Banks Have A Big Real Estate Problem But It’s Commercial, Not Residential

Forget about bank doom loop stories over residential mortgages. Instead put the spotlight where it belongs.

Not Residential!

A reader asked me to comment on Peter Schiff: Banks Have a Bigger Real Estate Problem Today Than They Did in 2007.

Banks are more vulnerable to the housing market now than they were in 2007.

Most people in the mainstream will scoff at that statement. They’ll tell you that the situation is very different today. After all, we don’t have a big problem in the subprime mortgage market. We’re not seeing a big spike in defaults. That’s true. The problem is different this time. And it’s actually worse.

So, what’s the problem?

As Peter Schiff explained in a recent podcast, the problem this time is the mortgages themselves.

As Peter points out, a 3% mortgage is a huge asset for the borrower. But it’s a huge liability for the lender. So, defaults would benefit the banks. They could theoretically repossess the home and resell it to somebody else and write a mortgage at a much higher rate.

So, this is a very different crisis. But it’s worse because they’re losing money on every single mortgage they have whether or not they go into default. … So, this is bigger. It is a bigger problem for the banks. They’re losing more money, and they will lose more money now than they did in 2008. That means we’ll need an even bigger bailout. All these ‘too big to fail’ banks have an even bigger problem now than they did then, and it’s going to take an even bigger round of QE to bail them out. The problem is how’s the Fed going to do that when inflation is as high as it is and going higher?

Total Silliness

For starters, banks tend to securitize mortgages they originate or dump them on Fannie Mae.

Second, few will be walking away. There is too much equity for a default crisis as happened in 2007.

Third, the Fed has a liquidity program (BTFP explained below) to help banks paper over losses.

Runs on banks have stopped. If bank runs start again, it will not be due to residential mortgages.

Fed’s Emergency Liquidity Program

BTFP funding data from the St. Louis Fed

The Fed started the BTFP program in the wake of the collapse of Silicon Valley Bank.

Small regional banks overleveraged in long term treasuries and were clobbered by paper losses and then bank runs.

In response, the Fed agreed to shield the banks from losses by offering swaps at par value, ignoring the losses.

BTFP Terms

- Eligible Collateral—Direct obligations of certain U.S. government agencies, including the U.S. Department of the Treasury, government-sponsored enterprises such as Fannie Mae and Freddie Mac, and the Federal Home Loan Banks. In addition, mortgage-backed securities issued and/or fully guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac are eligible.

- Loan Terms—Institutions may borrow up to the value of eligible collateral pledged. Collateral is valued at par, i.e., with no haircuts. Loans can be prepaid at any time without penalty. The rate is fixed for the life of the loan (up to one year) and is calculated by adding 10 basis points to the overnight index swap rate. The rate is published daily on the Discount Window website. Advances will be available until March 11, 2024, or longer if the program is extended.

Liquidity, Not Solvency Issue

This is a liquidity issue, not a solvency issue. The US is not going to default and the treasuries are not worthless. The Fed wanted to stop bank runs and did so by a method that hides losses.

However, the paper losses are still real, even if hidden in reports. This has an impact on banks willingness to make loans in a rising interest rate environment.

For further discussion, please see The Fed’s Emergency Liquidity Program, BTFP, is Over $100 Billion, What’s Going On?

Commercial Real-Estate Doom Loop

The Wall Street Journal reports Real-Estate Doom Loop Threatens America’s Banks, but the loop is commercial.

Bank OZK had two branches in rural Arkansas when chief executive officer George Gleason bought it in 1979. The Little Rock lender today has billions of dollars in commercial real-estate loans, including for properties in Miami and Manhattan, where it is helping fund the construction of a 1,000-foot-tall office and luxury residential tower on Fifth Avenue.

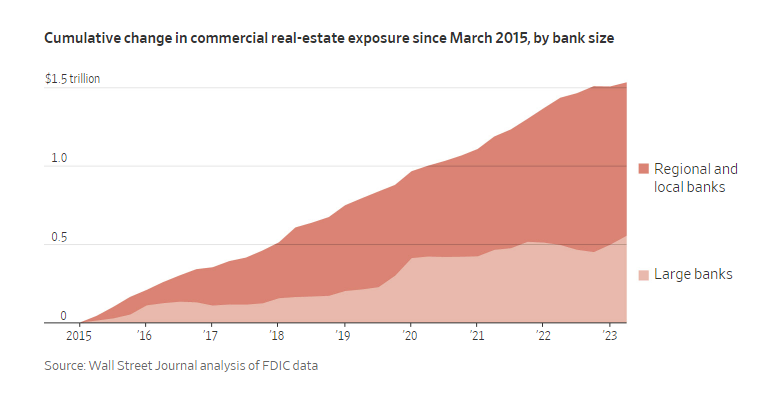

Regional banks across the country followed a similar playbook, gorging on commercial real-estate loans and related investments in big cities over the past decade.

With the commercial real-estate market now in meltdown, those trillions of dollars in loans and investments are a looming threat for the banking industry—and potentially the broader economy. Banks’ exposure is even bigger than commonly reported. The banks are in danger of setting off a doom-loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses.

The doom-loop scenario is starting to play out in big cities where office vacancies have soared. Real-estate investors that are unable to refinance their debt, or can only do it at high rates, are defaulting. The lenders, no longer getting the debt payments, often have to write down the value of those mortgages. Sometimes the bank ends up owning the property.

“The plumbing is clogged right now,” said Scott Rechler, chief executive of real-estate investor RXR. “And that is going to create a backup that will eventually overflow on the commercial real-estate markets and on the banking system.”

US Regional and Small Banks’ CRE Exposure Could Pressure Ratings

Fitch reports US Regional and Small Banks’ CRE Exposure Could Pressure Ratings

U.S. banks with less than $100 billion in assets are more susceptible to deteriorating commercial real estate (CRE) fundamentals than larger banks, which could add to ratings pressure, given their higher relative exposure as a percentage of assets and total capital, Fitch Ratings says.

The tight monetary environment has placed pressure on most CRE properties’ collateral values and transaction volumes while structural changes in demand for office space have adversely impacted occupancy for that asset class. These factors increase credit risk for banks that have CRE loan concentrations, and are expected to have an impact on asset quality in CRE loan portfolios of U.S. banks.

Banks with more concentrated CRE exposure to office markets, particularly those with much weaker vacancy trends, face moderate stress over the near- to medium-term. For example, larger cities, including San Francisco, Houston, Dallas/Ft. Worth, Washington DC and Chicago had high office vacancy rates as of 1Q23.

BTFP Eligible Collateral

Look again at the BTFP eligible collateral. It includes Fannie Mae, Freddie Mac, Ginnie Mae. It does not include commercial real estate, or any other kind of bank loans.

CRE and other types of bank loans are solvency issues.

By shielding mortgages and Treasuries, the Fed contained any residential mortgage crisis.

The big problem for banks is commercial but the residential housing market is in shambles.

How the Fed Destroyed the Housing Market and Created Inflation in Pictures

The Fed has a big problem of its own making on its hands that will make inflation harder to control.

For discussion, please see How the Fed Destroyed the Housing Market and Created Inflation in Pictures.

The Fed destroyed the housing market, but this will have minimal impact on banks. Commercial real estate is the key issue.

More By This Author:

The Cost Of Eating Out Is Skyrocketing, Are You Cutting Back?

CPI Rises More Than Expected As Rent Jumps Another 0.6 Percent

Republicans Nominate Scalise for House Speaker In Secret Ballot

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more