3 Safe Dividend Stocks Paying Double-Digit Yields

If you have an income stock keeping you up at night, replace it with any of these three safe-haven stocks paying hefty double-digit yields. With plenty of free cash flow to cover their payments, these three dividends are secure and will be great bargains if there is another market selloff again this summer.

There is an old stock market adage that says stock market players should “sell in May and go away.” The Wall Street Journal just published an article providing the reasons investors might want to sell their stock holdings and not come back into the market until after Labor Day. As an income stock focused investor, I plan to use the sentiment that drives this belief and take advantage of the reasons the saying exists.

There are several reasons why old stock market hands like to follow “sell in May and go away.” With many of the large institutional traders going on vacation during the summer months, trading volume drops significantly compared to the rest of the year. Lower volume can lead to higher volatility in share prices. There is also the perception that stocks tend to go down more in the summer than during the rest of the year. According to the WSJ, over the last 45 years, stocks had summer slumps in 15 of those years, with an 8% average decline for the S&P 500. In the other 30 years, the market gained from Memorial Day to Labor Day, with an average gain of 5.6%. For the entire period, both good and bad averaged together to generate a 1% average summer time return for the S&P 500. It seems that the sell in May and go away practice is more about avoiding the pain that can happen on average one year out of three.

As an income-focused investor, I understand that to earn dividends I need to own shares of dividend paying stocks. If I sell everything in May and buy it back in September, I would go four months without any investment income. That is not an acceptable outcome. As I talk to income-driven investors, I focus on discussing the need to work on building a stable, high-yield, and growing income stream. This different mindset for buying stocks makes it easier to not worry about share prices and also to be ready to buy or add shares when the market declines. Instead of selling in May, I recommend that income investors have some cash ready to put to work if there is a summer swoon in the market. To help you put that money to work, here are three high-yield stocks that will become even more attractive at a lower share price/higher yield:

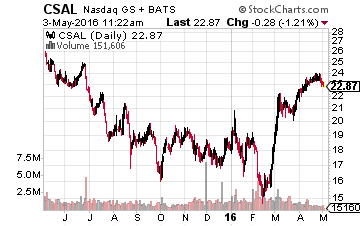

Communications Sales & Leasing Inc (Nasdaq:CSAL) is a different kind of high-yield real estate investment trust (REIT). The company was spun off in April 2015 by telecom service provider Windstream Holdings, Inc. (Nasdaq:WIN).

The new REIT received Windstream’s copper and fiber landline assets. This REIT does not own buildings but instead owns telecommunications infrastructure assets. CSAL received a 20-year lease from Windstream, which has been the REIT’s only customer since the IPO. Recently, Communications Sales & Leasing has closed its first outside acquisition, which should allow the company to start growing its dividend payments. The existing dividend rate can be viewed as guaranteed by the Windstream contract. A share price decline back towards $20 would make CSAL a great buy. The stock currently yields 10.4%.

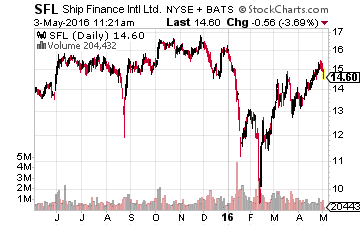

Ship Finance International Limited (NYSE:SFL) owns a diverse portfolio of shipping and offshore energy drilling vessels and leases them out to its customers on long-term leases. For over a decade, Ship Finance has paid steady dividends out of a very strong free cash flow producing business model. However, the market has made SFL shares one of the more volatile stocks in the high-yield space. Over the last year, the share price has ranged from a low of $9.83 to a high of $17.80. That is an 80% swing from low to high. Currently, SFL is trading at just above $15 for an 11.8% yield. This stock becomes a great buy, locking in a high yield and growing income stream when the shares drop below $14.

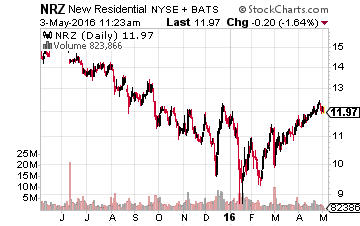

New Residential Investment Corp (NYSE:NRZ) is a high-yield finance REIT that has fallen out of favor with investors. I really cannot see the reasons for the current market value of NRZ shares, but I am happy to buy more at the current 15% yield. A year ago, New Residential completed a nice acquisition of its prime competitor in the mortgage servicing rights investment niche. The market liked the deal and at over $17 per share, NRZ was priced to yield about 10%. Since then, the company has grown cash flow per share every quarter, and there is a good probability of a dividend increase next quarter. Yet, now the stock trades at about $12 and yields over 15%. Any market dip is a good reason to buy more NRZ shares.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

Disclosure: There are currently over twenty of these stocks to choose from in my more