Best 3 REITs To Buy To Gain Exposure To Real Estate

REITs are one of the most lucrative investments for those looking for a hedge against inflation and a hefty dividend. Here are three names for your portfolio.

Real estate investment trust companies, or simply REITs, are companies that own income-producing real estate. One of the reasons why investors prefer such companies is to hedge against inflation because real estate is an alternative investment that serves such a purpose.

Another is that REITs are not subject to corporate income taxes if they distribute at least 90% of their taxable income to shareholders. Therefore, REITs are attractive investments for dividend-seeking investors, having one of the highest dividend yields in the market.

Moreover, real estate prices are rising fast. In the United States, the Northeast region is the one with the fastest pace, but other regions may catch up soon. New York is the most valuable city by total real estate value, with close to $3 trillion in estimated value, followed by Los Angeles, San Francisco, Miami, or Seattle.

Here are 3 REITs to buy to gain exposure to US real estate: Spirit Realty Capital, Rayonier, and Blackstone Mortgage Trust.

Spirit Realty Capital (SRC)

Spirit Realty Capital is a REIT from Dallas, Texas, running a portfolio of close to 1,800 properties. It operates a leasable area of more than 35 million square feet in almost all US states, and the office buildings are leased to tenants in more than 25 industries.

The company has a dividend payout ratio of 78.56% and a dividend yield of 5.34%, while the stock price is up +18.92% YTD.

(Click on image to enlarge)

Rayonier (RYN)

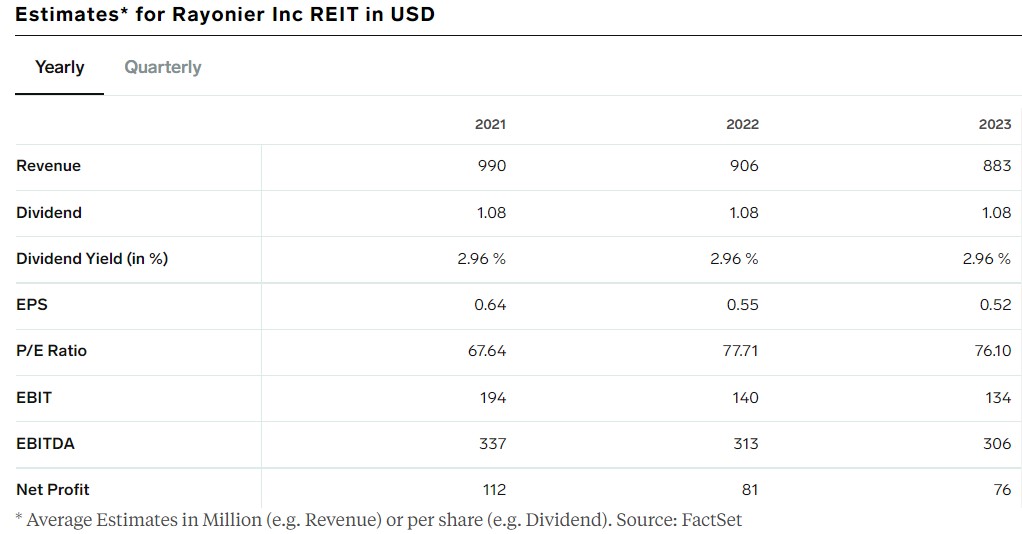

Rayonier is a specialized REIT – it focuses on timberland real estate investment. It invests in softwood timber in the United States and New Zealand, and the company is headquartered in Florida.

It has a dividend yield of 2.96%, and the stock price is up 36.62% YTD. The annual revenue estimate for the fiscal period ending December 2021 is $980.91 million.

(Click on image to enlarge)

Blackstone Mortgage Trust (BXMT)

Blackstone Mortgage Trust is a mortgage REIT from New York. This is a real estate finance company that originates senior loans backed by commercial properties. Besides the United States, it operates in Europe and Australia too.

It has a dividend yield of 7.48%, and the stock price is up +20.41% YTD. EPS are forecast to rise for the next consecutive quarters when compared to the same period last year.

(Click on image to enlarge)

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more