12 Recession-Proof Stocks

The stock market had a rough time in 2022, with the highly tremulous macroeconomic environment spooking investors and inducing a stormy bear market. At Sure Dividend, we are highly focused on stocks with strong dividend growth prospects.

Due to uncertainty remaining quite elevated and the possibility of a looming recession in 2023 being rather noteworthy, we have identified several recession-proof stocks whose dividend prospects should remain rock-solid if the current bear market persists.

As a reminder, recession-proof stocks are stocks that are considered to be less vulnerable to economic downturns and recessionary market environments and, therefore, may be less affected by elevated volatility in the capital markets. Of course, there is no such thing as a totally recession-proof stock, as all types of securities are subject to some degree of market risk.

Nevertheless, some stocks may be less sensitive to harsh economic conditions and, therefore, may be less likely to experience as much of an impact in their financial performance during a recession. Consequently, dividend-paying, recession-poof stocks should enjoy better longevity qualities when it comes to their payouts.

In this article, we are examining 12 dividend stocks covered in our Sure Analysis Research Database, whose recession-proof characteristics should enable them to keep growing their dividends in a bear market and beyond.

In fact, all 12 stocks featured here have been assigned an A rating in their Dividend Risk Score. They also feature a track record of at least 15 years of consecutive annual dividend increases, meaning they have already proven their ability to withstand harsh economic environments, including the Great Financial Crises and, most recently, the COVID-19 pandemic.

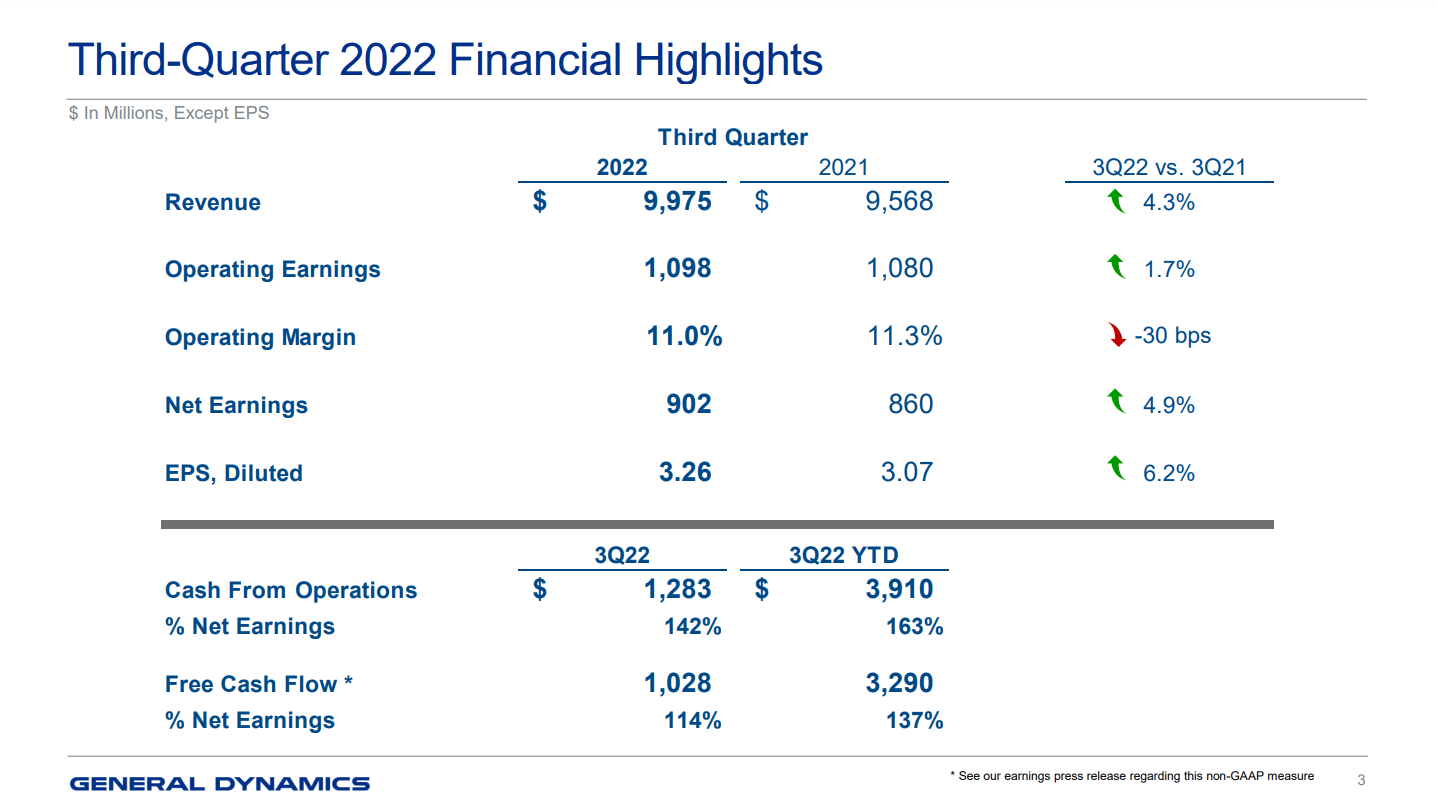

Recession-Proof Stock #12: General Dynamics Corporation (GD)

- Dividend Yield: 2.0%

- Years of Dividend Growth: 31

General Dynamics is a US aerospace & defense company that now operates in four business segments: Aerospace (21% of sales), Combat Systems (19%), Marine Systems (26%), and Technologies (34%).

General Dynamics Aerospace segment is focused on business jets and services, while the remainder of the company is on defense. The company makes the well-known products such as the M1 Abrams tank, Stryker vehicle, Virginia-class submarine, Columbia-class submarine, and Gulfstream business jets. Based on revenue, General Dynamics is the fourth largest defense company.

The company recorded revenues of approximately $38.5 billion in 2021, and both the top and bottom lines have grown consistently over the years due to increasing US defense spending, international sales, and business jet sales. Accordingly, the company has managed to consistently increase its dividend, now boasting an impressive track record of 31 consecutive annual dividend increases. This makes General Dynamics a Dividend Aristocrat.

Source: Investor Presentation

We believe the company will continue performing well as its established naval and ground platforms position it well to keep winning future support maintenance and modernization contracts as well as future prime contracts. Most recently, the company was awarded a $5.13 billion modification to a previously awarded contract by the U.S. Navy. The ongoing, unfortunate war in Ukraine should also be a strong driver toward future order inflow.

Due to its strong company-wide backlog of $88.1 billion, its low payout ratio of 41%, and the fact that the defense industry experiences multiple tailwinds these days, we believe that General Dynamics’ dividend growth prospects should remain rock-solid during a potential recession.

Click here to download our most recent Sure Analysis report on General Dynamics (preview of page 1 of 3 shown below):

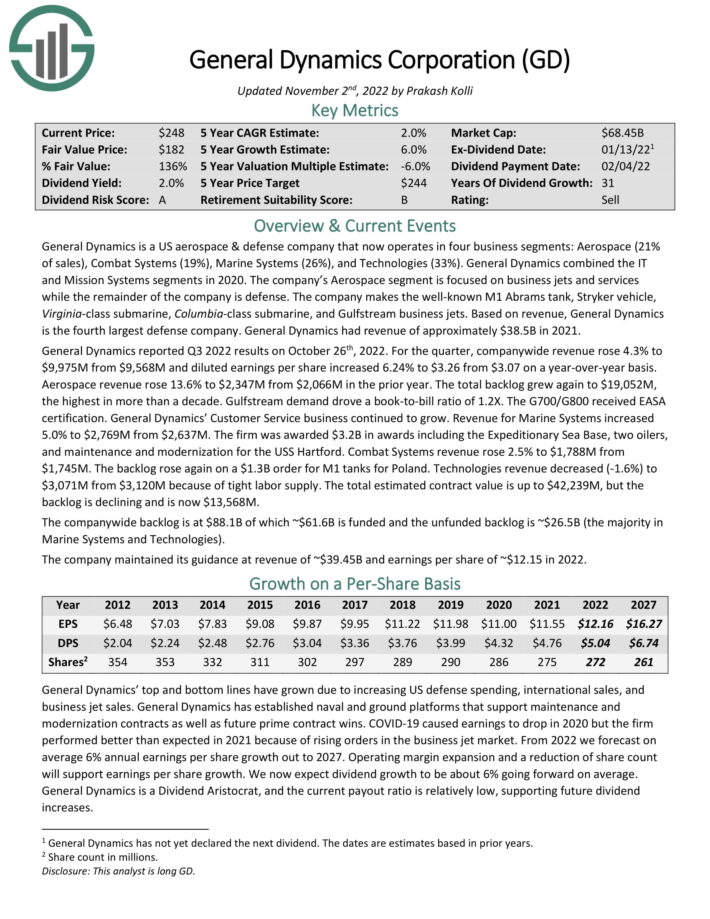

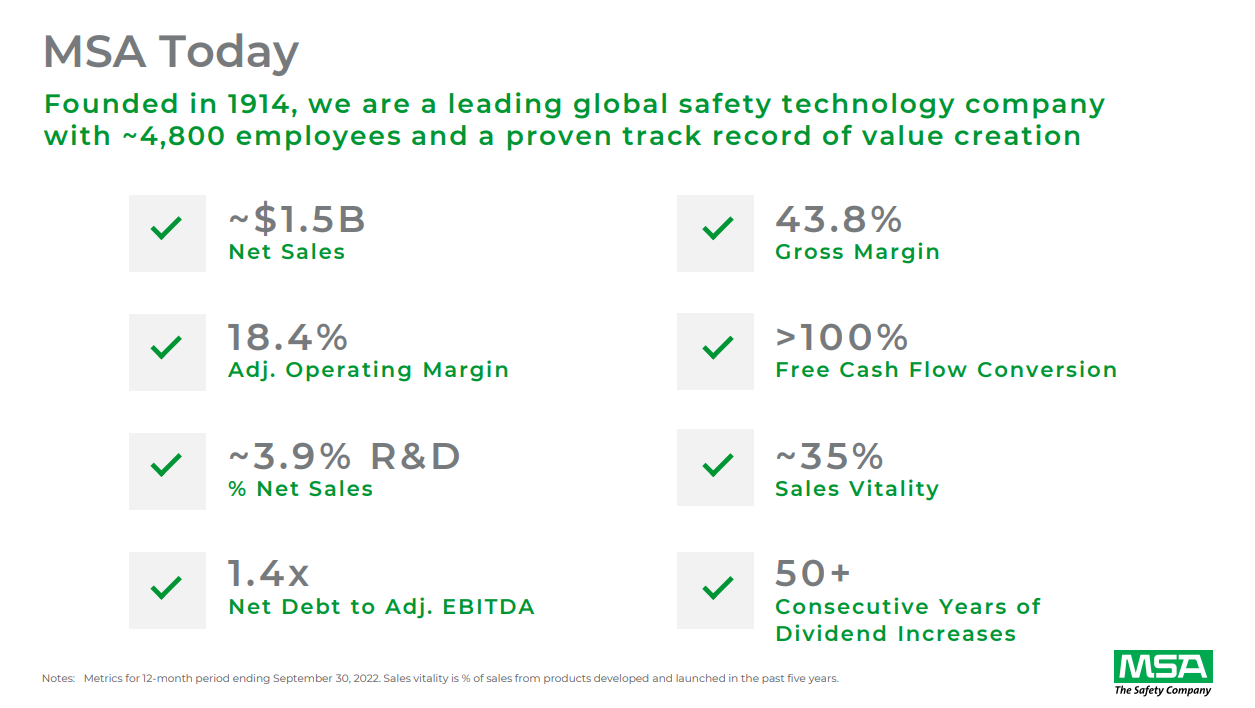

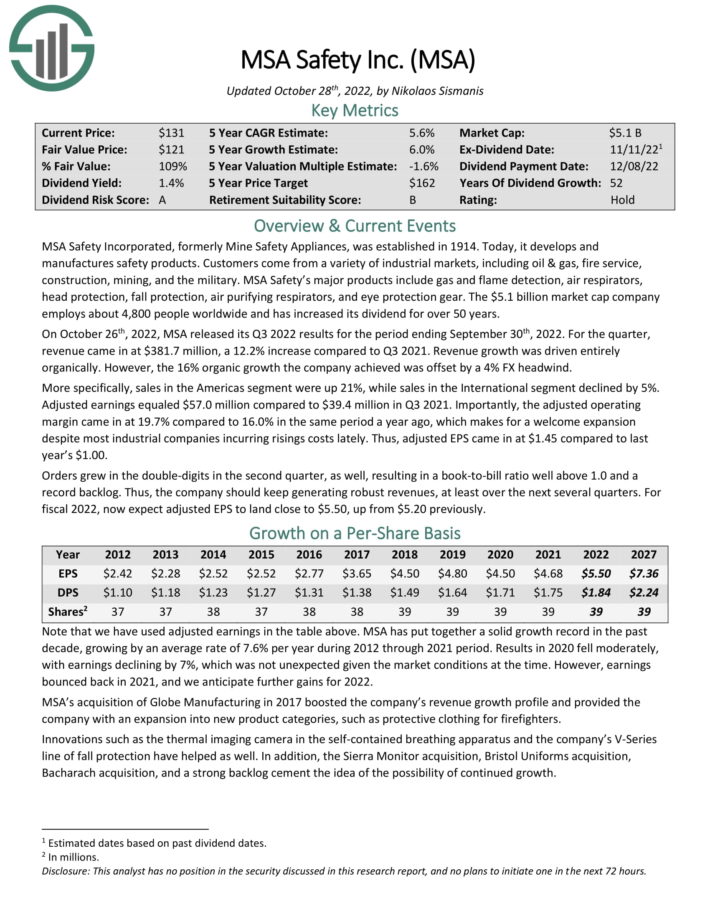

Recession-Proof Stock #11: MSA Safety Incorporated (MSA)

- Dividend Yield: 1.3%

- Years of Dividend Growth: 52

MSA Safety Incorporated, formerly Mine Safety Appliances, was established in 1914. Today, it develops and manufactures safety products. Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military.

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air-purifying respirators, and eye protection gear. The $5.5 billion market cap company has increased its dividend for 52 years, which qualifies it as a Dividend King.

Source: Investor Presentation

On October 26th, 2022, MSA released its Q3 2022 results for the period ending September 30th, 2022. For the quarter, revenue came in at $381.7 million, a 12.2% increase compared to Q3 2021. Revenue growth was driven entirely organically. However, the 16% organic growth the company achieved was offset by a 4% FX headwind.

Orders grew in the double digits in the second quarter, as well, resulting in a book-to-bill ratio well above 1.0 and a record backlog. Thus, the company should keep generating robust revenues, at least over the next several quarters.

The company has a global reach that competitors cannot match, with roughly a third of annual sales from outside the Americas, and it can invest in growth initiatives to retain its industry leadership. With its payout ratio standing at just 33%, a robust order backlog, and management’s explicit commitment to growing the dividend annually, we believe MSA investors should sleep well at night with regard to its dividends.

Click here to download our most recent Sure Analysis report on MSA Safety Incorporated (preview of page 1 of 3 shown below):

Recession-Proof Stock #10: Medtronic plc (MDT)

- Dividend Yield: 3.6%

- Years of Dividend Growth: 45

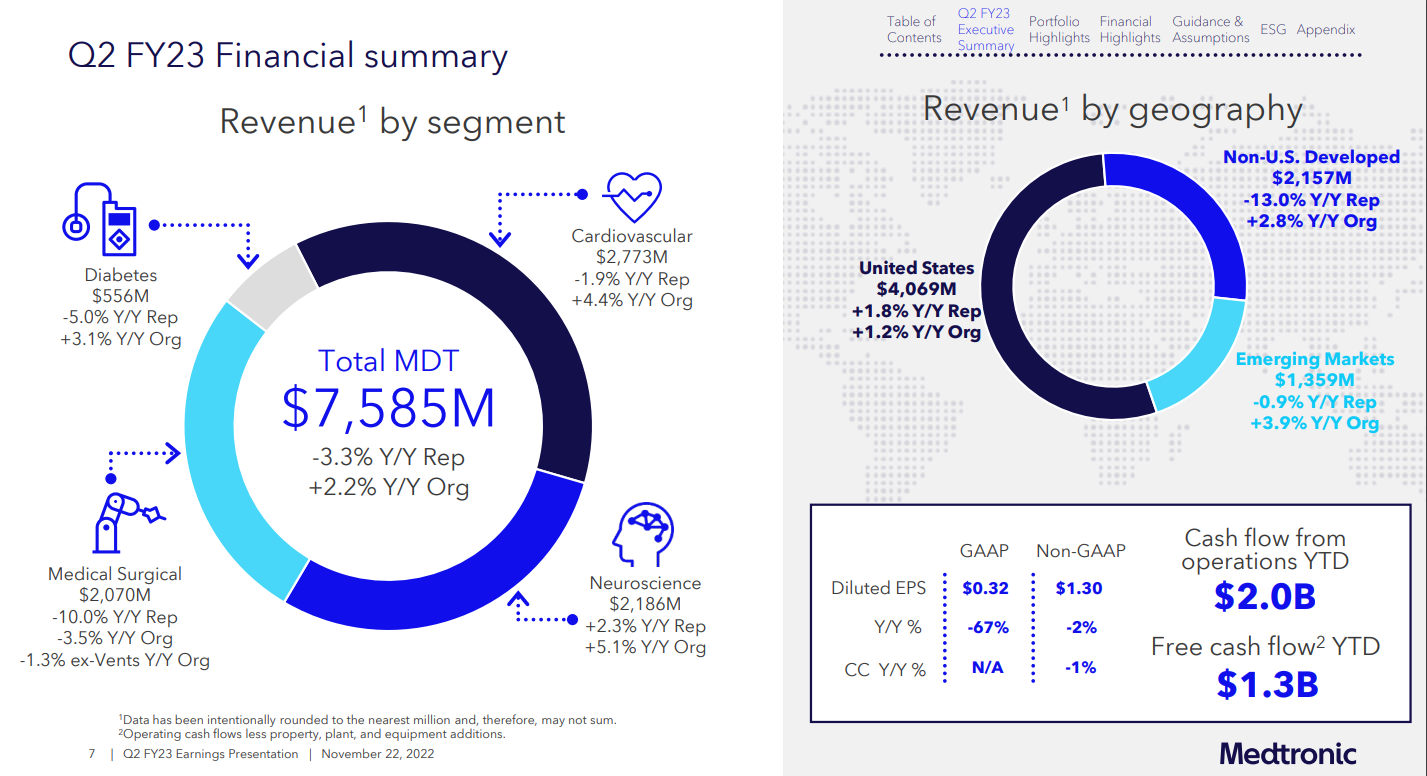

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees. Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes. Medtronic has raised its dividend for 45 consecutive years. The $103 billion market cap company generated $32 billion in revenue in its last fiscal year.

In late November, Medtronic reported (11/22/22) results for the second quarter of the fiscal year 2023. Organic revenue grew 2% over last year’s quarter, but revenue dipped by 3%, and earnings-per-share fell -by 2% due to a strong dollar. Results were hurt by slow supply recovery and modest market procedure volumes in some businesses, and hence Medtronic lowered its guidance for annual earnings-per-share from $5.53 to $5.65, down to $5.25 to $5.30.

Source: Investor Presentation

Medtronic’s most compelling competitive advantage is its intellectual leadership in a complicated industry within the healthcare sector. Medtronic also has a strong product pipeline that should drive its growth for the foreseeable future, most likely to result in further dividend hikes. The payout ratio stands at a healthy 51%.

Click here to download our most recent Sure Analysis report on Medtronic (preview of page 1 of 3 shown below):

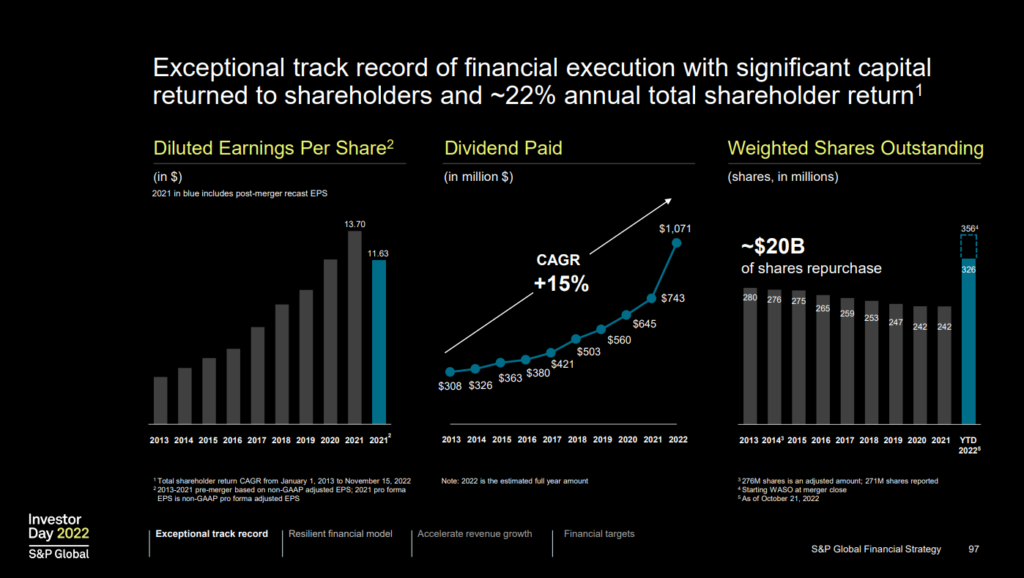

Recession-Proof Stock #9: S&P Global Inc. (SPGI)

- Dividend Yield: 1.0%

- Years of Dividend Growth: 49

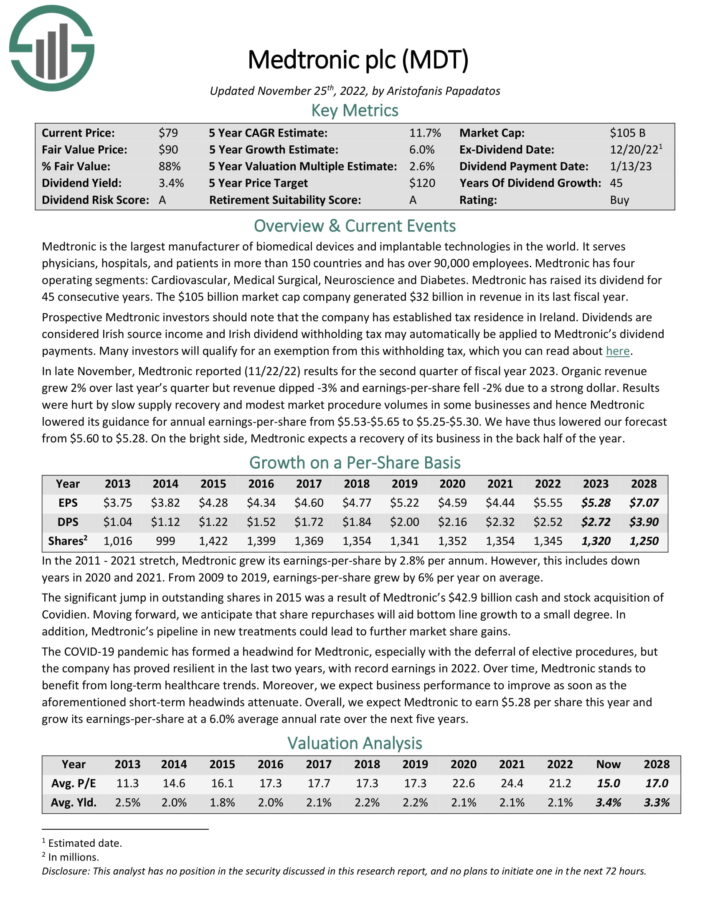

S&P Global is a worldwide provider of financial services and business information with a market capitalization of $108.2 billion and has annual revenue of about $12 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

The company’s early 2022 acquisition of IHS Markit boosted its pro forma revenue by about 50%. S&P Global has paid dividends continuously since 1937 and has increased its payout for 49 consecutive years.

Source: Investor Presentation

S&P reported third-quarter earnings on October 27th, 2022, and results were mixed. Adjusted earnings-per-share came to $2.93, which was 13 cents better than expected. Revenue rose 37% year-over-year to $2.86 billion, butwas $60 million light against estimates. Adjusted operating profit declined 200bps to 46.0% of revenue from the year-ago period.

On the other hand, S&P Global is vulnerable to recessions, as companies, countries, and individuals become much more conservative during such periods, and thus their interest in financial services and debt issuance greatly decreases. This was evident in the Great Recession when S&P Global’s earnings-per-share fell -21%.

However, given that it was a financial crisis and most companies saw their earnings collapse, the performance of S&P Global was solid overall. To its credit, S&P Global’s earnings thrived in 2020 despite the capital markets temporarily crumpling.

Click here to download our most recent Sure Analysis report on S&P Global (preview of page 1 of 3 shown below):

Recession-Proof Stock #8: Atmos Energy Corporation (ATO)

- Dividend Yield: 2.6%

- Years of Dividend Growth: 39

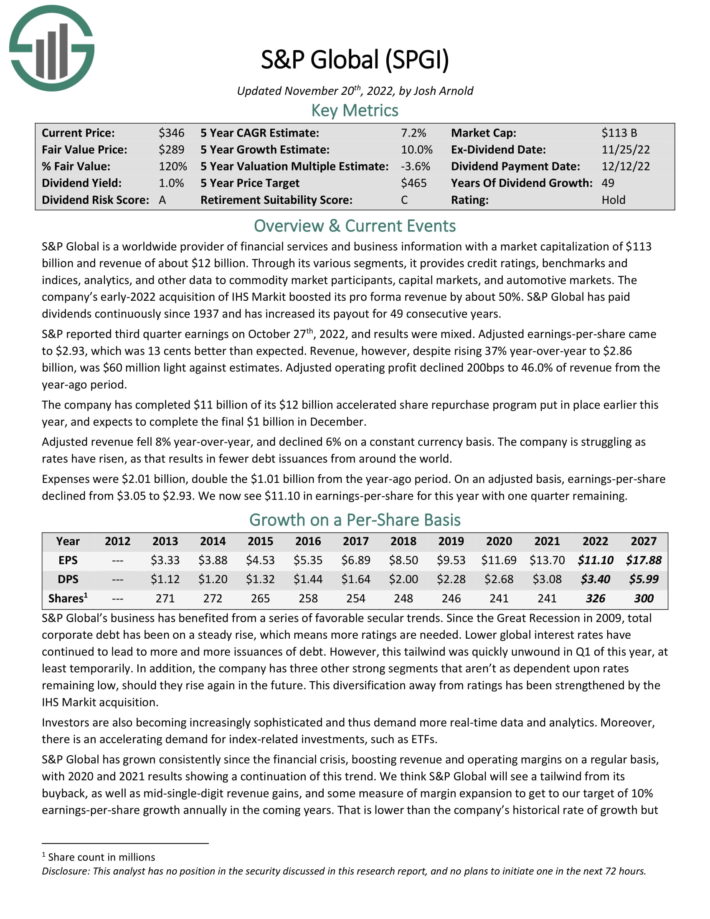

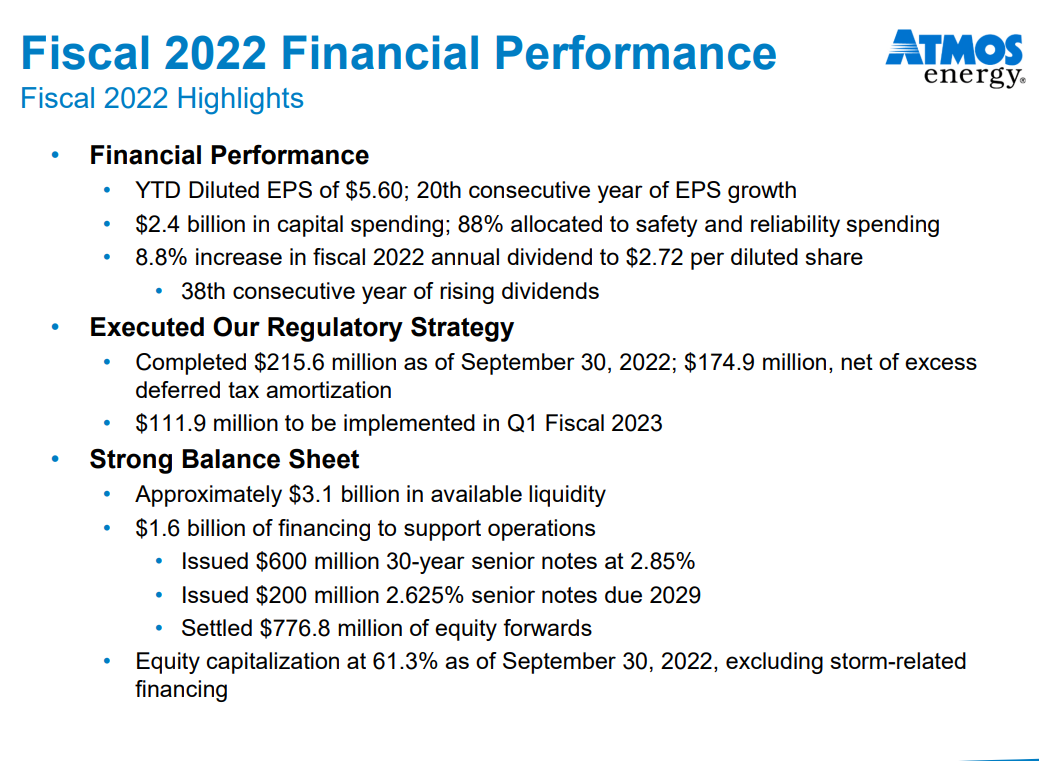

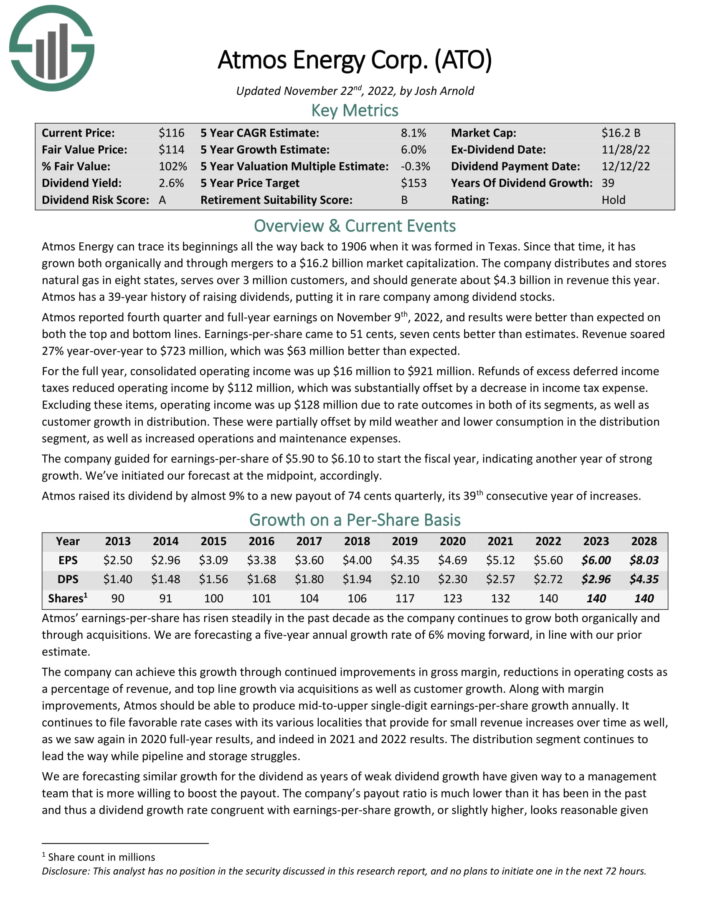

Atmos Energy can trace its beginnings all the way back to 1906, when it was formed in Texas. Since that time, it has grown, both organically and through mergers, to a $16.2 billion market capitalization.

The company distributes and stores natural gas in eight states, serves over 3 million customers, and should generate about $4.3 billion in revenue this year. Atmos has a 39-year history of raising dividends, placing amongst the elite group of Dividend Aristocrats.

Atmos reported fourth-quarter and full-year earnings on November 9th, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to 51 cents, seven cents better than estimates. Revenue soared 27% year-over-year to $723 million, which was $63 million better than expected.

Source: Investor Presentation

The company’s competitive advantage is in its wide distribution area and lack of direct competition in its service areas for residential and commercial customers. In addition, discretionary use of natural gas is low as people typically use what they need, regardless of economic conditions, meaning Atmos’ recession performance is likely to be resilient, as seen in 2020.

Click here to download our most recent Sure Analysis report on Atmos Energy Corporation (preview of page 1 of 3 shown below):

Recession-Proof Stock #8: Colgate-Palmolive Company (CL)

- Dividend Yield: 2.6%

- Years of Dividend Growth: 39

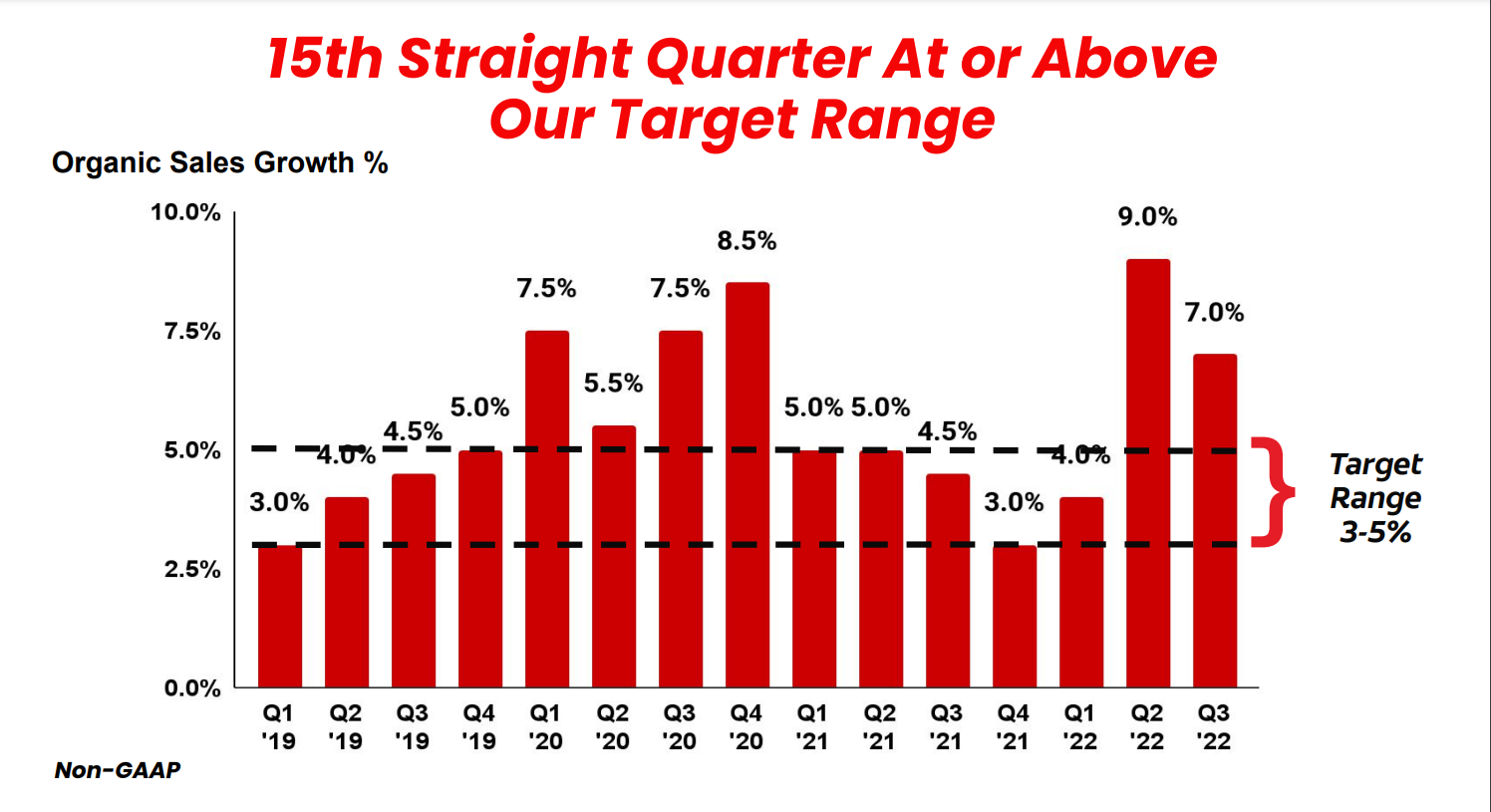

Colgate-Palmolive has been in existence for more than 200 years, having been founded in 1806. It operates in many consumer staples markets, including Oral Care, Personal Care, Home Care, and, more recently, Pet Nutrition. These segments generate nearly $18 billion in annual revenue for the company. The stock’s market capitalization sits at $66 billion.

Colgate reported third-quarter earnings on October 28th, 2022, and results were mixed. The company reported adjusted earnings-per-share of 74 cents, which was a penny better than estimates. Revenue was up 1.1% to $4.46 billion, but missed estimates by $10 million. Organic sales were up 7%, with growth in every division and in all four product categories. The gross profit margin was down 220 basis points year-over-year to 57.2% as inflationary pressures took their toll once again.

Source: Investor Presentation

The company’s payout ratio is 63% of earnings, somewhat higher than in recent years. Nevertheless, see the dividend as safe, and we believe Colgate-Palmolive will produce many more years of dividend increases. Colgate is a recession-resistant stock, given the staple nature of the products it sells, and its competitive advantage is found in the dominant brands it owns. This is proven in the company’s 60-year-long dividend growth track record.

Click here to download our most recent Sure Analysis report on Colgate- Palmolive Corporation (preview of page 1 of 3 shown below):

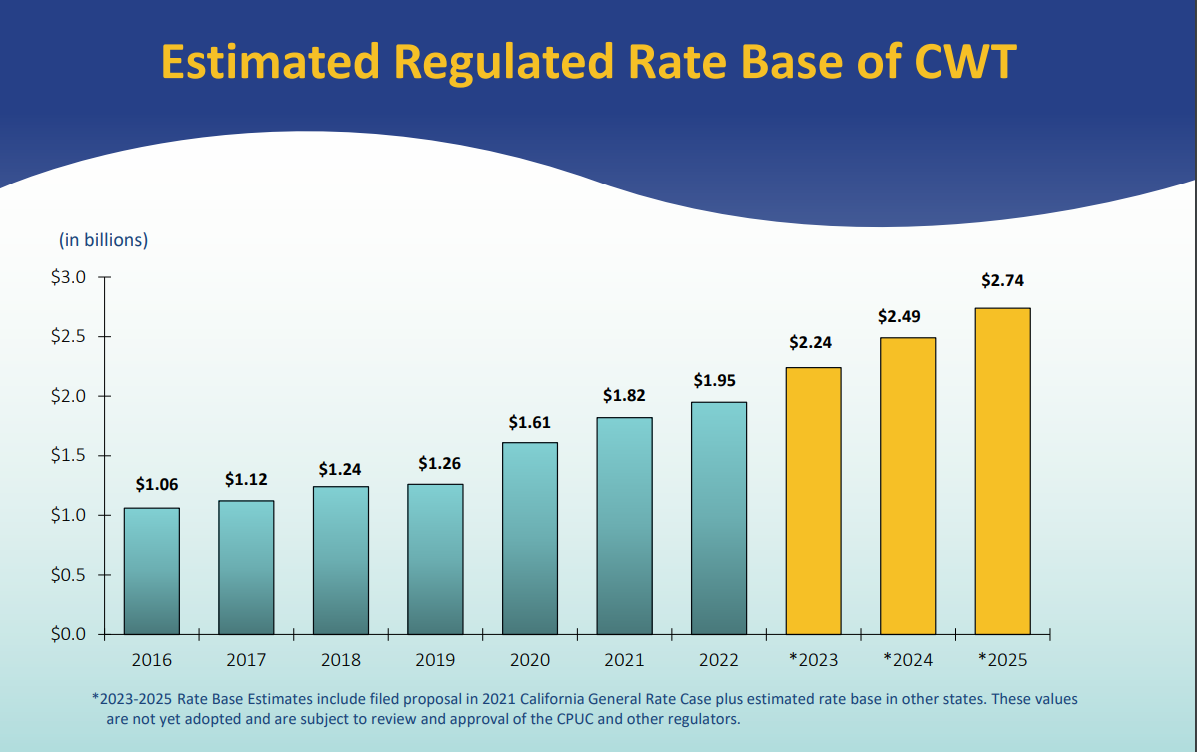

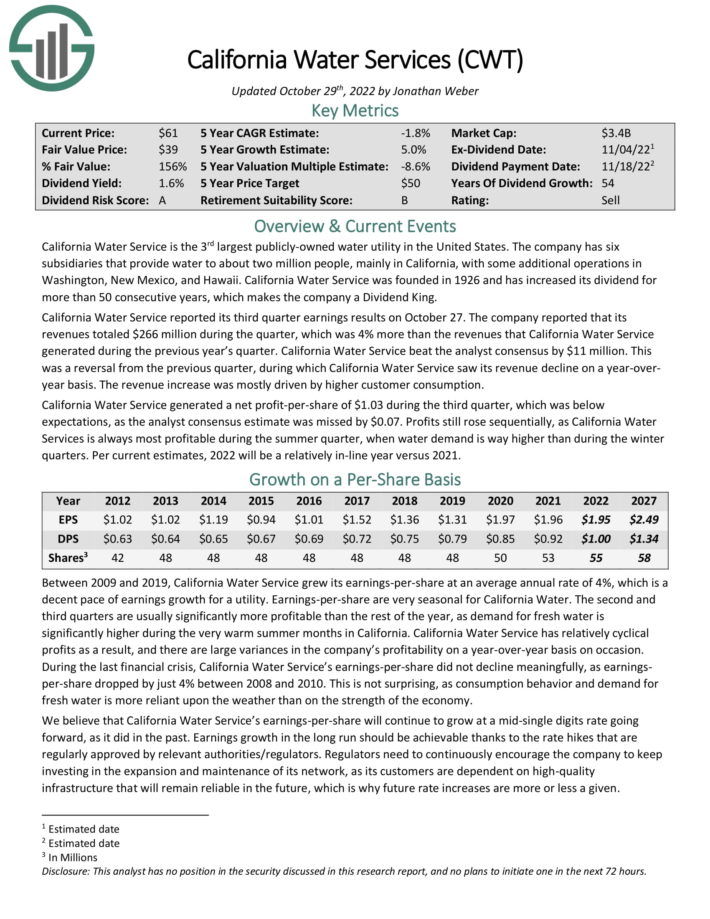

Recession-Proof Stock #7: California Water Service Group (CWT)

- Dividend Yield: 1.7%

- Years of Dividend Growth: 54

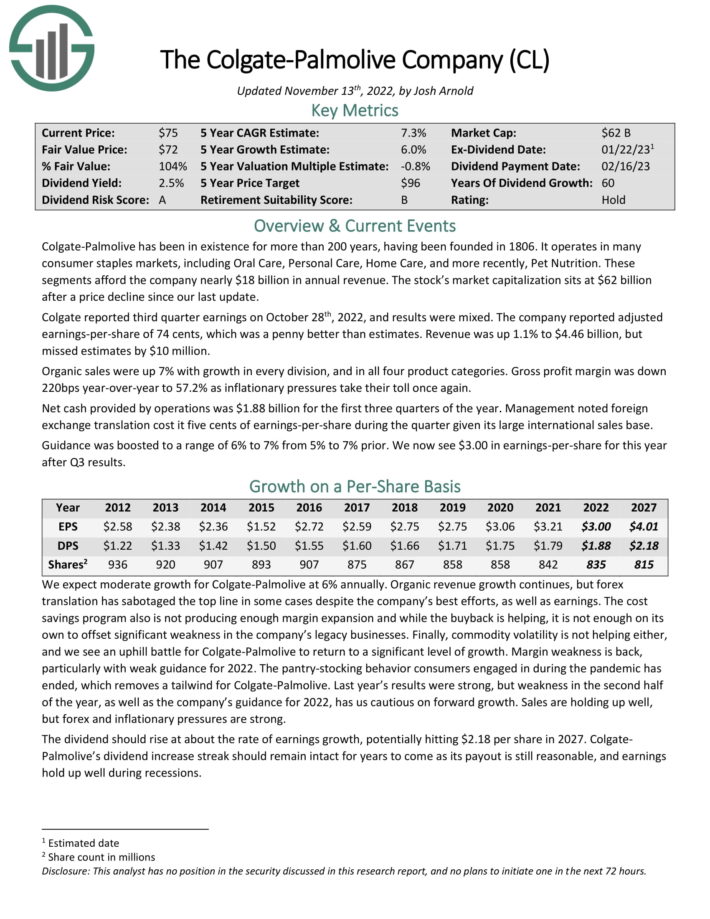

California Water Service is the 3rd largest publicly-owned water utility in the United States. The company has six subsidiaries that provide water to about two million people, mainly in California, with some additional operations in Washington, New Mexico, and Hawaii.

California Water Service was founded in 1926 and has increased its dividend every year for more than half a century, which makes the company a Dividend King.

California Water Service reported its third-quarter earnings results on October 27. The company reported that its revenues totaled $266 million during the quarter, which was 4% more than the revenues that California Water Service generated during the previous year’s quarter. The revenue increase was mostly driven by higher customer consumption.

California Water Service generated a net profit-per-share of $1.03 during the third quarter, which was below expectations, as the analyst consensus estimate was missed by $0.07. Profits still rose sequentially, as California Water Services is always most profitable during the summer quarter when water demand is way higher than during the winter quarters.

Source: Investor Presentation

The predictable nature of the company’s earnings, combined with a payout ratio that is not overly high, means that the dividend looks very safe. Further, California Water Service is a regulated utility, and as such, it does not have to worry about competition too much.

Click here to download our most recent Sure Analysis report on California Water Service (preview of page 1 of 3 shown below):

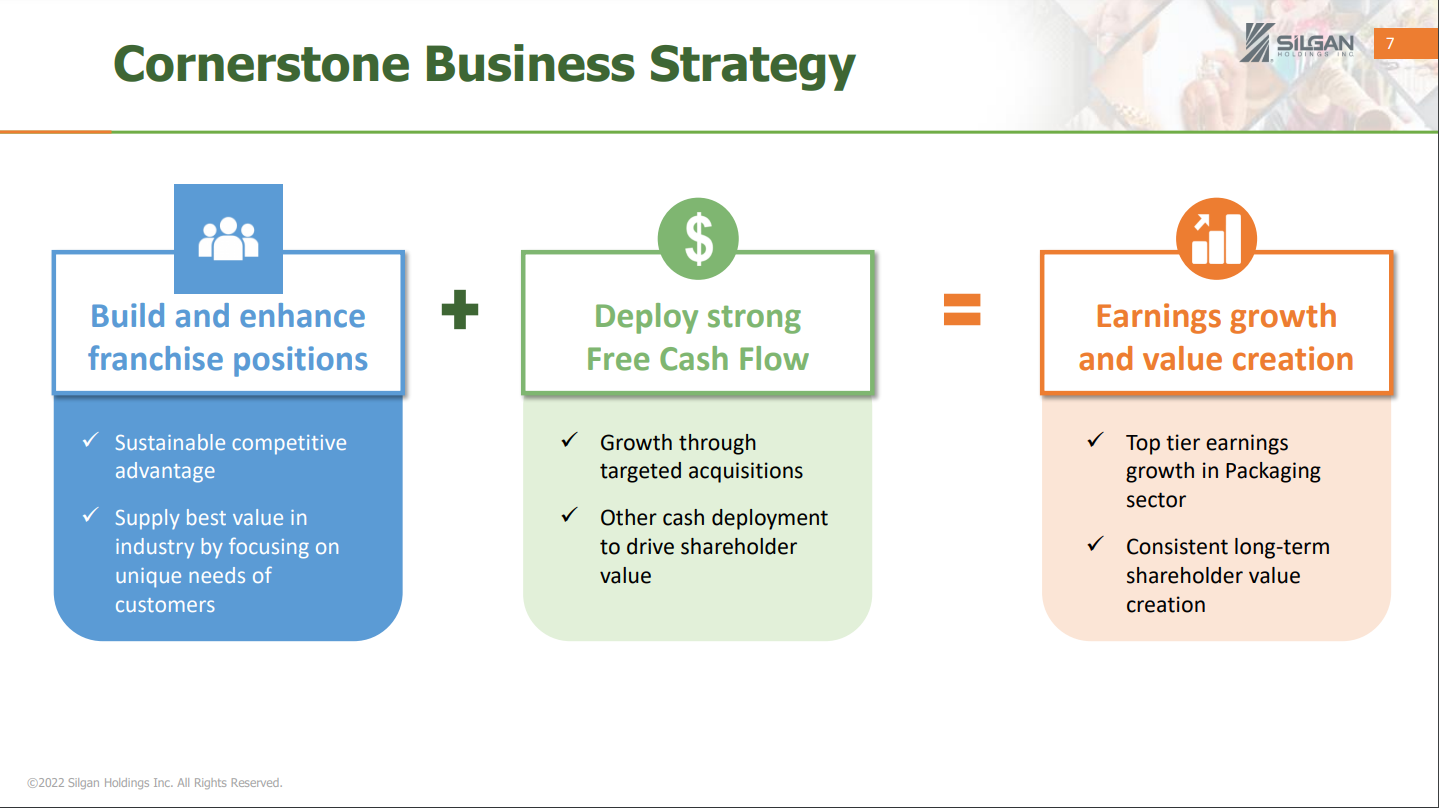

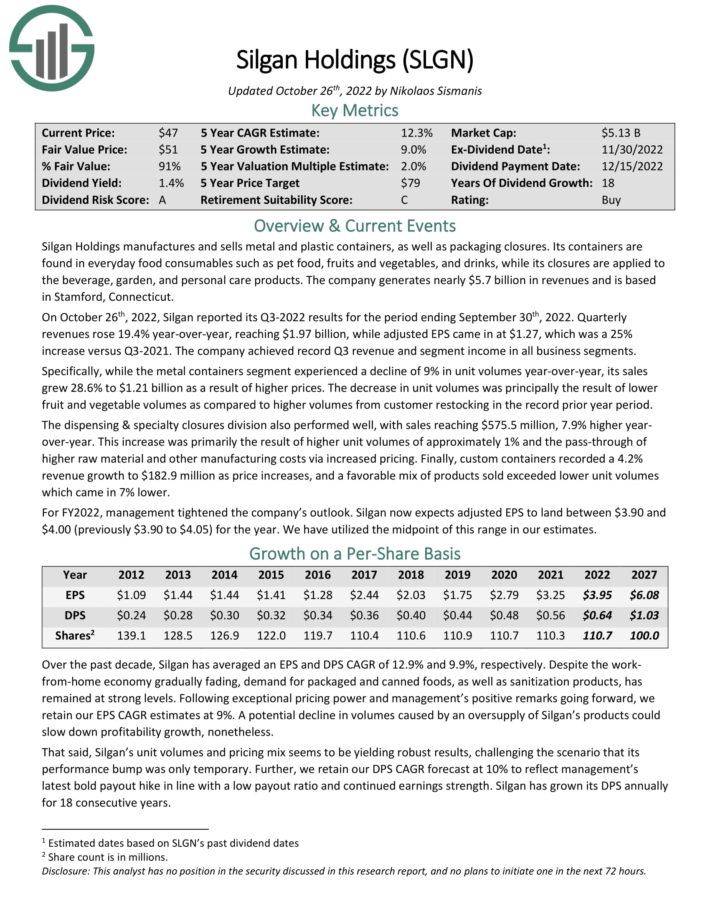

Recession-Proof Stock #6: Silgan Holdings Inc. (SLGN)

- Dividend Yield: 1.2%

- Years of Dividend Growth: 18

Silgan Holdings manufactures and sells metal and plastic containers, as well as packaging closures. Its containers are found in everyday food consumables such as pet food, fruits and vegetables, and drinks, while its closures are applied to beverage, garden, and personal care products. The company generates nearly $5.7 billion in revenues and is based in Stamford, Connecticut.

On October 26th, 2022, Silgan reported its third-quarter results for the period ending September 30th, 2022. Quarterly revenues rose 19.4% year-over-year, reaching $1.97 billion, while adjusted EPS came in at $1.27, which was a 25% increase versus Q3-2021. The company achieved record Q3 revenue and segment income in all business segments.

Over the past decade, Silgan has averaged an EPS and DPS CAGR of 12.9% and 9.9%, respectively. Despite the work-from-home economy gradually fading, demand for packaged and canned foods, as well as sanitization products, has remained at strong levels.

Source: Investor Presentation

Investors can rely on Silgan’s dividends since the company’s payout ratio has mostly remained incredibly low. It currently stands at 16%. Since the company’s IPO in 1996, Silgan has never reported a money-losing quarter. Its products are vital for various consumer staples. Hence, its operations are quite stable, displayed in its 18-year dividend growth record.

Click here to download our most recent Sure Analysis report on Silgan Holdings (preview of page 1 of 3 shown below):

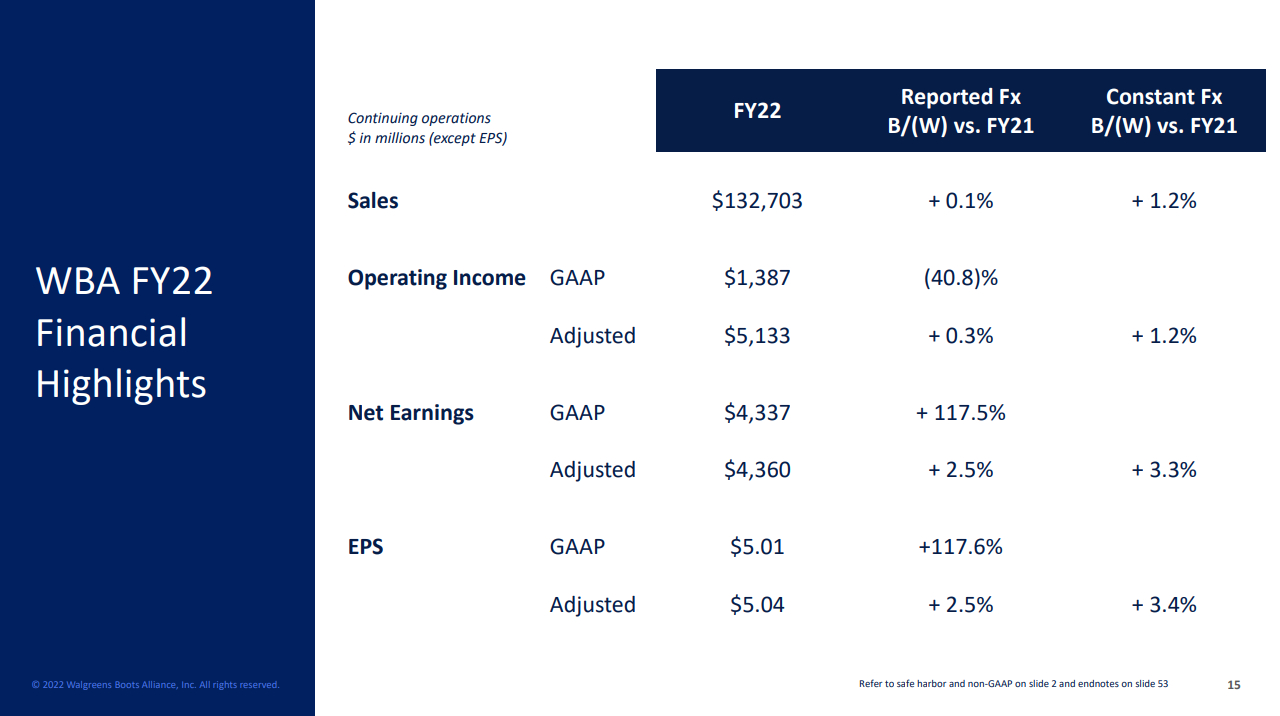

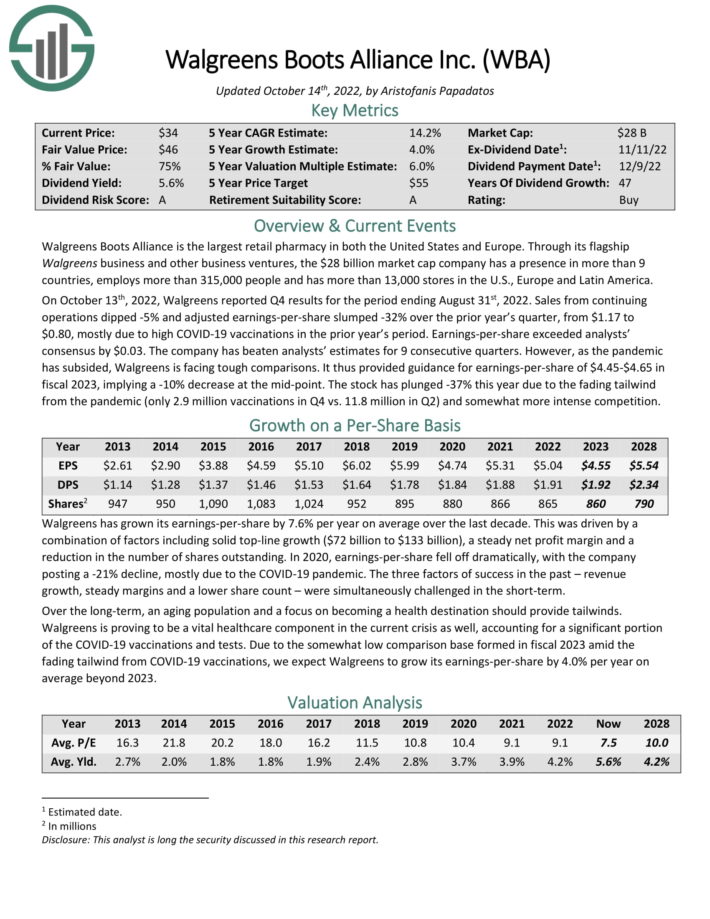

Recession-Proof Stock #5: Walgreens Boots Alliance, Inc. (WBA)

- Dividend Yield: 5.0%

- Years of Dividend Growth: 47

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the $28 billion market cap company has a presence in more than nine countries, employs more than 315,000 people, and has more than 13,000 stores in the U.S., Europe, and Latin America.

On October 13 th, 2022, Walgreens reported Q4 results for the period ending August 31st, 2022. Sales from continuing operations dipped -5%, and adjusted earnings-per-share slumped -32% over the prior year’s quarter, from $1.17 to $0.80, mostly due to high COVID-19 vaccinations in the prior year’s period.

Source: Investor Presentation

Walgreens’ competitive advantage lies in its vast scale and network in an important and growing industry. The payout ratio remains reasonable, at 42%, and should continue to add an income ballast for dividend-growth investors. Furthermore, despite the reduced earnings in 2020, it should be noted that Walgreens has put together a very strong record in good times and bad.

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance (preview of page 1 of 3 shown below):

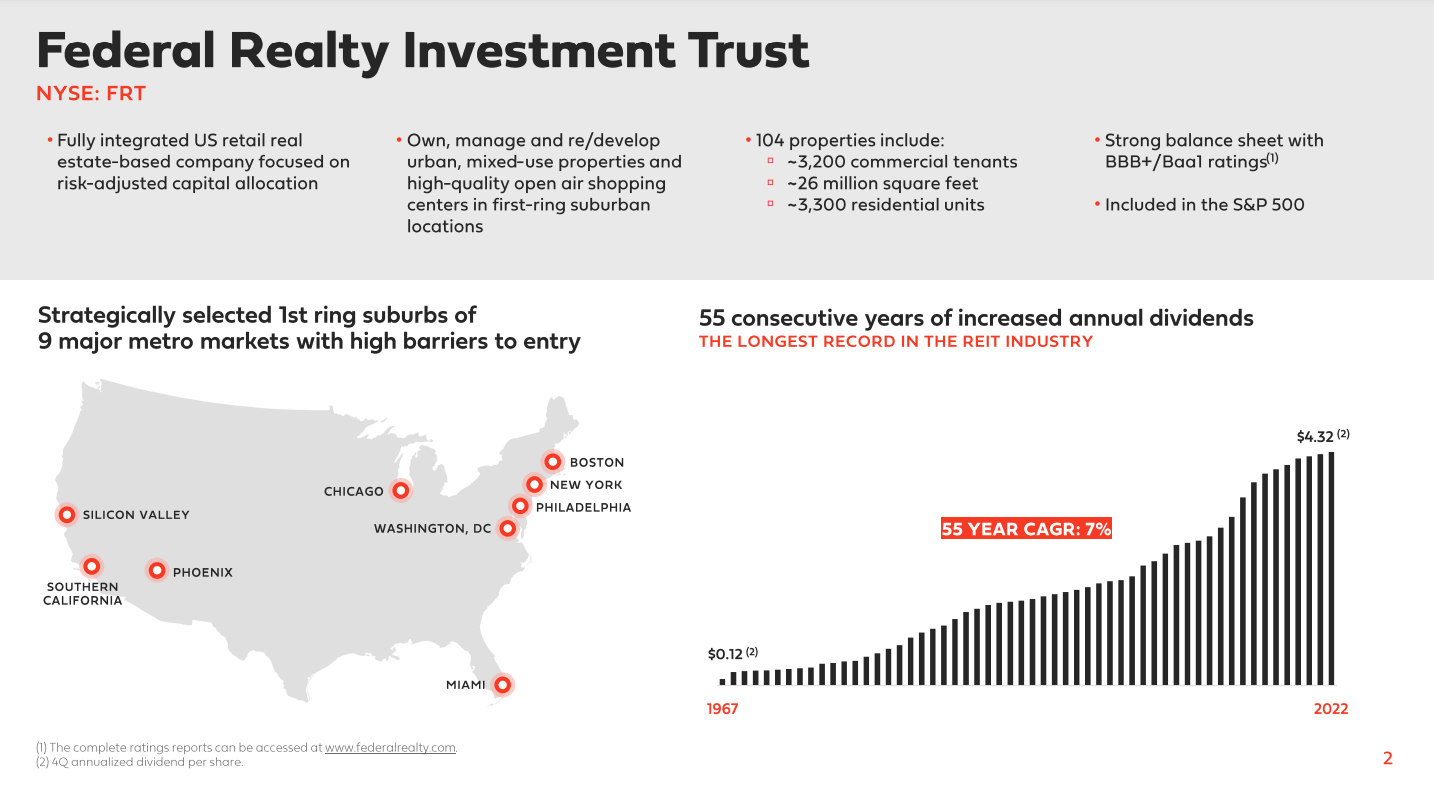

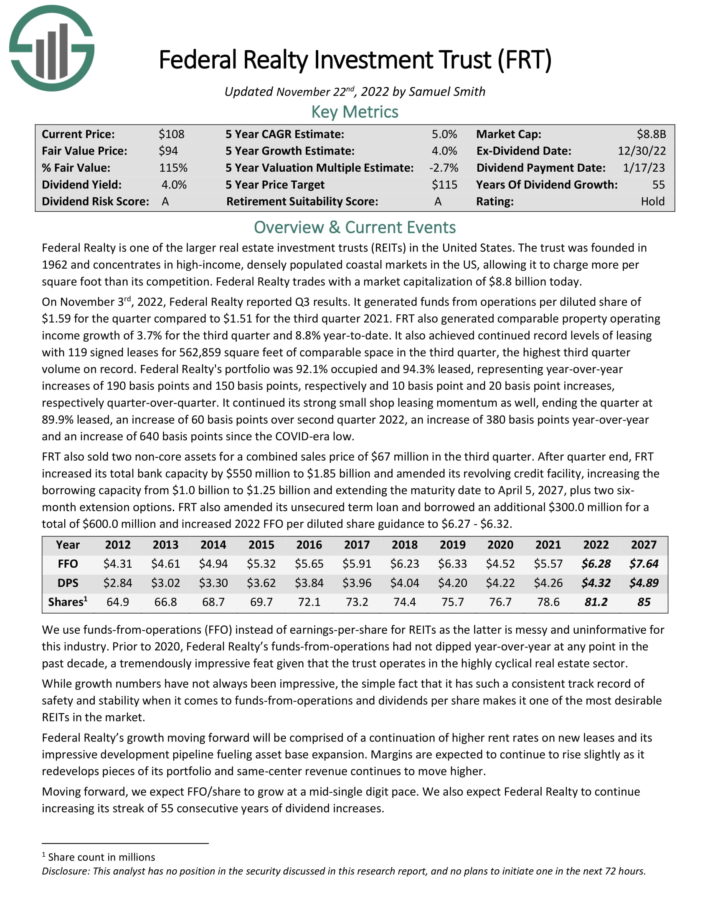

Recession-Proof Stock #4: Federal Realty Investment Trust (FRT)

- Dividend Yield: 4.3%

- Years of Dividend Growth: 55

Federal Realty is one of the larger real estate investment trusts (REITs) in the United States. The trust was founded in 1962 and concentrates on high-income, densely populated coastal markets in the US, allowing it to charge more per square foot than its competition. Federal Realty trades with a market capitalization of $8.3 billion today.

Source: Investor Presentation

On November 3rd, 2022, Federal Realty reported third-quarter results. It generated FFO/share of $1.59 for the quarter compared to $1.51 in the prior-year period. FRT also generated comparable property operating income growth of 3.7% for the period and 8.8% year-to-date.

The trust also achieved continued record levels of leasing with 119 signed leases for 562,859 square feet of comparable space in the quarter, the highest third-quarter volume on record. Federal Realty’s portfolio was 92.1% occupied and 94.3% leased, representing year-over-year increases of 190 basis points and 150 basis points, respectively, and 10 basis point and 20 basis point increases, respectively, quarter-over-quarter.

FRT features the longest dividend growth streak amongst REITs, boasting 55 years of successive annual dividend increases.

Click here to download our most recent Sure Analysis report on Federal Realty Investment Trust (preview of page 1 of 3 shown below):

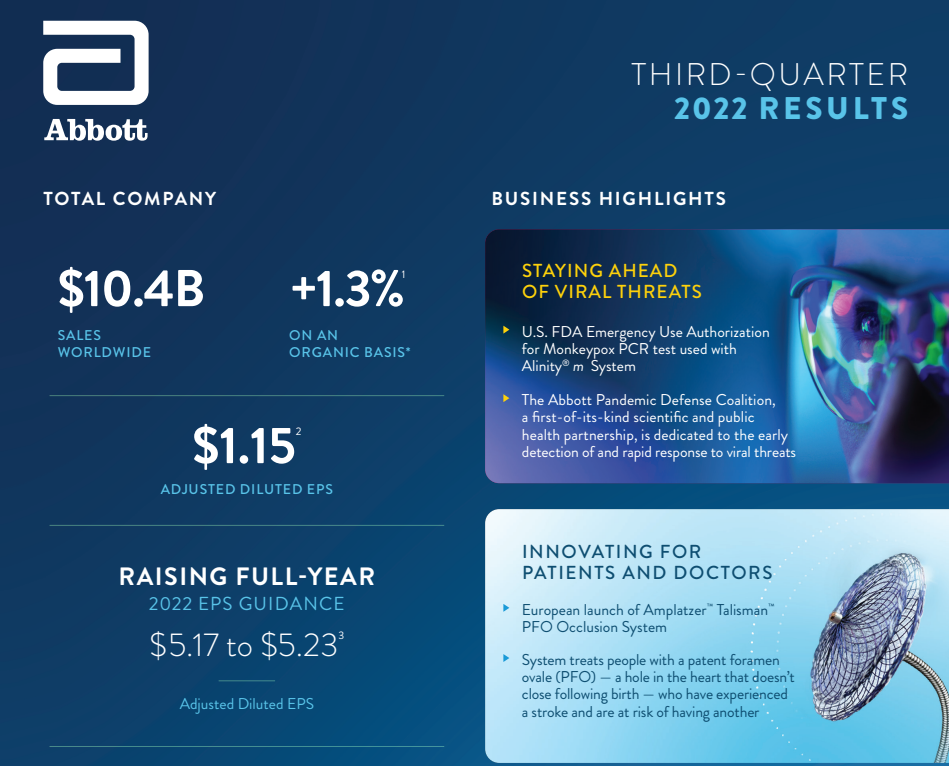

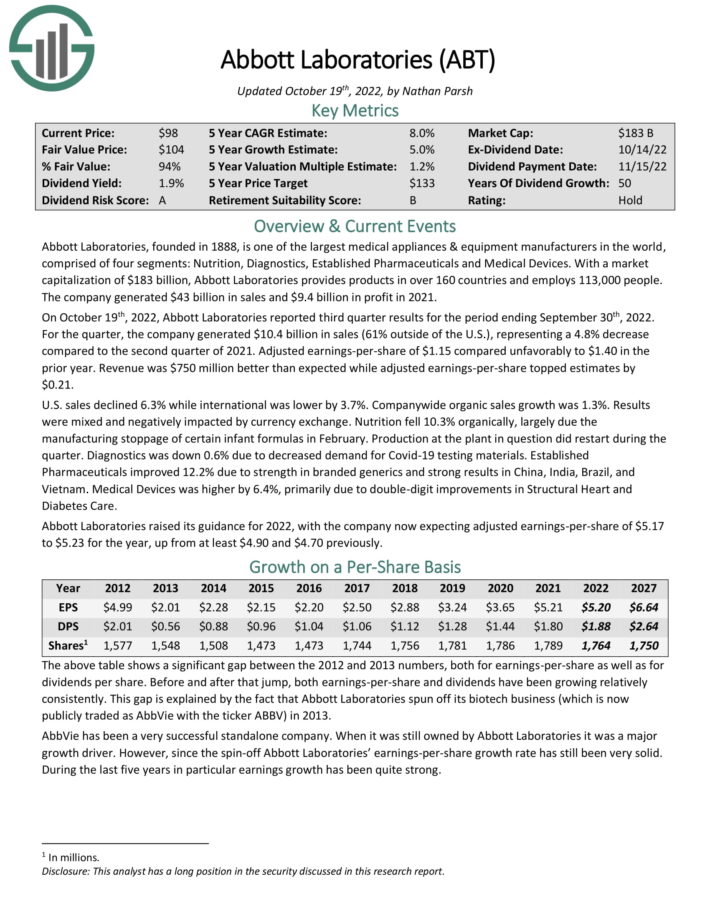

Recession-Proof Stock #3: Abbott Laboratories (ABT)

- Dividend Yield: 1.9%

- Years of Dividend Growth: 51

Abbott Laboratories, founded in 1888, is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals, and Medical Devices. With a market capitalization of $183 billion, Abbott Laboratories provides products in over 160 countries and employs 113,000 people. The company generated $43 billion in sales and $9.4 billion in profit in 2021.

On October 19th, 2022, Abbott Laboratories reported third-quarter results for the period ending September 30th, 2022. For the quarter, the company generated $10.4 billion in sales (61% outside of the U.S.), representing a 4.8% decrease compared to the second quarter of 2021.

Adjusted earnings-per-share of $1.15 compared unfavorably to $1.40 in the prior year. Revenue was $750 million better than expected, while adjusted earnings-per-share topped estimates by $0.21.

Source: Investor Infographic

Abbott Laboratories’ dividend payout ratio has never been above 50% throughout the last decade. It currently stands at a very healthy 36%. Coupled with the fact that the company’s earnings-per-share has shown consistent growth even during the harshest economic environments, Abbott Laboratories’ dividend looks very safe.

Click here to download our most recent Sure Analysis report on Abbott Laboratories (preview of page 1 of 3 shown below):

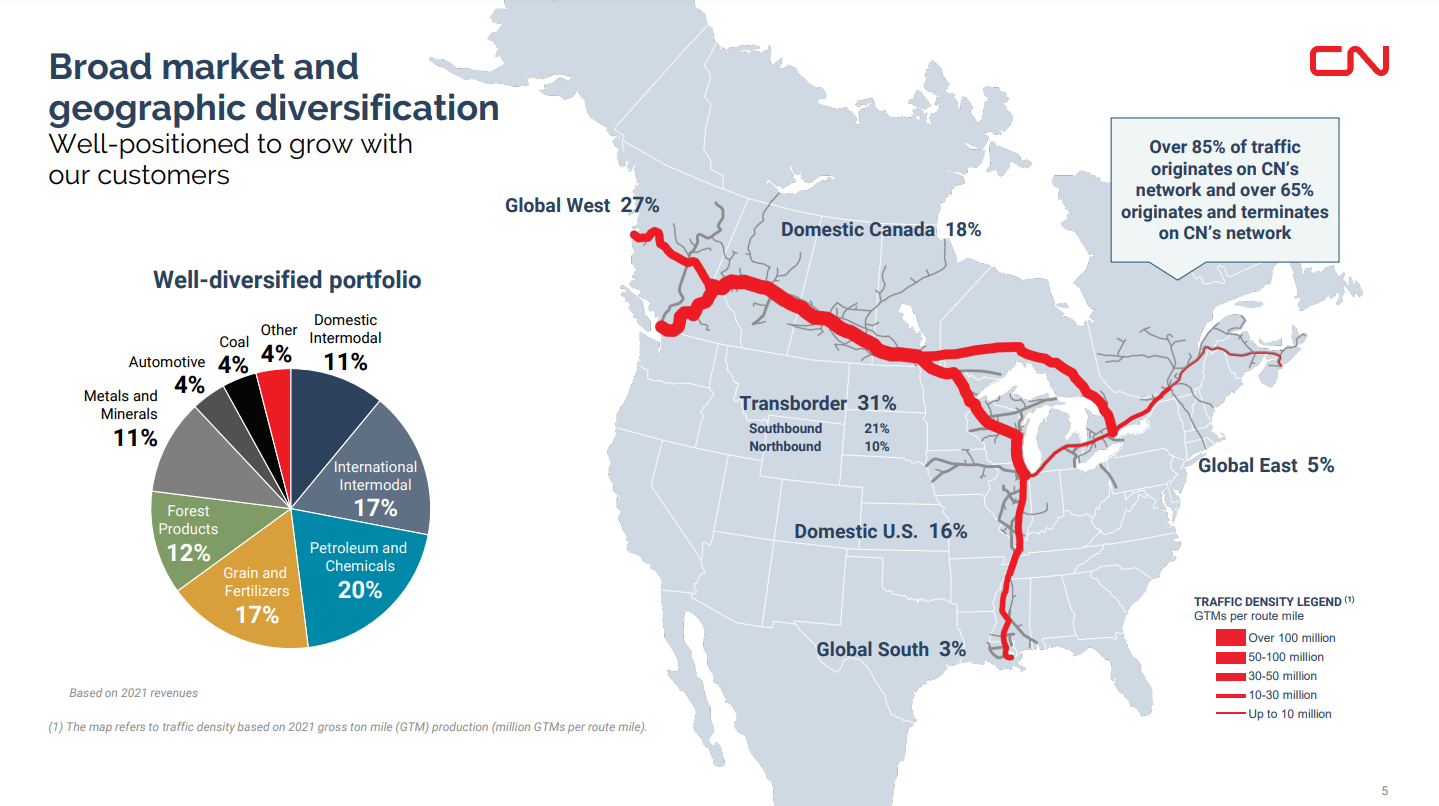

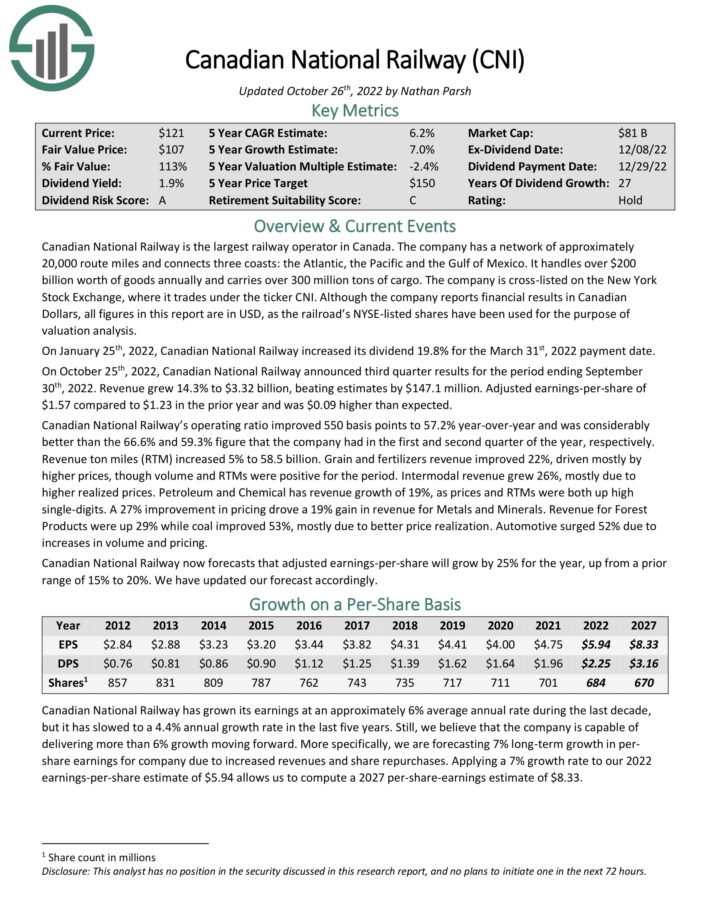

Recession-Proof Stock #2: Canadian National Railway Company (CNI)

- Dividend Yield: 1.8%

- Years of Dividend Growth: 27

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific, and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

Source: Investor Presentation

On October 25th, 2022, Canadian National Railway announced third-quarter results for the period ending September 30th, 2022. Revenue grew 14.3% to $3.32 billion, beating estimates by $147.1 million.

Adjusted earnings-per-share of $1.57 compared to $1.23 in the prior year and was $0.09 higher than expected. Canadian National Railway’s operating ratio improved 550 basis points to 57.2% year-over-year and was considerably better than the 66.6% and 59.3% figures that the company had in the first- and second-quarters of the year, respectively.

Canadian National Railway benefits from operating in the railway industry, one of the sectors with the highest barriers to entry. The capital and expertise required to build new railways are tremendous. Moreover, the railway industry is saturated and is structured as an oligopoly, which results in virtually no new entrants and minimal competition.

Click here to download our most recent Sure Analysis report on Canadian National Railway (preview of page 1 of 3 shown below):

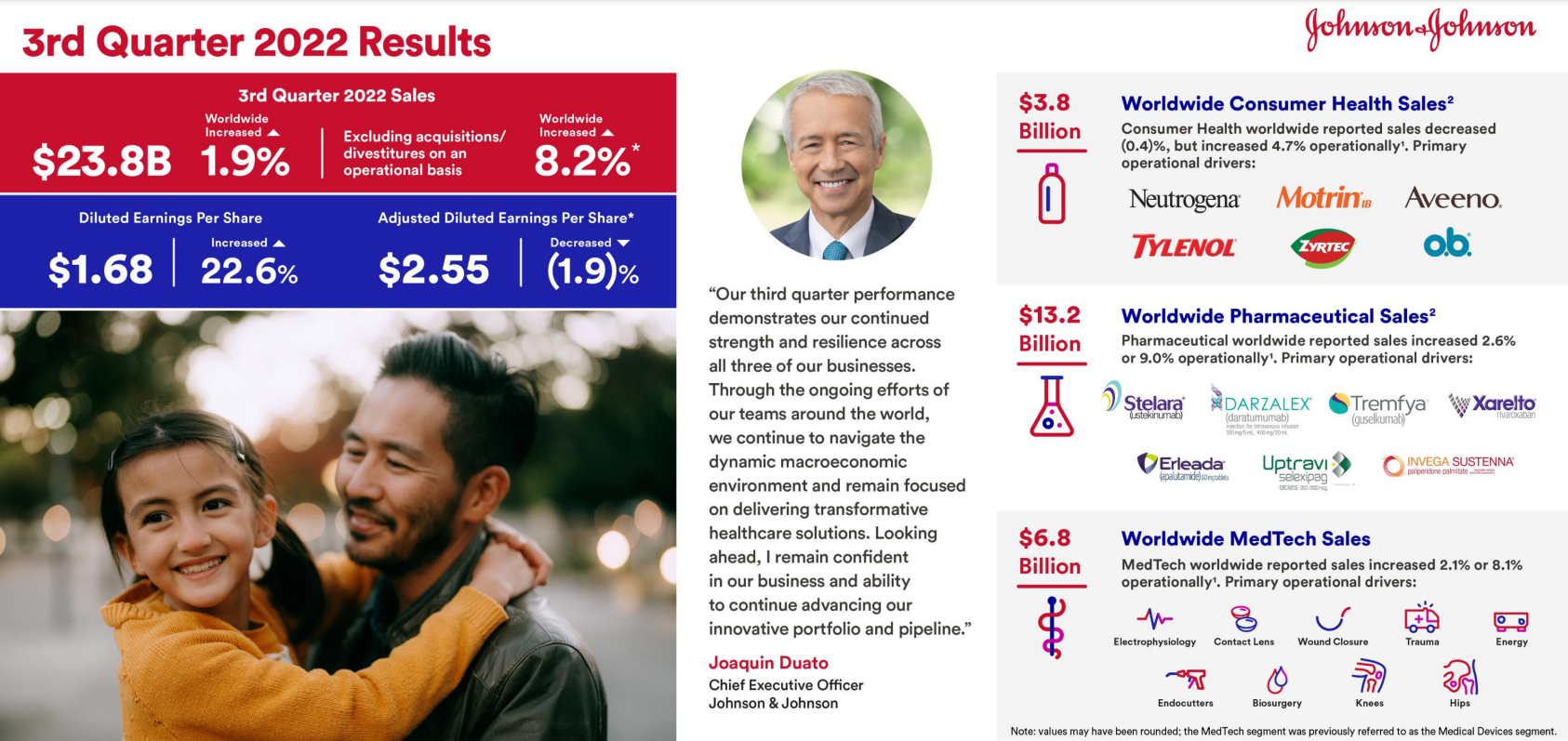

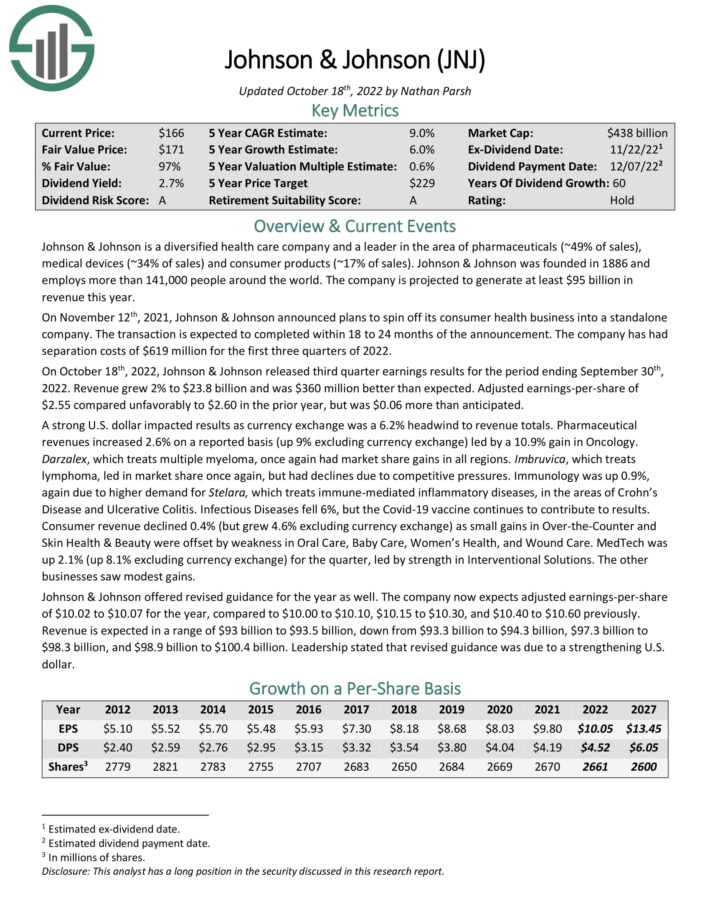

Recession-Proof Stock #1: Johnson & Johnson (JNJ)

- Dividend Yield: 2.5%

- Years of Dividend Growth: 60

Johnson & Johnson is a diversified healthcare company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales), and consumer products (~17% of sales). Johnson & Johnson was founded in 1886 and is projected to generate at least $95 billion in revenue this year.

On October 18th, 2022, Johnson & Johnson released third-quarter earnings results for the period ending September 30th, 2022. Revenue grew 2% to $23.8 billion and was $360 million better than expected. Adjusted earnings-per-share of $2.55 compared unfavorably to $2.60 in the prior year but was $0.06 more than anticipated.

Source: Investor Presentation

Johnson & Johnson has a reasonably low dividend payout ratio. This gives the company ample room to raise its dividend, even in a prolonged recession. One of Johnson & Johnson’s key competitive advantages is the size and scale of its business. It is a worldwide leader in a number of healthcare categories. Adequate diversification amongst its businesses, therefore, allows it to continue to grow even if one of the segments is underperforming.

The company’s qualities and ability to continue performing well under various economic conditions are reflected in its 60-year-long dividend growth track record. The payout ratio remains at a healthy 45%, which should allow for continuous dividend increases moving forward.

Click here to download our most recent Sure Analysis report on Johnson & Johnson (preview of page 1 of 3 shown below):

Final Thoughts

While no stock is ultimately recession-proof, there are certain sectors and industries that tend to be more resilient during economic downturns. In general, however, essential goods and services, such as healthcare, utilities, and consumer staples, have a better history in terms of generating solid results and continuing to grow their dividends during tough economic conditions.

The stocks we have selected for this article have already proven they can stand tall during recessionary environments quite sufficiently, as proven by their extended dividend growth track records. Their unique qualities, competitive advantages in each industry, quality revenues, and thoughtful capital allocation strategies should allow them to continue increasing their dividends both during a potential upcoming recession and beyond.

More By This Author:

6 Notable Dividend Investing Quotes3 Agriculture Stocks For Long-Term Dividend Growth

Exxon Mobil: Great 5-Year Growth Plan But Beware Of Some Caveats