AGNC Investment Corp.: Can This 14% Yielder Finally Afford Its Dividend?

AGNC Investment Corp. (Nasdaq: AGNC) is popular with income investors because of its fat 14.4% dividend yield. The company is a real estate investment trust that invests in pools of mortgages that are backed by government-sponsored organizations like Freddie Mac and Fannie Mae.

I covered the stock twice in 2024, giving it an “F” rating both times.

In January 2024, I wrote that it had “about as bad a dividend history as I’ve seen” and said the dividend was “at great risk of being cut.”

Then, in November, I called the dividend “extremely unsafe and a strong candidate for a cut.”

At the time, AGNC was coming off of a year with negative net interest income (NII), the measure of cash flow that we use for mortgage REITs. It was expected to post another negative number in 2024.

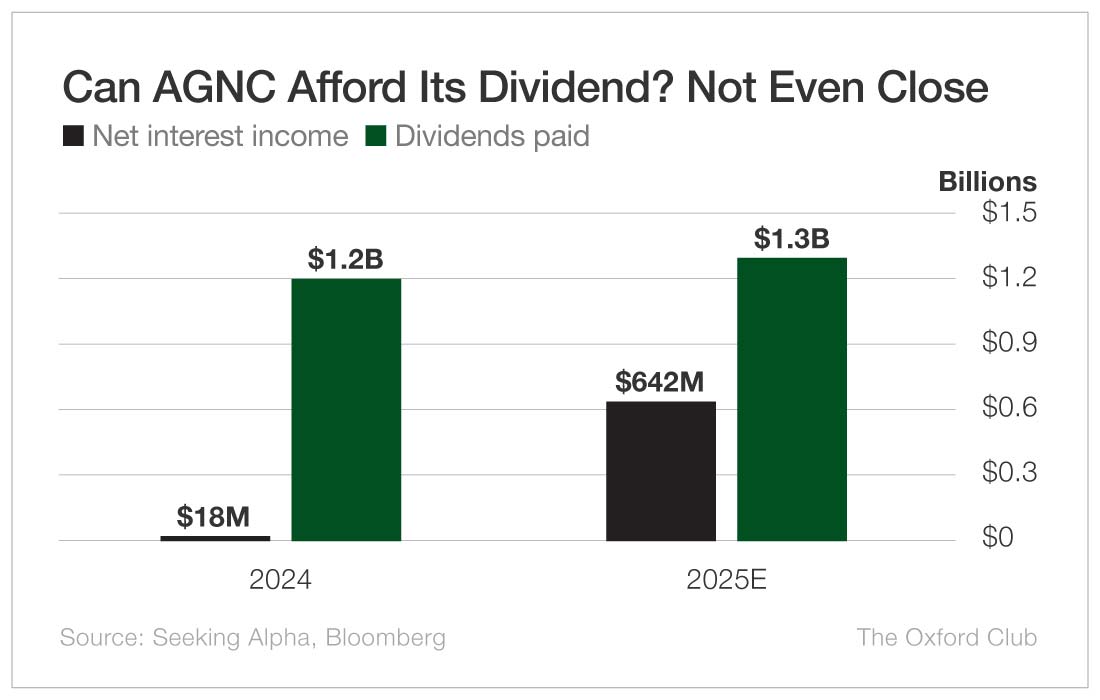

Instead, the company generated $18 million in positive net interest income. However, it paid out $1.2 billion in dividends.

That’s like if you made $18 and gave your buddy $1,200. You might be a hell of a friend, but it’s not smart or sustainable.

This year, net interest income should be much improved at over $600 million, but dividends paid are expected to be more than double that figure at over $1.3 billion.

AGNC has slashed the dividend three times over the past 10 years. The last one was in April 2020, right as the pandemic was kicking in. The $0.12 per share monthly payout that was established then has remained the same since. That track record shows us that management is willing to slash the dividend when necessary – and it certainly seems necessary now.

With three recent dividend cuts and an expected dividend payout that is still miles above the amount of net interest income the company generates, AGNC’s dividend remains very unsafe.

Dividend Safety Rating: F

More By This Author:

The Problem With “Buy Low, Sell High”

General Mills: How Safe Is This Beloved Company’s Dividend?

BCE: A Telecom Giant With A 5.4% Yield