Protalix: Leveraging Tech In Developing Therapies For Orphan Diseases

Image Source: Protalix.com

Protalix Biotherapeutics (NYSE:PLX) is a drug discovery company that develops therapies for orphan diseases. Protalix has been leveraging its proprietary ProCellEx® platform, which is the key to the company’s production of complex and biologically similar proteins with a major focus on treating rare human diseases.

Orphan diseases are disease which affect a relatively small number of people and as such drug therapies aren't developed because the small size of the market would lend the research and drug unprofitable.

The global orphan drug disease market was valued at $151 billion in 2019 and is expected to reach $340.84 billion by 2027. The industry is dominated by a few players such as Celgene (NASDAQ:CELG), Roche (OTC:RHHBY), Novartis (NYSE:NVS), Sanofi (NASDAQ:SNY), and Amgen (NASDAQ:AMGN). PLX collaborates with various pharma companies to market its drug, for which it earns royalties and milestone payments.

PLX has successfully developed and launched a biological drug to treat Gaucher disease, making Protalix the first and only company to gain regulatory approval for a protein produced through a plant cell-based expression system.

Protalix has four biological drugs in its pipeline with a focus on treating complex diseases like Fabry disease, Refractory Gout, and NETs (Neutrophil Extracellular Traps) related diseases.

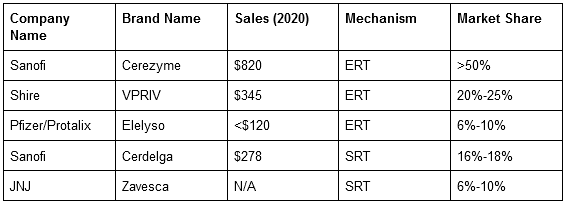

Elelyso - Treatment For Gaucher Disease

The Company’s first commercial drug approved by the FDA and EMA is Elelyso (taliglucerase alfa) to treat Type 1 Gaucher Disease (an Orphan Disease). Protalix, in collaboration with Pfizer (NYSE:PFE), developed the drug, and upon its approval, Protalix sold its 40% share in 2015 to Pfizer for $46 million.

The transaction included a $10M stock purchase. Pfizer has global rights to sell and market the drug except in Brazil, where Protalix maintains the distribution rights to the drug. In Brazil, the drug is marketed as BioManguinhos alfataliglicerase in partnership with Fundação Oswaldo Cruz. As a result, Protalix generates revenue from the sale of drug substances to Pfizer, and from its Brazil operations.

Gaucher Disease is a rare genetic Lysosomal Storage Disorder caused by the deficiency of an enzyme responsible for breaking down fats. The standard treatment method for the disease is enzyme replacement therapy (ERT), where recombinant enzymes are injected to restore the lacking enzymes.

Sales in $mm. Source: Company Annual Report & estimates, Market Share data are Estimates

Pegunigalsidase alfa (PRX-102) - Treatment for Fabry Disease

Since the approval of Elelyso in 2012, the company has concentrated its efforts on developing another potential ERT drug for the treatment of Fabry Disease. The company’s lead drug candidate, PRX-102, developed using the company's ProCellEx technology, is a chemically modified version of the recombinant α-galactosidase-A protein.

Protalix is developing this ERT drug in collaboration with Chiesi Farmaceutici. The company has signed agreements with Chiesi, which will allow Chiesi to market the drug globally. According to the agreement, Protalix will receive milestone payments upwards of $1 billion and royalties up to 15%-40% of sales once the drug is approved.

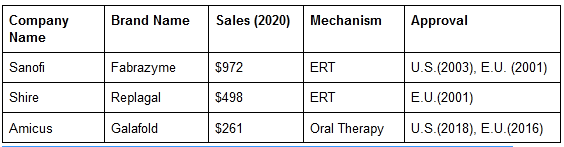

Fabry Disease is another rare genetic Lysosomal Storage Disorder caused by the deficiency of the α-galactosidase-A enzyme. This deficiency results in a build-up of fatty substances called globotriaosylceramide affecting the normal functioning of organs.

According to the company’s 10-K, the disease occurs in 1 of every 40,000 people and has an estimated market size of $1.9 billion in 2021, growing at a CAGR of 9.5%. Similar to Gaucher disease, the standard of treatment for Fabry disease is Enzyme Replacement Therapy (ERT). There are two ERTs approved for Fabry Disease: Fabrazyme by Sanofi and Replagal by Shire.

Sales in $mm. Source: Company Annual Report & estimates, PLX Investor Presentation

The CRL Hiccup

Protalix and Chiesi had submitted the BLA for PRX-102 post its successful completion of Phase 1/2 with the FDA on May 27, 2020, under an accelerated approval pathway, which the FDA subsequently accepted. The BLA also included the interim data of its Phase 3 BRIDGE study and safety data relating to its ongoing clinical trials of PRX-102.

On Apr. 27, 2021, the company confirmed the receipt of the Complete Response Letter (CRL) from the U.S. FDA. The CRL stated that the FDA is required to inspect the company’s facilities in Israel and the site of the company’s fill and finish provider in Europe before the FDA could move further with the approval process.

According to the company, the delay has been due to COVID restrictions, and no concerns were laid on the drug's efficacy and safety.

The cause for concern in the CRL is that the FDA has asked the company and Chiesi to address the recent full approval given to Sanofi’s Fabrazyme. The fact that Fabrazyme now has a full approval might raise a challenge for the resubmission of a BLA for PRX-102 under the accelerated approval pathway.

The company and Chiesi plan to submit a Type A (End of Review) meeting request with the FDA. A Type A meeting should provide more clarity on the approval process for a resubmitted BLA for PRX-102.

The company’s BRIDGE study showed promising results in terms of the safety and efficacy of the drug in Fabry patients previously treated with Replagal. The management is optimistic and expects the BALANCE study will prove the drug’s safety and potential superiority to Fabrazyme. The company announced top line interim results from the BALANCE study on June 2, 2021.

Other Drugs In The Pipeline

Protalix has three other drugs in the pipeline, Alidornase Alfa (PRX-110) treatment for cystic fibrosis (CF), PRX-115 potential treatment for refractory gout, and PRX- 119 expected to be the possible treatment for NET-related disease. The second lead drug candidate, PRX-110, is currently in its phase 2 trials; the other drugs are currently in the preclinical stages. In addition, Protalix has licensed PRX-110 to SacroMed USA.

Significant Factors To Look Out For

-

A Type A meeting with the FDA should provide more clarity on the PRX-102 approval pathway. Even though the full approval of Fabrazyme has created a hurdle for the company, we believe it has just delayed the approval process. Notwithstanding the interim top-line results from the BALANCE trial, the odds that the final results of the BALANCE will support approval of PRX-102 in the U.S. and the EU seem very high.

-

The European Commission has granted PRX-102 an orphan drug designation. Once the drug is approved for marketing by the European Union, (which is expected to be in the second half of 2022), it will likely gain 10-year market exclusivity within the European Union. This will limit the competition in the EU to three players.

-

VPRIV, marketed by Shire for the treatment of Gaucher disease, is likely to lose its market exclusivity after August 2022, after which Pfizer’s entry into the European markets will most likely benefit Protalix with increased demand for drug substances.

Valuation Outlook

Protalix Daily Chart

The company’s stock has seen a steep decline since it received CRL from the FDA. There has been a 70% reduction in the company’s market value. It seems like the market has priced in most of the worst-case scenarios like the delay in approval for PRX-102 and the FDA asking the company to perform another trial.

On the upside, if favorable results are provided in a Type A meeting with the FDA, and the drug gets approved within 6-8 months post-meeting, this would generate millions of dollars of milestone payments and royalties from Chiesi as per the agreements.

Currently, only one drug is approved as an ERT for Fabry disease in the U.S. Therefore, Protalix may experience a huge upside once PRX-102 is approved.

The company is currently valued at a P/S (Ex- PRX-102 milestones) ratio of 5.6x, a discount to the Biotechnology & Drug Industry P/S ratio of 6.4x.

The company’s risk to reward scenario looks favorable, and we expect significant upside from current levels.

Disclosure: None.