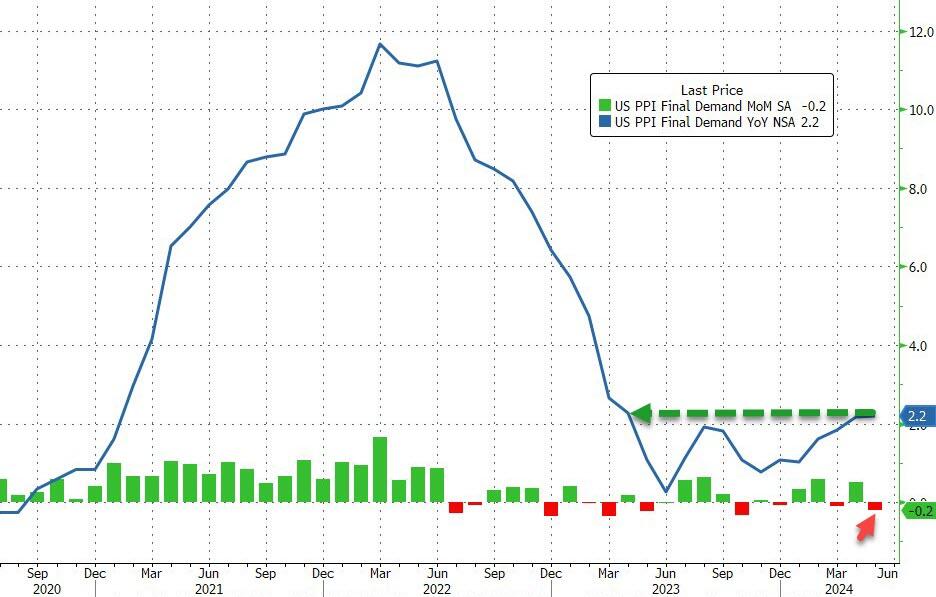

Producer Price Inflation Cooler Than Expected (But Hovers Near 1 Year Highs)

After a softer than expected CPI yesterday sparked an all out buying panic in stocks and bonds (before Powell pissed in the punchbowl), this morning's PPI is expected to be 'mixed' with a smaller MoM rise but higher YoY rise (beyond the 12 month highs reached in the prior month).

The headline producer price index unexpectedly tumbled 0.2% MoM in May (+0.1% MoM exp) from a +0.5% MoM rise in April - that's the biggest MoM decline since Oct 2023. This left the YoY change in the headline index down from a revised 2.3% in April to +2.2% (well below the +2.5% YoY expected)...

Source: Bloomberg

That is still the highest YoY since April 2023.

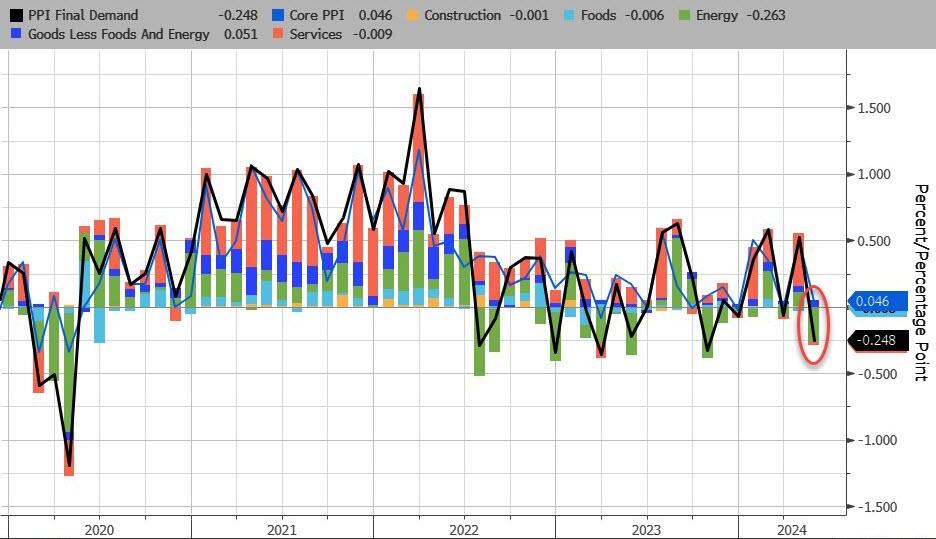

Core PPI was unchanged MoM in May (cooler than the +0.3% MoM exp). On a YoY basis, Core PPI dropped from +2.5%

Source: Bloomberg

The decline in the headline index was driven by a plunge in energy and a small deflation MoM in Services...

Source: Bloomberg

Of course, we've seen these MoM declines in PPI before... and they have always been driven by energy costs. So once again we only have to follow that!

More By This Author:

FOMC Holds Rates As Expected, Dot-Plot Shifts More Hawkish In 2024Consumer Prices Hold At Record Highs - Up 20% Since Biden Elected

Stellar 10Y Auction Sees Surge In Foreign Demand, Near Record Stop Through

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more