Payroll Time

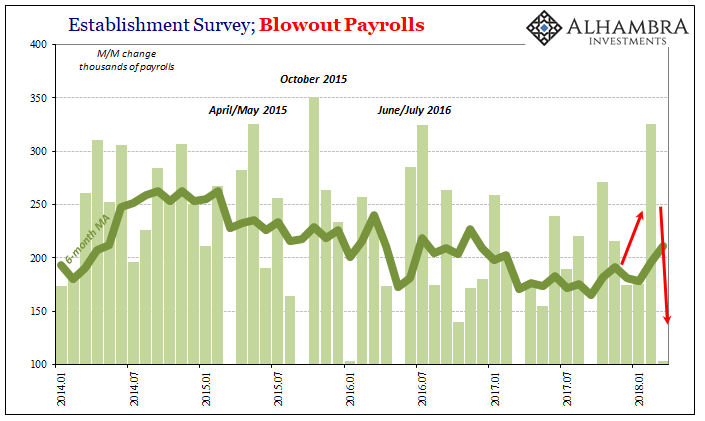

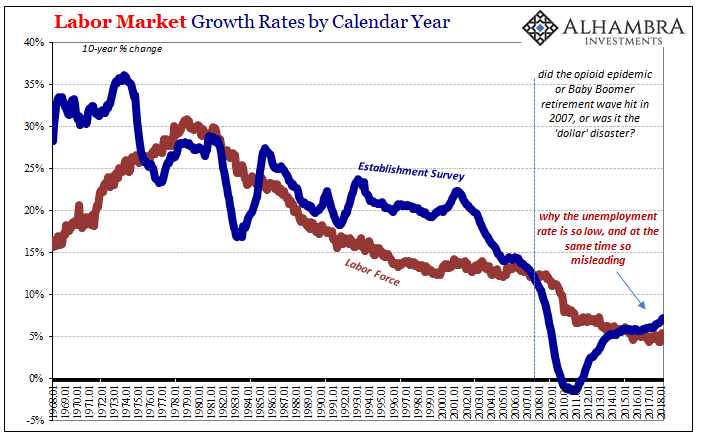

Never get hung up on one payroll report, good or bad. The Establishment Survey series, seasonally-adjusted and statistically smoothed as much as humanly possible, is still incredibly noisy. It didn’t used to be this way, which is an important clue that “something” has changed. The lack of consistency in the monthly measurement is as the unevenness of overall economic growth.

That way we aren’t surprised by any one weak payroll report because we realize they all are. What is truly inconsistent is how these are characterized as something they are not. The bigger issue is why.

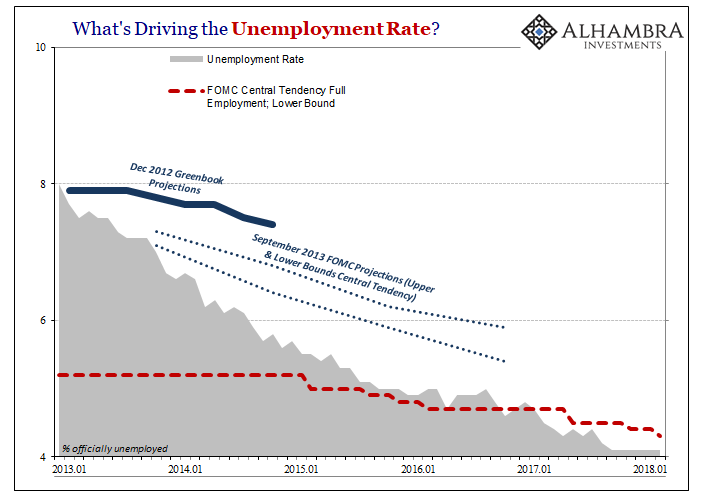

If we go back to around the beginning of QE3 and QE4 in late 2012, the Federal Reserve’s best statistical models projected a gentle downward trend for the unemployment rate. They did so starting with the assumptions that those particular QE’s would be a powerful and lasting boost to the US economy.

Even so, their models calculated that by the end of 2014 the unemployment rate would only decline to about 7.4% from then around 8%. That would have been considered good progress, and monetary success in keeping the economy in line of anticipated recovery.

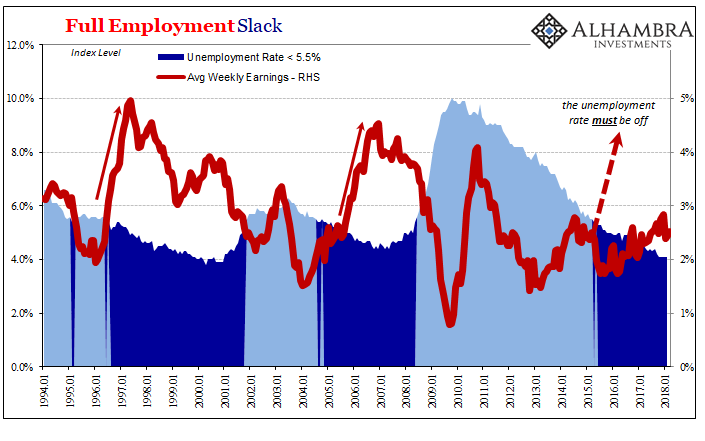

Instead, by the end of 2014 the actual unemployment rate had collapsed far faster than any economist could have imagined. It was already at around 5.6% to begin 2015, which was into the range their staff economists had forecast for full employment.

Obviously, something was missing given these results. In forecasting the rate in the Greenbook (or any other modeled predictions, such as those in September 2013 shown above), it was always assumed that the looming recovery would act like any other. In historical experience, and in common sense, as growth picks up in that cyclical process people who were then outside the labor force would begin to either enter or re-enter (the latter having been displaced by the recession part of the cycle).

It balances out the unemployment rate to some degree, to where there is meant to be robust growth for the numerator that draws in these displaced workers onto an almost equal pace for the denominator, too. That’s what the December 2012 Greenbook was expecting, therefore setting the narrative for each and every policymaker and Economist (redundant).

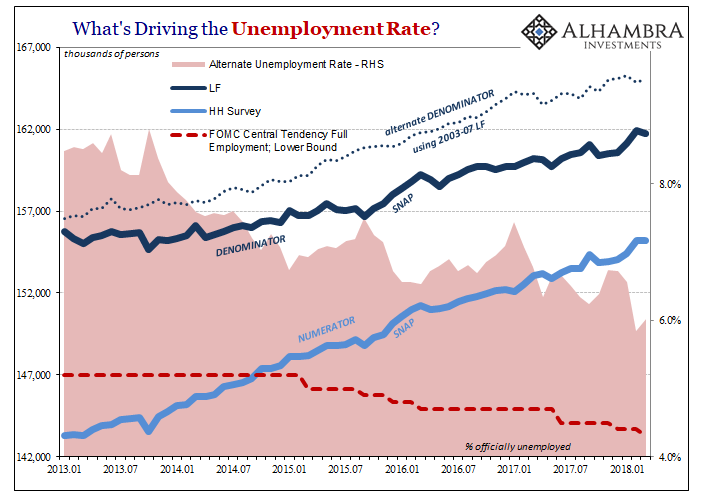

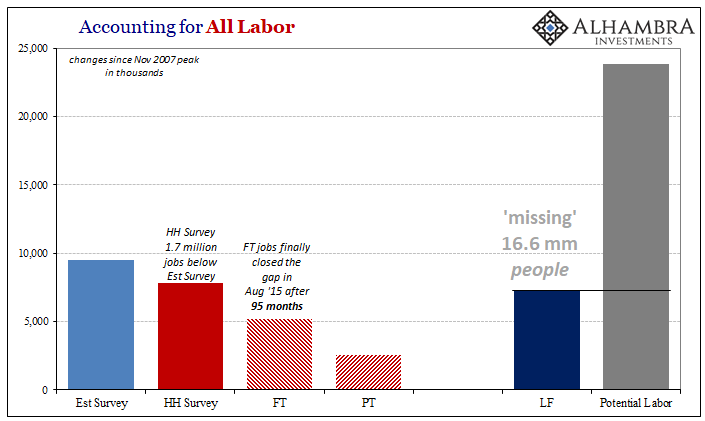

If we produce a counterfactual illustration using the Labor Force growth from the recovery after the dot-com recession (which wasn’t all that great, and exhibited the early stages of the participation problem), the alternate trend for the LF (denominator) gives us, assuming the same level of employment growth in the HH Survey (numerator), an alternate unemployment rate rather close to what the 2012 Greenbook was looking forward at.

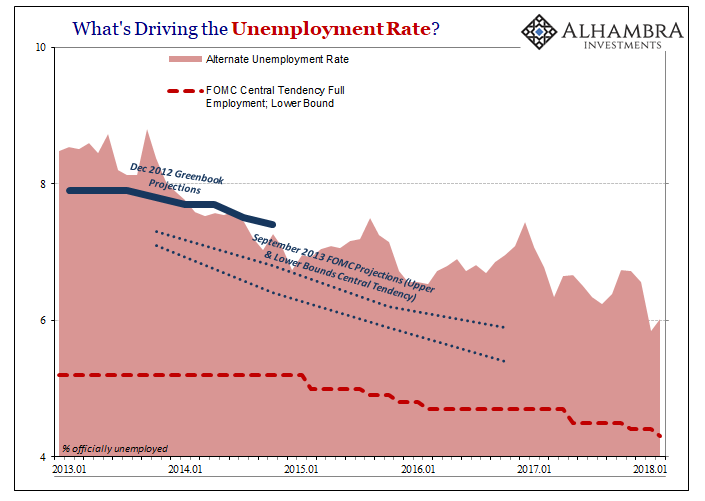

In this scenario, notice that the unemployment rate doesn’t yet achieve as late as March 2018 even the prior estimates for the upper bound of full employment. That would have meant very little expectation for wage acceleration and therefore consumer inflation (or what would be called in the mainstream a far more “dovish” policy situation) all this time. No inflation hysteria here.

In fact, that is in many ways how policymakers were thinking at times like 2014. Very early on in Janet Yellen’s tenure, in April 2014, she defended the FOMC’s apparent cautiousness from those who (always) view QE as too much “money printing” therefore risking an inflation outbreak:

The recovery still feels like a recession to many Americans and it also looks that way in some economic statistics.

As the New York Times surprisingly admitted in response to her contention:

The core of Ms. Yellen’s speech was devoted to a central issue confronting Fed officials as they seek to calibrate their efforts to stimulate the economy. Employment dropped sharply during the recession and has barely recovered. The unemployment rate has fallen because it counts only people who are looking for work, and a lot of people have given up entirely.

In short, the Fed at that time was looking past the sharp drop in the unemployment rate because they expected cyclical (symmetric, meaning acceleration) growth would draw those people back in at some point. The decline in the rate would have slowed considerably when that happened, giving monetary policy much more time to be patient about withdrawing what they still thought was lingering “stimulus” of the QE’s.

But it never happened. The unemployment rate kept falling because those outside the official labor force definition never really bothered an attempt at re-entry. Why not?

It is the only question that matters, speaking in part to why +326k is considered a blowout month when it’s not, and it tells us why we don’t expect that +326k to be followed up by another and another and another as in any truly healthy labor market and economy.

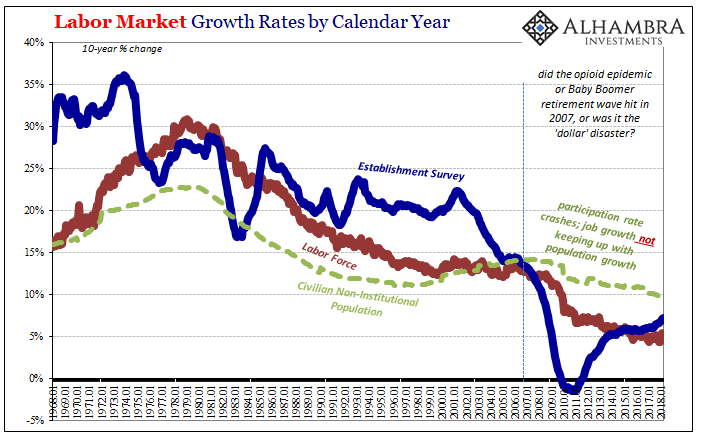

This is where economics really shows itself to be lacking the most basic and rigorous scientific characteristics. Rather than keep consistent even with those 2014 views, instead the idea has taken root and further establishes how there must be something wrong with the labor force itself rather than the economy. Baby Boomer retirement and the opioid crisis are offered as partial explanations, ridiculous attempted answers to this fundamental question.

The labor force hasn’t grown because the economy hasn’t. It really is just that simple. Because the economy isn’t actually growing, the labor market has been for a very long time caught in a chronic state of feebleness and malfunction. In linear terms, there are only positive numbers but that doesn’t matter nearly as much as the intensity of them.

Without actual growth, far, far too many Americans remain on the sidelines of the jobs market. Worse, this weakness is reinforced forward as job growth isn’t nearly enough to absorb possible new entrants, either (population growth). That’s the participation problem being derived directly from continued cyclical underperformance.

But it’s 2018, ten years later. This defies all sense of economic proprieties, and therefore we are conditioned to disbelief. The economy must be really growing, or just about to, because it can’t take a whole decade off from it. If the unemployment rate says 4.1% for still another month, then there is surely a boom; wage inflation is right around the corner.

In reality, of course, it never is. The unemployment rate is and has been misleading for a very, very long time, acknowledged even by those who try to wield it today in a completely different fashion. There is just no evidence that the economy is in the position it would otherwise suggest. It doesn’t matter how low the unemployment rate will go in the coming months, or how many of them feature +300k in Establishment Survey payroll gains. The labor market is as weak as the overall economy, based upon leftover cyclical problems that weren’t produced by a business cycle.

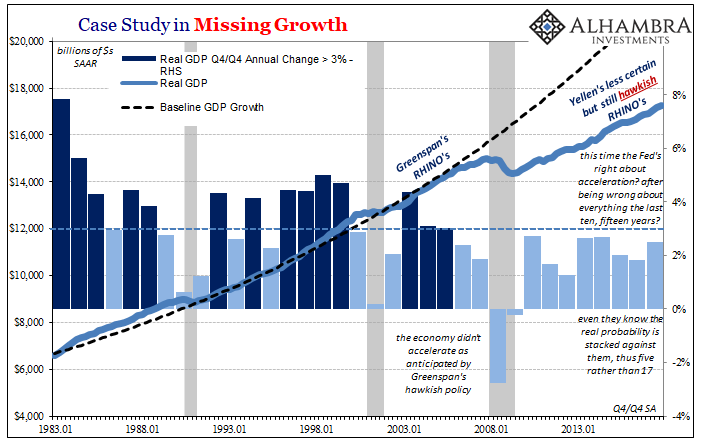

Economic growth is not a given. Time does factor but in this opposite direction. What I mean is that the longer it goes the more we have to consider this lack of growth proven and established baseline fact. To merely suggest a change back toward actual growth will require a whole lot more than the unemployment rate.

The Great “Recession” was, quite simply, never a recession to begin with. Recognizing recent economic history in this way shows us the labor force makes sense as a response to the perpetually awful labor market and therefore the unemployment rate becomes entirely irrelevant. It’s interesting in that policymakers were prepared to believe just that in 2014 but only as an intermediate step until the big economic acceleration happened (which they all thought was certain for 2015).

Now four years later and still without any acceleration at all, the unemployment rate is taken for accurate anyway? No, it is only because of this misconception about time.

Disclosure: None.