With Strong Demographics

Image Source: Unsplash

Federal Realty Investment Trust (FRT) is among the oldest US Real Estate Investment Trusts (REITs) and ranks first in terms of dividend growth. The company focuses on the ownership, operation, and development of high-quality retail properties, from grocery-anchored shopping centers to large-scale mixed-use malls.

FRT’s properties are largely centered in nine major metropolitan markets with excellent demographics: Washington DC, New York, Boston, Philadelphia, Miami, Chicago, Phoenix, Southern California, and Silicon Valley.

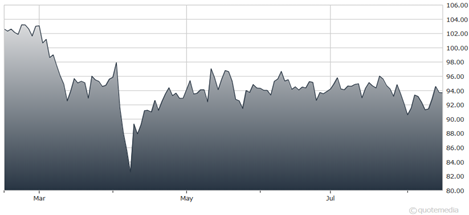

Federal Realty Investment Trust (FRT)

The portfolio is well diversified, with a broad property mix and a wide range of tenants that include TJX Companies, Williams Sonoma Companies, Whole Foods, PetSmart, Apple, AT&T, Verizon, Chipotle, and Gold’s Gym. As of March 31, the portfolio consisted of 103 properties with approximately 3,500 tenants and 3,100 residential units.

Occupancy was a strong 93.6% at quarter-end, with limited troubled retailer exposure. FRT reported Q1 2025 funds from operations (FFO) of $146.5 million, or $1.70 per share, topping analyst estimates by a penny. FFO climbed 7.2% from a year ago.

Quarterly rental income of $309.2 million rose 6.1% year-over-year and was slightly ahead of consensus. Higher operating results were driven by increased same-property operating income and strong leasing activity.

FRT has demonstrated a proven history of delivering solid operating results and the longest record of dividend growth, with 57 consecutive years of increased dividends. FRT’s common shares are suitable for low- to medium-risk tax-deferred portfolios. Dividends are taxed as ordinary income.

Recommended Action: Buy FRT.

More By This Author:

VNT: A New "Buy" In The Industrial Tech SpaceORLY: A Cannibal Stock That You Should Consider

GOOGL: What's Behind Perplexity AI's $34.5B Chrome Bid?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more