Akre Capital’s 26 Stock Portfolio: Top 10 Holdings Analyzed

Founded in 1989, Akre Capital Management is an asset management firm located in Middleburg, Virginia, with about $15.9 billion in private funds, mutual funds, and separately managed account assets. Chuck Akre Jr., the founder, managing member, CEO, and CIO, is still at the firm’s helm, having delivered exceptional returns to his clients over the years.

Investors following the company’s 13F filings over the last three years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 19.96%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Akre Capital Management’s Investment Strategy & Philosophy

Chuck Akre describes the essence of the company’s investment approach as a “three-legged stool." This metaphoric three-legged stool represents what he and his colleagues are looking for in a potential investment. That is:

- An extraordinary business.

- Talented management.

- Great reinvestment opportunities and histories.

The company believes it differentiates itself from other fund managers in two main ways. The first is that Akre is looking to compound the capital it manages once it has identified that investing in these “extraordinary” businesses, as it defines them, is the best way to achieve its goal. The company is only thinking of selling shares when one or more of its legs of its stool is “broken or injured." Hence, the fund is not looking to trade or sell its shares based on price movement alone.

The second is that Akre likes to take the opportunity to exploit Wall St.’s obsession with quarterly misses and buy companies that trade at very attractive valuations based on their book value during the Street’s “penny-misses” selloffs.

These principles have remained true and have helped Akre and his team’s investments lead to superior returns. This is not only visible in our calculated 13F returns but also in the company’s mutual fund, which is publicly traded under the ticker (AKREX). Investors looking to let their funds compound under Mr. Akre’s long-term tested and superior leadership are better off investing in this fund instead of trying to copy the 13F’s individual holdings.

Source: Google Finance

Akre Capital Management’s Portfolio & 10 Largest Public Equity Investments

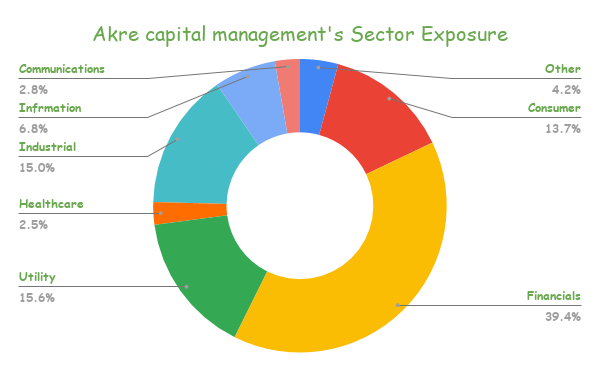

Akre Capital Management’s public-equity holdings consist of 26 individual equities, mostly allocated in the Telecommunications, Industrial, Financials, and Consumer Discretionary sectors.

Source: Author, Company Filings

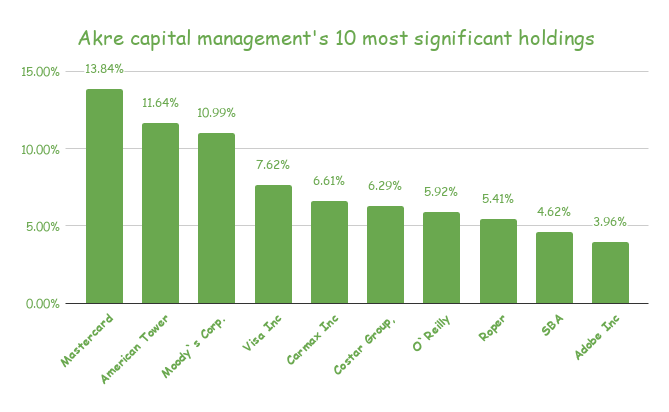

The portfolio is fairly diversified, with no stock exceeding 15% of its total weight, though the first 10 holdings do comprise around 77% of it. The fund made almost no changes from its previous quarter’s holdings.

Source: Author, Company Filings

Mastercard Incorporated (MA)

Akre’s largest holding is one-half of the dominating global payment processors duo. Along with Visa (V), they have been dominating the space. Benefiting from what is essentially a duopoly, Mastercard has been delivering exceptional returns for years as the company has been tapping fully into the going-cashless trend.

COVID-19 has indeed impacted its payment processes volumes, and hence its financials. Despite that, the company remains a cash cow, has high margins, and focuses greatly on shareholder returns with a bold combination of stock buybacks and dividend growth. The company should continue benefiting from the possible outcome of a cashless society.

Akre has been holding shares since early 2010, confirming management’s philosophy of what a “forever-holding” looks like, as the company’s three-legged stool remains robust.

Mastercard reported its Q4 results recently, achieving $4.12 billion in revenues, which is still lower on a year-over-year basis, though it is improving. The company’s net income margins remain at jaw-dropping levels, around 43.3%, helping Mastercard achieve incredible profits despite its pressured top line. However, with high-quality companies attracting sky-high valuations nowadays, the stock has recently been trading at 47 times its forward net income. Hence, investors must be aware of the possibility of valuation headwinds ahead.

American Tower Corporation (AMT)

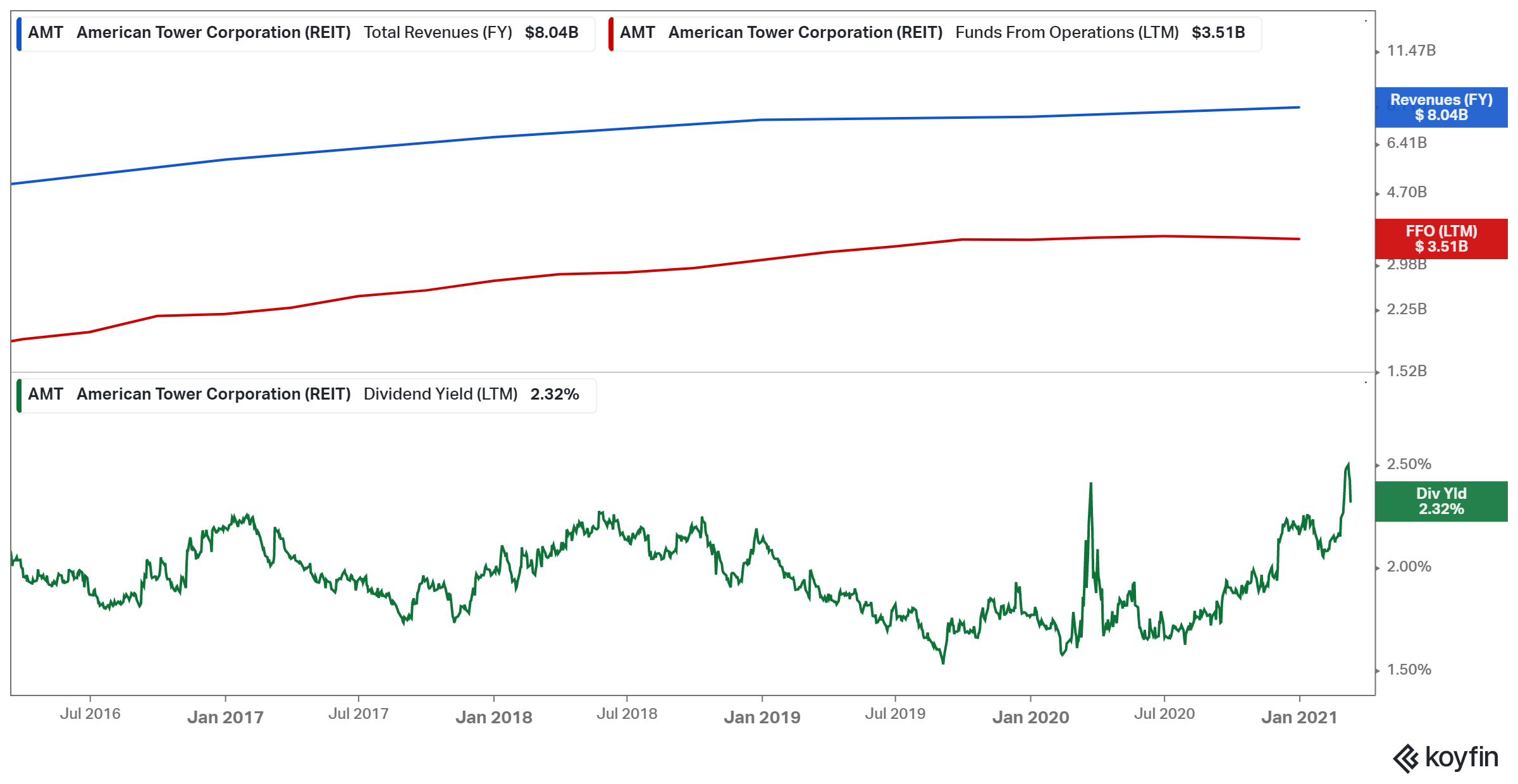

American Tower Corporation is not just another REIT. It’s the U.S.’s largest REIT by a wide margin. The $96 billion telecom tower provider has been benefiting from the recurring nature of its cash flows, expanding its reach continuously. The company is enjoying positive catalysts ahead amid 5G’s ongoing rollout.

Akre has held shares in the company since 2001. Twenty years later, the company is its second-largest holding, as Akre owns around 1.5% of the total shares outstanding. It’s one of the company’s most successful long-term investments and another example of its philosophy fully practiced.

Due to its critical infrastructure assets, American Tower achieved all-time high revenues during 2020 despite the ongoing pandemic. Additionally, the company increased its annual dividend once again, this time by 19.8%, while still retaining a healthy payout ratio of just 53%. American Tower is a truly resilient REIT with favorable catalysts ahead. Therefore we can see why Akre holds the company in such high regard.

It’s worth noting that shares have recently been trading at the higher levels of their historical dividend yield range, which may signal an attractive entry point for dividend growth investors.

Moody’s Corporation (MCO)

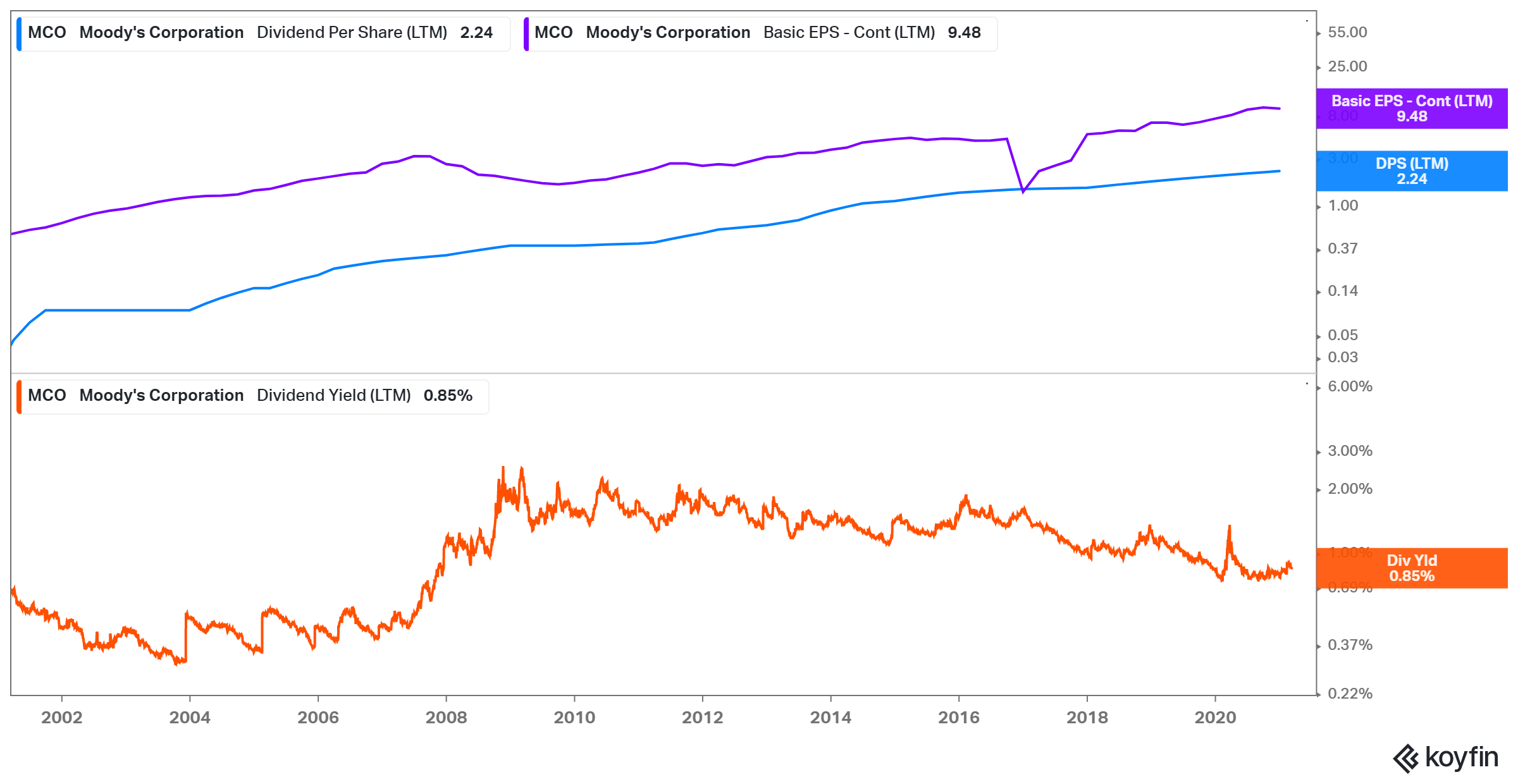

Buffet-backed Moody’s is one of the well-known credit rating providers. The company enjoys extremely secure cash flows amid its essential services. A potential recession is even likely to increase demand for its credit-rating services. For context, the company kept increasing its dividend even under the global financial crisis. While a rapid dividend grower, Moody’s is also executing aggressive buybacks, which make for a significant EPS booster over time.

Akre owns around 3% of the company and has been holding the stock since 2012. The company’s dividend is well-covered, though the stock’s yield stands below 1%, as management prefers to return Moody’s excess by repurchasing and retiring its own stock. Investors should expect the majority of future returns to be in the form of capital gains as a result.

Visa Inc. (V)

The second half of the global payment processor duopoly, Visa, is Akre’s fourth largest holding. The fund’s love for the two companies is clear, as they collectively account for more than 20% of its total portfolio. With a combination of aggressive buybacks, double-digit dividend growth, and a business model with an incredibly moat, Akre is set to continue benefiting as Visa takes on the cashless-society trend by storm.

Akre has been holding Visa since 2012, once again executing on its long-term philosophy.

Similar to Mastercard, Visa’s revenues have not fully recovered to their pre-pandemic levels, as retail locations globally have remained mostly closed. Despite that, Visa’s profitability has also remained robust due to its capital-light business model. While Visa is one of the highest-quality tech stocks, it’s not a cheap one. At 41 times its forward net income, current investors are paying a hefty premium for the payment-processing giant.

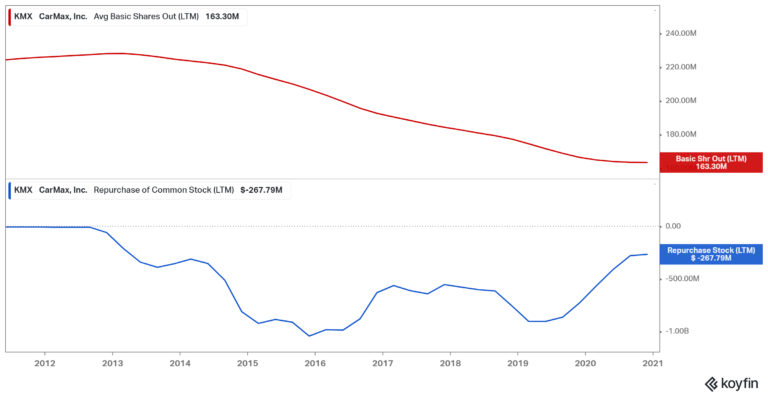

CarMax, Inc. (KMX)

CarMax operates as a retailer of used vehicles in the United States. The company has been expanding its footprint over the past few years, which has been reflected in its top and bottom-line growth as well as in its rising stock price. While its operations differ from those of O’Reilly (ORLY), which Akre also holds, the company employs a similar capital return policy, having never paid a dividend and only buying back stock. CarMax has retired around 40% of its stock since 2012.

Akre has been holding shares since 2013, currently owning around 4.6% of the company.

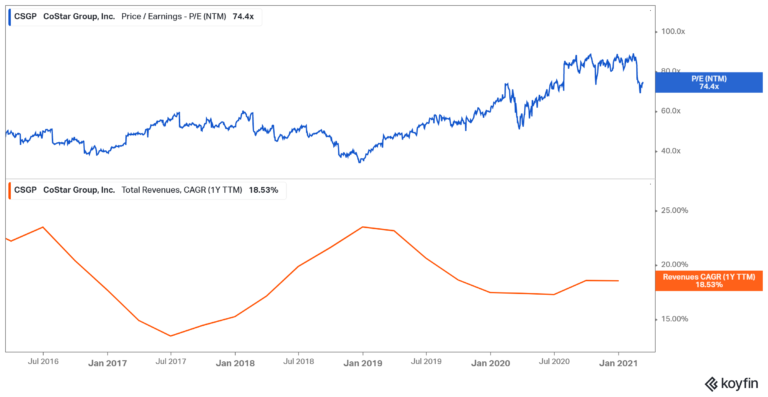

CoStar Group, Inc. (CSGP)

The real estate information provider king, CoStar, is Akre’s fifth largest holding. The company’s stock has been on a non-stop rally for decades, essentially monopolizing its industry. With a continuous client expansion trajectory, incredible margins, and a AAA management team, shares have been rewarding shareholders for years.

The stock may seem quite expensive, with a forward P/E ratio of around 74, but almost all quality growth stocks hold elevated valuations right now. Considering the company’s monopolist nature, robust top-line growth, which has consistently averaged around 20% annually, and potential for its economies of scale to boost profitability substantially in the medium-term, we believe that the expanded valuation is actually quite reasonable.

Akre owns around 2.4% of the company. The holding is relatively new compared to the rest of its portfolio, as the position was initiated in late 2019.

O’Reilly Automotive, Inc. (ORLY)

O’Reilly Automotive is an automotive aftermarket parts and tools supplier. The $33.2 billion company (by market cap) is not particularly disruptive, employing a relatively “boring” business model. What makes its stock unique, however, is the way management chooses to allocate its capital.

Management has been obsessed with repurchasing the company’s stock, which is its only capital return method. To highlight the scale of its repurchasing programs, the company has bought back half of its shares outstanding over the past decade.

Due to its non-stop buybacks, Akre has ended up owning around 2.5% of the company. It has owned shares since 2005.

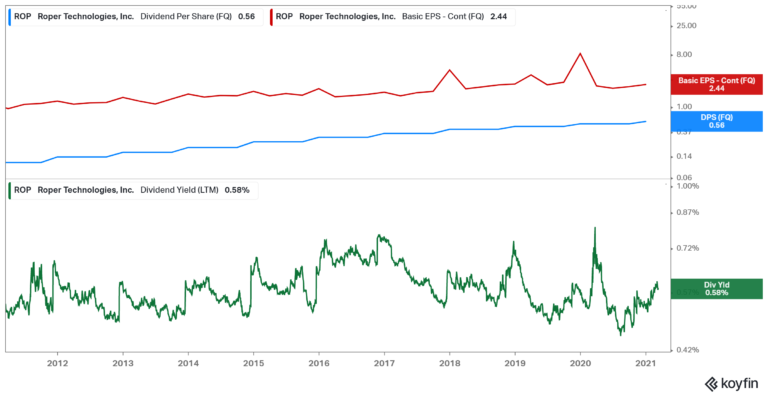

Roper Technologies, Inc. (ROP)

Roper Technologies produces and develops software and engineered products and solutions worldwide. The company has two unique characteristics. The first is that it is a Dividend Aristocrat, boasting 28 years of annual dividend increases.

The second is that it is the lowest-yielding Dividend Aristocrat, despite growing its annual dividend by a 10-year CAGR of nearly 20%. The company enjoys recurring cash flows, a world-class management team, and displays Akre’s stock-picking strategy in action.

The fund has been holding shares since 2014. It held its position steady during the last quarter.

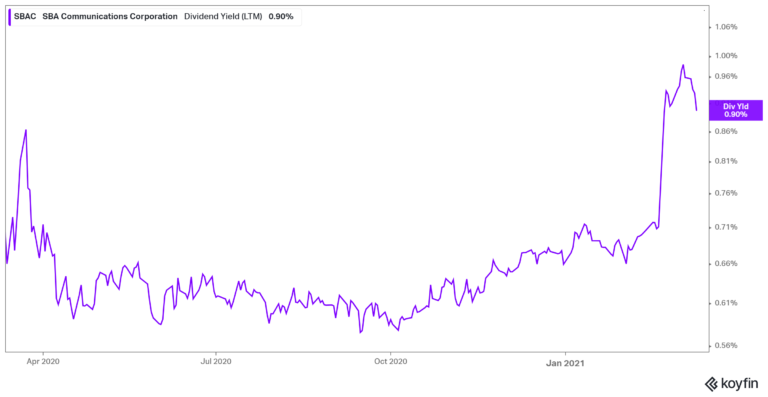

SBA Communications Corporation (SBAC)

As with American Tower Corp., Akre has been holding SBA for years, initially purchasing stock in 2014. SBA has been one of the best performing REITs over the past decades, enjoying the ultra-secure, inflation-resistant, recession-proof cash flows coming from the telecom giants.

Despite being a REIT, the company used to reinvest all of its net income. Hence, dividends began only relatively recently. Shares currently yield an underwhelming 0.9%, though investors are mostly into the stock for its future growth, despite its REIT categorization.

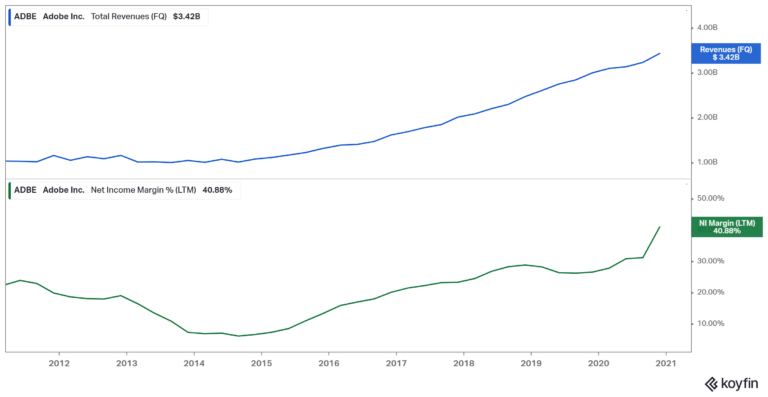

Adobe Inc. (ADBE)

Akre’s tenth largest holding is digital media software giant Adobe. The company has essentially monopolized the editing-media-software market, with its famous suite of SaaS products, including Photoshop, After Effects, Lightroom, etc. Since the company switched its products to a subscription service, its revenues have become recurring, while the growing media market has been pushing its financials higher by the quarter.

As a result, since 2014, Adobe has not posted a single quarter whose revenues were lower than its previous one. As Adobe acquires new customers, the company gains new streams of additional recurring revenue which have a massive lifetime value amid the products’ essential nature for digital creators.

Akre bought shares in the company as recently as Q1-2020, missing the stock’s prolonged rally over the past decade. However, judging by the fund’s apparent excellent stock-picking skills, it could also indicate that Adobe has plenty of more room to run in the future.

Final Thoughts

Akre Capital Management is one of the most compelling funds we have analyzed, showcasing mind-blowing returns, not only due to their impressive rate but also due to their incredible consistency. Mr. Akre’s philosophy is evident everywhere in the fund’s holdings, which makes for an excellent management team that keeps its promises and stands true to its word.

For individual investors, while individually picking some of the fund’s holdings may also be a viable strategy, the company’s publicly-traded mutual fund could be the best long-term option, which also requires the least effort.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more