Bear Of The Day: Lennar Corporation

Image Source: Unsplash

Lennar Corporation (LEN - Free Report) is one of the largest U.S. homebuilders. Lennar’s business has been booming for most of the last decade and it certainly benefited from the covid housing push alongside its peers and the likes of Home Depot.

Lennar now faces a rapidly cooling housing market on the back of higher mortgage rates and a natural slowdown after the year-plus covid surge. The company released its fourth quarter FY22 results on December 14 and provided rather downbeat guidance that sent its earnings estimates much lower.

Lennar’s Story

Lennar’s homebuilding operations include the construction and sale of single-family detached homes as well as townhomes and condominiums. The company primarily focuses on homes in communities targeted to first-time, move-up, and active adult homebuyers. Lennar builds homes in roughly 25 states across the country from California and Arizona to Illinois, Georgia, and beyond

Lennar operates other segments within the wider home buying space and aims to help its clients with the entire process from financing and selling their current home to its core building segment. The company’s average sale price was $424K in 2021, up from $394K in 2020.

Lennar then benefit from a strong housing market and higher prices once again in its fiscal 2022 which ended on November 30. Overall, its home sales revenue increased by 25%, with sales driven by an 11% increase in the number of home deliveries and a 13% jump in the average sales price. New home deliveries climbed to 66.4K and its average sale price hit $480K. Homebuilding sales accounted for roughly 95% of total FY22 revenue.

Image Source: Zacks Investment Research

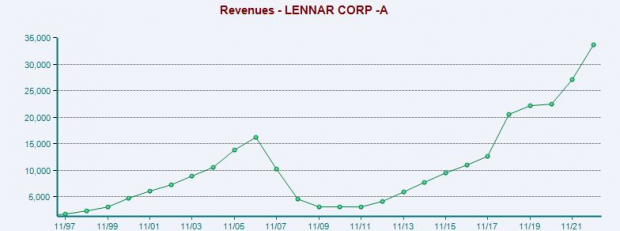

The nearby chart showcases Lennar’s massive spike in revenue in the lead-up to the financial crisis and its boom years from around 2011 onward. But the housing market is cooling and it faces tough-to-compete-against periods.

Mortgage rates earlier this year climbed above 6% for the first time since 2008, up from 2.9% in the summer of 2021. The higher rates make buying homes far more expensive, with the average 30-year fixed-rate mortgage sitting at around 6.3% at the moment. Fresh data out earlier this week showcased that the U.S. housing market slowed for a 10th straight month in November.

Zacks estimates call for Lennar’s FY23 revenue to slide by -15% to $28.74 billion and then stabilize in FY24 to come in around 1.6% higher YoY. Meanwhile, its adjusted earnings are projected to tumble 40% in FY23 from $17.55 per share to $10.50 a share and then pop 7% in FY24.

Image Source: Zacks Investment Research

Bottom Line

The company’s FY23 and FY24 consensus EPS estimates have fallen rather substantially since its Q4 report. The nearby chart showcases Lennar’s sliding Zacks consensus estimates, with FY23 down 17% in the last 60 days and FY24 now 34% lower. These downward revisions help LEN land a Zacks Rank #5 (Strong Sell) right now.

LEN shares have outclimbed its Zacks econ sector over the last 10 years, up 140% vs. 77%. More recently, Lennar had fallen 22% in 2022. This downturn includes a 30% surge in the last six months.

The company does pay a dividend and its valuation is solid. Overall, the stock likely offers long-term potential for those looking to hold Lennar for years and years to come. But the near-term uncertainty likely means investors should be cautious about LEN stock at the moment.

More By This Author:

3 Top Market-Beating Stocks To Buy In December For More GrowthBear Of The Day: Hertz Global Holdings, Inc.

Time to Invest in the Energy Revolution

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more