Annaly Capital: "Buy And Hold Forever"

Annaly Capital Management (NLY) as a fantastic opportunity in the current rate environment; indeed, I consider this an income pick that you can buy and hold forever. NLY buys "agency" mortgage-backed securities. These are mortgages where GSEs (government-sponsored enterprises) guarantee the principal. If the borrower defaults, the GSE buys back the principal. The result is an investment with very low credit risk.

NLY buys up these mortgages and increases their returns by utilizing leverage. Since the principal is guaranteed, NLY can borrow funds at very low rates using agency MBS as collateral. NLY profits from the difference in the yield received from the MBS and the price they pay on their borrowings.

One common theme we have seen people say in the comments is that agency mREITs are good "trading" stocks, but not for buying and holding. While we see the appeal to trading them, we think their income-generating power over time is greatly underrated. Investors get this idea because they look at stock charts which show a stock's price over time but do a poor job showing income.

An investor looking at a chart of NLY would see that the recent price is the same as it was in January 2000. They then conclude it is a "bad" investment and go find something they hope will rise so they can sell it. But when you are retired, what do you need from your portfolio more than anything else? Income.

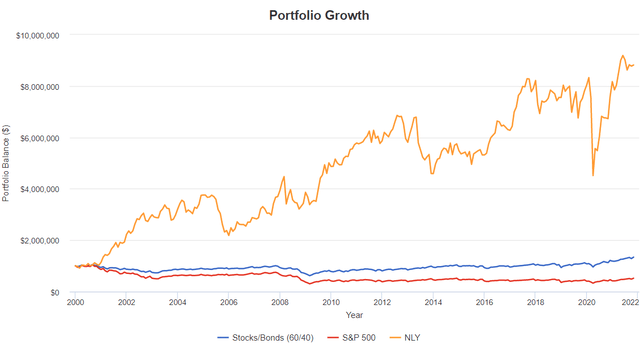

One tool I love for backtesting is "Portfolio Visualizer" because it can show you the impact of withdrawing income from your portfolio. Here is a look at NLY compared to the S&P 500 and a traditional 60/40 equity and bonds portfolio.

The model starts with a $1 million investment and assumes a withdrawal of $40,000 that is increased each year with inflation. You might have heard of the "4%" rule. How does NLY fare?

It isn't even close. After 21 years, NLY is up over $8.8 million, the S&P is down to $520,000, and the 60/40 Stocks/Bonds portfolio is around $1.34 million. Why the massive difference?

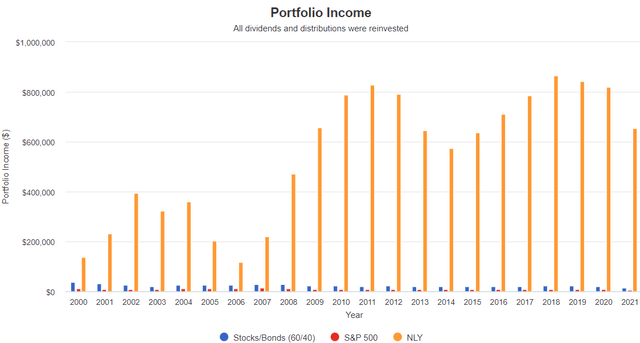

It's all about the income. NLY generates a massive amount of income, even though its dividend has varied over the decades. As the amount of income being withdrawn increased from $40,000 to $61,000 in 2020 due to inflation, the dividends from NLY were consistently much higher, allowing the investor to reinvest the difference.

As a result, by 2020, the investor's NLY portfolio produced $820,000 in dividends for the year. Meanwhile, the S&P 500 portfolio only produced $7,200 in 2020, forcing the investor to sell off yet more shares and the Stocks/Bond portfolio produced $21,000. Nearly three times what the S&P produced, but the investor would still need to sell off $40,000 in holdings to cover their income needs.

So after 20 years, the S&P 500 and the stock/bond portfolio are failing to produce enough income to cover a $61,000 withdrawal, and the investor has to sell off stocks, owning less and less.

Meanwhile, the NLY investment would produce over $750,000 in excess dividends that could be reinvested. Or better yet, give yourself a raise because the investment has outperformed your needs, so feel free to spend on some wants. Remember, the share price is the same. This outperformance came exclusively through dividends.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.