AGNC: A High-Yielding Mortgage REIT To Check Out

Image Source: Pixabay

New construction is slowing. Permits and housing starts are both down sharply. In many markets, there just aren’t enough houses to buy — a supply shortfall that’s persisted for years. While housing inventory is finally rising in some regions, it’s still 13% to 14% below pre-pandemic levels nationally.

That leads to the Econ 101 Effect: When there’s not enough of something, and demand holds steady or rises (as it has over the past few years), the price of that “something” rises. The median US home price is about $443,000 — up 60% since 2019. That’s created a major affordability crisis in US housing.

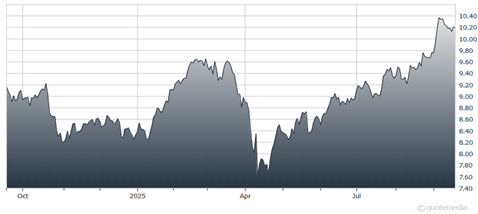

AGNC Investment Corp. (AGNC)

So what’s this got to do with yesterday’s Fed meeting? Simple: Mortgage rates are the key catalyst for housing-market health. This week’s rate cut won’t directly impact mortgage rates — it’ll be a more-indirect process. And mortgage rates are an issue.

Thanks to the massive refinancing wave of 2020-2021 – when mortgage rates dipped below 3% — an estimated 85% to 90% of Americans holding mortgages have rates below 5%. That’s created something called the “Mortgage-Rate Lock-In Effect,” where folks with those low fixed rates find themselves stuck in their current house and disincentivized to sell.

So, why do I like AGNC? It’s got a 14.2% yield. The price has held up well. Plus, it should benefit from falling rates down the road and an (eventual) rebound in housing.

In sum, AGNC adheres to our “real income” storyline. We tell folks to think of income more like cash flow — and to understand how much “real money” goes into your pocket after taxes, inflation and comparative market rates.

Recommended Action: Buy AGNC.

More By This Author:

Affiliated Managers Group: An Asset Management Play With Strong Wall Street SupportMining Stocks: Three Places To Find The Biggest Potential Gains

What’s Really Powering The Rally In Stocks And Metals

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more