Best REIT Stocks To Buy That You Never Heard Of

Real estate investment trust (REIT) companies are known for paying a hefty dividend while giving investors the chance to protect their portfolios by adding an alternative investment such as real estate. What are the best REIT stocks to pick up at the end of the trading year?

Investors like adding REIT companies to their portfolios for at least two reasons. First, they pay a hefty dividend, as the dividend yields of these companies are much higher than the norm. Second, real estate is an alternative investment, thus protecting the portfolio from rising inflation.

Here are three REITs to consider buying in the last trading month of the year: Diversified Healthcare Trust, Urstadt Biddle Properties, and Gladstone Commercial Corporation.

Diversified Healthcare Trust

Diversified Healthcare Trust (DHC) is a real estate investment trust company from the United States. It focuses on medical office and life science properties, among others, and it was founded in 1998.

The company pays a hefty dividend, although the five-year dividend growth rate more than halved. Yet, the dividend yield is 1.48%, and the payout ratio is 76.19%.

While the stock price is sharply down on the year, the FFOs or the funds from operations for the next four quarters are expected to increase drastically, from negative $0.04 to positive $0.1. The metric defines the cash flow from a REIT operations and the higher the number, the better.

Urstadt Biddle Properties

Urstadt Biddle Properties (UBA, UBP) is an American real estate investment trust from Greenwich, Connecticut. It owns or has equity interest in more than 5 million square feet of space and it is one of the companies with the longest uninterrupted dividends payment history of over 200 consecutive quarters.

The FFOs are projected to increase sharply in the next four quarters, and the annual revenue estimate for the fiscal period ending October 2022 is $140.19.

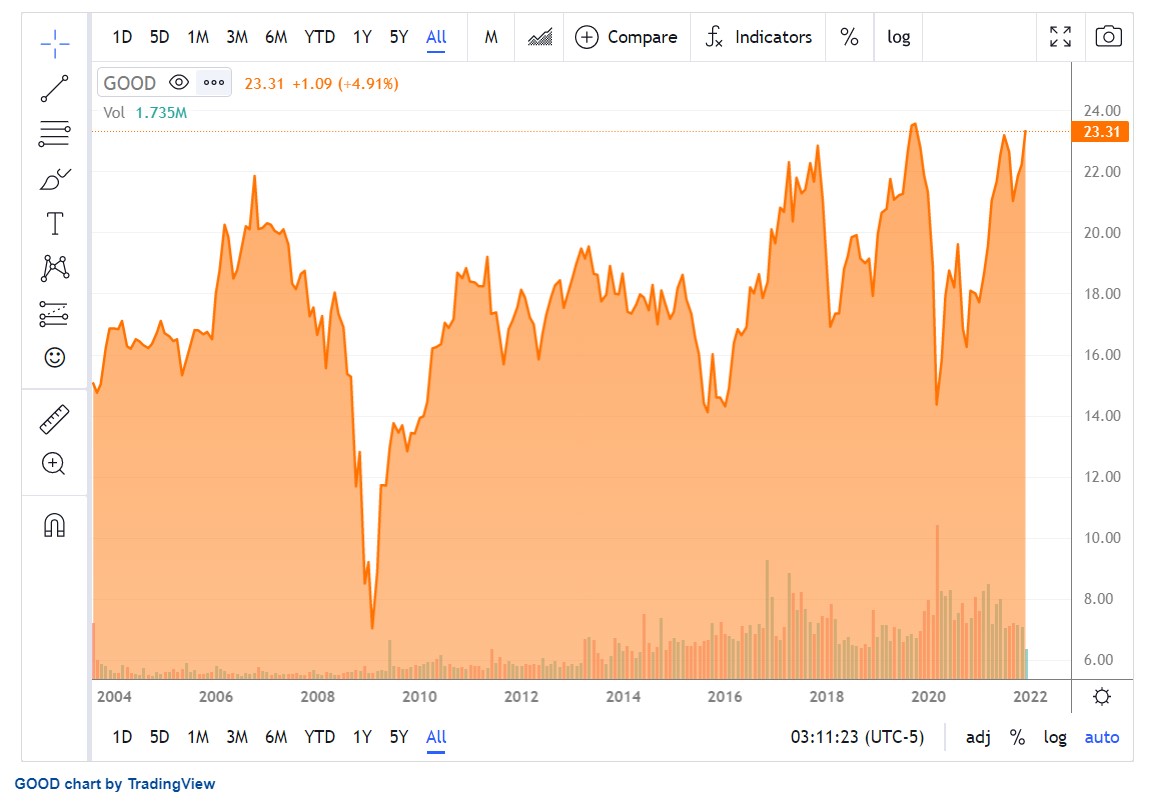

Gladstone Commercial Corporation

Gladstone Commercial Corporation (GOOD) is a diversified real estate investment trust from the United States. It focuses on industrial and office properties across the country and it pays a hefty dividend; the dividend yield is 6.45% and the dividend payout ratio is 95.91%.

Moreover, behind the dividend income, investors enjoyed stock price appreciation in 2021. The stock price is up +29.5% YTD and the annual revenue estimate for the fiscal period ending December 2021 is $137.89 million, expected to reach over $150 million in the following year.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more