Orgenesis' Leveraged Approach To Lower The Cost Of Cell And Gene Therapies

Orgenesis (ORGS) is an innovative biotech company in the CGT (Cell & Gene Therapy) space. It has a multi-faceted strategy combining therapeutics, technologies, processes, and systems via a network of collaborative partners, and research institutes, and hospitals around the world in order to provide life-changing treatments to large numbers of patients at reduced costs at the point-of-care. From the 10-Q:

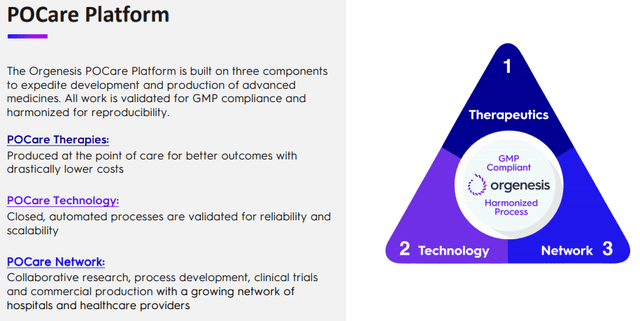

The Platform consists of: (A) POCare Therapeutics, a pipeline of licensed cell and gene therapies (CGTs), and proprietary scientific knowhow; (B) POCare Technologies, a suite of proprietary and in-licensed technologies which are engineered to create customized processing systems for affordable point of care therapies; and (C) POCare Network, a collaborative, international ecosystem of leading research institutes and hospitals committed to clinical development and supply of CGTs at the point of care.

The CGT market is of course in the first innings of a secular expansion, from the company IR presentation:

The problem with many of these therapies is that they are complex and terribly expensive, from the company IR presentation:

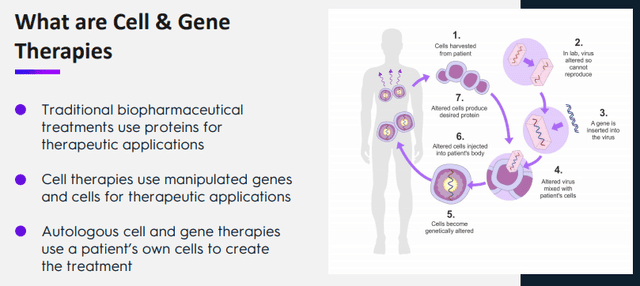

It's the company's mission to reduce these costs and make more therapies available for more patients. One way they're doing that is by specializing in autologous CGT therapies, that is, the cells are harvested from the patients themselves, from the company IR presentation:

But, according to the company website:

Autologous therapies are produced from a patient’s own cells instead of mass-cultivated donor cells. This is a substantial segment of the cell and gene therapy market. These therapies are derived from a treated patient and manufactured through a rigorous, defined protocol before re-administration. As a result, this involves a set of highly complex supply, logistics, and orchestration chains. For patients and healthcare providers alike, the complexity of the supply chains increases risk. In addition, current centralized manufacturing processes significantly contribute to these therapies’ high price tags.

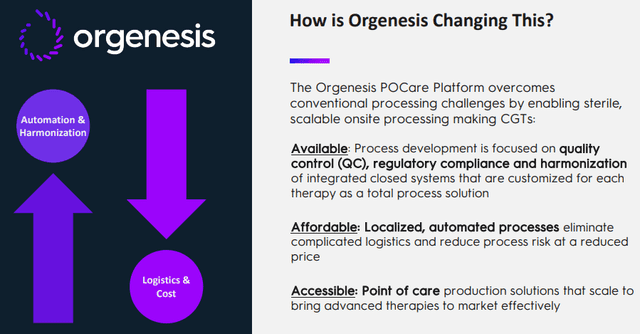

The company's POCare platform is their solution for these problems, from the company IR presentation:

That POCare platform consists of three parts, from the company IR presentation:

One might wonder how producing at the point of care delivers "better outcomes with a drastically lower cost" as the slide above argues. The main plank of that is in the POCare Technologies, a suite of proprietary and in-licensed technologies that are engineered to create customized processing systems for affordable point of care therapies which they are bringing to their partners.

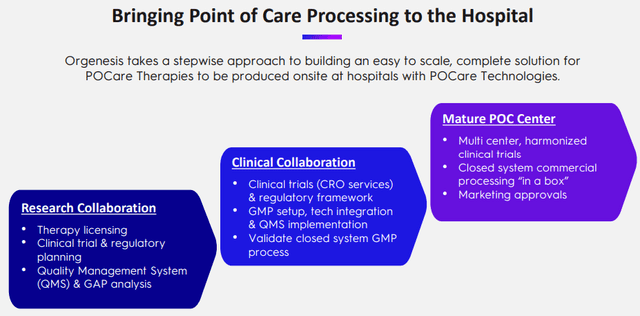

The company has a systematic three-step methodology for developing POCare therapies:

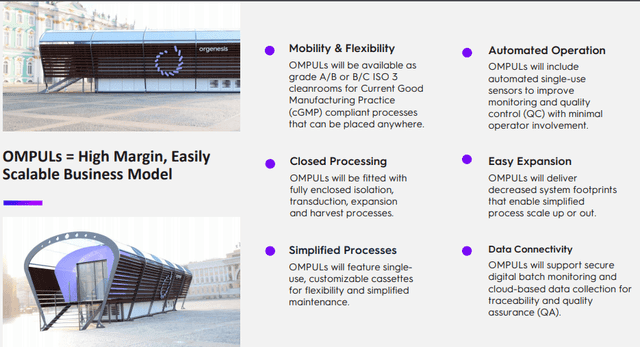

Central to this are OMPULs (Orgenesis Mobile Processing Units & Labs) which are still in development, but here is an overview:

Here is some further meat on that, from the 10-Q:

The Company is committed to the validation, adoption and development of systems, technologies and processes for mobile processing unit and labs (“OMPUL”). OMPULs are intended to be used and/or distributed through Company’s point of care network of partners, collaborators and joint ventures for the purpose of validation, development, performance of clinical trials, manufacturing and/or processing of potential or approved cell or gene therapy products in a safe, reliable and cost-effective manner. This provides an industrial solution for any clinical institution in the world to provide more therapies at the point of care.

There are a number of advantages that these OMPULs bring (company website):

- Lower required grade of clean room, simplifying facility management requirements

- Enabling multi-batch processing per clean room, requiring reduced technical staffing

- Localized processing eliminates many logistical difficulties associated with traditional centralized manufacturing and transport

- Faster turnaround, increased safety, and improved QC (Quality Control) management on-site

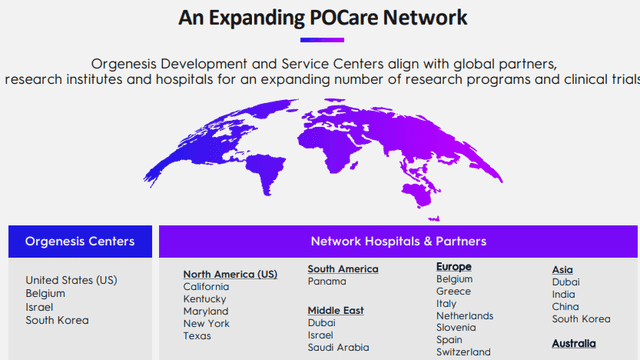

Before we go to specific therapies, we have to stress that this is a collaborative approach, relying on networked expertise, the company's POCare network:

There is a range of benefits for all participants (from the company website):

- Orgenesis’ partners gain access to extensive expertise in process development, operational excellence, and access to a broad network of like-minded institutions.

- Patients and the global healthcare market benefit from reduced costs, improved safety, and access to more clinical-stage research programs.

- Orgenesis gains access to shared development programs, facilities management, and new and promising therapies and technologies.

Technologies

Technologies are potentially more valuable than individual therapies as they could be used in the production of multiples of these. The company uses a variety of approaches for ATMP (Advanced Therapy Medicinal Product), like:

- STMP; a somatic cell therapy medicinal product, that is, cells or tissues that have been manipulated to change their biological characteristics of cells or tissues not intended to be used for the same essential functions in the body.

- TEP; a tissue-engineered product using cells or tissues that have been modified so they can be used to repair, regenerate, or replace human tissue.

- GTMP; a gene therapy medicinal product containing genes that lead to a therapeutic, prophylactic, or diagnostic effect and work by inserting "recombinant" genes into the body, usually to treat a variety of diseases, including genetic disorders, cancer, or long-term diseases.

- Combined ATMP, which contains one or more medical devices as an integral part of the medicine, such as cells embedded in a biodegradable matrix or scaffold.

And there are a host of joint-ventures to develop specific technologies, for instance:

- Joint-venture with RevaTis to produce stem cells

- Cooperation with ExcellaBio to develop a manufacturing process for bioxomes

- Developing a lentiviral manufacturing system with the University of California

The RevaTis joint-venture aims to leverage RevaTis patented technology utilizing and banking muscle-derived mesenchymal stem cells (mdMSC) as a source of exosomes and other cellular products. RevaTis has developed a patented technique to obtain mdMSCs through a minimally invasive muscle micro-biopsy and produce mdMSCs utilizing a turnkey isolator system.

The cooperation with ExcellaBio has led to a breakthrough less than a year later (PR):

Exosomes, or extracellular vesicles (EVs), are small vesicles that transfer DNA, RNA, and proteins to other cells, thereby altering the function of the targeted cells. Exosomes are believed to provide the same therapeutic benefit of cells without the risks and difficulties of administering entire cells to patients.

Together, Orgenesis and ExcellaBio have developed Bioxomes, which are synthetic exosomes/EVs. Until now, exosome/EV production has been based on conventional ultracentrifugation or ultrafiltration. These are both complex and costly techniques. Bioxomes are engineered and produced through a patented method as membrane nanoparticles isolated from cell cultures of various sources. Orgenesis and ExcellaBio have now demonstrated the optimization and scale up of Bioxomes™, while generating consistent and repeatable results, including uniform particles sizes. These Bioxomes have demonstrated the ability to fuse with cell membranes and deliver an intracellular cargo, in a similar manner to natural exosomes.

CEO Vered Caplan now believes that this technology can be used for large-scale production of Bioxomes for a variety of therapeutic applications based on the natural intracellular trafficking abilities of exosomes/ EVs.

That is, this is a technology that could really help bringing down the astronomical cost of some CGT therapies.

On the cooperation with UC Davis (linked PR):

The UC Davis GMP facility has developed a small-intermediate scale, high quality vector process that has been successfully utilized to manufacture lentiviral vectors in several clinical trials, including manufacturing of CAR T cell therapies.

Therapies

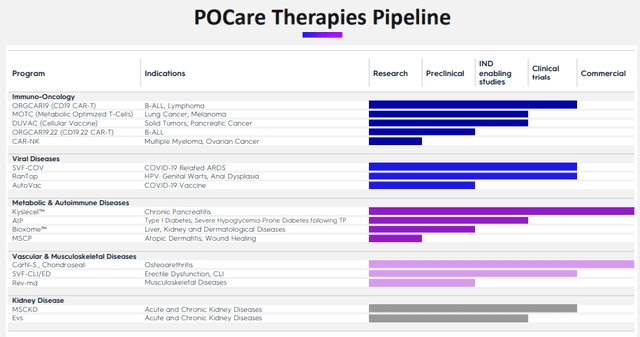

The company has a nice overview slide:

They have two therapies that are already in the commercial stage:

- KYSLECEL for chronic pancreatitis, the company got this when it acquired Koligo Therapeutics in September.

- Cartil-S

KYSLECEL is still in the early stages though:

KYSLECEL is made from the patient's own pancreatic islets, which are the cells that make insulin. Developments are promising (PR):

The KYSLECEL pilot program has generated approximately $2 million in sales revenue. KYSLECEL has also been shown to result in significant savings to payors over traditional chronic pancreatitis management. Following the closing of the Transaction, Orgenesis plans to make KYSLECEL available to an increasing number of hospitals throughout the United States through its POCare Network.

Cartil-S has been developed by the Greek company Theracell, from the company website:

Theracell has developed an autologous injectable product (Cartil-S) that helps delay, or even stop the progression of arthritis. Cartil-S, is an autologous treatment that makes use of the patients own Stem Cells and their immunosuppressive properties. It is indicated for cartilage defects of degenerative origin.

The two companies have a joint-venture:

Under the Master Service Agreement, Orgenesis will provide regulatory consultancy services, pre-clinical studies, intellectual property (IP) services including IP life cycle management, and POCare services including training and technical runs, quality management systems and operational support.

But the rationale seems more geared to develop kidney regeneration (with the help of Theracell's ADSCs or adipose-derived stem cells) for chronic kidney disease.

Two phase 2 clinical trials are being set up for:

- KT-PC-301

- Ranpirnase

See below for some details.

Other prospects, further out

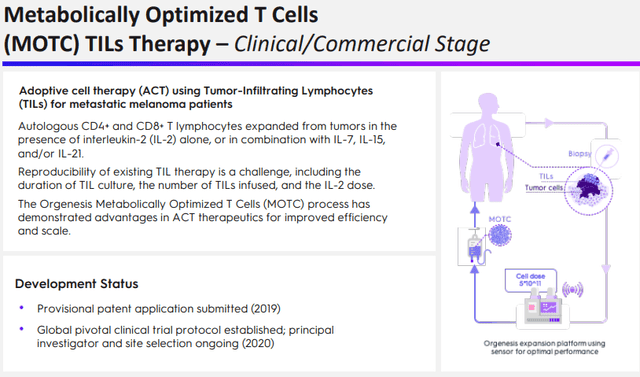

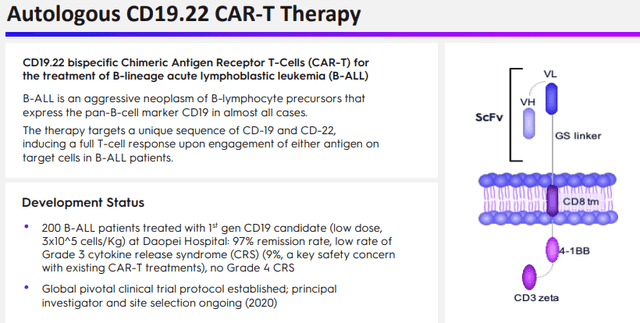

As one can gauge from the therapies overview slide, the company has a host of additional therapies in early development stages like MOTC:

And

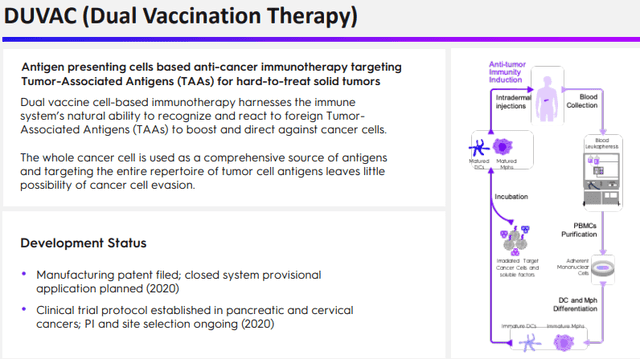

And Duvac

But these are not near approval so we won't go into these in detail.

Acquisitions

- Koligo (September 2020) for $15M

- Tamir (April 2020) for $21M

The main aim of the Koligo acquisition is to accelerate the commercialization of KYSLECEL, as well as to rapidly advance the 3D-V platform and KT-PC-301 autologous cell therapy for Covid ARDS (acute respiratory disease syndrome). About the 3D-V platform (linked PR):

Koligo’s development stage technology utilizes 3D bioprinting and vascularization with autologous cells (“3D-V” technology) to create biodegradable and shelf-stable three-dimensional cell and tissue implants. The 3D-V technology is being developed for diabetes and pancreatitis, with longer term applications for neural, liver, and other cell/tissue transplants.

So they are acquiring a promising platform with applications developed by Koligo, but they are also planning to leverage the 3D-V platform across the company's POCare platform.

Covid

The company also has a few therapies that can become useful in the battle against Covid:

- KT-PC-301, which was acquired through the Koligo acquisition in September and it will be employed in a phase 2 clinical trial

- Ranpirnase

- BioShield Program

KT-PC-301 is derived from a patient's own fat tissue, manufactured within hours into KT-PC-301 and administered intravenously. It contains mesenchymal stem cells, vascular endothelial cells, and immune cells which migrate to the patient’s lungs and other points of inflammation. From the link above:

Published nonclinical and clinical evidence demonstrate that KT-PC-301 may: (1) stabilize microcirculation to improve oxygenation; (2) maintain T and B lymphocytes to support antibody production; and (3) induce an anti-inflammatory effect. Koligo believes that the multiple mechanisms of action of KT-PC-301 are important to treat ARDS symptoms of moderate to severe COVID-19.

Ranpirnase is a broad-spectrum antiviral platform and was obtained through the acquisition of Tamir Biotechnology earlier this year. The company is preparing another phase 2b clinical trial this year, there has been one in 2016.

On the BioShield program, from the PR:

Orgenesis plans to leverage its POCare anti-viral technologies as part of the development efforts of the BioShield Program, including exploration of alternative and breakthrough processes to induce neutralizing antibody discovery and validation against targeted pathogens. The BioShield Program is designed to combine different technologies in preclinical stage to induce a response of the immune system within selected animal models, which could potentially speed the discovery of neutralizing antibodies. Orgenesis’ cell-based vaccine approach, which utilizes irradiated permissive cells that have the ability to activate an endogenous immune response, is a component of the BioShield Program.

Growth

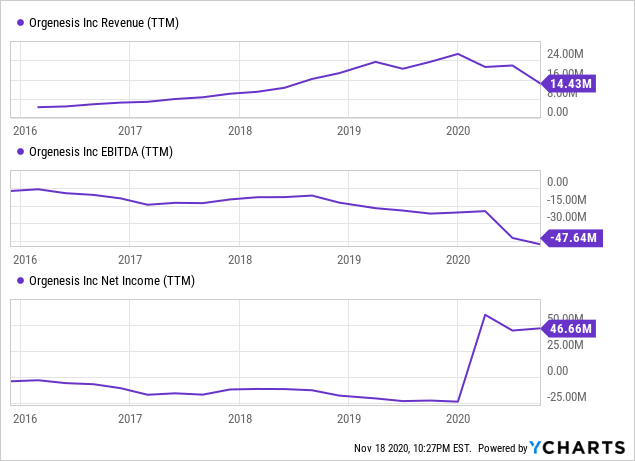

Data by YCharts

This is not a very useful graph as it is put out of whack by the sale of Masthercell for $127M in Q1 2020. But revenue of its point of care and CGT network, which is now its only source of revenue, is rising pretty fast:

| Q1 19 | Q2 | Q3 | Q4 | Q1 20 | Q2 | Q3 | |

| Revenue | 0.4 | 1.1 | 1.2 | 0.4 | 1.9 | 1.7 | 1.7 |

| Cash | 107.1 | 88.8 |

Revenue for the POC services for the whole of 2019 was $3.1M. In the first nine months, this has already risen to $5.3M. Revenues are coming entirely from the company's POC Development Platform, which the 10-K describes

These regional partners have cell therapies in clinical development and are to whom we also provide manufacturing know-how, assay services, licensing, regulatory assistance, pre-clinical studies, intellectual property services, and co-development services (collectively "POC Development Services") to support their activity in order to reach patients in a point-of-care hospital setting.

Additional information from the Q3 earnings PR:

Orgenesis intends to leverage our network of regional partners to advance the development and commercialization of our therapeutic pipeline. Towards this end, our partners have committed to funding the clinical programs. In turn, Orgenesis typically grants its partners geographic rights in exchange for future royalties, and a partnership with Orgenesis to support the supply of the targeted therapies.

This could ramp up pretty fast, from the Q3 earnings PR:

Orgenesis typically grants its partners geographic rights in exchange for future royalties, and a partnership with Orgenesis to support the supply of the targeted therapies. Through this unique model, Orgenesis has already signed contracts, which we expect to generate over $40 million in revenue over the next three years, if fully realized. There are also plans to continue to develop, license and form partnerships around a variety of POCare Technologies to support work in areas such as Tumor Infiltrating Lymphocytes (TILS), CAR-T, CAR-NK, dendritic cell therapies, and mesenchymal stem cell (MSC) based therapies.”

It's an interesting business model that is endlessly extendible, and that's exactly what they are doing with their POCare network.

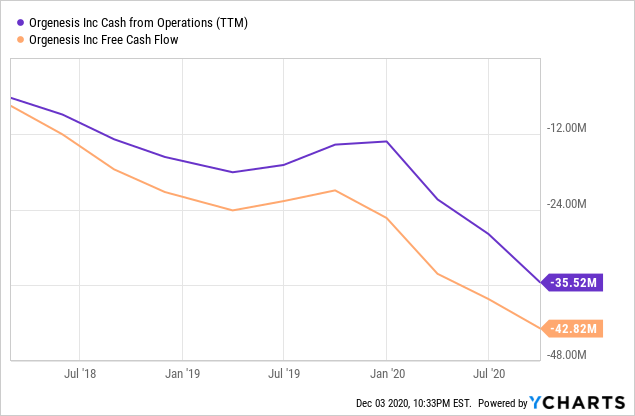

Cash

Data by YCharts

The acquisitions were only made possible by the sale of most of its CDMO (contract development manufacturing organization) business Masthercell, for roughly $127M.

Investors should take note of the fact that when the company acquired the CDMO business in March 2015, it had just $3M of revenues, which they managed to increase tenfold by the end of 2019. Not surprisingly, they rejoiced with a five-fold return on their investment.

At the end of Q3 they still had $88.8M of cash remaining (and $10.5M in convertible loans), while their cash burn rate is roughly $9.5M in Q3 so they could continue for quite a while without raising finance (assuming no M&A activities).

Conclusion

This is an interesting company that is not easy to sum up, as it's more like a collaborative network, rather than a company.

It has an innovative approach that leverages a wide and increasing network of partners for capabilities, therapies in development, technologies, and funding for clinical trials. In exchange, geographic rights are granted for royalty payments.

Then there are the services the company provides to its partners and the OMPULs the company is about to rollout at different partners worldwide.

In terms of immediate commercial prospects, the two drugs out are KYSLECEL and Cartil-S, and management argues it has agreements in place to ramp up revenues.

They have cash for about two years, but they are still some time away from achieving an inflection point where past activities generate enough cash to finance new developments.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Which companies directly compete with $ORGS?

Well, anything in the cell & gene therapy space, in theory, but it really depends on the therapy in question, and even that might not be a problem because Orgenesis argues they are doing things cheaper.

Very interesting, thanks. I've heard about this company, but haven't been able to find much about them.

My pleasure Alexa. It's a pretty complex company, perhaps it's more like a little network, as it happens.