2 Under-The-Radar Net Lease REITs That Are Poised To Profit

Image Source: Unsplash

A few days ago, I wrote an article titled "Nothing But Net (Lease REITs)" in which I highlighted a few of my favorite freestanding REITs based on their "wide moat" advantages.

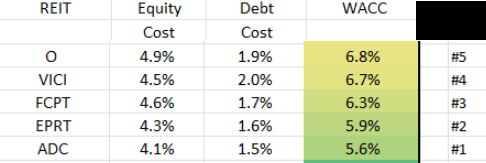

Seeking Alpha / iREIT®

As you can see, Agree Realty (ADC), Essential Properties (EPRT), Four Corners (FCPT), VICI Properties (VICI) and Realty Income (O) all stand out for their lower WACC (weighted average cost of capital) and ability to generate peer-beating investment spreads.

Although net lease REITs have underperformed other property sectors over the last few years, historically, the "steady Eddie" property category has generated a respectable 10% annualized (based on total returns) over the last 15 years.

While many dividend investors own these net lease REITs for their high dividend yields and steady dividend growth, some investors scout the REIT universe for bargains, after all, everyone likes to have their cake and eat it too.

Over the years, I've made some good money off of deeply valued net lease REITs.

For example, I recommended Four Corners Property Trust (FCPT) during COVID, in March 2020, as I explained,

"…we believe that, because of FCPT's strong financial condition, it will likely pursue concessions such as rent reductions in exchange for lease extensions. Because of its "circle of competence" as a restaurant landlord, the REIT is perfectly positioned to strategically amend leases in its favor. Unlike EPR (EPR)."

That Strong Buy call was spot on, as FCPT later soared from $13.78 to around $30.00 by the end of 2020, returning over 113%.

Not bad for a net lease REIT…

Forgive me for cherry-picking, so let me provide you with another example of a net lease that I recommend that delivered very solid returns.

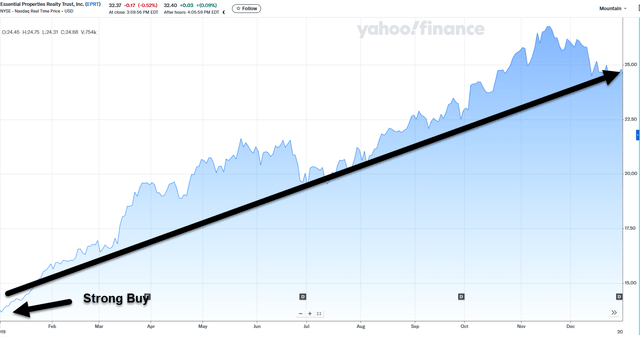

In late December 2018, I initiated coverage of Essential Properties Realty Trust (EPRT) with a STRONG Buy rating, and I said that the company warrants a Strong Buy because it could return 25% in 12 months.

As you can see below, that Strong Buy pick was also Spot on" as FCPT generated 87% total returns in 2019.

Yahoo Finance

So, you see, it is possible to "have your cake and eat it too" when it comes to net lease REIT investing, but you have to know where to find the buried gold…and in this article, I'm going to provide you with my road map.

FrontView REIT (FVR)

FrontView REIT was formed in 2016 as a private REIT, and by 2023, the company had acquired around $800 million in gross assets. In October 2024, the company listed on the NYSE at $19 per share, and the recent closing price was $11.33 per share.

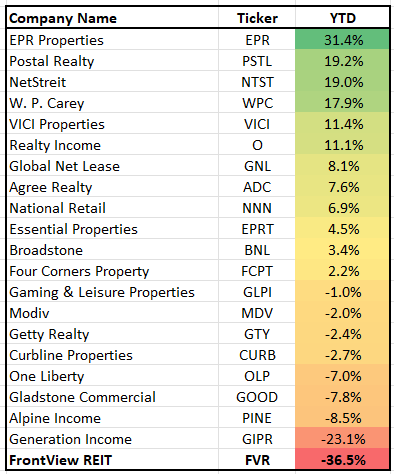

iREIT®

As you can see, FrontView is the worst-performing net lease REIT YTD, down around 36%, which leads me to the next question: "what's wrong with this REIT?"

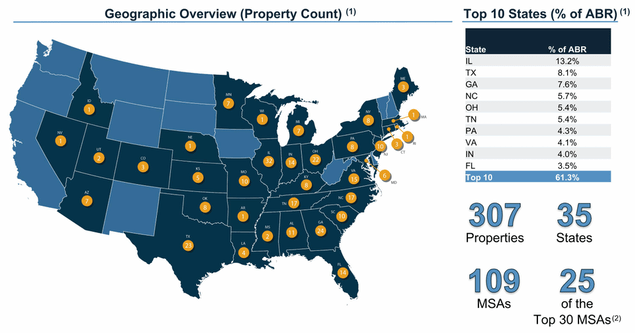

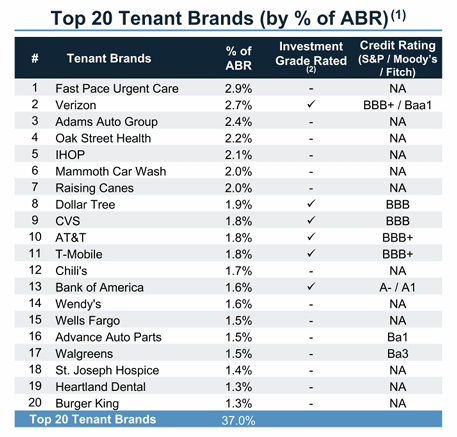

Upon closer inspection, FrontView now owns 307 stand-alone properties (over 2.4 mm sq.ft.) leased to 150 different brands in 35 states. The portfolio consists of 33% IG (investment grade) customers with an average remaining lease term of 7.2 years and average occupancy of 98%.

FrontView Investor Deck

FrontView's investment strategy is part of its name; the company seeks to own properties located along high-traffic (frontage) corridors in which the building facades are highly visible, allowing the tenants to advertise their brands on the buildings.

Importantly, FrontView's highest tenant concentration is 2.9%, with just 21.8% concentration within the company's top 10 list. This makes FrontView one of the most diversified net lease REITs in terms of tenant concentration.

FrontView Investor Deck

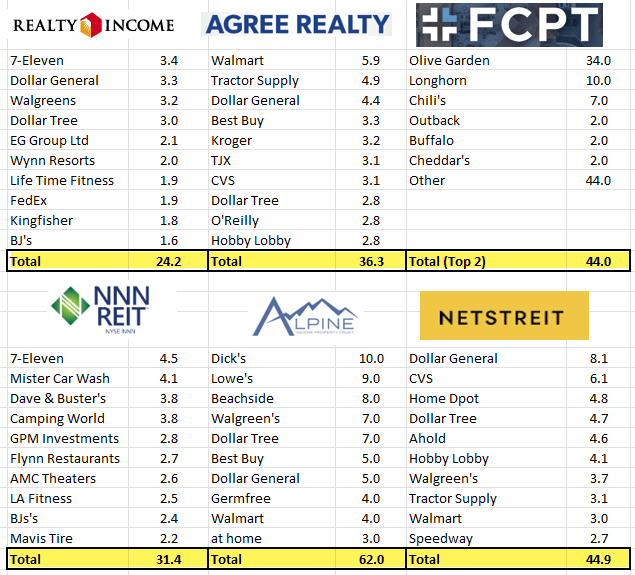

Compare that "top 10" tenant concentration with these peers:

iREIT®

So, as you can see, FrontView has better diversification than all of the net lease REIT peers, with just 21.8% concentration with the "top 10". Also, I find it interesting that FrontView provides the details for its "top 40" customers, which is an added level of transparency you don't get with the other net lease REIT peers.

In terms of direct peers, I would classify FrontView of something of a hybrid between Realty Income and Agree Realty - that have 34% and 68% investment grade customers respectively - and NNN REIT (NNN) and Essential Properties (EPRT) - that have private equity backed customers that operate car washes, casual dining restaurants, and QSRs.

I see nothing wrong with FrontView's business model, and in fact, I like these smaller +/- $1 mm ticket sites in which the land is typically worth as much as the building in many cases.

These are smaller bets, so in addition to the enhanced customer diversification attributes, the smaller deals help to mitigate risk in the event of a tenant default.

Take it from me, as an experienced net lease developer for over two decades, I would much rather own a vacant freestanding building on my major corridor than a big box in the middle of nowhere when the tenant blows out.

And FrontView has held up fairly well with 98% occupancy as of Q1-25.

However, on the latest earnings call, FrontView management said it had taken back or planned to take back a Freddy's, two TGIF Fridays, four Hooters, three On The Border, and a Joanne Fabrics, collectively around 4% of ABR.

The company said that two of its four Hooters could be candidates for leases, post-bankruptcy, with Hooters. In addition, management said it "expects that a substantial majority of these properties should be back online in late 2025 at meaningful recovery rates."

Most of the pain comes from the casual dining space, which represents around 15% of ABR (down from 19.3% at the end of Q3-24).

Another category that FrontView and other net lease REITs are cognizant of is the drug store category. FrontView has been reducing exposure there as well. As of Q1-25, the company owned three Walgreens and four CVS properties, representing around 3.3% of ABR.

At the end of Q4, FrontView acquired 29 properties at an average price of $3.6 million (12 tenants) and 27% investment grade rated.

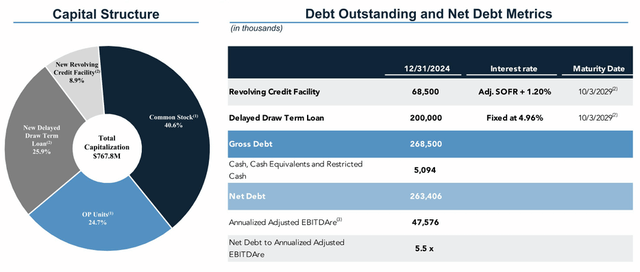

At the end of the quarter, the company had $68.5 million drawn on its $250 million revolving line of credit, and the company has no near-term debt maturities. Also, as shown below, OP units represent ~25% of the capital stack.

FrontView Investor Presentation

FrontView initiated 2025 guidance of $20.00 to $26.00 per share, with acquisitions of between $175 million to $200 million and dispositions of $5 million to $20 million.

The Q4024 AFFO per share was 0.33, and the quarterly dividend was $.215, which translates into a healthy payout ratio of 65%.

Now, clearly, the casual dining sector has resulted in the above-referenced selloff; however, it appears that FrontView should be able to easily mitigate pressures because of its diversified asset base.

And the valuation is tasty…

Shares are now trading at $11.33 per share, with a dividend yield of 7.6%.

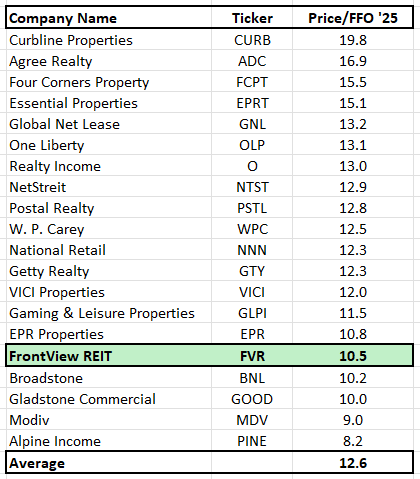

Now take a look at FrontView's P/FFO multiple compared with its peers:

iREIT®

FrontView is a new player in REIT-dom, and there hasn't been much coverage here on Seeking Alpha. Just two recommendations: 1 Buy and 1 Sell.

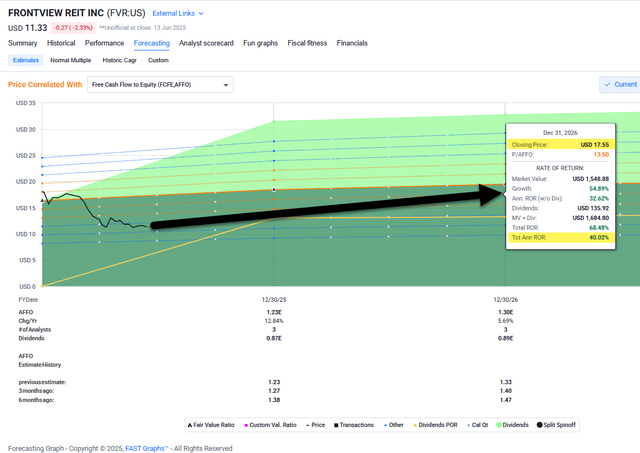

However, we now have a third recommendation (on FVR), and this one is a Strong Buy. If the company can manage its watch list customers, which it should be able to do give the experienced management team, shares could fetch $17.00, which translates into annualized returns of 40% to 50%.

FAST Graphs

Modiv Industrial (MDV)

Modiv Industrial is a net lease REIT that invests in industrial manufacturing facilities to companies that make products that support and strengthen our nation".

Although not as diversified as FrontView, Modiv has carved out an interesting niche by investing in private-equity backed customers that produce "Great American" essentials in the infrastructure, auto parts, aerospace/defense, technology hardware, and light metal fabrication sectors.

Modiv owns 43 properties (4.5 mm sq.ft) leased to 29 tenants in 15 states. 39 of the properties are considered industrial properties (80% of ABR) along with four non-core properties (20% of ABR).

Approximately 30% of the tenants or their parent companies have an investment-grade credit rating from a recognized credit agency of BBB or better.

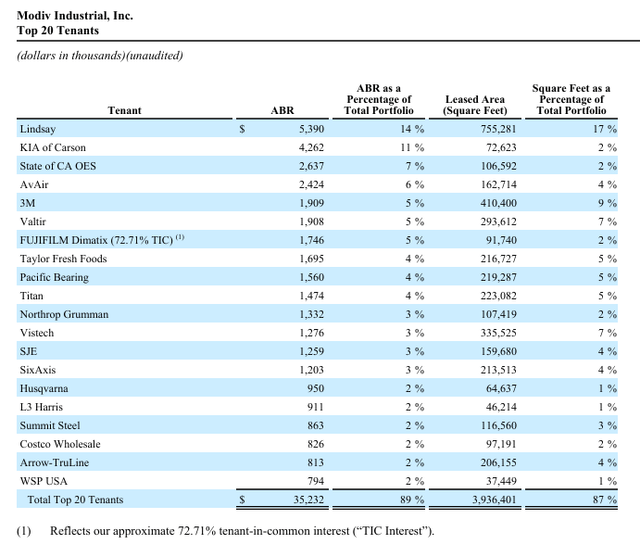

MDV Latest Supplemental

It's worth noting that Modiv's largest customer, Lindsay, generates 14% of ABR, and its second-largest customer, KIA of Carson, generates 11% of ABR. As Austin Rogers explains,

"Lindsay Precast, produces concrete and steel molds for highway guardrails, overpasses, commercial construction projects, and utility equipment pads. It has a long history of operating at the locations MDV now owns, and it could even benefit from increased infrastructure spending in the US."

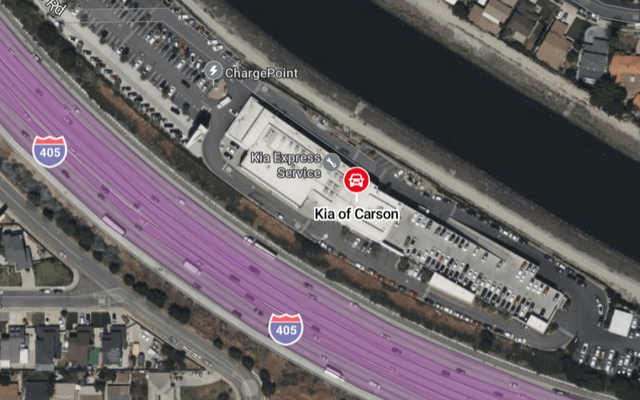

I looked in the latest annual report to determine what Modiv owns (Kia of Carson) and it appears to be a dealership that was built in 2016 and acquired by Modiv in January 2022 for around $70 mm.

So, Modiv fished in a smaller pond than other peers, as I would consider Gladstone Commercial (GOOD) and Broadstone Net Lease (BNL) closer peers.

Modiv's portfolio is valued at around $602 mm and generates around $39 mm in annual rent. The weighted average lease term is 14.2 years, with 2.5% average annual rent increases.

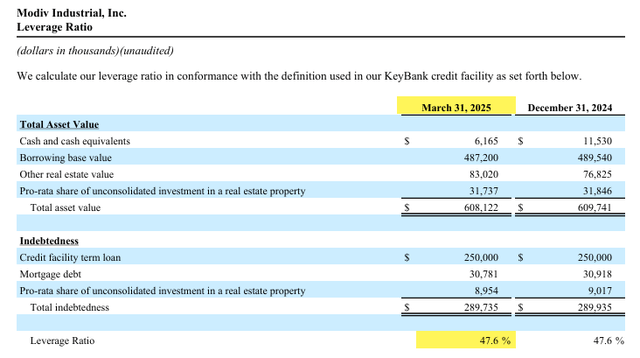

Concerning the balance sheet and liquidity, at the end of Q1-25, Modiv had total cash and cash equivalents of $6.2 million and $280 million of debt outstanding ($31 million of mortgages on 2 properties and $250 million of outstanding borrowings on the $280 million credit facility).

Importantly, Modiv has higher leverage than most peers:

MDV Latest Supplemental

In Q1-25, Modiv's AFFO was $3.9 million, up 18% compared with $3.3 million in Q1-24. The increase in AFFO was related to a $195,000 increase in cash rental income, a $200,000 decrease in cash interest expense, and $140,000 decrease in property expenses.

On a per-share basis, AFFO was just $.03 per share because of an increase of 483,000 shares from ATM issuances, Class X OP units issued to employees in Q1, and shares issued from an UPREIT transaction.

MDV Latest Supplemental

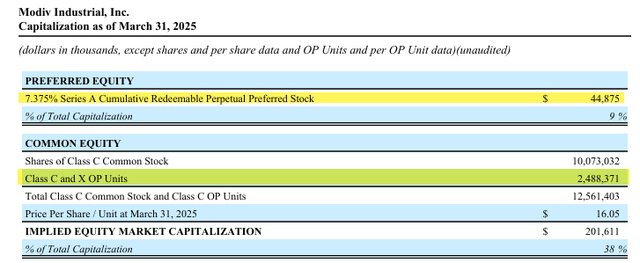

Modiv has around $45 million on 7.375% Series A preferred shares (9% of capitalization) as well as around 2.5 mm shares in OP units. I consider OP units opportunistic for REITs and property owners; however, it's important that such OP transactions are accretive.

I do like the fact that insiders hold around 8.7% of shares outstanding and insiders such as CEO, Aaron Halfacre, and Director, Gingras Raymond, are busy buying.

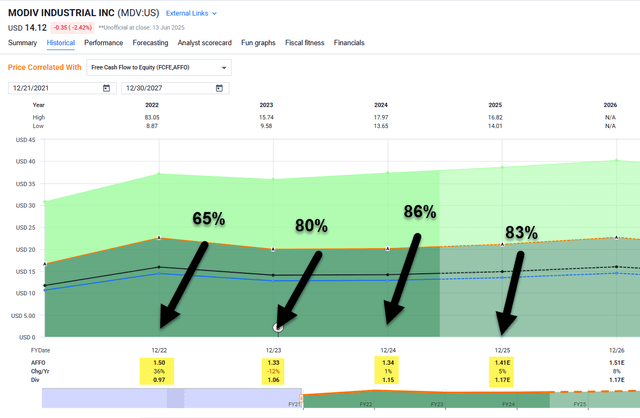

In addition to tenant concentration and higher leverage, I also want to point out the lumpy earnings history. As shown below, the company's AFFO has been up and down, which puts more pressure on the dividend payments.

FAST Graphs

Importantly, Modiv stands for MOnthly DIVidends, which makes the company a retail-oriented investment alternative like Realty Income (O), Agree Realty (ADC), STAG Industrial (STAG), and Healthpeak (DOC), to name a few.

Of course, I would rather have quality than quantity, and I think you would too.

Using analyst consensus data (above chart), Modiv's 2025 payout ratio is around 83%, which seems reasonable given its industrial tenant composition. In addition, the consensus growth estimate for 2026 is 8%, which suggests Modiv can continue boosting its dividend.

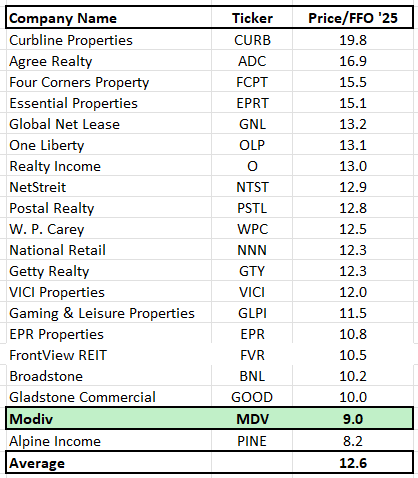

In terms of valuation, shares are trading at $14.12 with a dividend yield of 8.1%, one of the highest in the net lease sector. And the P/FFO multiple is the second lowest (in the peer group) as shown below.

iREIT®

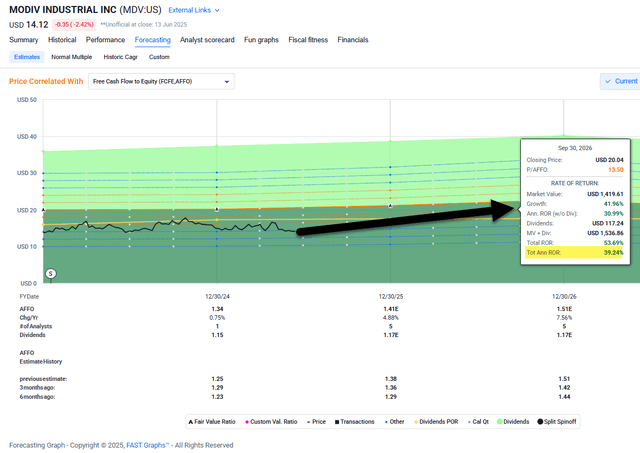

Although there's enhanced risk (leverage, tenant concentration, OP dilution, compensation), I believe Modiv warrants a speculative Strong Buy. Shares could fetch $20.00, which translates into a 12-month return of 40%.

FAST Graphs

In Closing

Keep in mind, small-cap stocks are riskier stocks, and as a responsible investor, you should always maintain reasonable diversification.

More By This Author:

A Backdoor Way To Play The ‘Golden Dome’

You May Never Look At These Two Companies The Same

Coming Soon: ‘The Great American Last Frontier’

Brad Thomas is the Editor of the Forbes Real Estate Investor.

Disclaimer: This article is intended to provide information to interested parties. As ...

more