Producer Prices Rose More Than Expected In July; Money Management Fees Soar

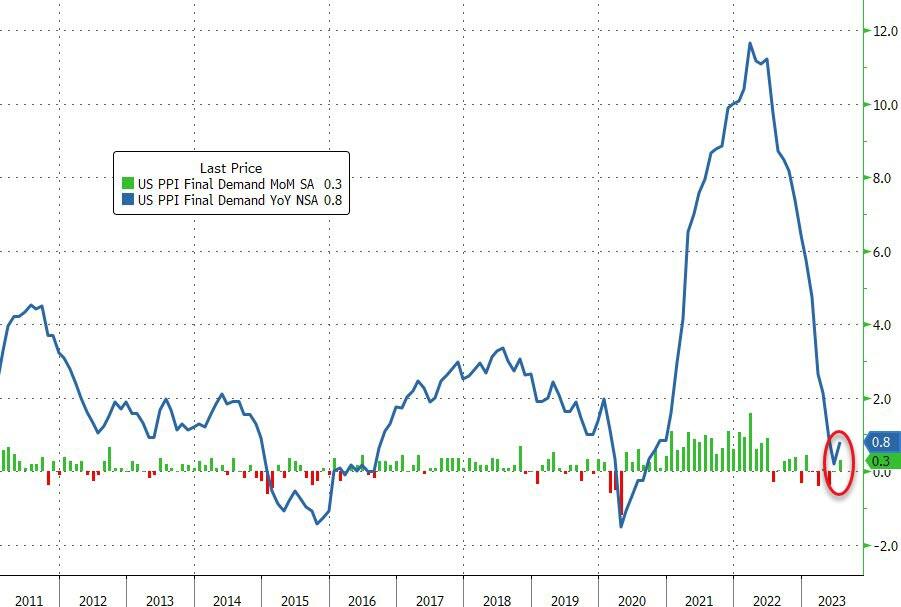

After yesterday's mixed picture from CPI, all eyes are on producer prices for signs of 'stickiness' in the pipeline for consumer prices. Against expectations of a 0.2% MoM rise, headline producer prices rose more than expected (+0.3% MoM - biggest jump since Jan 2023), pushing the YoY rise up to 0.8%...

Source: Bloomberg

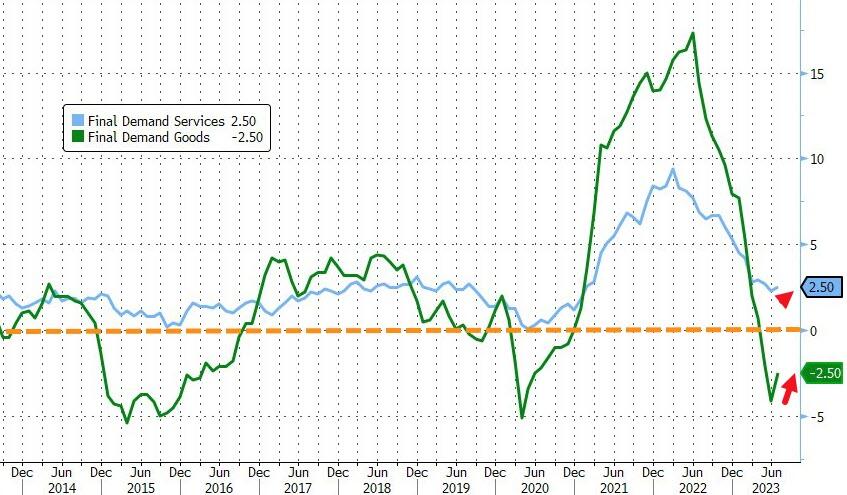

In July, the increase in final demand prices was led by a 0.5-percent rise in the index for final demand services. Prices for final demand goods edged up 0.1 percent.

The index for final demand less foods, energy, and trade services moved up 0.2 percent in July, the largest increase since a 0.3 percent rise in February. For the 12 months that ended in July, prices for final demand less foods, energy, and trade services advanced by 2.7 percent.

Final demand services

The index for final demand services increased 0.5 percent in July, the largest rise since moving up 0.5 percent in August 2022. Leading the broad-based advance in July, prices for final demand services less trade, transportation, and warehousing climbed 0.3 percent. Margins for final demand trade services rose 0.7 percent, and the index for final demand transportation and warehousing services moved up 0.5 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: Forty percent of the July advance in the index for final demand services can be traced to a 7.6-percent rise in prices for portfolio management.

The indexes for machinery and vehicle wholesaling; outpatient care (partial); chemicals and allied products wholesaling; securities brokerage, dealing, investment advice, and related services; and transportation of passengers (partial) also moved higher. Conversely, margins for food and alcohol retailing declined 2.5 percent. The indexes for application software publishing and for long-distance motor carrying also fell.

Final demand goods

Prices for final demand goods edged up 0.1 percent in July after no change in June. The July increase is attributable to the index for final demand foods, which rose 0.5 percent. Prices for final demand goods less foods and energy and for final demand energy were both unchanged.

Product detail: Within the index for final demand goods in July, prices for meats rose 5.0 percent. The indexes for gas fuels; hay, hayseeds, and oilseeds; utility natural gas; and motor vehicles also moved higher. In contrast, prices for diesel fuel dropped 7.1 percent. The indexes for gasoline, fresh fruits and melons, and plastic resins and materials also decreased.

The pipeline for PPI appears to have inflected for now...

Putting all of this together, it appears inflation is stickier than many had hoped.

More By This Author:

Disney Streaming Subs Miss, As Company Surprises With Huge Price Hike, Slashes CapEx OutlookEuropean NatGas Prices Explode 40% Higher

WTI Extends Gains Despite Crude Production Surge, Biden Admin Begins 'Refilling' SPR

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more