Q2 2023 Earnings: What The Data Showed And What's Coming Next

Image Source: Pexels

Earnings season is now largely completed, and, as usual, it turned out much better than Wall Street expected. S&P 500 earnings from continuing operations fell 3.4% year-over-year from Q2 22 -- much better than the preliminary forecast for a 6%-7% decline. Excluding the Energy sector, earnings actually rose 3% year-over-year, explains John Eade, president of Argus Research.

Earnings exceeded expectations as they usually do: Almost four-fifths of S&P 500 companies reported earnings above expectations, compared to the long-term average of 66%. And the “beat” was above normal. Companies tended to exceed pre-reporting estimates in Q2 by about 8%, compared to the average surprise factor of 4.1%.

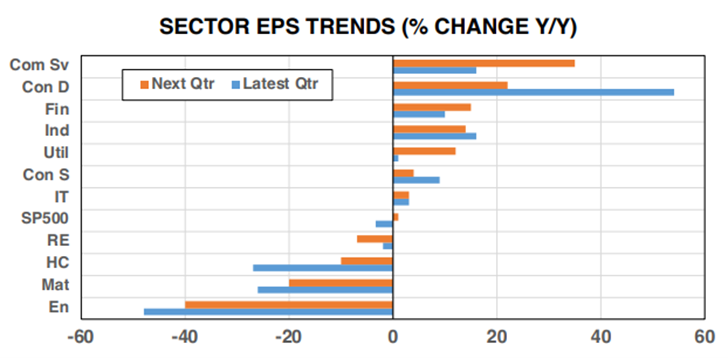

By sector, the strongest earnings growth came from Consumer Discretionary, Communication Services, and Industrials. Lagging sectors were Energy, Materials, and Healthcare. The all-important Technology sector reported a 3% increase in EPS.

Some sector trends are starting to emerge. Energy, which was the strongest EPS contributor in 2022, is facing difficult comparisons as oil prices have slumped; sector earnings are expected to decline 40% in Q3. Materials are no longer benefiting from peak commodity prices, and EPS for the group are expected to decline 20% next quarter.

On the brighter side, Communication Services earnings are expected to ramp higher, generating a 35% gain in Q3 compared to the 16% advance in the recently completed Q2. Overall, the Q2 EPS decline followed EPS declines in Q4 22 and Q1 23 and thus constituted an “earnings recession.” At this point, Q3 S&P 500 EPS are expected to rise 1% and then continue to grow into 2024.

About the Author

John Eade is CEO and President of Argus Research Corporation. He has been with Argus since 1989 and has worked as an analyst, director of research, market strategist, and director of portfolio strategies at the firm. Mr. Eade has an MBA in finance from New York University's Stern School of Business and a Bachelor's degree in journalism from Northwestern University's Medill School of Journalism.

He has been involved with Argus's new product development team, which has kept the company at the forefront of the independent research industry. Mr. Eade is a founder and board member of the Investorside Research Association, an industry trade organization. He is also a member of the New York Society of Security Analysts and the CFA Institute.

Mr. Eade has been interviewed and quoted extensively in The New York Times, The Wall Street Journal, Forbes, Time, Fortune and Money magazines, and has been a frequent guest on Fox Business News, CNBC, CNN, CBS News, ABC News, and the Bloomberg Radio and Television networks.

More By This Author:

Market Challenges? Sure. End Of The Bull Market? Nope.Gas Prices And Inflation Are Picking Up Again - Use These Strategies To Cope

Two Value Picks For Income Growth

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.