What Is Tail Risk?

Tail risk is broadly defined as the probability of rare events that are outside the normal distribution of outcomes we typically see. Odds are if you have a portfolio of any type (even those invested in AAA bonds or cash), you have tail risk.

What is Tail Risk and How Can I Manage It?

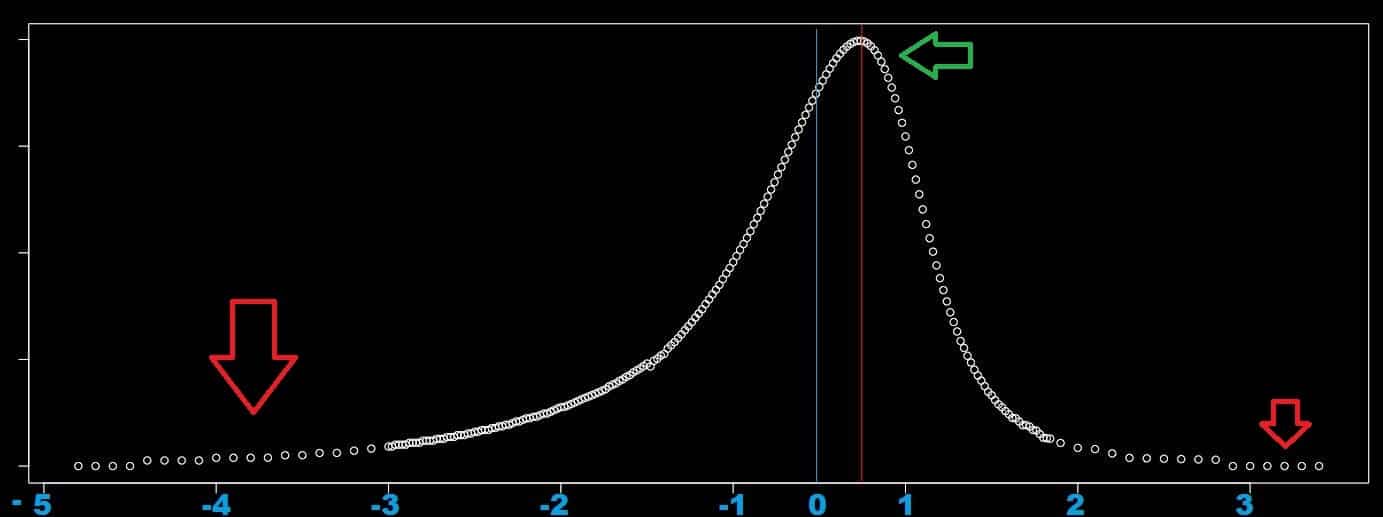

On the chart below, I have plotted the daily price move on the X axis and the frequency of that outcome (on the Y axis) over two decades in the S&P 500. You may notice a few things:

- The curve does not have a normal distribution.

- The highest point of the curve (as shown by the green arrow) is not at 0, but slightly above it.

- On the extremes of the curve (as shown by the red arrows), the left side is a lot longer and fatter than the right side.

Visualizing the Fat Tail of the S&P 500

Why is the peak above 0%? It's because the most common day in the stock market is one that is calm; nothing much but a minor positive equity drift (as stocks tend to go up over time). So the next time your friends ask what you expect the stock market to do tomorrow you can reply "it will be slightly higher."

The extremes of the graph or the tails are what we are focused on instead. There is an especially fat tail on the left side of the graph, illustrating the downside risk in the S&P 500. These large moves of 3+ standard deviations occur a lot more commonly than a normal distribution of returns would imply.

Using Skew to Measure Tail Risk

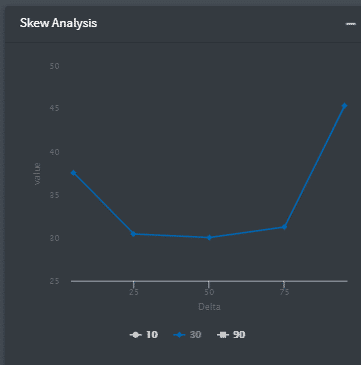

Thankfully we don’t need to spend hours pouring into company financials to have a good estimation of risk. All we have to do is look at the skew (the implied volatility of different strike prices for the same date and underlying).

This fat left tail is common in all equity indexes and in most single name equities. Though there are some equities, specifically biotechs and heavily shorted stocks, that exhibit a fatter right tail. This illustrates that the most common daily move is a small move down, but if a large move does happen, it will most likely be to the upside.

Imagine a small biotech company looking to develop a cure for cancer. As each day goes by, they deplete their cash reserves. Odds are the company will slowly fail. Yet if they do hit a miracle cure (or even positive trials), the stock will skyrocket. Most stocks will have tail risk to both sides, resulting in a volatility smile or smirk (as shown below with Apple (AAPL)).

Stressing Our Positions

In order to protect ourselves against tail risk, we need to first stress test a worst possible situation for our positions.

Any bank will have its own department to manage risk. They employ multiple methods, such as Value at Risk (VAR), to try to manage risk as best as possible. For those of us without fancy software or a team of risk managers, there are some simple methods we can use.

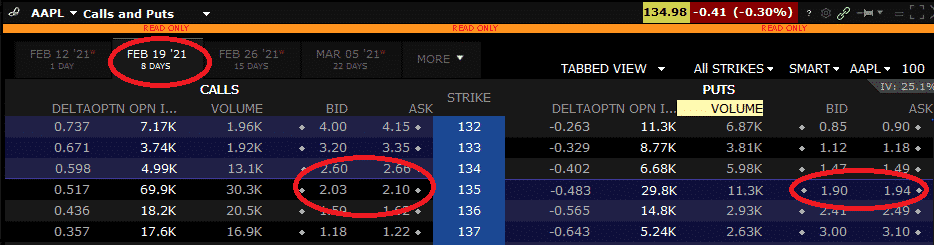

The first thing I like to do is to calculate the standard deviation of my position. This is remarkably simple. Let’s say I have a short strangle or I am long shares of Apple. I am curious about my tail risk by next Friday’s expiry. All I do is pull up the Apple option chain and check out the price for the at-the-money straddle.

We can see that the calls cost $2.06 and the puts cost $1.92 = $3.98 for the straddle. Once we have the straddle price, we can get a good estimate of standard deviation by simply dividing the straddle price by 0.8 to get the standard deviation.

- $3.98 / 0.8 = $4.98.

We can then conclude a 1-standard deviation (or normal) move for Apple for the next week would be between $130.02 and $139.98. To then stress our position we simply multiply by the number of standard deviations we want to stress it to. I like to stress my position to a 3-standard deviation move, which is a common tail move.

- $4.98 X 3 = $14.94. This would be a range of $290.06 – $319.94 by next Friday.

A 3-standard deviation move should not be enjoyable, but there is no reason not to be prepared. I also like to check a 5-standard deviation move which should cause a lot of stress, but not send you to the soup kitchen.

With options, stressing our position for a change in volatility is also crucial. If Apple's volatility is 20% and the stock moves 5% tomorrow, the volatility of Apple is going up. Therefore as an options trader, you need to stress for all exposures, not simply price.

Another common mistake that traders make is assuming that because you can individually handle the tail risk of a position, your portfolio can handle the tail risk of multiple positions. Take for example the retail trader who is selling strangles on Netflix (NFLX), Mcdonalds (MCD), and General Motors (GM). You would assume these stocks are relatively uncorrelated. In normal times, that may be the case.

Yet when the worst tail events happen, correlations pick up. Potentially you will be hit with tail risks on every position. This shows the importance of diversifying not only holdings, but strategies and exposures as well.

If we have a situation where the tail risk in our portfolio has developed into something sizable, a prudent investor has to reduce their risk through lowering positions or hedging. While mathematically these 5-standard deviations would appear to be something to not worry about, the few examples below stress that it happens a lot more often than one might think.

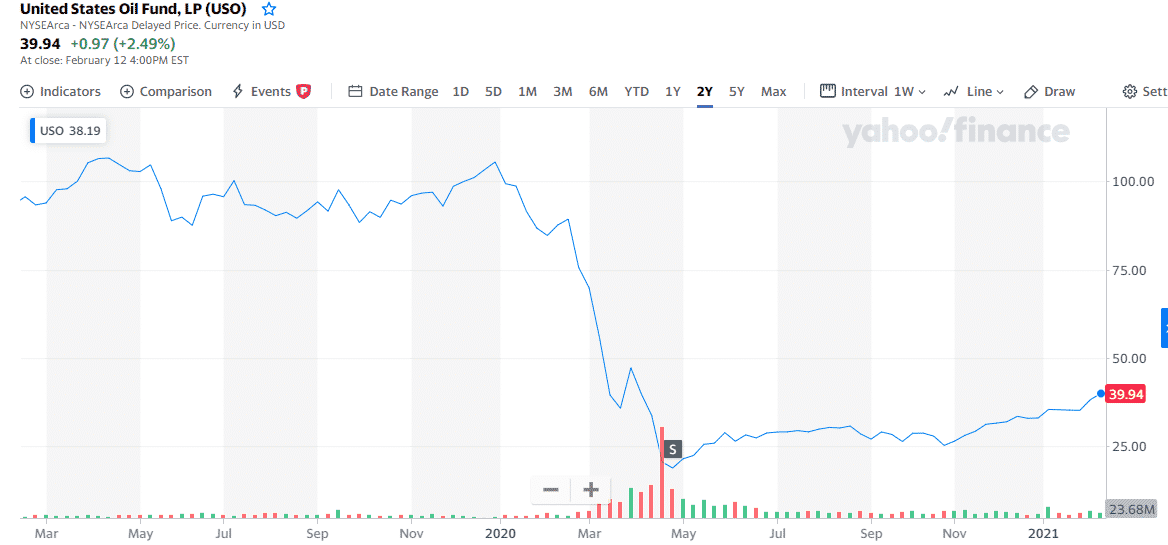

Negative Oil

Over the last few years we have seen some unprecedented moves. In March of 2020, we had probably the most extreme move in oil for any major asset class. With most tail risk events there are significant macro events which start the move. In this case, on March 8, Saudi Arabia cut their prices of oil, resulting in oil declining by 30% in one day. We also had the worsening Coronavirus pandemic causing shutdowns and severely reducing demand for oil..

The result was a glut of oil, crude stockpiles growing, and floating storage being bought up. While all this was happening, we had retail investors saying it was time to get in on cheap oil. Crude at $20 a barrel, are you kidding me? It has to go up. These investors piled into the ETF USO (which tracked the front month futures contract at the time).

We can see what happened to USO below.

Interesting to note is how the ETF has not even remotely recovered from the drawdown despite oil prices recovering. Yet, ironically, the people who were worst off were those who bought and held the front month future itself.

As USO rolled over and investors started to roll their futures contracts out of the front month, there simply was not enough capacity for those few who were able to take physical delivery of the oil. Nothing ends well with forced liquidations, especially when very few people can take the other side.

Unfortunately I don’t have a tanker, and do not have the permissions to take 100 physical barrels of crude in my backyard. On April 20, we saw crude touch $-37 a barrel. That’s right, negative $37 a barrel.

When the Game Doesn’t Stop

Tail risks can happen on both sides of the spectrum, and the best, recent example of this was GameStop (GME). Going into 2021, GameStop was one of the most heavily shorted stocks on the street. The stock had miraculously staged a great run in 2020 despite getting initially destroyed by the pandemic and missing on multiple earnings reports.

After all this, it was sitting in the mid-teens after being less than $5 a year prior. Now some of these moves were justified, as activist investor Ryan Cohen jumped in and helped pivot into ecommerce. What happened next was what really stood out.

GameStop released good holiday numbers (as one would expect with a new console release cycle) and Cohen increasing his holdings. This sent the stock rocketing to $40, and it wouldn’t stop there. Anyone who has visited Wall Street Bets knows the rest of the story.

A Reddit-fueled mob took over, pushing GameStop higher at any price. Ignited mainly by a small float and a heavy demand for OTM options (which market makers had to hedge), this caused an insane gamma and short squeeze which caught the attention of media outlets around the world. There are a lot of good lessons from each of these cases, but one Reddit user summed it up the best for me:

“We can remain degenerate (irrational) longer than you can maintain solvency.”

Nobody actually believed oil was worth -$37 and no professional would see GameStop at $483. Yet these same people would not believe oil was at $10 or Gamestop was at $50. Not having any risk management in place is a ticking time bomb, as you can be right but also very wrong.

Tail Risk Protection

By now you should understand the importance of protecting yourself against tail risk. Let’s break down a few ways to do so for an example of a short strangle. We can see from selling these options that we do well in calm markets but we have a potential for infinite losses. So how do we protect ourselves?

- Buying Wings as Protection – Buying tail risk wings on the asset your trading is the most effective reason for controlling for tail risk in that underlying.

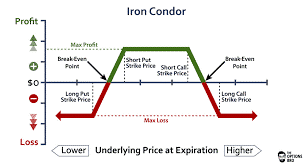

In the case of the short strangle, this converts it to an Iron Condor (as shown below). If you had a long equity position, buying the OTM put will cap your downside risk to whatever level you are comfortable with.

While this is the most effective in hedging tail risk, that often makes it the most expensive. To choose this option, you need to make sure the wings are not costing too much so that you still have a positive expected value on the trade.

- Buying Quazi-Protection – Sometimes we can buy protection in one place while selling protection in the other in the form of a pairs trade.

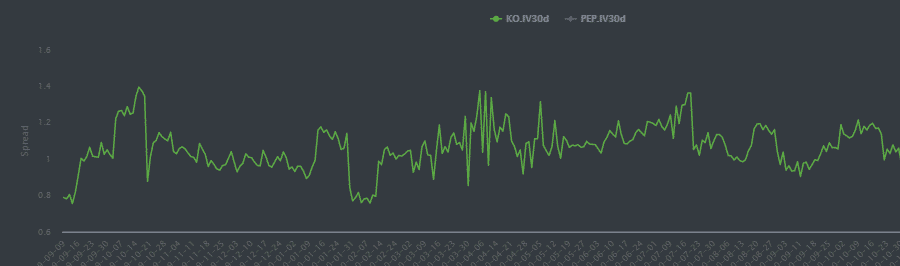

Take the example of Coke (COKE) and Pepsi (PEP). Both have a very high correlation and generally move together. If we see that Coke volatility is cheap relative to Pepsi, we could buy a strangle on Coke and sell one on Pepsi. If the correlation holds up, we have protection from both macro vol in both the market and the soft drink space.

For this trade we need to add alpha, as we are also taking on risk that the correlation doesn’t break down vs. simply buying protection on the asset we are trading.

- Reducing Position Size – People often worry about tail risk hedging without simply considering taking on a smaller position.

If buying tail protection is too costly, sometimes simply reducing size can bring risk down to a reasonable level. If the position moves against you, you will be able to handle the swings.

Final Remarks

Most of the time the weather is calm and cloudy. Yet those times you find yourself in a storm it’s good to have brought a jacket in preparation and not wishing for one after the fact.

We cannot prepare for all tail risks. Though we should try to be well prepared for most reasonable tail risks so that we can take them in stride.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more