Producer Prices Surged In January As Services Costs Soared

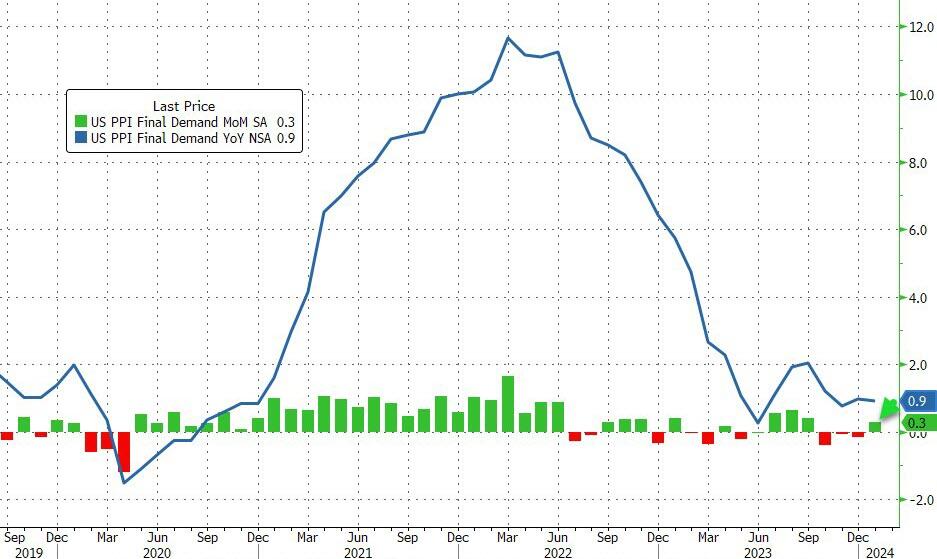

After the hotter-than-expected CPI (which has been shrugged off entirely by the stock market), Producer Prices were expected to rebound very modestly MoM but continue to slow on a YoY basis in January. Instead, like CPI, it re-accelerated with headline rising 0.3% MoM (+0.1% MoM exp), which left PPI up 0.9% YoY (down from December but hotter than the +0.6% exp)...

Source: Bloomberg

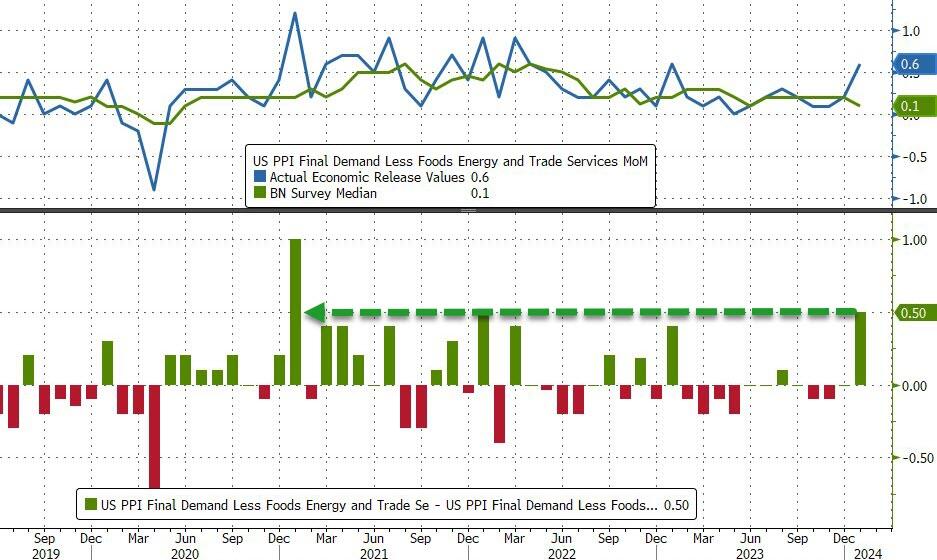

The picture was even worse under the hood with PPI ex food and energy up 0.5% MoM (vs +0.2% prior and +0.1% exp) and ex-food, energy, and trade up 0.6% MoM (vs +0.1% exp).

This was the biggest 'beat' for Core PPI since Jan 2021...

In fact, core PPI reached a new record high (reminder, disinflation does not mean lower prices), now up 17.4% since Biden was elected...

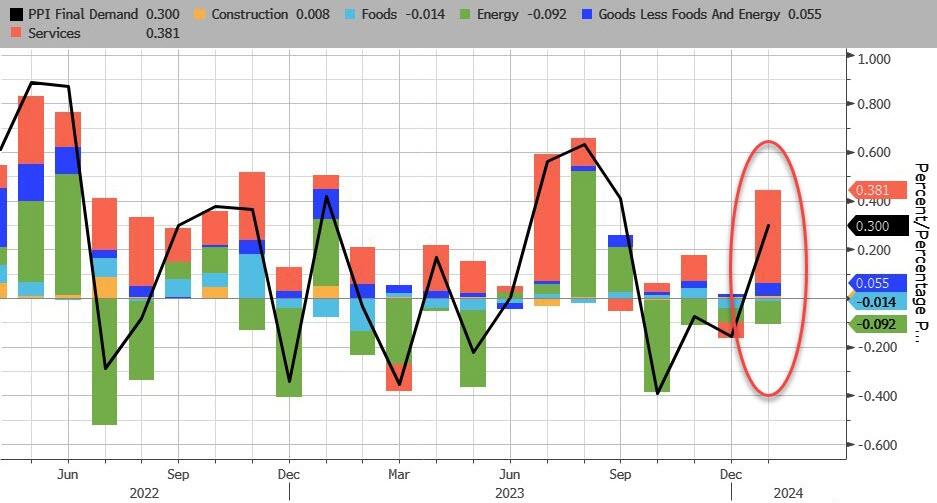

Services PPI soared MoM, and energy continues to be a driver of deflation (but is losing its power)...

Source: Bloomberg

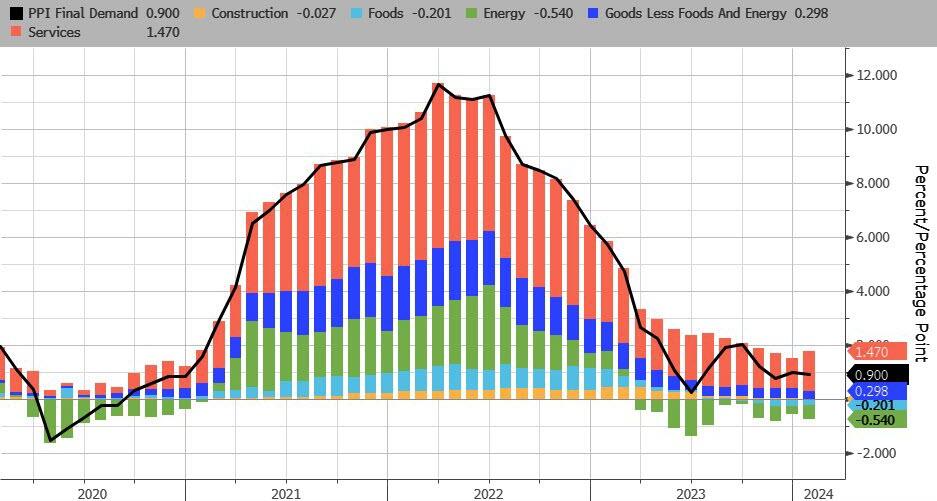

And on a YoY basis, Services PPI is also re-accelerating (+1.47% from +1.14%). Energy continues to be the deflationary driver...

Source: Bloomberg

This is not good news for the disinflationistas. And it will stop President Biden's narrative that 'prices are coming down'...

More By This Author:

Reverse Repo Liquidity Plunges Below Key Level As Fed's QT StallsUS Manufacturing Output Plunged In January (Despite Surge In PMI)

US Retail Sales Plunged In January, Worst YoY Growth Since Covid Lockdown

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more