What The Options Market's Expecting For Microsoft And Alphabet Earnings

By: Steve Sosnick Chief Strategist at Interactive Brokers

In a piece last week, we asserted that this week would be the “main course” of the earnings season buffet. This afternoon we hear from Microsoft (MSFT) and Alphabet (GOOG, GOOGL), which alone represent just under 10% of the weight of the S&P 500 Index (SPX) and about 17.5% of the NASDAQ 100 (NDX). With other mega-cap heavyweights like Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) to come later this week, the earnings season entrees are hitting the table.

On Wednesday afternoon, traders enjoyed the tasty morsel that was Tesla (TSLA) earnings, pushing that up just under 10% in the subsequent day’s trading. Interestingly, the options market was somewhat blasé ahead of what turned out to be an upside surprise. Since then, SPX has given back its gains, though TSLA has been resilient. Traders appear to be more focused on the positive surprise than the limp overall market, however, at least when it comes to GOOG.

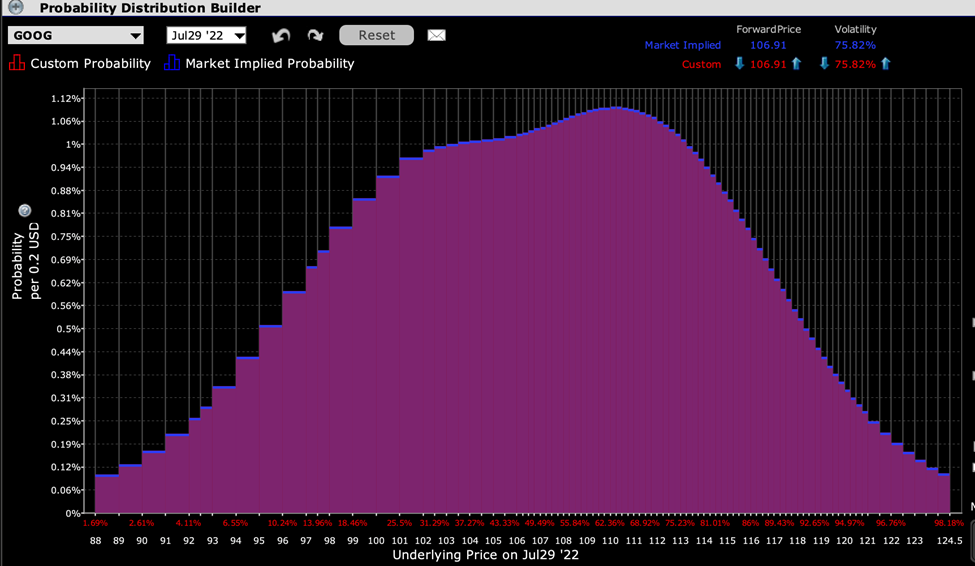

The IBKR Probability Lab shows an unusual hump in above-market options expiring Friday. We see a peak in the area around $111, about 5% higher from current levels. That alone would not be particularly unusual, but the relatively linear rise in at-money options and a secondary bump above market is. It appears that traders are sanguine about upside for GOOG after results:

IBKR Probability Lab for GOOG Options Expiring July 29th

(Click on image to enlarge)

Source: Interactive Brokers

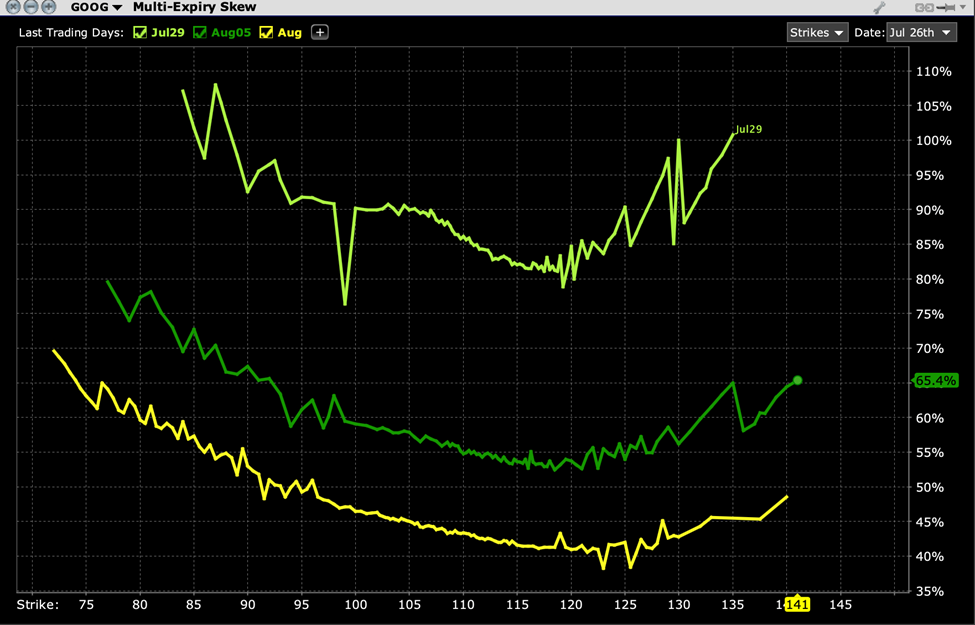

This sanguine view becomes apparent when we look at the skews on near-term options. Note the big decline in the current week’s implied volatilities for above-market options in the graph below:

GOOG Options Skew, July 29th (top), August 5th (middle), August 19th(bottom) Expirations

(Click on image to enlarge)

Source: Interactive Brokers

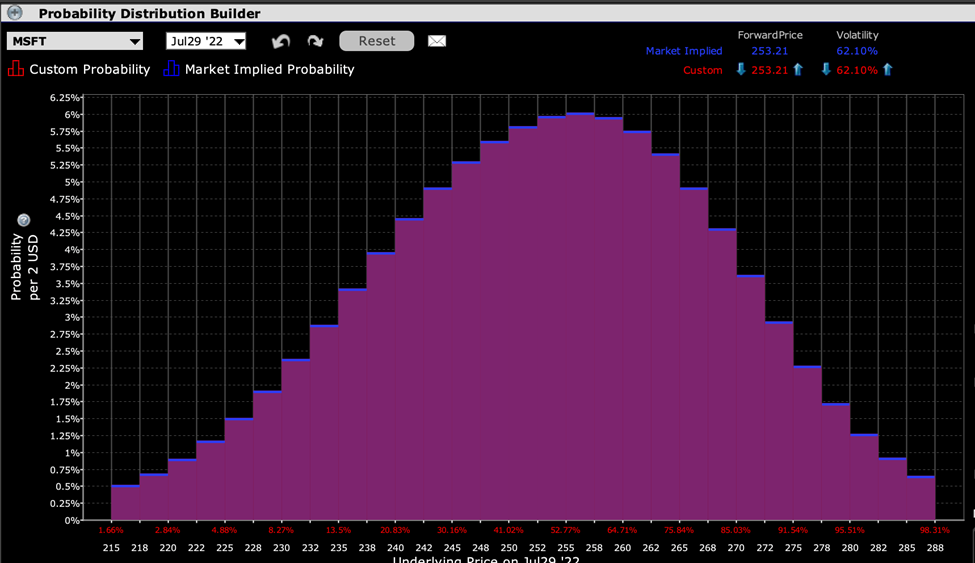

Meanwhile, the options market’s view of MSFT is much more neutral. Perhaps it is because the company already warned that a stronger dollar would be impacting its views. In any event, we see a fairly standard symmetrical probability distribution for options expiring this week, with the peak probability in at-money options:

IBKR Probability Lab for MSFT Options Expiring July 29th

(Click on image to enlarge)

Source: Interactive Brokers

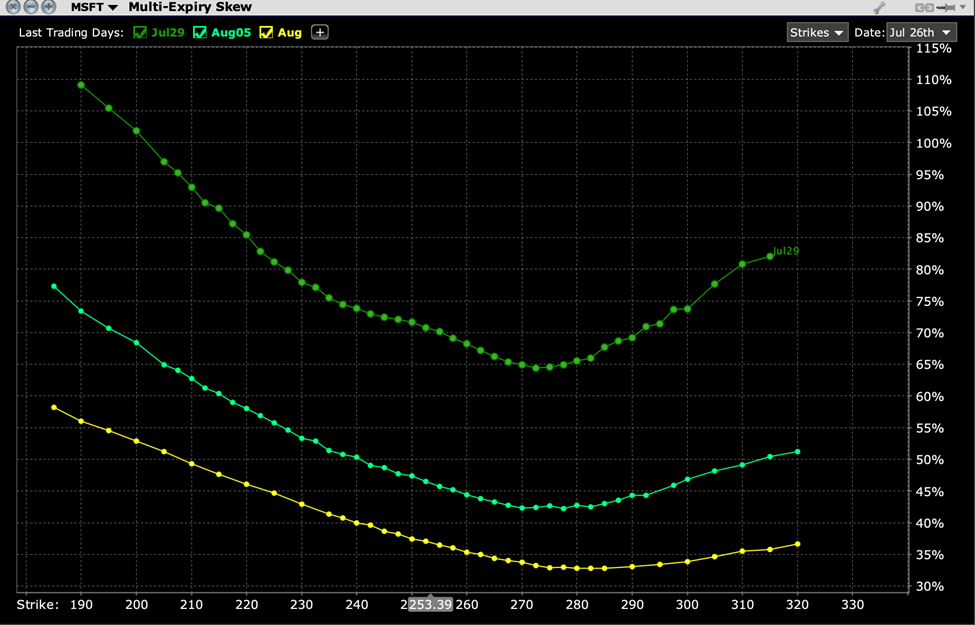

The skew graph also appears fairly standard, with a nadir in implied volatility in above-market options, and the normal assymetric “Elvis Smile” in its skew graph (downside options with generally higher implied volatilities than similarly upside options).

MSFT Options Skew, July 29th (top), August 5th (middle), August 19th(bottom) Expirations

(Click on image to enlarge)

Source: Interactive Brokers

Now the question becomes whether the market has its expectations properly calibrated or not. With TSLA, the options market missed the move. Today with GOOG, they are anticipating an upside move, while with MSFT they are basically neutral. It’s now up to the companies to let us know if more caution was warranted.

More By This Author:

Socially Acceptable Volatility Strikes Again

What the Options Market is Telling Us About TSLA Earnings

Cocktail Hour is Ending, Please Join Us in the Main Dining Room

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more