What Is Open Interest In Options?

Millions of investors make decisions daily to buy or sell options, which results in the price fluctuation within the options market. An options trader must keep their eye on a key statistic called ‘Open Interest.' Put simply, open interest is the number of active contracts. It is one of the fields of data in an option chain, along with bid and ask prices, implied volatility, and volume.

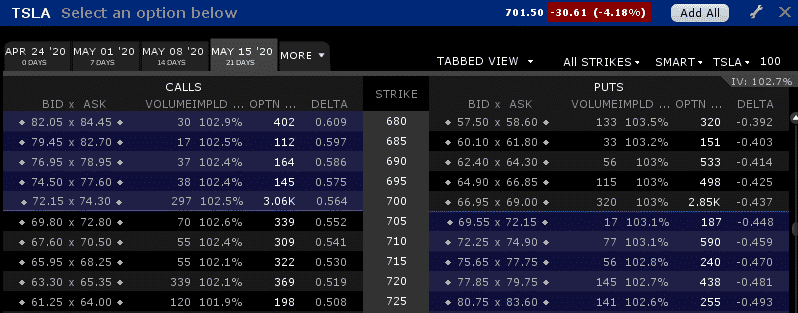

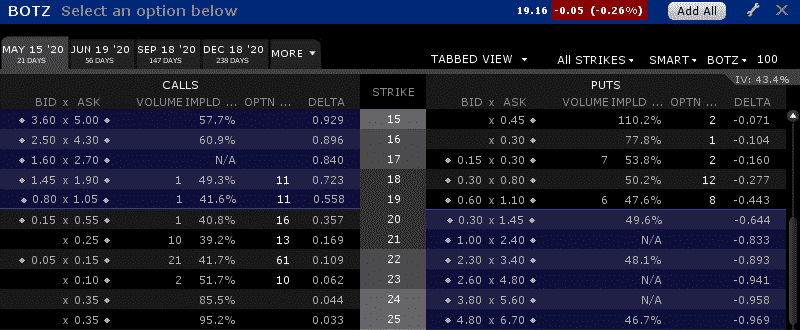

Ignoring the number of active contracts is an all too common mistake that a substantial number of traders make, a mistake that can have potentially widespread consequences. In the tables below, we can see that TSLA has very high open interest, with about 3,000 open contracts in the at-the-money strikes, whereas BOTZ has only around 10 contracts open.

TSLA options: high open interest.

BOTZ options: Low open interest.

What Is Open Interest?

Open interest defines the total amount of option contracts that are presently in the market. There are transactions that have been sold, but have not yet been liquidated by offsetting trade, exercise, or assignment. It is important to note that option interest is not updated throughout the trading day.

When a trader purchases or unloads an option, the contract is recorded as either an opening or a closing transaction. For example, if you were to buy 5 call options in Apple (AAPL), you are buying the calls to open. Your purchase of 5 calls in Apple would then add 5 to the open interest figure.

If you wanted to exit that position, you would sell those same options to close, rather than to open, as mentioned above. If we refer back to the Apple example and wanted to do a covered call by selling 5 calls, you would be entering a sale to open. Due to it being an opening transaction, it would add 5 to the open interest. In the future, if you wanted to repurchase the options you once held, you would enter a transaction to buy to close. The open interest would then decrease by 5.

Investors should note that a transaction is not always counted as open interest. If you were purchasing 5 of the Apple calls to open and you partnered with someone unloading 5 of the Apple calls to close, the overall open interest figure will not change.

Why Does Open Interest Matter?

Whilst looking at the total open interest of an option, an investor cannot distinguish whether the options were bought or sold – there is no way to know. It is speculated that this is the reason that a large percentage of options traders disregard them entirely.

There is still important information in those figures, despite the ignorance they receive from investors.

How To Look At Open Interest

A method of using open interest figures is to reference it relative to the volume of contracts that have passed hands. When the volume surpasses the existing open interest on any day, it implies that trading in that specific option was significantly high that day. Open interest also provides an investor with critical guidance regarding the liquidity of an option.

In the case that there is no open interest in an option, it indicates that there is no secondary market for that option. That can make it hard to close a position at a good price.

If the open interest is substantially high for an option, it is indicative of a large number of buyers and sellers in the market. If there is a secondary market for an option, it increases the likelihood that your orders will be filled at good prices. With all other aspects being equal, the larger the open interest, the simpler it will be to trade that option at a realistic bid / ask spread.

It’s best not to trade options with low open interest because of the difficulty of getting filled at good prices.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more

Learned a lot from this, thanks.