Polkadot Crypto Price News Today

Elliott Wave Analysis TradingLounge Daily Chart,

Polkadot/ U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

Polkadot/ U.S. Dollar (DOTUSD) Trading Strategy:

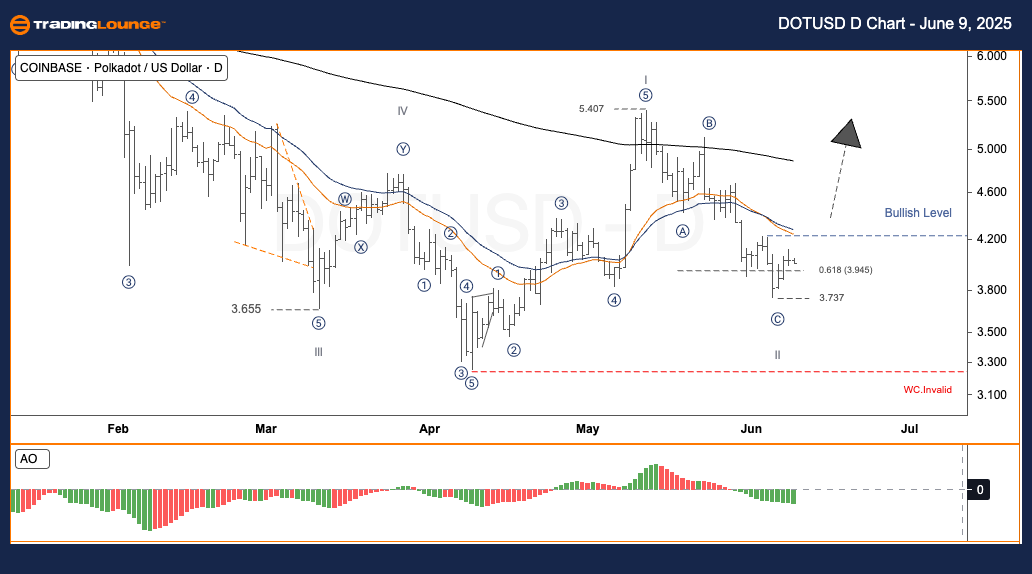

DOTUSD completed wave I at a peak of 5.407, after which it entered a corrective phase under the ABC format in wave II. The most recent wave C appears to have concluded at 3.737, aligning closely with the 0.618 Fibonacci retracement level from wave I, set at 3.945. This indicates a potential shift into wave III, typically associated with upward momentum. If the price surpasses the critical 4.40 resistance level—defined as the Bullish Level—it would confirm the conclusion of wave II.

Trading Strategies

- Strategy

-

- Swing Traders (Short-Term)

-

- Long Position: Enter after a confirmed breakout above 4.40, signifying wave III has started.

- Risk Management:

-

- Place a Stop Loss just under 3.30

Elliott Wave Analysis TradingLounge H4 Chart,

Polkadot/ U.S. Dollar (DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

Polkadot/ U.S. Dollar (DOTUSD) Trading Strategy:

DOTUSD wrapped up wave I at 5.407, after which it retraced in wave II via an ABC structure. The recent wave C seems to have ended at 3.737, effectively testing the 0.618 Fibonacci level of wave I at 3.945. This behavior hints that wave III may now be unfolding—typically a stronger, upward-trending leg. A breakout above 4.40 would validate that wave II has concluded.

Trading Strategies

- Strategy

-

- Swing Traders (Short-Term)

-

- Long Position: Wait until the price breaks above 4.40 before entering.

- Risk Management:

-

- Stop Loss should be placed below 3.30

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Technical Forecast: Newmont Corporation - Friday, June 6

Elliott Wave Technical Analysis: Bovespa Index - Friday, June 6

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Friday, June 6

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more