ProInvestor Insights

Welcome to ProInvestors Insights!

ProInvestors Insights brings you the latest insights and actionable ideas from a variety of viewpoints to help you navigate and invest like a professional. For many investors it is fine to stay fully invested in the broad indexes. For others with a deeper interest in the markets, ProInvestors Insights is your guide into the minds of some of today’s most renowned investors.

Forbes, Navellier, AAII - just to name a few.

Over the last four decades I have made it a mission to meet and learn from top money managers and the most knowledgeable professionals in the financial industry. Originally my motive was to understand their different styles and strategies. I was interested in what others were looking for in their own stock selection. The result of my work is The Magnet® Stock Selection Process, the first to blend value, growth, and momentum factors.

The Magnet® Stock Selection Process has stood the test of time, with just a few modifications over the years. Almost 15 years ago, we then blended Magnet® with several “non-financial” data factors and built a second model called FACTS. FACTS measures companies by their “trustworthiness”. FACTS has generated strong returns as well and is now being used by other advisors using Separately Managed Accounts. We will share some of our current best ideas from both the Magnet® and FACTS models.

I have had the pleasure and opportunity to stay in touch with dozens of today's most well-known financial professionals. These relationships are diverse, and they cover all of the broad asset classes. You see them often on the major financial shows discussing the stock market, bonds, real estate, insurance, and options. In one place, you will have access to these professional’s thoughts monthly.

Please enjoy and share your feedback. Our intention is for ProInvestors Insights to be a valuable resource for our readers, and you to get as much out of our team that you can.

As education and service are our primary goals, we are offering free subscriptions to all students and members of the military- active and veterans- and of most nations. Members of TalkMarkets will have a one-year complimentary welcome as well.

To view the entire July, 2024 ProInvestors newsletter as a PDF, click here.

Higher Returns Using the Magnet® Selection Process

The Magnet® Stock Selection Process is a unique and proprietary process to achieve superior long-term risk-adjusted returns. When I first introduced The Magnet Stock Selection Process several years ago, I suggested that the approach of screening for stocks would rise in popularity. Now most stock market software packages include a screening feature. By utilizing a screening process, the universe of companies can be quickly brought down to a manageable list to further investigate. This list is then taken through a deeper dive before companies are brought into my portfolios. I believe that excess market returns can be achieved through the construction and management of a fundamentally sound portfolio of companies whose revenue growth and profit margins are accelerating above market expectations. I construct some proprietary measures for company fundamentals, some of which are proxies for what would be earnings performance from corporate financial data. As a result, the Magnet analysis is not misled by reported earnings and responds much more directly to strong sales, low price-to-sales ratios, and other value measures taken from corporate balance sheets.

Individual investors now have a significant advantage over the big institutions. Individuals can identify companies with strong fundamentals that are still too small to be picked up by the bigger institutional funds. Once the institutions find them and drive them higher, the real profits materialize. By just placing a few of these companies in a portfolio and then being patient, individual investors can achieve outstanding results. Individuals willing to continue to do their homework to find these companies will be rewarded.

Key Factors:

M—Management must be outstanding; momentum must be improving

A—Acceleration of earnings, revenues and margins

G—Growth rate must exceed valuation

N—New product or management may be the driver

E—Emerging industry or product creates opportunity

T—Timing needs to be right (technically poised for large price increase)

Secondary Factors:

· Margin Acceleration: When companies cash flow accelerates, institutions find them and they attract attention

· Value and Valuation- We use several measures to determine value- not only the standard P/E and PEG style metrics.

· Reasonable liquidity.

Top 10 stocks for consideration:

Company Ticker Sector

Amgen Inc AMGN Medical

Applovin Corp APP Business Services

Celestica CLS Industrial

First Solar FSLR Oils-Energy

Ies Holdings IESC Computer and Technology

Immersion Corp IMMR Computer and Technology

Medpace Hldgs MEDP Medical

Neurocrine Bios NBIX Medical

Super Micro Com SMCI Computer and Technology

Weatherford Int WFRD Oils-Energy

For further information: www.magnetinvestinginsights.com

Why the Monthly Jobs Report is Often Misleading (or At Least Premature)

Last Wednesday, ADP announced that 150,000 new private payroll jobs were created in June, but those jobs were not very broad-based. Nela Richardson, chief economist at ADP, said, “Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.”

ADP’s balanced jobs report, as usual, is probably closer to the truth than the more widely heralded Friday jobs report, which will likely be revised later on. ADP is based on actual payroll data, not sample surveys.

On Friday, the Labor Department announced that 206,000 payroll jobs were created in June, which was slightly higher than the economists’ consensus estimate of 190,000. Despite that robust new job total, the unemployment rate rose to 4.1% in June, from 4.0% in May. The other big news was that there was a substantial downward revision of 57,000 payroll jobs for April (108,000 now, down from the 165,000 jobs first reported) and a 54,000 negative revision for May (218,000 jobs, down from the initial 272,000).

This is caused by the Labor Department reporting initial job estimates too early in the month to be accurate. Also, about three quarters of June’s payroll growth was in government, healthcare and social assistance, according to The Wall Street Journal (“Government to the Jobs Rescue”). The Journal said, “These industries also made up roughly half of the new jobs in May and more than 90% in April.” In contrast, June’s total manufacturing jobs declined by 8,000, the biggest monthly drop since February.

The Labor Department also announced on Wednesday that jobless claims rose to 238,000 in the latest week, up from a revised 234,000 in the previous week. This was the ninth straight week that jobless claims have steadily risen. Continuing unemployment claims rose to 1.858 million in the latest week, up from a revised 1.832 million in the previous week, the highest rate since November 2021.

In other economic news, the Institute of Supply Management (ISM) announced that its manufacturing index slipped to 48.5 in June, down from 48.7 in May. This represents the third straight monthly decline and the 19th time in the past 20 months the index fell below 50, the mark which signals a contraction.

The ISM service index has been below 50 in two of the past three months, dropping sharply from 53.8 in May to 48.8 in June. Also, the new export orders component declined to 48.8 in June, from 50.6 in May.

ISM Chairman Timothy R. Fiore, said, “Demand remains subdued, as companies demonstrate an unwillingness to invest in capital and inventory due to current monetary policy and other conditions,” adding that “62% of manufacturing gross domestic product (GDP) contracted in June, up from 55% in May.”Ouch!In addition, nine of the 17 manufacturing industries surveyed in June contracted.

The U.S. trade deficit rose 0.8% in May to $75.1 billion, the largest deficit since October 2022. Exports declined by 0.7% to $261.7 billion in May, while imports declined 0.3% to $336.7 billion. Any time both exports and imports are declining, it is a sign of weak worldwide economic growth. I suspect that economists will be trimming their second-quarter GDP estimates in the wake of the May trade data.

Sure enough, in the wake of the lagging ISM manufacturing report and lower trade data, the Atlanta Fed cut its second-quarter GDP estimate to a 1.5% annual pace, down from its previous estimate of 1.7%.

For further information: www.Navellier.com

The Feature Article for the Month, Jordan Kimmel, FACTS Investor

How much time should institutional and individual investors allocate to evaluating the quality of governance, or what we call the trustworthiness of public companies?

A growing body of evidence shows an increasing correlation between trustworthiness and superior financial performance. Over the past decade, a series of qualitative and quantitative studies have built a strong case for senior business leaders to make stakeholder trust building a high priority. For example:

History and Fast Facts

In the wake of the 2008 financial crisis Trust Across America-Trust Around the World (TAA-TAW) began to develop a Framework called FACTS, seeking the input from a cross-silo multidisciplinary team of professionals from leadership, compliance and ethics, governance, accounting, finance, HR, corporate social responsibility, ESG, and other disciplines, The goal was to create a sustainable model that would reduce corporate risk and maximize profitability. FACTS was finalized in 2010. It evaluates, on an annual basis, the trustworthiness of over 1500 US public companies.

How we describe trustworthiness: In the context of FACTS we describe trustworthiness as “the outcome of principled behavior” as outlined in our Framework. We do not attempt to define it.

Methodology: Now in its 14th year, Trust Across America performs an independent annual analysis using its rigorous and unique FACTS Framework. Companies do not participate, nor do they know they are being analyzed.

Framework Components: The FACTS Framework incorporates proprietary metrics and evaluates the trustworthiness of public companies based on five equally weighted indicators that form the FACTS acronym: Financial stability, Accounting Conservativeness, Corporate Integrity, Transparency & Sustainability.

Our analysis has never identified a “perfect” company. In fact, on our 1-100 scale, it is unusual for a company to score above 80%

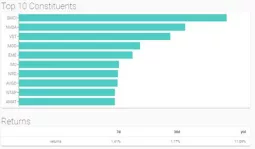

Trust 200 Index

In June 2022 we retained Index One, a global back testing and index creation firm based in London to evaluate FACTS versus major US indexes. They were given ten years of annual FACTS scores for 800+ of the largest companies. More information on Index One can be found at www.indexone.io

Trust Based Investing provides the following:

· Companies have proven through a rigorous analysis that they are well governed and trustworthy and represent lower investment risk.

· Investors can be assured that both business and investment decisions are being made ethically.

· The most trustworthy companies have stable and strong investment returns.

· A virtuous cycle is created. As investment money flows into the hands of these companies, other companies will want to follow suit and become more trustworthy.

This link allows you to follow the Trust 200 Index.

FACTS: With a 12+ year track record, the FACTS framework analyzes US based public companies on five indicators of trustworthy business behavior: Financial stability, Accounting conservativeness, Corporate governance, Transparency, and Sustainability. Index One maintains our Trust 200 Index, rebalanced annually and updated daily. Individuals can invest in the FACTS through separately managed accounts through several platforms. You can invest in FACTS using Separately Managed Accounts offered by a few selected Registered Investment Advisors.

For further information: www.MagnetInvestingInsights.com

Finding August Dividend In A Pair Of Jeans With Levi Strauss - Buy Write, John Dobosz, Forbes

This trade is a buy write on clothing company Levi Strauss & Co. (LEVI), a stock that we have successfully traded over the past five years on multiple occasions. The blue jeans maker tanked last month after delivering disappointing quarterly results. Nonetheless, with an upcoming dividend, and by selling slightly in-the-money calls, the opportunity to earn 3.69% over the next 36 days looks compelling.

Levi Strauss & Co. (LEVI) - Buy Write

- Buy 200 LEVI

- Sell to Open 2 August 16 $19 Calls

- Execute for Net Debit of $18.45 or lower

San Francisco, Calif.-based Levi Strauss & Co (LEVI) dates back to 1853 when Levi Strauss went to California to sell dry goods to gold miners. In 1873, Levi Strauss & Co. added metal rivets to work pants, giving birth to blue jeans. This year, revenue is expected to grow 2.2% to $6.32 billion, with earnings expected to rise 13.9% to $1.25 per share.

The company pays a $0.13 per share quarterly dividend, and the next ex-dividend date is August 2. With the next earnings report not until September, and with the dividend coming up, we will buy the stock and sell $19 August monthly calls that expire in 36 days.

Here is the buy write: Buy 200 LEVI, and sell to open 2 contracts of $19 August 16 calls. Use a net debit (stock price minus premium) of $18.45 or lower.

If we earn the dividend on August 2, and if LEVI closes above $19 when the call options expire, we would earn $0.68 per share on $18.45 per share at risk, or 3.69%. Over 36 days, that’s an annualized return of 37.4%. If the stock closes at or below $19 at expiration, we would continue owning LEVI shares at a cost basis of $18.32 per share, reflecting today’s premium and the dividend next month.

Options income for this trade: We earn $145 selling 2 LEVI August 16 $19 call contracts.

For further information: John Dobosz (forbes.com)

Wall Street CEO who predicted Great Recession issues New Warning: MIDNIGHT IN AMERICA, Dylan Jovine

We are about to see the stock market crash 50%...real estate drop 40%, savings accounts lose 30%...and unemployment will triple.

After publicly calling the Great Recession a year in advance, I used my Bear Market Playbook to save my family a lot of pain and actually mint fortunes for myself and family and friends.

For the first time ever, I’m publishing the exact playbook I used then to navigate what I predict will be the darkest period the U.S. stock market has seen in 50 years.

Because while everything looks great on the surface,serious cracks are forming beneath our “shining city on a hill.”

Cracks that threaten our wealth, and even our way of life.

I’ve laid out the full story you’re not getting from the mainstream media right here:

MIDNIGHT IN AMERICA CLICK TO ACCESS THE PLAYBOOK

For further information: www.BehindTheMarkets.com

Understanding and Evaluating Digital-Asset Mutual Funds and ETFs, Cynthia McLaughlin, AAII

ETFs, and mutual funds to a limited extent, pave the way for individual investors to gain exposure to cryptocurrency and other securities in the digital-asset ecosystem.

Featured Tickers: BCHG, BITB, BITW, BLOK, BTCFX, BTCLX, BTCO, BTCW

- The basics of digital assets and how they are traded

- Advantages offered by investing in digital assets through mutual funds or ETFs

- A review of the current digital-asset funds and what to look for

Love it or hate it, digital assets are a part of mainstream investment options. Cryptocurrency and blockchain are heterogeneous, and their universe covers a varied landscape—not unlike going from a scorching desert to cool wetlands in a short trip. More specifically, the digital-asset umbrella includes cryptocurrency assets such as bitcoin and ethereum, stablecoins, nonfungible tokens (NFTs) and decentralized financial assets.

Thematic strategies expand this universe by investing in companies comprising the digital-asset ecosystem. These companies include cryptocurrency miners, blockchain technology providers and users, as well as other enabling technologies.

Digital assets are known for both volatility and momentum. Each of these assets is unique and warrants a thorough understanding and careful evaluation before investing in mutual funds or exchange-traded funds (ETFs) that hold them.

Buying and Selling Digital Assets Directly

Bitcoin and ethereum are the best-known cryptocurrencies, but they have very different uses. Bitcoin was created as an alternative to fiat currencies, while ethereum is the locomotive for the ethereum network. Bitcoin is stored on a distributed ledger called a blockchain. Blockchain transactions are registered and linked together cryptographically in a string of blocks that cannot be modified.

The ethereum network is a platform designed for applications like stablecoins, NFTs and decentralized applications and is tied to the ethereum blockchain. A stablecoin is linked to a fiat currency like the U.S. dollar or the Japanese yen.

Cryptocurrencies have presented a regulation puzzle, falling into a gray area. The U.S. Securities and Exchange Commission (SEC) doesn’t view them as securities, whereas the U.S. Commodity Futures Trading Commission (CFTC) views them as commodities. Last month, the U.S. House of Representatives passed a bill that would establish regulation for digital-asset markets. The bill places the bulk of cryptocurrency regulation under the CFTC.

Traditional lines between brokers, custodians and exchanges don’t exist in cryptocurrency markets. Investors can buy and sell cryptocurrency on centralized exchanges like Coinbase. Retail brokerages such as Fidelity, TradeStation and Robinhood offer cryptocurrency trading. There are also decentralized exchanges that specialize in trading cryptocurrency; these have done away with intermediaries and instead use preprogrammed smart contracts on a blockchain to connect buyers and sellers.

Trading cryptocurrency through a centralized counterparty is often expensive when compared with trading equities, ETFs or mutual funds. Fidelity includes a 1% spread in its quoted prices. Many brokerages offer investors free or low-cost trading. Though Robinhood touts zero-commission cryptocurrency trading on five platforms and a wide range of currencies including stablecoins, it routes orders to its preferred third parties for execution.

How large and liquid is the digital-asset marketplace? As of mid-June 2024, the global cryptocurrency market is $2.5 trillion, compared to $45.4 trillion for the S&P 500 index. Bitcoin currently represents $1.3 trillion of cryptocurrency’s market capitalization.

CoinMarketCap.com tracks price, trading volume and other statistics for over 10,000 cryptocurrencies. Liquidity is measured as trading volume divided by market cap for the past 24 hours. Market cap considers a cryptocurrency’s circulating supply. On June 17, 2024, bitcoin’s volume per market cap was 2.91% and ethereum’s was 4.86%. This implies that most of the value of these two cryptocurrencies is not being traded on a daily basis.

Using Mutual Funds and ETFs for Cryptocurrency Exposure

Cryptocurrency-related funds must be approved by the SEC. Earlier this year, bitcoin ETFs were allowed to be launched. The SEC has approved ether ETF applications but not the actual launch of such funds as we write this article.

ETFs, and mutual funds to a limited extent, pave the way for individual investors to gain exposure to cryptocurrency and other securities in the digital-asset ecosystem. The mutual fund and ETF structure provides investors convenience by eliminating the need for a crypto wallet or separate account. Funds trade on regulated exchanges and holdings are held with qualified custodians.

ETFs might be futures-based, relying on contracts for future delivery rather than direct asset ownership, or they might operate as grantor trusts, where the fund holds the actual assets. Spot ETFs directly invest in the underlying digital assets. Additionally, management styles vary, with some ETFs tracking specific indexes and others adopting active management strategies.

Trading digital-asset ETFs offers advantages over direct cryptocurrency investments, particularly in terms of liquidity and ease of access via exchanges. These ETFs tend to have better liquidity and higher trading volumes compared to direct trading on platforms like Coinbase. Understanding buy/sell orders and trading strategies is essential for navigating this market effectively.

Premiums and discounts to net asset value (NAV) are not unusual for ETFs and vary widely. Due to differences in price movements between the underlying assets and the creation and redemption process, ETF prices and their NAVs do not always line up. Over longer periods of time, premiums and discounts tend to shrink or are structural and explainable. Using limit orders to buy or sell ETFs can help with situations where ETFs are experiencing temporary volatility and/or the ETF’s underlying assets are infrequently traded, especially in specialty markets such as digital assets.

A limit order can also help with orders placed at the opening or closing of markets, which may have greater price volatility. (We suggest avoiding trading during the first and last half hour of the market day, when possible, because of the greater volatility.) Checking the last trade date and the average daily trading volume should provide further insights into the nature of the discrepancies.

Table 1 displays two mutual funds that focus on investing in bitcoin, and Table 2 displays ETFs that cover cryptocurrency and digital-asset thematic strategies. In Table 2, we excluded all ETFs that did not have at least $25 million in assets. ETFs are grouped by bitcoin, ethereum or thematic/other. Inverse and leveraged strategies were excluded.

Download the Excel spreadsheet of Table 1.

The mutual funds and ETFs in the digital-asset category lack long-term track records. Since most lack even a three-year track record, performance is ranked by year-to-date returns with one-year returns included, if available. Bitcoin ETFs include 10 that were recently launched. These are presented in alphabetical order since they lack a year-to-date performance record. For mutual funds and ETFs that track an index, the index is also listed.

Bitcoin Strategy Mutual Funds

We filtered for no-load mutual funds that are accessible to all individual investors. There are only two digital-asset mutual funds meeting these criteria. Both are actively managed and focus on bitcoin. The Bitcoin Strategy ProFund Investor fund (BTCFX) gains exposure to bitcoin through entering bitcoin futures contracts. Year-to-date and one-year performance are above the digital-assets category average at 53.4% and 126.2%, respectively with A+ Investor Grades of A. The expense ratio of 1.41% is high on an absolute basis and also above the average of its category peers (grade of D), reflecting the active management of futures contracts.

The Vest Bitcoin Strategy Managed Volatility Investor fund (BTCLX) takes a different path. The fund invests in a combination of bitcoin futures and cash investments. The performance is designed to achieve total return with the aim of both managing fund volatility and limiting losses due to severe sustained decline. Its year-to-date return of 51.6% and one-year return of 117.8% rank near the bottom among the six mutual funds in the digital-asset category (grades of F). (The category includes four institutional-only funds.) Its expense ratio of 1.24% is high on an absolute level but average among its peers (grade of C).

Digital-Asset ETFs

Investors can choose from an eclectic variety of digital-asset ETFs. Spot bitcoin ETFs are the largest category of comparable products in Table 2. Spot bitcoin ETFs are designed to directly track the current market (“spot”) price of bitcoin.

Download the Excel spreadsheet of Table 2.

In January 2024, the SEC approved 11 spot bitcoin ETFs. Out of those 11, 10 met our requirement for a minimum of $25 million in assets. These are shown in Table 2, along with four older bitcoin ETFs that have performance figures.

Trading volumes have mostly been low so far: Volume in the Grayscale Bitcoin Cash Trust (BCHG) was 4.7 million shares on June 14, 2024. For comparison, the large-cap SPDR S&P 500 ETF Trust (SPY) had volume of over 40 million shares on the same day. The Grayscale Bitcoin Cash Trust had previously traded on the over-the-counter (OTC) market and was moved to the NYSE Arca exchange upon approval. It is the oldest ETF shown in Table 2. The ETF has taken some heat over its high expense ratio (2.50%).

Expense ratios for the Bitwise Bitcoin ETF (BITB), the Fidelity Wise Origin Bitcoin ETF (FBTC), the Franklin Bitcoin ETF (EZBC), the Invesco Galaxy Bitcoin ETF (BTCO), and the WisdomTree Bitcoin ETF (BTCW) are currently 0.00%, reflecting fee waivers. These waivers typically apply to the first $1.0 billion to $10.0 billion and are nearing the end of the six-month period in conjunction with the January launches. The waivers are set to expire in mid-July to early August, depending upon the terms and conditions of each ETF sponsor.

Ethereum ETFs

The ProShares Ether Strategy ETF (EETH) and the VanEck Ethereum Strategy ETF (EFUT) both launched in the U.S. in October 2023. Both are actively managed and track ethereum futures. The year-to-date return for the ProShares Ether Strategy ETF is 57.6%, ranking in the highest 20% for the digital-assets category as indicated by its A+ Investor Grade of A. The VanEck Ethereum Strategy ETF’s gain of 45.9% is average for the category at a grade of C. Expense ratios for these two ETFs are average and above average, respectively.

The best performer in this category was the Grayscale Ethereum Trust (ETHE) with a year-to-date return of 62.2% (grade of A), and one-year performance of 97.7% (grade of C). The ETF is passively managed and trades on over-the-counter markets. Its expense ratio of 2.50% ranks high for the category (grade of D). It has the most assets under management (AUM) of the four ethereum ETFs. The ETF’s name is often shown with the letters “ETH” in parentheses, which stands for ethereum.

Grayscale Ethereum Classic Trust (ETCG) has average year-to-date and one-year returns of 32.5% and 62.4%, respectively. This passively managed ETF tracks the value of ethereum classic. Among other differences, ethereum classic has a fixed limit of coins that can be issued, whereas ethereum does not. This ETF also trades over the counter and has a very high expense ratio of 3.00%.

Looking ahead, spot Ethereum ETFs are anticipated to join the digital-asset ETF group. The SEC approved proposals for eight spot ethereum ETFs on May 23, 2024. The launch dates are unknown, but assuming they follow a similar timeline as spot bitcoin ETFs, some in the investment industry are targeting late August. The initial group of ethereum ETF issuers include ARK Invest, Bitwise, BlackRock, Fidelity, Franklin Templeton, Grayscale, Invesco Galaxy and VanEck.

Thematic and Other ETFs

ETFs in this category are cryptocurrency-themed or home in on various niches of the cryptocurrency economy. Behind bitcoin and ethereum in popularity is the blockchain solana. The Grayscale Solana Trust (GSOL) and the Osprey Solana Trust (OSOL) both provide exposure to solana, but trade over the counter with limited volumes.

For those wishing to gain exposure to the broader cryptocurrency market, the Bitwise 10 Crypto ETF (BITW) tracks an index of the 10 largest cryptocurrency assets, weighted by market cap and screened for certain risks. Its holdings include bitcoin and ethereum. Year-to-date and one-year returns are above the category average (grades of B) at 53.3% and 122.2%, respectively. Investors will pay a high expense ratio of 2.50% for this exposure though.

Related

The Amplify Transformational Data Sharing ETF (BLOK) focuses on companies actively involved in the development and utilization of blockchain technologies. The First Trust Indxx Innovative Transaction & Process ETF (LEGR) offers similar exposure. The VanEck Digital Transformation ETF (DAPP) expands this exposure to include digital-asset economies. The Fidelity Crypto Industry and Digital Payments ETF (FDIG) includes digital payments processing in its objective in addition to companies engaged in activities related to cryptocurrency and blockchain technology. Year-to-date and one-year returns have mostly been below average and expense ratios are above average.

Evaluation Using Conventional Metrics

The short history of digital-asset funds means there is little return information to base decisions on. Expense ratios, however, have historically been good predictors of the future relative returns investors will see. Investors should pay attention to past capital gains distributions and take into account any potential tax implications. Tax-cost ratios aren’t currently available for most funds because they require three years of fund data to calculate.

Premiums and discounts for the ETFs shown in Table 2 vary widely from 178.7% to –0.01%. The Grayscale Solana Trust has the largest premium year to date of 178.7%. This ETF is one of the few ways to gain exposure to solana’s native cryptocurrency SOL aside from holding the cryptocurrency directly or trading futures contracts. This exchange-traded vehicle invests in a trust that holds SOL instead of directly investing in the cryptocurrency.

Cryptocurrencies are characterized by volatility. Bitcoin experienced an all-time low price of $0.04865 on July 14, 2010, and an all-time high price of $73,750.07 on March 14, 2024. During the past 12 months, its price range was $24,930.30 (September 11, 2023) to $73,750.07.

Being able to invest in cryptocurrency through an ETF reflects ongoing acceptance of digital assets. Nonetheless, a risky asset is a risky asset. Cryptocurrencies have not only experienced a high level of volatility but remain highly speculative. When a high-risk asset is placed into an ETF or something similar, it remains a high-risk asset. Digital-asset mutual funds and ETFs just make it easier and cheaper for most investors to gain exposure. If you’re interested, tread carefully. Given the history of volatility, including even a small amount of cryptocurrency in a portfolio may change its risk profile.

For further information: www.AAII.com

Grant’s Rules for Investing and Grant’s Rules of Conduct, Mark J. Grant, Colliers Securities

April marked the fiftieth year that I have wandered around Wall Street. Looking back, looking at our history, is an interesting adventure, that we can all learn from. Experience is the best teacher! Looking forward, however, is an even more interesting adventure, as we have the opportunity to create our own history. For more than thirty-five years my nickname on Wall Street has been “The Wizard.” I may not have seen it all, but I have seen a great deal of it. I don’t watch sports, I have never played golf, I don’t fish, I only socialize with very interesting people, and I focus on the “Great Game,” with incredible intensity.

I get up between 3:00-4:00 AM daily, seven days a week, to ponder the markets, my client’s portfolios, and often times to write my commentary, “Out of the Box.” I go at it with vigor, because I continue to be fascinated with winning, in the most complicated game on Earth, Wall Street. The X-Box has nothing that is even close to it.

From time to time, and today is one of those days, as we carefully navigate 2024, I share with you the lessons that I have learned. Recently, one of the largest money managers in the world asked for my updated recount of the Grant’s Rules. Here you are my friend, the Grant’s Rules for Investing, and Grant’s Rules of Conduct, and what I think “really” matters. I hope the rest of you enjoy my musings as well.

Grant’s Rules for Investing

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Preservation of Principal

- Make Money

- When a company is under Federal investigation for Fraud---Sell.

- When a company gets a “Going Concern” letter from its auditors---Sell

- Remember that dividends are based upon the Principal Value and not the liquidating value and some are taxed at lower rates.

Grant’s Rules of Conduct

Your reputation is EVERYTHING. Guard it with your life. Your word is not only your bond, but it is also your future. There is no amount of money that is worth tarnishing your reputation. This plays out in a number of ways, living in your own skin, sleeping soundly at night, and earning the title of being a “stand-up guy.” Not even the title of CEO, or Chairman of the Board, carries more weight.

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”- Warren Buffett

In my life I have learned that you can’t sit back and let life happen to you. No, you have to go out and make your own “Mark” on life, so to speak, so says Mark.

Surround yourself with people you love, and who love you. The rest, well, be polite.

There is nothing you can do about getting older. There is “everything” you can do about getting old. You can trust me 100% on this one.

I am older than most of you. When I grew up our politicians were Americans first. Now they are Democrats or Republicans first. This is a significant detriment to our country, in my humble opinion.

My wonderful mother recently informed me that life comes in three stages:

Youth

Middle Age

And, “Oh, you’re looking good.”

I am now at the point in my life where I am doing my very best to be “looking good.”

Your best, that is what you give. Not one iota less, ever. Good is never enough. Learn to be Great!

In a nod to my fuzzballs, the two Sages, Ms. Crystal, and Mr. Tracker, I remind you that it is not two legs or four legs. It is just who you love!

When you meet an obstacle, and you will meet plenty of them along the way, here are the instructions: “You can go over it, you can go under it, you can go around it, you can go through it, and when nothing else works, dance until it moves.”

Winnie the Pooh said it best, “You can’t stay in your corner of the forest waiting for others to come to you. You have to go to them sometimes.” Just take his advice, “Think it over and think it under.”

Many people, along the way, will tell you, “It can’t be done.” Just smile, and then do it. I have done this several times in my life. They will never forget the moment, and neither will you. Never!

“You have brains in your head. You have feet in your shoes. You can steer yourself any direction you choose.” - Dr. Seuss

Life is just an adventure. More than that, it is “your” adventure. You don’t “know” where you came from. You may believe, but you don’t “know” where you are going, when you leave this Earth. Have a wonderful adventure, from your first breath to your last breath. Nothing less, not one iota less!

I view myself as an American. My family came to the United States in 1840 from the Hapsburg Empire. I am just appalled with the way we are approaching religion now. Whether you are Catholic or Christian or Muslim or Mormon or Baptist or Jewish or Lutheran or any religion at all everyone should be able, and encouraged, to approach God the way they see fit without rancor based upon anyone’s religious beliefs. Everyone’s faith should be honored!

I have had several memorable experiences in life. It was on April 10, 1972, that I got to have dinner with Charlie Chaplin. I would guess that I am one of the last people alive to have that honor. Another wonderful moment in my life was when I got to sit on the Throne of the Pope. I asked for “Divine Guidance.” I also got to have brunch with the immortal Mae West once in my life. I quote her today, “You only live once, but if you do it right, once is enough.”

The road to success comes in four stages. They are dreaming, thinking, planning, and executing. Everyone can dream, fewer can think, fewer still can plan, and the people that know how to execute, to get things done, are a very, very rare breed. Learn how to execute.

No university, on the planet, teaches deductive reasoning. It is one very important key to winning on Wall Street, “Figuring it out.” Go buy yourself the collective Sherlock Holmes books. Read them. Learn how to reason deductively and always remember, “The game is afoot.”

“Holmes and Watson are on a camping trip. In the middle of the night Holmes wakes up and gives Dr. Watson a nudge. “Watson” he says, “look up in the sky and tell me what you see.” “I see millions of stars, Holmes,” says Watson. “And what do you conclude from that, Watson?” Watson thinks for a moment. “Well,” he says, “astronomically, it tells me that there are millions of galaxies and potentially billions of planets. Astrologically, I observe that Saturn is in Leo.

Horologically, I deduce that the time is approximately a quarter past three. Meteorologically, I suspect that we will have a beautiful day tomorrow. Theologically, I see that God is all-powerful, and we are small and insignificant. Uh, what does it tell you, Holmes?” “Watson, you idiot! Someone has stolen our tent!”- Sir Arthur Conan Doyle

Make sure your tent hasn’t been stolen.

Wishing, Hoping, and Praying are not functional tools of the Great Game. Avoid them and the people that use them. Our playing field is riddled with both their losses, and their memories.

If you make a mistake, it is “your” fault. It is never “their” fault and always remember, “There is no crying in the trading room”.

On Wall Street, “Experience” is the teacher. She is a harsh taskmaster. The test comes first, and the lessons come afterwards.

Wall Street, you know, is a kind of Wonderland. It is just like Alice stated, “Curiouser and curiouser.”

Remember the Past and make use of it. Stand in the Present and contemplate it. Finally, stride purposefully into the Future. It is yours to own!

If you want to be successful, don’t go with the crowd. Make your own path and leave a trail for the crowd to follow.

Learn how to transform Excellence from a goal, into a habit.

Take the shot. No goal can be made, unless the shot is taken.

You get in life what you have the courage to achieve.

Wall Street is full of storms. Most people just stand there and wait for them to pass. I suggest that you follow Gene Kelly and learn how to dance in the rain.

When opportunity knocks, open the door.

Learn to be so good at what you do that they can’t ignore you. If you are really, really good, however, you will find that you can ignore them.

In my first job interview on Wall Street I was asked, by the head of Human Resources, what I wanted to be. I said, “Fascinated.” I was told that I didn’t understand the question. I replied that she didn’t understand the answer. I was hired.

Wall Street isn’t about finding yourself. It is about creating yourself. Wall Street is not a spectator sport.

Learn the Rules like a pro, so you can bend them like an artist.

Keep your eyes on the stars and your feet on the ground.

In the middle of any difficulties, if you look around carefully, you may find new opportunities.

Life is like a book. Each day is a new page. May your book be a bestseller with adventures to tell, lessons that have been learned, and tales of accomplishments to remember.

It is our choices that determines who we are. It is our dedication, our courage, our creativity, and our abilities, that can make our choices our reality. Never back up.

Today, you have 100% of your life left.

Finally, there is “Stuff.” If it is your health, or the health of those that you love, two legs or four legs, or if it is a significant amount of money, then it matters. The rest is just “Stuff.”

Don’t confuse what matters, with “Stuff”.

For further information: www.Colliers.com

MarketGrader Idea, by The MarketGrader Editorial Team

Carnival Corp. (CCL) - Navigating Choppy Waters with Improving Financials

MarketGrader Highlights

- Sentiment Score & Rating: 8.2 (out of 10) / POSITIVE

- StockGrade & Rating: 58.6 (out of 100) / HOLD

- Recently added to our list of ‘Best Momentum Stocks’

- Among our top picks based on Improving Earnings Guidance

- FY EPS Estimate Change Last 3 Months: 14.9%

Carnival Corp, a leader in the cruise industry operating brands like Carnival Cruise Line and Princess Cruises, has shown resilience in a challenging market. Despite a 3% drop following a rating upgrade on Dec. 28th, the company's financials paint a promising picture for short-term investors, with the stock up 11% in the last month.

Universal Display Corp. (OLED) Shines Bright: Strong Growth and Cash Flow Boost Investor Appeal

MarketGrader Highlights

- Sentiment Score & Rating: 8.9 (out of 10) / POSITIVE

- StockGrade: 70.1 (out of 100) / BUY

- Recently added to our list of ‘Best Momentum Stocks’

- Among our ‘Best Large Caps’ and ‘Best Growth Stocks’

- One of our top ideas for short-term investors based on Improving Earnings Guidance

Universal Display Corp, a leader in organic light emitting diode (OLED) technologies, has been catching investors' eyes with its impressive performance. The Ewing, NJ-based company, which develops and commercializes OLED tech for displays and lighting, saw its MarketGrader rating upgraded on May 2, 2024. Since then, the stock has surged 42%, reflecting growing investor confidence in the stock.

Arista Networks, Inc. (ANET): Cloud Networking Giant Continues Stellar Growth Trajectory

MarketGrader Highlights

- Sentiment Score: 9.1 (out of 10) / POSITIVE

- StockGrade & Rating: 74.0 (out of 100) / BUY

- Recently added to our list of ‘Best Momentum Stocks’

- Stock populates some of our best ideas, including ‘Best Large Caps,’ ‘Best Growth Stocks,’ ‘Cash Kings,’ and ‘Growth Compounders’

Arista Networks, a leading developer of cloud networking solutions, continues to impress investors with its remarkable growth and profitability. Since MarketGrader's upgrade on May 12, 2021, the stock has surged an astounding 356%, reflecting the company's strong market position and management’s impressive execution.

More By This Author:

Marker Rotation Is In Full Gear

Goldilocks May Have Made An Appearance To Ring The Bell At The Top

Goldilocks Has Made An Appearance On Wall Street!

Disclaimer: Please be aware that the investment strategies and stock recommendations provided in the ProInvestor Insights newsletter are for informational purposes only. While our contributors ...

more