Pershing Gold – Steady Insider Buying And A Catalyst For Revaluation

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

There are thousands of listed publicly traded companies in the United States alone.Globally there are many multiples of that.

If you are an investor interested in doing some stock research finding a starting point amongst all of these companies can be overwhelming. Further complicating things is the fact that a lot of these companies are not worth risking your hard earned money on in the first place.

I have a very simple approach that helps me both shorten the list of companies to consider for investment and also lowers my risk of making a mistake by owning something of very low quality.

My approach involves focusing exclusively on companies that are either owned by world class investors or are seeing significant insider buying.

By doing so I’m restricting my entire pool of investment choices to only those that have the stamp of approval of a either a proven world class investor or company insiders who are the people with the best possible information on the company.

I strongly believe that this approach both reduces my risk of making mistakes and helps me find better opportunities.

Pershing Gold – Very Steady Insider Buying

Source: Yahoo Finance

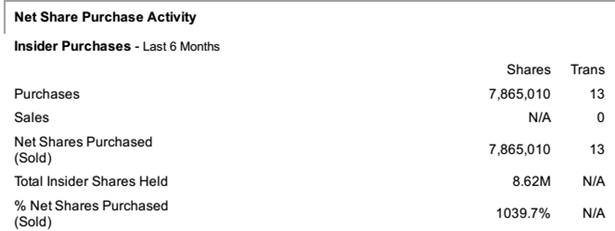

Pershing Gold gets into my pool of potential investments through insider buying. An unusually large dollar amount of insider buying. The amount of their own money that insiders at Pershing Gold (PGLC) have been spending on shares is definitely enough to perk a person’s interest.

Over the past six months alone more than 7.8 million shares have been acquired by insiders at prices in and around $4 per share. That is over $30 million dollars which is much larger amount than I typically see at a smaller cap company.

(Click on image to enlarge)

Source: Yahoo Finance

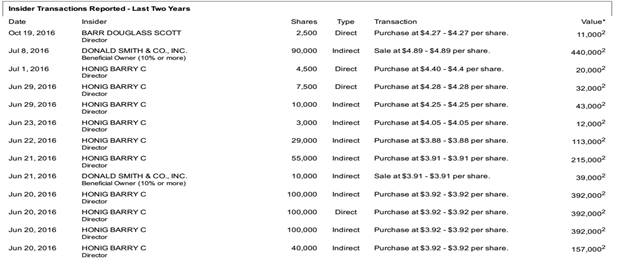

You can see a couple of insider sales in the six month period above as well, but the buying dates back for more than 18 months and dwarfs the sales in both dollar amount and regularity.

Insider buying guarantees nothing, but there is really on one reason for insiders to be spending their own cash on shares. They believe those shares are going higher in the future for some reason.

After identifying an opportunity such as this I next try to reverse-engineer why insiders seem to think that shares are a good buy.

For Pershing Gold I believe that reason may be that the market will soon (relatively) be re-valuing the company as it transitions from developer to producer.

The Market Treats Producers and Developers Very Differently

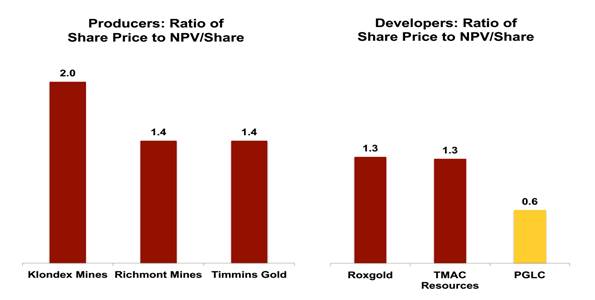

Pershing is a pre-production gold developer.As a pre-production company, Pershing’s stock price is valued relative to its net asset value at a pretty sizable discount to gold companies that are in production.

Source: Pershing Gold Corporate Presentation

With a valuation of 0.6 times, its Net Present Value Pershing’s valuation is only 40 percent of that of Richmont Mines (RIC) and Timmins Gold (TGD). The discount to Klondex Mines (KLDX) is even larger with Pershing receiving only 30 percent of what Klondex does.

The market is of course, correct in this valuation difference. A producer has a reliable cash flow stream and has de-risked its assets. A true cash flowing ability of a development stage is much less well defined and therefore riskier.

But Pershing isn’t just valued at a discount to the gold producers in the chart above. It is also being valued at only half the valuation of the two other development stage companies included (Roxgold and TMAC).

That could explain the steady insider buying.

The Catalyst for the Company Would Be the Move to Production

The obvious catalyst for this valuation discount that the market is applying to Pershing’s share price being removed is the company becoming a cash flowing producer.

If the company’s projections are correct (see the chart below) Pershing’s cost per ounce of production will be in line or better than all of the other companies in the previous NPV chart.

(Click on image to enlarge)

Source: Pershing Gold Corporate Presentation

That would suggest that the valuation should also be similar.

The next obvious question would be when can we expect production and cash flow to commence?

The most recent information that I could find to try and address that question is in this interview with Pershing’s CEO Stephen Alfers.In the interview, Alfers noted that Pershing has completed an economic assessment that confirms the profitability of the project, have all of the necessary permits in hand and fully intend to commence production at some point in 2017.

He was vague about when in 2017 that production might happen, but he did seem committed to next year.

(Click on image to enlarge)

Source: Pershing Gold Corporate Presentation

The insider buying would seem to suggest that there is no reason to doubt that.

Disclosure: I don’t own any shares of companies mentioned in this article.

In December 2016, NDEP (Nevada Division of Environmental Protection/Bureau of Mining Regulation and Reclamation Phase) issued the Reclamation Permit for Phase I expansion of the Relief Canyon Mine. Pershing Gold also has the approval from Bureau of Land Management for Relief Canyon Mine Expansion. Now, Pershing Gold has the permission to initiate the restart and expansion of Relief Canyon Mine. They are also working on air pollution control mechanisms. It shows that the company is progressing and investors seem happy about it (reflected in stock price).