5 Harsh Lessons About Investing In Raw Materials Companies

Raw materials companies are sometimes lauded by investors as great plays against rising inflation due to their hard asset nature. This can be true, but investing in these companies comes with its own risks—mainly that the P/E for these companies is often meaningless.

In this post I will reveal some of the most valuable lessons of previous cyclical bear markets for two differing types of raw materials companies:

- Distributor.

- Manufacturer.

You will be able to identify easy-to-find financial line items in companies’ cash flow statements which can signal an upcoming tough period for a very cyclical stock.

As we will see, the signals can appear very fast and the drawdowns can be very swift for very cyclical companies like those in the Raw Materials sector. But for observant value investors, these lessons might help you clue-in on times where it’s better to let your cyclicals ride and when it’s time to cut your losses.

Lessons from a Raw Materials Distributor

One of the primary raw materials for home building and construction is lumber. Among the companies in the lumber industry, you have REITs that own the actual lumberyards such as Weyerhaeuser Company (WY) and PotlatchDeltic (PCH). You also have distributors in the middle; one of the biggest lumber distributors is UFP Industries (UFPI).

A company like UFPI sees higher profits based on demand and volume rather than directly benefiting from increases in lumber prices. As the company mentions in their 10-k, it can be the movements of lumber prices which create more profits for the company rather than just the overall price level.

What’s important to remember about a raw materials industry like lumber is that there are many different kinds of lumber, with different buildings applications, different supply/demand dynamics, and thus different prices at different times. The question remains:

- How can an investor best profit from investing in lumber stocks?

- If raw materials companies in lumber make up the literal building blocks of construction, can earnings results of lumber companies foreshadow the future performance of companies like homebuilders?

Luckily for us, UFPI has a stock history going back to 1993; since then there have been several boom and bust cycles to observe. Let’s start at the obvious last major drawdown for the company—the housing bust in ‘08/’09.

Here’s a chart that shows the dramatic fall in UFPI’s stock from the housing crash, courtesy of Yahoo Finance:

Peak to trough, the stock went from $26.65 all the way down to $5.30. That’s a gut wrenching drop of -80%.

Lesson 1: Don’t Buy at the Peak - Reasonable P/E’s are Dangerous

Obviously, “don’t buy high” is much easier said than done. What makes this idea even more difficult is that a raw materials stock like UFPI can look very cheap at exactly the worst times to buy it.

To see what I mean, look at this chart from Gurufocus on the company’s historical P/E; I’ll highlight the perilous 2006/2007 period which would’ve been an awful time to invest in the company:

You can see how the peak in P/E corresponds with the peak in the stock price of $26.65. However, notice how much the P/E drops in the September 2006 time period. At an 11 P/E, the stock appears very cheap, and this is due in part because the reported earnings of the company are still high at the time after the steep drop in stock price.

Even after the first major drawdown, when the stock was around $15-$16 from about July 2006 – June 2007, the returns still appeared substantial if you purchased in 2005 or before. In other words, most investors probably weren’t too concerned about the stock’s quick peak and drop to $15-$16 because it still represented a nice gain from 2005 and before.

But they weren’t aware that the worst was yet to come, even after the approximate -40% drop from the $26.65 peak. Was there something in the July 2006—June 2007 which could’ve clued investors in? To answer that we’ll dive into some of the company’s quarterly 10-q’s at the time.

Lesson 2: Watch the Quarterly Changes in Inventory

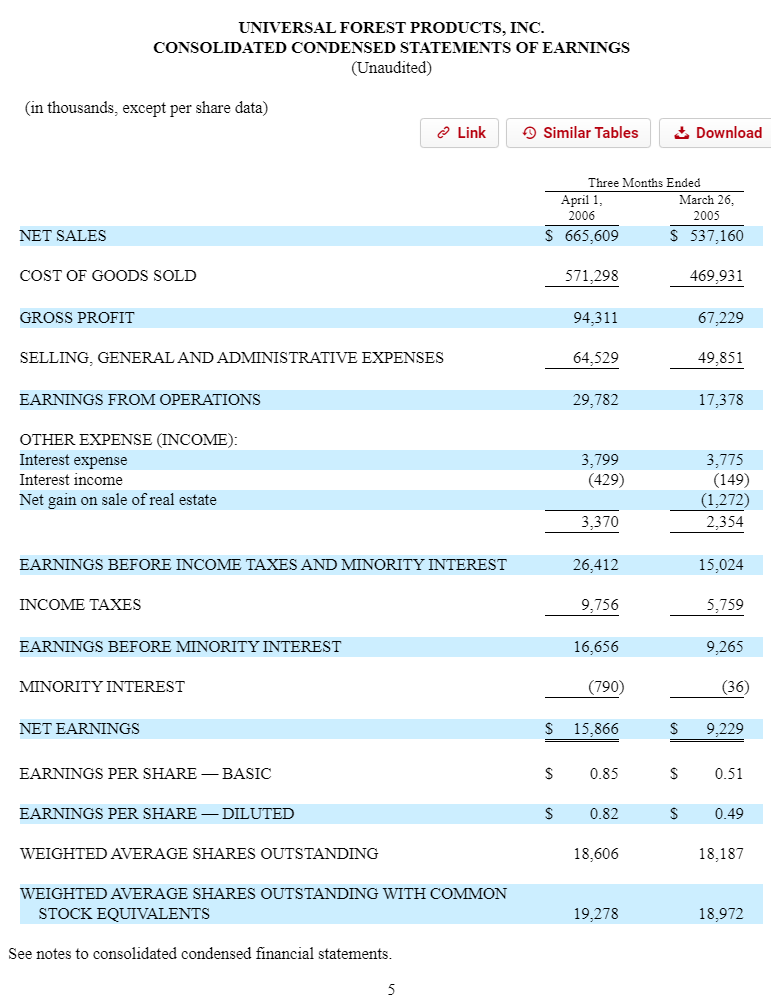

Here’s the company’s Income Statement from the May 2006 quarter, which if you’ll recall was the time period where the stock first peaked and then crashed:

Not much to see here. In fact, the earnings are up +71.9% year-over-year (from $9,229 to $15,866 thousand), and so you might think that the company is humming along and the housing boom still has plenty of room to run.

Looking at the cash flow statement, the only major difference year-over-year was a -$50 million lower investment in inventories than the previous year. There was probably something in the company’s guidance which drove what happened in the stock price, but let’s stick with the financials and fast forward three months.

In the July 2006 10q, it’s a similar story with Net Income with $27.3 million in earnings for a 19.8% year-over-year increase and 72% increase sequentially (quarter-over-quarter).

But, cash flow from inventories takes a turn here, with a year-to-date $7.7 million increase to cash flows from changes in inventories instead of a -$31 million investment year-to-date the previous year. This indicates that the company has slowed down investments in inventory, and is selling through more of the inventory rather than adding inventory.

To sum up the year, here’s the company’s changes in inventory by quarter for Fiscal Year 2006:

- Q1 filed May 11, 2006: -$25.8 million.

- Q2 filed July 28, 2006: +$33.6 million.

- Q3 filed Oct. 25, 2006: +$16.0 million.

- Q4 filed Feb. 27, 2007: -$1.5 million.

Here’s how the company’s changes in inventory has looked historically over the last 20 years:

These are from company 10-k’s, and so they might be more of a lagging indicator rather than anything else.

To speculate whether the average investor could get ahead of the curve in timing the selling of raw materials companies by observing changes in inventory in the cash flow statement, consider the company’s annual release dates with the Fiscal Years covered:

- FY2006: Feb. 27, 2007.

- FY2007: Feb. 26, 2008.

- FY2008: Feb. 25, 2009.

February 2007 would’ve been a great time to get out of UFPI’s stock—any 10-k after that, not so much. The October 2006 10-q paints a similar picture with regards to the financials—inflows in cash flows from inventories (+$23.6 million) instead of outflows (-$10.7 million in year-to-date 2005).

For Fiscal Year 2007, here’s the company’s changes in inventory by quarter:

- Q1 filed April 26, 2007: -$23.3 million.

- Q2 filed Aug. 1, 2007: -$11.3 million.

- Q3 filed Oct. 25, 2007: +$34.7 million.

- Q4 filed Feb. 26, 2008: +$27.7 million.

Going back to the stock chart for UFPI, by this time it’s mostly too late. Though the investments in working capital for Q1-Q2 might’ve seemed like a great sign; it turned out that things were slowing down very soon.

To get some context on the changes in inventory during that Q2/Q3 2006, the Operating Income for the company in Fiscal Year 2005 was $124 million. So, each increase in cash flows for inventory in the Q2/Q3 2006 period represented 27% and 13% of the previous year’s operating income. This context on the scale of inventory changes can help provide additional clarity on just how much these quarterly swings really represented for the company.

One fast and easy rule for selling out of a raw materials distributor?

-

Sell when a significant amount of cash flows relative to Operating Income are now being added from inventory instead of invested into it (preferably after two consecutive quarters).

Lesson 3: The Lumber/ Homebuilding Value Chain Moves Together

Since lumber is a raw material for construction, their stocks tend to be tied with residential real estate stocks. One example of a residential real estate company is PulteGroup (PHM). Let’s look at their historical stock price around the same time period to observe the similarities:

The last peak for PHM before crashing again was around January 2007. That was a similar time frame for UFPI’s as well. In this value chain, where lumber stocks serve as the raw materials companies for homebuilders, it did not seem like the tail is wagging the dog one way or the other.

Looking at PHM’s inventory investments in a similar fashion to UFPI’s, it appears that they were still investing even by the time UFPI stopped—at least when UFPI stopped in those last two quarters of 2006. So, looking at a lumber distributor and its changes in inventory might be a better indicator of an impending cyclical slowdown instead of solely watching homebuilder financials.

This logically makes sense since distributors tend to see the demand across the industry faster than its customers and may be able to make better decisions with investments in working capital and their timing.

Lessons from a Raw Materials Manufacturer

The next raw materials stock we will look at today is Westlake Chemical Corporation (WLK). Westlake makes for an interesting case study because they produce the plastics and specialty chemicals which make up the building blocks of not only buildings, but also the consumer goods and packaging that makes its way to shelves across the globe.

While this company is also driven by residential real estate to an extent, due to its construction focus especially with its latest building materials acquisition; historically the company has had a large exposure to plastics and polymers markets which will make for a great case study in that poor late 2014- early 2017 time period.

And though the stock had a deep drawdown in ‘08/’09 from a peak of $18.55 to $5.37 (so many stocks were crushed), it also experienced a significant drawdown from August 2014 ($97.24) to June 2016 ($42.48). Here’s what that time period looked like for WLK:

You can see that there was a classic boom/bust cycle starting in late 2014—it’s this historical case study that we’ll use to hopefully apply to other related raw materials companies and those industries with boom/bust cycles which can separate in timing from the typical cyclical.

Lesson 4: The P/E Story Again - “High” is Lower Than You Think

First let’s look at one of those typical “value ratios” for the stock directly leading up to its deep 2015 correction:

You can see that leading up to the fall in late 2014, the stock’s P/E was trending higher, but it wasn’t in any way extraordinarily extreme - especially compared to the rest of the market.

This has been one of the tricky things about raw materials stocks over the past two decades; they haven’t traded at crazy high valuations to make a bubble look obvious. In fact, because raw materials companies tend to be so cyclical and have such wide swings in profitability, it’s at the times when profits are the greatest that it may be the exact worst time to be buying these stocks.

That overly high profitability in boom times is what keeps the P/E lower, but when the bottom falls out, it happens quickly and is basically impossible to predict from a standard Price-based ratio. (Contrast that to technology stocks, which can be so obviously overvalued when their P/E’s are above 100).

Now we’ll go back to the quarterly financials for the company leading up to the stock crash to try and suss out any hints of impending contractions. Reminder of important dates in this timeframe:

- Aug. 31, 2014: stock price peak.

- Nov. 16, 2014: second peak at $71.40.

- April 19, 2015: third peak at $77.71.

From the company’s 10-q filed on Aug. 6, 2014, we can see that the Income Statement once again doesn’t tell us much about the likely future of the business. Everything is trending up:

- Revenue = +6.3% year-over-year.

- Net Income = +16.2% year-over-year.

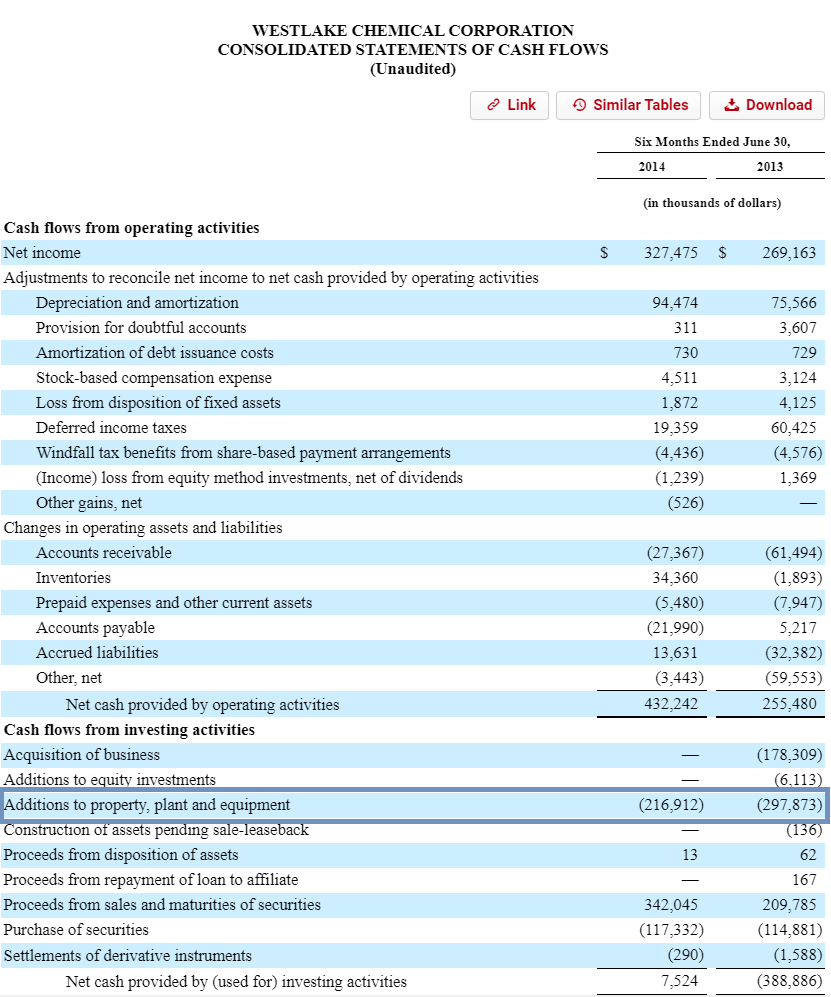

But if we look at the cash flow statement, it’s a very different story:

Notice how the cash flow statement shows a much different kind of business than a distributor like UFPI.

Instead of investments in working capital making up a significant portion of either Cash From Operations or Operating Income from quarter-to-quarter, it is capital expenditures which make up a large portion (50% or more).

Lesson 5: Watch the Quarterly Changes in Capital Expenditures

In this case, we do see cash from inventories up +$34.4 million year-to-date versus investments of -$1.9 million in the previous year-to-date, but notice the slowdown in capex (capital expenditures):

- Q2 ’14 year-to-date: Additions to property, plant ,and equipment of $216.9 million.

- Q2 ’13 year-to-date: Additions to property, plant, and equipment of $297.9 million.

That might not seem like a significant slowdown, but that’s a full -$81 million reduction in spend from year-to-year, and around a -25% reduction. You could maybe argue that this has to do with quarterly timing more than anything, so let’s look at a long-term picture of the company’s capital expenditures over various cycles.

I’ve highlighted places where the company reduced capital expenditures rather than increased or maintained them. To sum up, those include the Fiscal Years:

- 2009. 10-k filed Feb. 24, 2010.

- 2010. 10-k filed Feb. 24, 2011.

- 2014. 10-k filed Feb. 25, 2015.

- 2017. 10-k filed Feb. 21, 2018.

- 2020. 10-k filed Feb. 24, 2021.

The question is—are these good times to sell a heavy capex raw materials company like WLK or is it more of a trailing indicator? Well, the answer is kind of both. You can follow along if you wish, but in general here’s the places where it would’ve been a good time to sell based on the ups and downs of this stock:

- 10-k filed Feb. 24, 2010: Too late. Drawdown of -45%+ already experienced.

- 10-k filed Feb. 24, 2011: A good time to sell to avoid late 2011 drawdown (-30%), but good time to buy long-term.

- 10-k filed Feb. 25, 2015: Yes. Drawdown of -30% already happened, but the despair of late 2015-2017 (additional -35% drawdown) could’ve been avoided.

- 10-k filed Feb. 21, 2018: almost perfect time to sell. -50% drawdown in 2019 incoming (with more to follow from COVID-19).

- 10-k filed Feb. 24, 2021: We will see.

Going back to FY 2014, in Q1 the company also showed a strong reduction in capex year-over-year, from -$150 million in Q1’13 to -$110 million in Q1’14. Taking it both on a percentage basis, -25% reduction, and absolute basis, -$40 million compared to Operating Income of $191 million in Q1’13 (=21% of Operating Income).

Conclusions: Capex, Inventories, and Your Investments

It seems like management for WLK has historically seen the writing on the wall when it comes to the overall economic trend in their industry and reduced capex before significant downturns in the stock.

What I find striking though is how fast the decline comes. It took just one year-over-year decrease in capex from WLK to precipitate a steep drawdown in the stock.

Investors in heavily capital intensive raw materials companies with large capex investments would be wise to respect how quickly the tide can turn with these stocks. And, just because WLK’s management has historically been able to stay ahead of these trends doesn’t guarantee that your raw materials company will.

But it’s an interesting observation and another great lesson when following these heavily cyclical companies. Hopefully this post has helped you identify two excellent forward-looking signals for the outcome of a cyclical industry like raw materials.

Each business model is different, and so it takes some context to understand them (working capital intensive for distributors, capital expenditure intensive for producers). And just because a company is cyclical, doesn’t mean they will manage their inventory or capex well (like many homebuilders in ‘08/’09).

But takeaways like this could help you stay ahead of the curve. And they definitely help more than EPS or sales trends for these particular businesses.

Disclosure: The author doesn't hold any securities that may be listed.

Thanks for a very educational article!!