Q4 GDP Unchanged In First Revision, Despite Hotter Core PCE

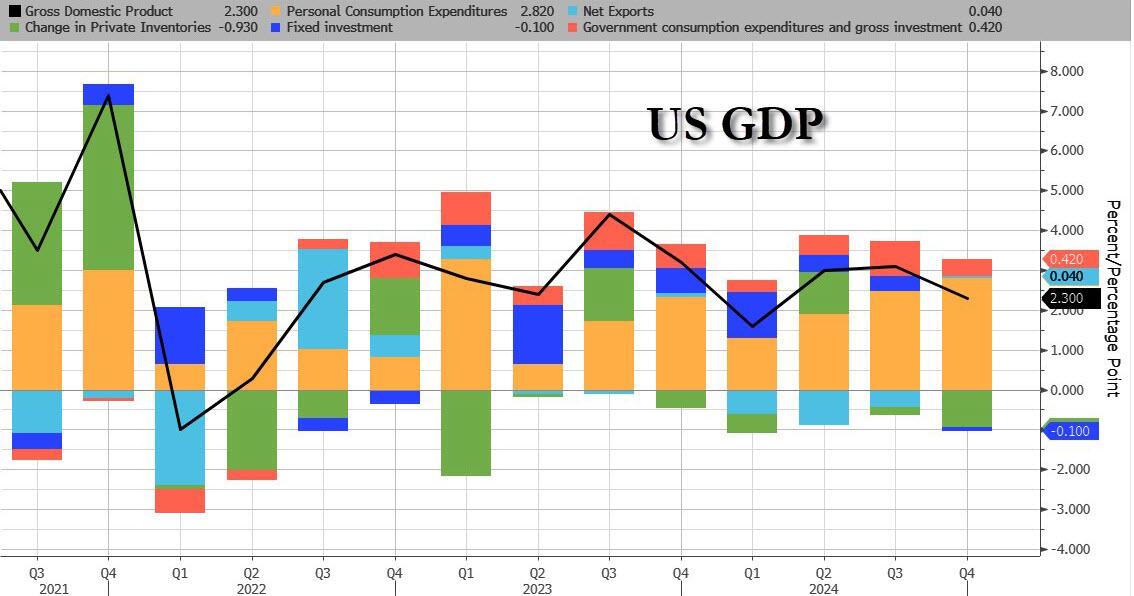

In what was the most boring number of today's data barrage, the BEA reported the first revision of Q4 GDP (initially reported last month) and found no changes at the headline level, meaning Q4 GDP still rose at a 2.3% pace, same as calculated previously and the same as estimated.

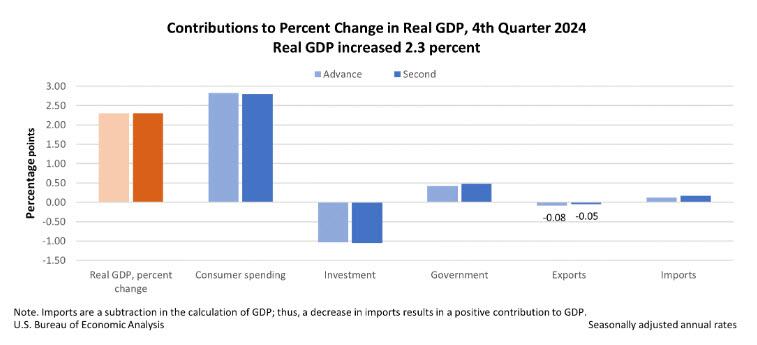

According to the BEA, the increase in real GDP in Q4 reflected increases in consumer spending and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Real GDP was revised up by less than 0.1 percentage point from the advance estimate released last month, primarily reflecting upward revisions to government spending and exports that were partly offset by downward revisions to consumer spending and investment.

Compared to the third quarter, the deceleration in real GDP in the fourth quarter primarily reflected downturns in investment and exports that were partly offset by an acceleration in consumer spending. Imports turned down.

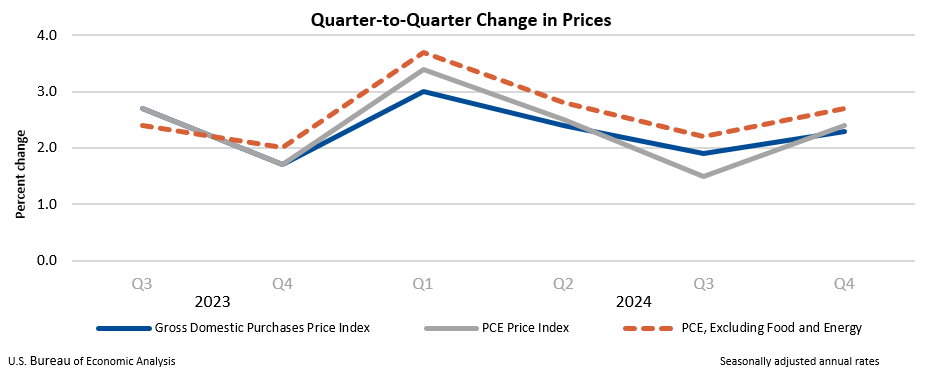

While the GDP numbers are meaningless - and stale - what traders paid a bit more attention to what the deflator, the price index and core PCE all of which were revised hotter than initially reported, to wit:

The GDP price index increased 2.3% in the fourth quarter, revised up 0.1% from the previous estimate. The personal consumption expenditures (PCE) price index increased 2.4%, also revised up 0.1%. And excluding food and energy prices, the core PCE price index increased 2.7%, revised up 0.2%.

But aside for the modest upward revision in core prices, don't expect anyone to focus much on this data which is not only stale but irrelevant (it reflects the last quarter of Biden's political regime) and now that Trump is president all that matters is i) tariffs and ii) whether they will be inflationary and boost growth, or deflationary and spark a recession.

More By This Author:

Nvidia Blows Away Expectations As It Sells "Billions" Of Blackwell Chips, Stock Goes Nowhere7Y Auction Stops Through Despite Muted Foreign Demand

New Home Sales Plunge In January As Mortgage Rates Spiked

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more