Avoid These Turkeys In Your Stock Portfolio

Turkey is the traditional Thanksgiving fare, and I don’t know anyone who doesn’t like to sit down to a full-spread Turkey dinner on the holiday (OK, my sister the vegetarian is an exception. She just wants her dinner to taste like turkey). However, what we don’t want is turkeys in our stock portfolio. In the case of high yield stocks, those are ones where the dividend payment is at risk of disappearing like the pie on Thanksgiving.

The results from high-yield stock investments tend to have a binary outcome. The reason for the high yield on an individual stock is because there is a market perception that the dividend rate is at risk. You have likely heard the saying that high-yield equals high risk. The outcome for an individual dividend stock will go one of two ways.

One possible outcome is that the market is correct, and the dividend is reduced or eliminated. When this happens, it’s bad news in a stock portfolio. Dividend cuts also typically come with steep share price declines. The other potential outcome is that the market is wrong, and the company continues to pay the current dividend or even grow the payout rate. My research for my Dividend Hunter high-yield stock focused service is focused on finding the second kind of big dividend-paying stock.

Today I want to highlight a few stocks in the first, dangerous to your wealth, group. Many investors pick income stocks just from the yield and don’t analyze the underlying financials to see if a company is positioned to sustain the dividends.

The analysis steps are different in the high-yield world, and if you have not been exposed to the techniques, you will likely end up cursing the idea of investing for yield. Here are three, that if you own them, my suggestion is to sell before the dividend gets cut and you are left with a lot less income and value in your brokerage account.

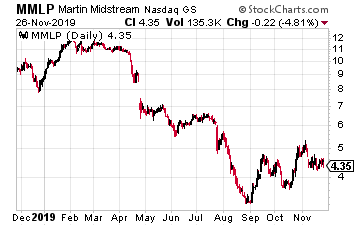

Martin Midstream Partners L.P. (MMLP) is a high-yield master limited partnership. The shares currently yield over 22%. After a decade of dividend growth, the music stopped, and in November 2016, the company slashed its payout by 38%.

You might assume or hope that after the big reduction, the management team would have put itself into a position to support the new lower dividend rate and at some point, resume growth.

It appears that this is not the case. For the first three quarters of 2018, the company generated distributable cash flow coverage of just 76% of the distributions paid to investors.

The dividend was cut again by 50% in April 2019. Distribution coverage was at just 0.84 times in the 2019 third quarter. This MLP is in a death spiral.

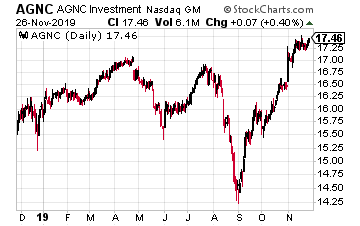

AGNC Investment Corp (AGNC) is the largest of a group of finance real estate investment trusts (REITs) those own portfolios of government agency-backed mortgage-backed securities (MBS).

You will see these referred to as Freddie Mac, Fannie Mae, and Ginnie May mortgage-backed bonds. The challenge for AGNC and all the agency MBS owning finance REITs is taking the 3% yield of these bonds up to a double-digit stock yield.

The step-up in yield is done with large amounts of leverage. An agency REIT will leverage its equity 5 to 10 times with borrowed money. For the 2019 third quarter, AGNC reported a leverage of 9.8 times book value. The problem with this amount of leverage is that a flattening of the yield curve can wipe out the net interest margin and the ability to continue paying dividends.

History has shown that these REITs are better for management compensation than they are for investors looking for stable dividend payments. The AGNC dividend has shrunk by 14% per year on average over the last five years. Ignore the 11% yield and sell.

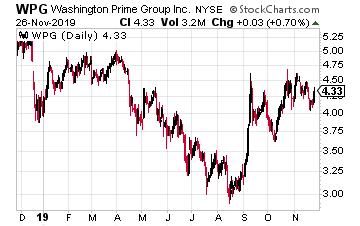

Washington Prime Group (WPG) is a shopping mall REIT on the wrong side of the shopping center great divide. At one end are the successful REITs that own Class A malls, which are 95% plus occupied with successful retailers.

At the other end are the REITs that own malls with fading demographics anchored by declining retailers like Sears and JC Penny. These second-tier malls will require millions in capital spending to make them again attractive to shoppers, and that spending may not do the trick.

Shoppers are fickle, and it may be impossible to draw them back to a near failed mall. It’s easy to tell the difference between the successful mall REITs and the trouble ones.

The good REITs in the shopping center category have yields under 7%. The challenging ones have double-digit yields.

In the case of mall REITs, the high yield is a true danger signal to sell and stay away. WPG yields 24%!

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more

O- bullcrap - just pay up shorties.