A Real Estate Play For The AI Boom

Photo by Steve Johnson on Unsplash

In 1984, the band Alabama sang:

“If you’re gonna play in Texas,

You gotta have a fiddle in the band.”

While Texas may still have some down-home music, today the Lone Star State is known for big business. Oil is a major industry, and the state is attracting billionaires – and their companies – in droves. Furthermore, it is home to 405 data centers, with another 445 under construction. Both figures are the second-most in the country.

If you were going to pen a song about Texas today, instead of talking about a fiddle, it might be more appropriate to write about the business climate:

“If you’re gonna build a data center,

You gotta have a little bit of land.”

Or maybe a lot of land.

There are tons of ways to play the AI boom – and it is a boom, with more than 3,000 data centers currently being built (which represents 75% growth over the 4,000 that are already in operation). One area investors should look at is real estate.

Prologis (PLD) is a real estate investment trust that owns properties all over the U.S. and Mexico, with many in Austin, Dallas, San Antonio, and Houston. It also owns real estate in Georgia and Pennsylvania, two more states that are seeing profound data center growth.

Prologis specializes in warehouses and industrial facilities. It also has 5.7 gigawatts of power available and 15,000 acres of development-ready land that could be used for data centers. For example, it has a campus planned in Austin, Texas, that will span 160 acres, feature three data centers and a private substation, and offer 600 megawatts in capability.

Prologis just reported full-year earnings on Wednesday. Revenue climbed 7% to nearly $8.8 billion, and the company leased 228 million square feet in 2025, a four-year high.

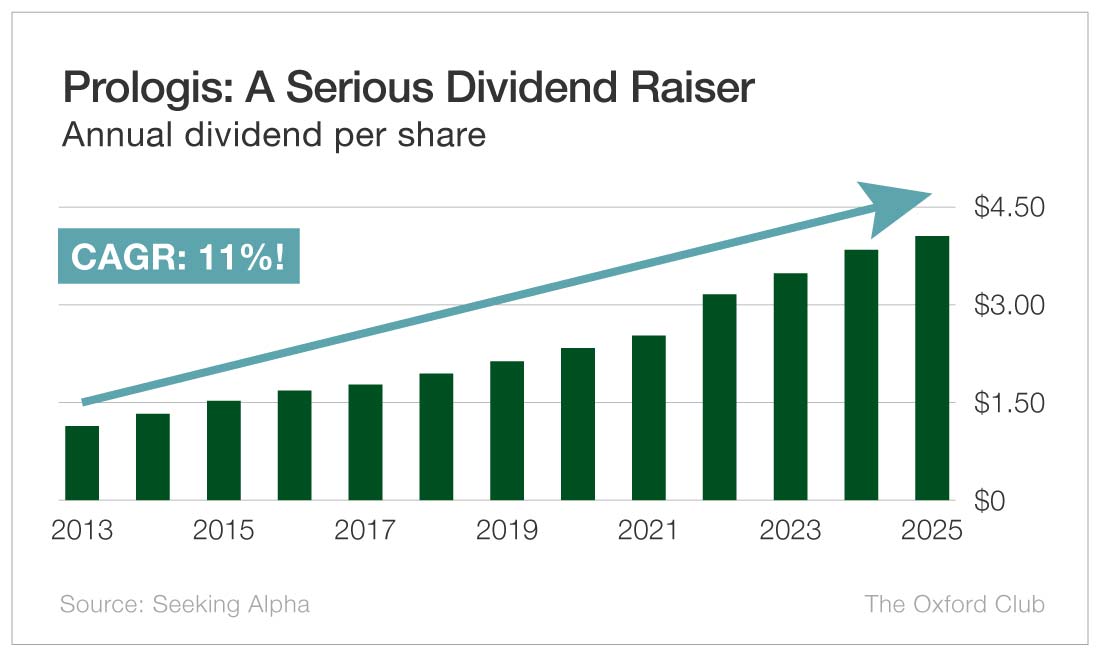

The stock has a 3% dividend yield, and it has boosted the payout to shareholders every year since 2014. Over those 12 years, the dividend has climbed from $0.28 to $1.01, rising at a compound annual growth rate of more than 11%.

When it comes to AI, you can buy the big players like Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOG). But during booms, I prefer the picks-and-shovels companies – the ones who make money no matter which other companies succeed.

Real estate is a commodity that is necessary for AI to function. The data centers have to be built and be operational. Companies with land and the ability to construct data centers in desirable locations will have a leg up over their competitors and should be able to print money for years to come. Prologis is a great way to “own” land that will be used for AI.

This is the first in a three-part series on how to play the AI boom. Be sure to read Part 2 on Tuesday, which will have my recommendation for how to play the insatiable need to cool the data centers.

More By This Author:

Will Hess Midstream’s 8.7% Yield Keep Growing?Gladstone Capital: This 8.6% Yielder Won’t Make You Glad

“Nobody Knows Nothin'” About The Markets