Bull Of The Day: Life Storage, Inc. (LSI)

People simply have more stuff than ever before, so much so that there is an entire thriving industry revolving around storing things people don’t have room for. Life Storage, Inc. (LSI) is a standout in the self-storage space and the real estate investment trust’s growth outlook showcases a significant pandemic boost.

Life Storage’s expanding dividend and stable business model make it an even more attractive target amid the current market downturn and rising interest rates, as investors clamor for safety.

Photo by Hans Eiskonen on Unsplash

LSI & The Self-Storage Story

Life Storage opened its first self-storage facility in 1985. Today, LSI is one of the largest self-storage firms in the country, with over 1,000 facilities across roughly 35 states. In total, the company services around 600,000 customers.

Life Storage has been gaining momentum for decades, as Americans continue to buy more and more things, from furniture to electronics. Much of these things end up in self-storage units, which are essentially giant walk-in lockers, that are rented, often on a monthly basis.

Life Storage’s customers include college students and people who live in apartments and condos in big cities, as well as those who have huge homes with basements, and a variety of other clientele. And the self-storage industry was growing long before the pandemic.

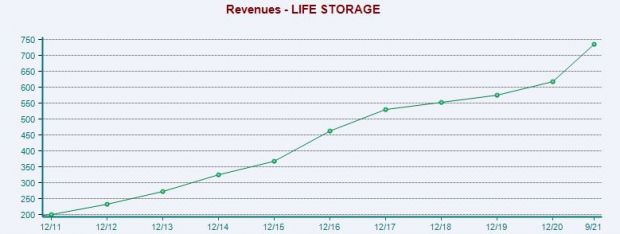

(Click on image to enlarge)

Image Source: Zacks Investment Research

Covid then sent the self-storage sector flying, as Americans reworked their entire lives. This saw people move in mass, buy second homes, purchase big-ticket items, clear out garages and spare rooms, and more. Even businesses utilized storage to keep extra inventory and other essentials. All of this helped the industry and allowed them to raise prices.

Life Storage and self-storage players now have greater pricing power. Crucially, many people will likely end up holding onto their units for a long time for various reasons, one of which is it’s hard for many people to part from items even if they have been in storage for a long time.

Other Fundamentals

Life Storage is a self-administered and self-managed equity REIT that acquires and manages self-storage facilities. The Buffalo, New York-based company has consistently grown its revenue, while slowly expanding its dividend payout. And one of the distinct advantages of owning REITs as part of a well-diversified portfolio is that they must pay at least 90% of their taxable income in dividends to shareholders.

Life Storage in early January raised its dividend by 16% from $0.86 a share to $1.00 per share. LSI’s current 2.99% yield tops its industry’s average and destroys the 10-year U.S. Treasury’s 1.76% and the 30-year’s 2.14%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Life Storage executives are confident its strong cash flow will also help it continue to invest in improving its business, whether that be more properties or better tech offerings. With this in mind, Zacks estimates call for its fiscal 2021 revenue to climb 27% to $781 million, with FY222 projected to jump another 20% higher to reach $939 million. This would come on top of 7% top-line expansion last year and mark its best growth since 2016. And its bottom-line outlook appears almost equally impressive.

We should note that instead of earnings, REITs report funds from operations or FFO, but investors can view them as essentially the same for our purposes. Life Storage’s adjusted fiscal 2021 FFO is expected to climb 26% to $5.01 a share and pop 18% higher to nearly $6.00 per share in 2022.

Life Storage has consistently topped our bottom-line estimates over the last several years and its strong bottom-line revisions help it land a Zacks Rank #1 (Strong Buy) right now.

Price Movement and Valuation

Before we jump into Life Storage’s performance, we should note that the firm in January 2021 announced a three-for-two stock split to help make its shares more broadly appealing to a larger swath of investors by lowering its price per share. LSI stock is up 340% in the past decade vs. its industry’s 63% and the S&P 500’s 260% climb. This outperformance continues over the last two years, with the stock up 77% compared to the benchmark index’s 38%.

In the past 12 months, LSI stock is up 65% to outshine its industry’s 19% and the S&P 500’s 17%. Life Storage shares have gotten caught up in the wave of selling to start 2022, with it down 12% from its December 31 records.

The recent pullback has thankfully recalibrated its valuation in a big way, with the stock now trading at a discount to its one-year median at 22.6X forward 12-months earnings and 23% beneath its recent highs. Life Storage is also trading at only a slight premium compared to its industry and the S&P 500 despite its significant outperformance.

Image Source: Zacks Investment Research

Bottom Line

It’s worth stressing again just how much stuff the average person or family has. Wall Street is also high on Life Storage, with seven of the nine brokerage recommendations that Zacks has coming in at “Strong Buys,” alongside one “Buy” and one “Hold.” And at roughly $134 a share, LSI trades 11% below its current Zacks consensus price target.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more