Are Hotel REITs Attractive Again?

Many investors are playing the recovery trade, looking for those stocks and companies that are not yet out of the pandemic woods, but should see a substantial improvement in their business results as the economy continues to open. Hospitality and travel-related companies are popular stocks for this investment strategy. However, with the hospitality-related REITs, shares now trade close to or even more than the levels in effect when they were paying dividends.

I have been a fan of lodging REITs in so-called “normal” times. This REIT sector owns hotel properties branded as corporate or independent hotel names. Hotel REITs differ from others in that they participate in the financial results of the hotels they own.

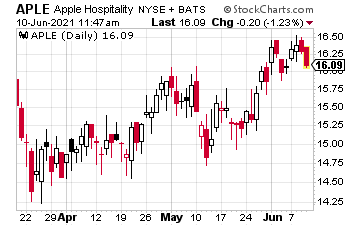

Before the pandemic, hotel REITs provided very attractive dividend yields, with solid coverage of those dividends. For example, Apple Hospitality Trust (APLE) was a long-recommended holding for my Dividend Hunter subscribers that paid monthly dividends with a 7% to 8% yield. Yet, when the pandemic forced the suspension of Apple Hospitality’s dividend, I recommended selling our shares.

When the pandemic hit, hotel revenues dropped to near zero, and the hotel REITs all slashed or suspended dividend payments. Now, with the economic recovery underway, investors wait for dividends to resume. I suspect it will be 2022 before these companies can get back to pre-pandemic dividend levels. However, the markets are pricing the shares as if dividend payments will soon restart.

To analyze a hotel REIT, you only need to look at the revenue per available room (RevPAR) metric. To determine whether one of these REITs can resume dividends, compare the current RevPAR number to what the company reported for the 2019 fourth quarter. Let’s look at three of these companies.

Why not start with our old holding, Apple Hospitality? At the end of 2019, Apple traded for $16.20 per share. For the 2019 fourth quarter, the company reported RevPAR of $85.82 and a modified FFO of $0.32 per share. Of that FFO, $0.30 was paid out as dividends.

Recently, for the 2021 first quarter, Apple Hospitality reported RevPar of $55.09, resulting in $0.04 of FFO per share. This REIT is not close to resuming a meaningful dividend, yet the shares trade for $16.42, which is higher than when the company was earning enough to pay the dividend.

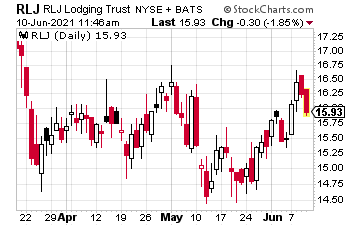

Another REIT I follow, RLJ Lodging Trust (RLJ), now trades for $16.36, close to its $18.00 pre-crash level. For the 2019 fourth quarter, RLJ reported RevPar of $144.51 and FFO of $0.41 per share, handily covering the $0.33 dividend.

For RLJ’s 2021 first-quarter earnings (the company’s most recent), RevPAR was $0.59, resulting in an FFO of minus $0.18 per share. The RLJ results have a long ways to go to match the current share price level.

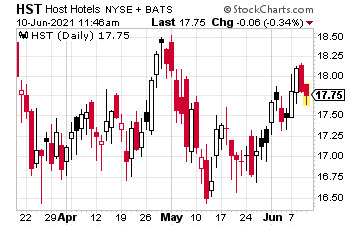

With the largest market cap in the sector, Hotels and Resorts (HST) gathers a lot of investor attention. The current $18.00 share price is above the $17.00 level at which the stock traded before the pandemic. For the 2019 fourth quarter, Hotels and Resorts reported RevPAR of $179.22 and an adjusted FFO of $0.41 per share. The then-current dividend was $0.25 per share. For the 2021 first quarter, RevPAR came in at $61.43, resulting in an adjusted FFO of one cent per share.

My point for this look at lodging REIT results is that these companies are just back to covering expenses and are still a long way from resuming pre-pandemic dividend levels. Investors who jump in now will likely be disappointed. I will keep monitoring this sector’s quarterly results for my subscribers and will probably add a hotel REIT to my recommendations list when a resumption of meaningful dividends is imminent.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more