VXX Options Strategy Review

I want to walk you through a VXX options strategy that I’ve been using recently that has worked quite well.

If you need a refresher on trading VXX options, you should read this first.

VXX has the tendency to explode higher when market volatility spikes, but when the market is in a normal contango situation, then VXX tends to just slowly drift lower.

The strategy I’ve been using is a diagonal put spread that has zero risk on the upside and a nice profit zone on the downside.

Before we start, it’s important to remember that just because something has worked in the past, doesn’t mean it will continue to work in the future.

Let’s get in to the details.

Trade Setup

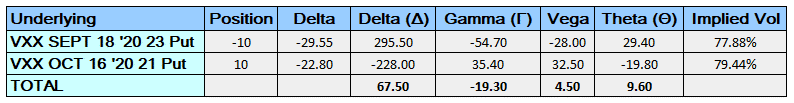

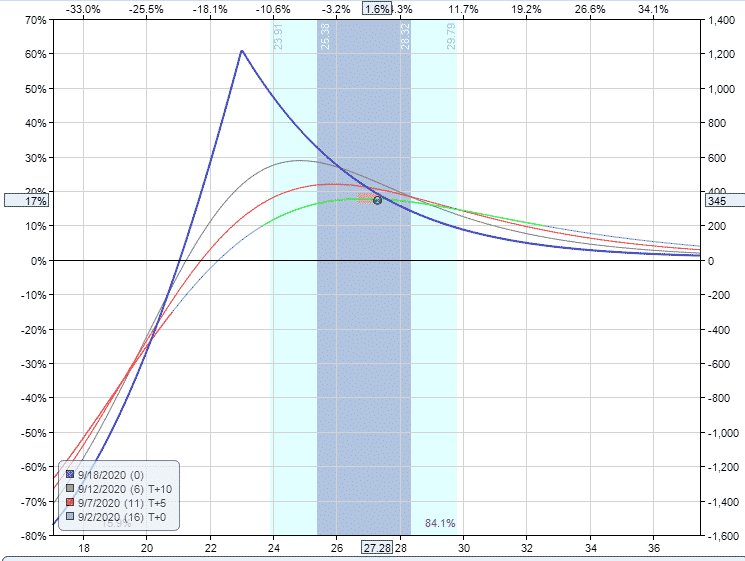

For this diagonal put spread trade, I like to sell an out-of-the-money put with delta around 25-30.

Then I go out either 2 weeks or 4 weeks and buy a put for around the same value of slightly less than the put I sold.

Here’s an example:

Trade Date: August 12, 2020

Current Price: 25.46

Trade Details:

Sell 10 VXX Sept 18th, 23 puts @ $1.31 (delta 29)

Buy 10 VXX Oct 16th, 21 puts @ $1.30 (delta 23)

Premium: $10 net credit

Max Loss: +$10 on the upside and -$1,990 on the downside

Max Gain: Estimated at $1,090

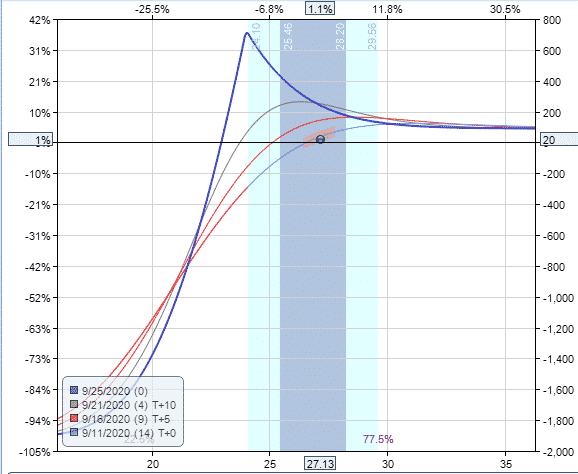

You can see above that the trade starts as a long delta trade, but that can switch to negative delta later in the trade if VXX is well above the short strike.

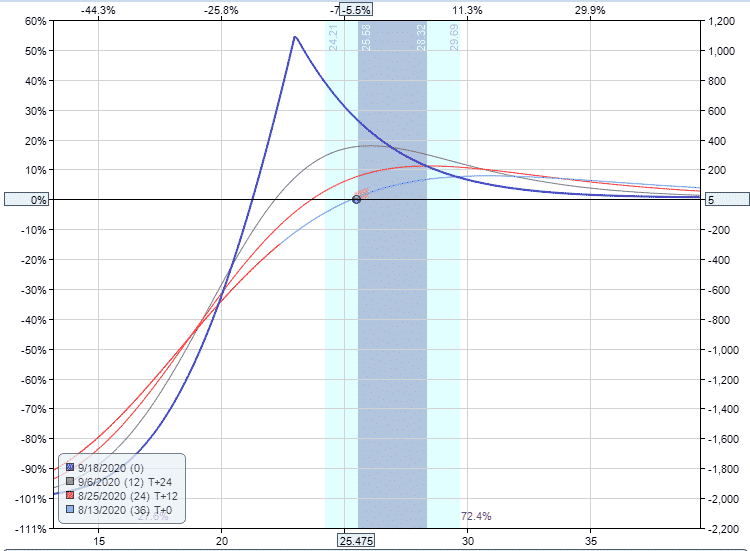

Looking at the payoff diagram, notice that there is absolutely no risk. The worst that can happen is that both puts expire worthless and we keep the $10 premium received.

Also, take a look at the interim payoff lines. The T+24 line shows a healthy profit zone for anything above 22, which is a roughly 18% decline for the current price.

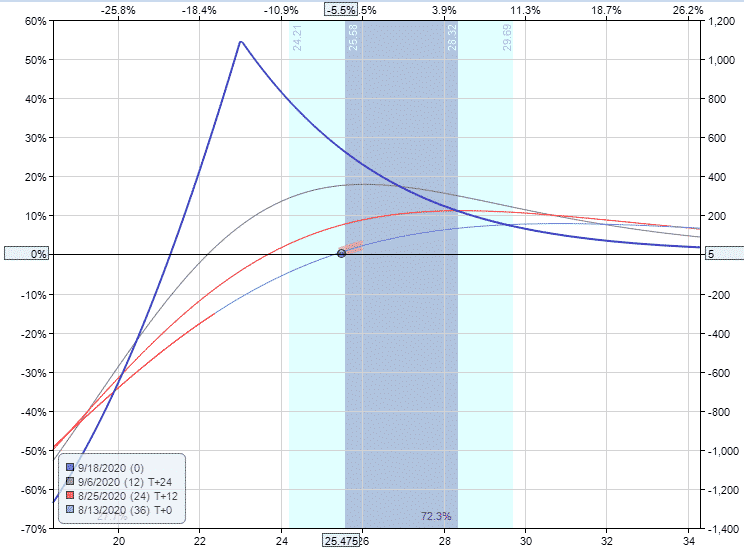

Here’s a zoomed-in version.

The good thing with a diagonal put spread on VXX is that even if the market is quiet, VXX will tend to drop quite slowly (provided we haven’t entered after a large implied volatility spike).

This gives you plenty of time to exit the trade without too much damage if VXX gets down towards the short strike.

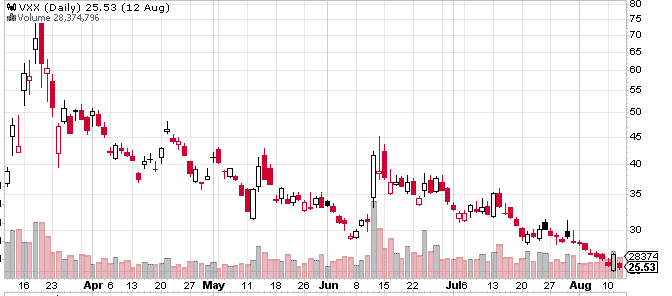

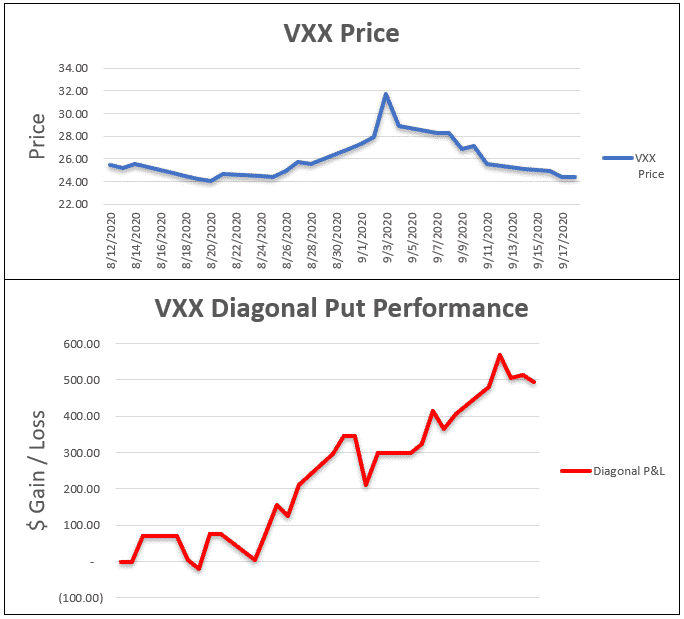

Below is the VXX chart from that date. I was pretty confident that it wasn’t going to drop too sharply as it had already been declining for a few months.

The key is not to enter a diagonal put spread after a big spike when VXX could potentially drop quickly as the market returns to normal.

After a spike in VXX, I prefer to buy long-term puts or trade a poor man’s covered put (the opposite of a poor man’s covered call).

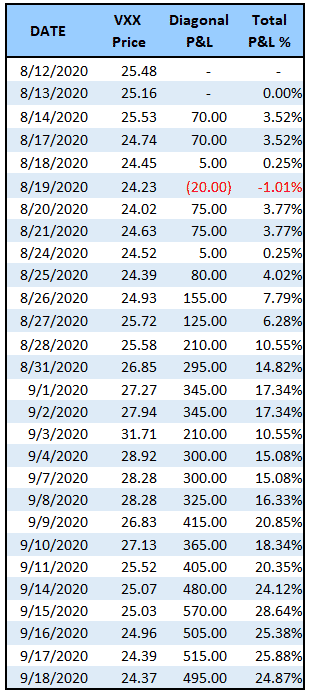

Let’s see how the trade progressed. As of September first, the trade was up $345, here’s how it looked.

Below is a full list of the dates and P&L until expiry.

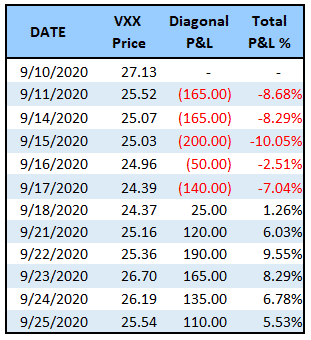

Let’s take a look at the next example. This one was a little different in that it was a shorter duration trade and also utilized weekly options.

The delta on this one was slightly further out at 21 and the credit received was a bit higher, so the profit in the event of a move up was larger.

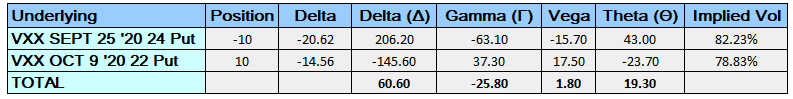

Trade Date: September 10, 2020

Current Price: 257.13

Trade Details:

Sell 10 VXX Sept 25th, 24 puts @ $0.66 (delta 21)

Buy 10 VXX Oct 9th, 22 puts @ $0.57 (delta 15)

Premium: $100 net credit

Max Loss: +$100 on the upside and -$1,900 on the downside

Max Gain: Estimated at $710

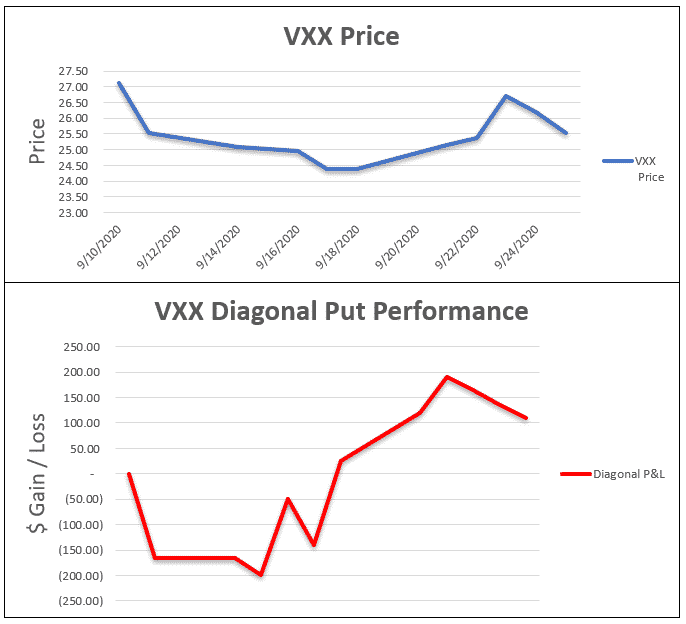

This trade started off under a bit of pressure with VXX dropping pretty quickly, but it never broke through the short strike.

Here’s the P&L details:

With this VXX option strategy, I would set a stop loss of around 20% OR if VXX breaks through the short strike.

This should help to minimize any big losses.

Also, remember that just because something has worked in the past, doesn’t mean it will continue to work in the future.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more