Arbor Realty Trust: "Fan Favorite" Sporting A 10.8% Yield

Image Source: Unsplash

Let’s welcome back fan favorite Arbor Realty Trust (ABR) to our portfolio. For years, readers have asked about bringing this old flame back into our lives. This could be a good time to do so, spells out Michael Foster, editor of Contrarian Income Report.

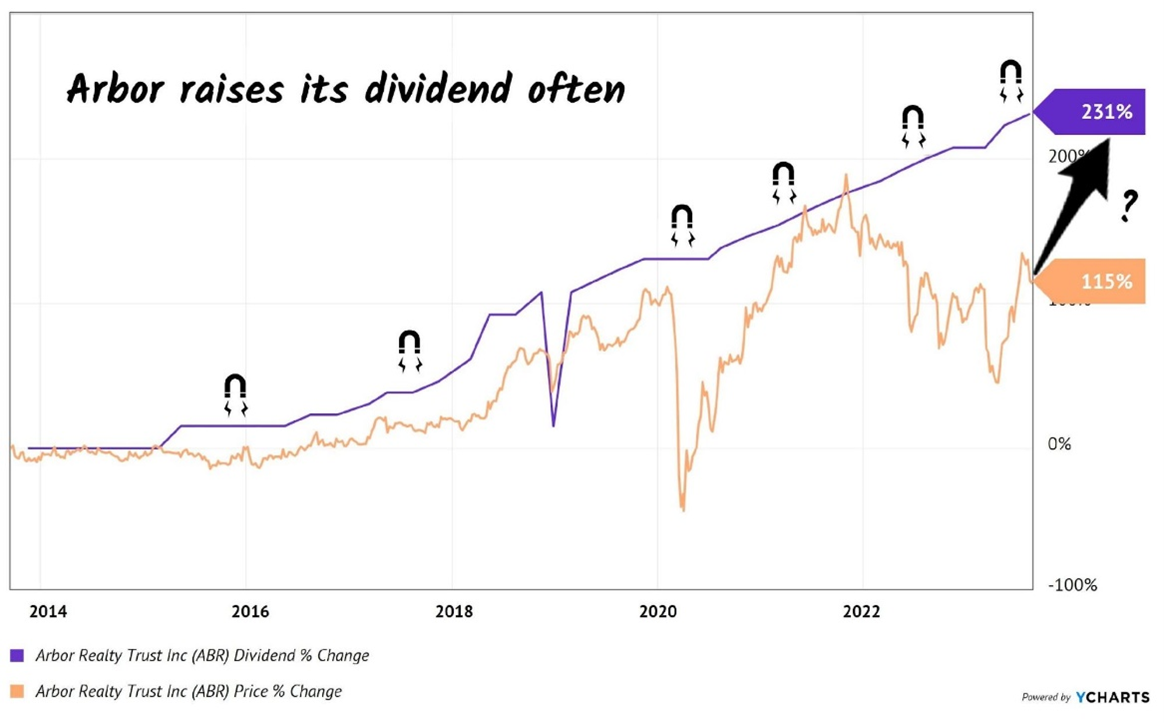

Shares have recently been below their late 2021 highs. Arbor’s dividend, meanwhile, has continued higher. Over the past decade, the company’s payout has popped by 231%. That’s terrific for any stock, let alone one with a 10.8% dividend. Warren Buffett may warn investors that “trees don’t grow to the sky,” but Arbor’s dividend might prove him wrong.

When dividends zoom by 231% over a decade, we expect the stock’s price to reward investors with a similar amount. Dividend raisers tend to have a consistent current yield over time. As a company’s payout climbs, investors pay more for shares. The result is a steady headline yield.

Arbor is a special case. It paid “only” 6.9% back in September 2013. The stock’s doubled (+115%), yet still hasn’t kept pace with the company’s generous dividend increases. Can you spell “upside?”

The result? A 10.8% bargain that we’re buying.

So why is this dividend deal available? Ivan Kaufman founded Arbor 40 years ago as a lender for single-family mortgages. True to its name, the company sent every new homeowner a tree at loan closing.

Mortgage rates sit at 23-year highs today, so fortunately, Arbor is long gone from the residential lending business. But it’s also diversified away from commercial real estate. Which, quite frankly, is the reason the stock is so cheap. “Going to the office” will never be the same after the pandemic. Yet Arbor is wrongly lumped with commercial lenders and landlords. It doesn’t plant in that forest.

Smartly, Arbor has had cash flow diversification wheels in motion for some time. In the mid-2010s, the company made a particularly big bet. At the time, Arbor was only valued at $325 million. Ivan threw down a chunk of change—$250 million—to purchase a commercial mortgage-lending agency and its in-house technology platform.

Ivan didn’t have much margin for error acquiring something close to Arbor’s size. Fortunately, he knew what he was doing. The technology belonged to Arbor Commercial Mortgage, an independent company the big boss had previously spun off from the mothership in 2004.

It was a smart move because it created a new stream of loan servicing income. This grew to one-third of Arbor’s total sales in just two years—a diversified and protected income stream. Today, Ivan refers to this as Arbor’s service income annuity. It amounts to $240 million of annual profits, which equates to $1.20 per share.

ABR’s quarterly dividend is $0.43 per share. This annuity covers two-thirds of it off the bat. Plus, the company still makes money lending. My recommended action would be to look into buying shares of ABR.

About the Author

Michael Foster, PhD, has worked as an equity analyst for a decade, focusing on fundamental analysis of businesses and portfolio allocation strategies. Dr. Foster reports are widely read by analysts and portfolio managers at some of the largest hedge funds and investment banks in the world, with trillions of dollars in assets under management. He received his PhD in 2008 and continues to offer consulting services to institutional investors and ultra-high-net-worth individuals.

More By This Author:

SPY: The Primary Trend Remains UP, So Don't Get Shaken OutSeptember Seasonals Not Great For The Bulls, But Year-End Looking Good

Bull Vs. Bear: Two Competing Stock Market Strategist Takes For 2023 And Beyond

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.