Why $190 Was The Level To Watch On Oracle

Image Source: Pixabay

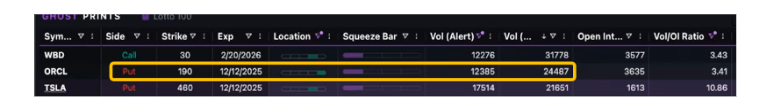

24 hours before Oracle's earnings, someone bought 24,000 puts at exactly one strike: $190.

The next morning, Oracle gapped down and stopped right there. Was it luck? Insider knowledge? Neither. They just understood something most traders miss about how stocks behave after disappointing earnings.

The Setup Nobody Talked About

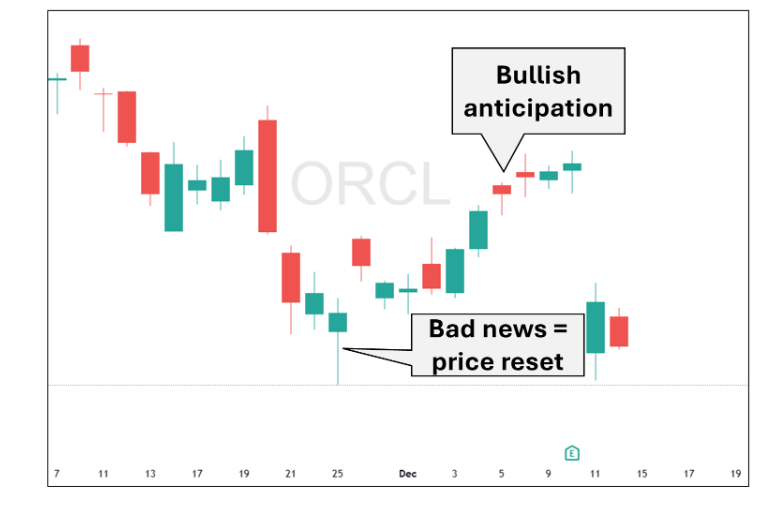

Oracle rallied into earnings. The stock climbed from 190 to 210 on pre-earnings momentum. Analysts were bullish. But consider the possible outcomes:

- If Oracle surprises to the upside, maybe the stock rallies 5%. That move is largely baked into the price already. Limited upside.

- If Oracle disappoints, the stock snaps back to 190. All that anticipated gain evaporates. You give back the entire pre-earnings rally in one overnight gap.

The math was asymmetric. Upside capped at around 5%. Downside was a clean 10% back to prior support. And the downside would hit faster and harder.

Why $190 Mattered

That $190 level was where Oracle traded before the pre-earnings rally started. It was natural support.

When stocks disappoint after running into earnings, they don't drift lower gradually. They often gap back to where they started. This happens repeatedly.

The Ghost Prints Surveillance Console flagged 24,000 puts at that exact strike. Someone positioned for mean reversion. This was not a crash. Not insider knowledge. Just recognition that the $190 level was where the stock would land if the news disappointed.

The puts didn't cause the stock to stop at $190. The puts were positioned there because sophisticated traders understood that's where mean reversion would take it.

What the Print Actually Told Us

This is how you read institutional flow. You're not looking for someone who knows the earnings numbers. You're looking for positioning around asymmetric outcomes.

The print revealed which move would be bigger. Not which direction was guaranteed. The skew favored the downside - larger magnitude, faster move, cleaner target. As I said during the trading session: "Is it gonna be perfect? No, nothing is 100%. We're just trying to put ourselves in that position."

How Gamma Accelerated the Move

Oracle missed. The stock gapped lower. Then the mechanics kicked in. Those 24,000 puts moved toward the money. Market makers who sold those contracts had to hedge their exposure by shorting shares.

As Oracle dropped toward $190, hedging requirements increased. More selling pressure. The gamma squeeze accelerated the decline toward the target that was already baked in.

The options didn't determine the destination. They accelerated the journey to a level that fundamental mean reversion was already pointing toward.

What's Different About Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing showed different positioning. Someone bought 8,000 puts at the $175 strike while the stock traded near highs around $200. Same directional bet. Different setup entirely.

I specifically noted that the Taiwan Semiconductor puts lacked gamma squeeze potential. At $175 with the stock at $200, those puts had roughly 0.03 delta. Almost no hedging required. No feedback loop.

The Taiwan Semiconductor print reflects sentiment - someone wants downside protection. But without meaningful delta, there's no mechanical pressure pulling the stock toward that strike.

Not every put print creates a target. The Oracle setup was specific: puts near prior support, close to the money after a gap, with enough delta to force hedging. Taiwan Semiconductor doesn't have that.

The Framework, Not the Prediction

The print doesn't predict outcomes. It reveals which outcome offers better risk-reward when the probabilities are asymmetric.

Oracle validated the framework: identify the natural reversion level, recognize when options positioning aligns with that level, and understand that gamma can accelerate but doesn't determine direction.

The goal isn't prediction. It's probability. Oracle showed what happens when skew, positioning, and fundamentals align.

More By This Author:

Surviving Markets That Want You DeadA.I. Fear Escalates And Begins To Spread

Blake Just Spotted the Fed's Real Winners

Watch this short video and see how I quickly scan ...

more