2015 Could Be A Reset Year, Here’s How To Invest

After a tumultuous start to 2015, the market appears to be signaling “all clear.” But don’t be fooled. Here’s how you should be invested for 2015.

Things got off to a rough start this year, selling off pretty hard in the first few trading days of 2015. But the market has since started to show signs of life; the S&P 500 is close to breaking even on the year after a multi-day rally.

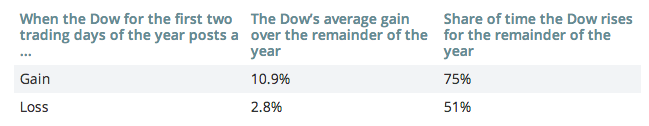

Yet, the fact that 2015 got off to a rocky start is still a bad omen. This simple chart is very telling:

Source: MarketWatch

So, when the Dow is down the first two days of the year, there’s a 50-50 chance it will end the year down. Sounds like a typical year in the market — until you compare it to the fact that when the Dow is up the first two days, it goes on to finish the year up 75% of the time.

What’s more is that there’s a number of factors working against the market this year, making a tough year all but certain.

These factors include the idea that the stock market is no longer cheap — trading at a Shiller P/E of 27x, compared to the long-term historical average of 15x. Then, there’s the fact that Russia is struggling, economic weakness continues in Europe, Japan’s recession has deepened and China’s economic growth could be slowing.

So, no, 2015 won’t be so easy.

Thus, it is time to focus on companies that tend to perform “well” in a down market (read: stocks that are less volatile and have stable dividends).

But what about rising interest rates? Won’t that make dividend stocks less appealing? Well, rising rates appears to be an event we won’t have to worry about until 2016.

Two of the market’s most respected bond investors have said that rates will remain low in 2015, meaning dividend stocks will remain in favor.

DoubleLine Capital founder, Jeff Gundlach, has said that the 10-year Treasury yield fall below its record low this year. And Bill Gross recently said, “When the year is done, there will be minus signs in front of returns for many asset classes. The good times are over.”

What this means is that for 2015, investors will have to focus on those parts of the market that will continue to reward them with high dividends (read: stable dividend payers, utilities, REITs, etc.)

Granted, 2015 could well prove to be a pleasant surprise — just like 2014 was. Yet, why take the risk? As Warren Buffett said, “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

It’s worth staying safe until we see more stability in the global markets, whether it be from a stable bottom in oil prices or a stronger commitment to quantitative easing in Europe.

With all that, here are the best plays for 2015:

Best Way to Play 2015 No. 1: Steady Dividend Payers

Logically, investors should first have a look at the strong dividend paying companies that will be strong investments even if the market experiences a setback in 2015. Outlined below, we have five low-beta dividend stocks that pay above average dividend yields — recall that the S&P 500 average dividend yield is just 1.9%.

And low beta means low volatility. For example, if a stock has a beta of 0.5, and the market falls by a dollar, in theory, the stock should only fall 50 cents. That’s, in part, because low beta stocks tend to have a longer-term shareholder base that doesn’t get concerned with interim market swings.

And all five of the steady dividend payers below have also outperformed the S&P 500 on a total return basis (includes stock appreciation and dividends) over the last two decades.

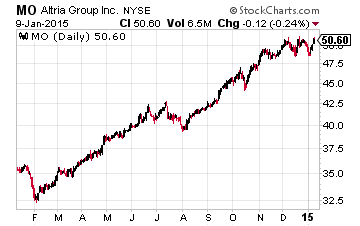

First, tobacco has long been a great place to find high dividends. Altria Group (NYSE: MO) has an impressive 4.1% dividend yield and has 45 years of consecutive dividend increases. Even with health concerns, tobacco companies have been able to raise prices to successfully counter slowing demand.

Altria is the largest cigarette maker in the U.S. and has a beta of just 0.5. As well, it’s focusing on smokeless tobacco products, including non-tobacco chewables.

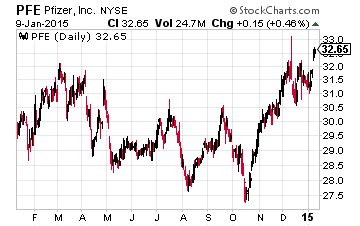

Pfizer (NYSE: PFE) is the pharma giant that tried to buy AstraZeneca (NYSE: AZN) for a whopping $120 billion last year. But don’t count them out on the M&A front, with a strong balance sheet it will likely be back at the M&A table in 2015.

It also has a pipeline that includes a breast cancer drug and a cholesterol drug in Phase III trials (the phase responsible for final confirmation of safety). And you’ll get an impressive dividend of 3.5% with Pfizer, which paid a dividend for 32 years and its beta is just 0.7.

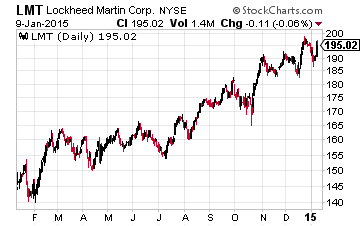

Lockheed Martin (NYSE: LMT) is one of the nation’s largest defense contractors and it offers a dividend yield that’s 50% above the industry average, coming in at 3.1%. It has 12 straight years of dividend increases under its belt and its beta is a mere 0.6.

The beauty of Lockheed is the F-35 fighter jet, which is one of the most popular defense systems sold worldwide. Lockheed is also increasing its presence in cyber security, missile defense and various unmanned systems.

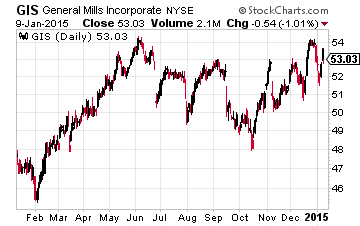

Then you have General Mills (NYSE: GIS), which has one of the lowest betas in the entire market, coming in at 0.16. It also has a fairly solid dividend, having upped it for 11 straight years and yielding 3.1%. The beauty of General Mills model is that it offers consumer staple products like cereals, meals and baking products.

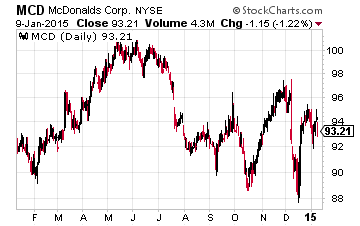

Then there’s McDonald’s (NYSE: MCD). Love or hate its food, it’s hard not to enjoy the dividend. It’s yielding 3.6% and has increased its annual dividend for 38 straight years now. And its beta is a low 0.35. On bright side, McDonald’s still has growth opportunities in China, where a rising middle class will ultimately lead to increased demand for fast food.

Now, let’s turn our attention to industry specific investments.

Best Way to Play 2015 No. 2: Utilities

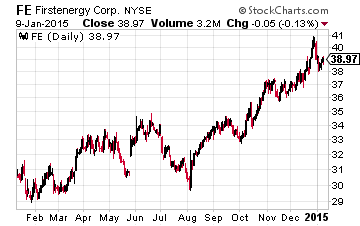

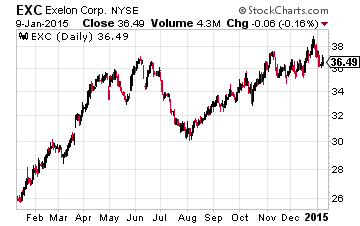

In truth, utilities remain the belle of the ball when it comes to low-volatility dividends. A couple notable picks here are FirstEnergy Corp. (NYSE: FE) and Exelon Corporation (NYSE: EXC), which have 0.3 and 0.5 betas, respectively.

FirstEnergy pays a solid 3.7% dividend yield and has been paying a dividend for 16 straight years. It’s a diversified utility company, servicing various states in the Northeast — including New York, New Jersey and Pennsylvania.

Income investors started shunning FirstEnergy after it cut its dividend in early 2014. But the benefits of a strong balance sheet are ultimately outweighing the reduction in its dividend.

Exelon Corporation (NYSE: EXC) is another player in the utility space and offering a handsome dividend — currently yielding 3.4%. Exelon has paid a dividend for 34 years.

It’s one of the larger utilities (with a $30 billion market cap), operating in nearly every state within the U.S., as well as parts of Canada. Like FirstEnergy, Exelon might get shunned by some given its large dividend cut in 2013. However, the move increased financial flexibility and allowed it to invest in the more stable regulated utility business.

Both the above utilities trade at 1.3x book value, while the utility sector trades at an average of 2x. And as natural gas prices continue to fall, which is one of the key input costs for utilities, there’s margin improvement on the horizon for these guys.

Best Way to Play 2015 No. 3: REITs

REITs were one of the best performing industries in 2014. With rates expected to remain low in 2015, there’s no reason 2015 won’t be just as great. More specifically, healthcare REITs should prove particularly interesting.

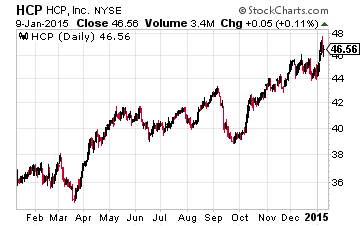

HCP, Inc. (NYSE: HCP) is one of the largest healthcare REITs around. Its dividend yield is a healthy 4.7%. But what’s more is that HCP is a dividend aristocrat (S&P 500 companies with 25 years or more of consecutive dividend increases), having upped its dividend for 29 straight years.

This REIT is focused on many areas of healthcare, which includes managing real estate tied to senior housing, medical offices, skilled nursing and hospitals. Going forward, look for HCP to increase its exposure to senior living and medical office real estate — which are two of the fastest growing areas of the healthcare market. HCP is a REIT favored by my Investors Alley colleague and dividend expert Tim Pleahn from The Dividend Hunter.

Overall, the healthcare REITs are very interesting given the rising demand for healthcare thanks to health care reform, as well as the increased need for health care related to a rapidly aging population.

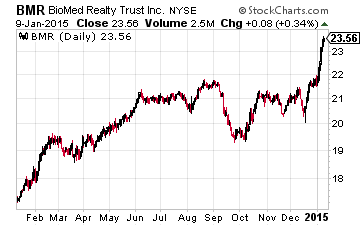

And a couple other under-the-radar picks include Biomed Realty Trust (NYSE: BMR) and Senior Housing Properties Trust (NYSE: SNH). BioMed is a REIT focused on office space and laboratories for life sciences — its key tenants are biotech and pharma companies. BioMed’s dividend yield is 4.5% and it’s paid a dividend for 10 years

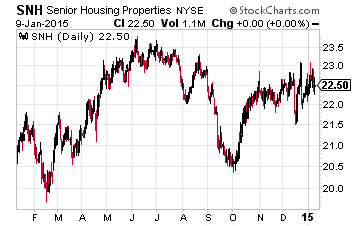

Senior Housing Properties, as you might have guessed, owns various senior living communities across the U.S. Its dividend yield is a juicy 7% — and the REIT has paid a dividend for 14 years. Both these REITs trade around 1.5x book value, while the REITs in the healthcare space are trading at an average of 2x book value.

In closing: 2015 might well be another solid year for the market, but with rates expected to remain low throughout the year and market gyrations here to stay, it seems like a solid bet that stable dividends and high yield industries like REITs and utilities will be the big winners regardless of the economic backdrop.

Tim Plaehn from The Dividend Hunter, mentioned above, has put together an amazingly powerful yet simple to use system for collecting monthly dividends from payers like some of the REITs and utilities in today’s article. He calls it The Monthly Dividend Paycheck Calendar and it’s proven quite popular with income investors.

The Monthly Dividend Paycheck Calendar is set up to make sure you’re getting 6, 7, even 8 dividend paychecks per month from stable, reliable stocks with high yields. (Note: February has a whopping 8 payments!)

And it ensures that your income stream is more stable and predictable as you’re getting payments every month, not just once a quarter like some investors do.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you could make from stable, low risk stocks paying upwards of 8%, 10%, even an eye-popping 21% in one case. Tim’s done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

Disclosure: None