Unusual Tesla Call Options Volume Shows Investors Bullish On TSLA

/Tesla%20charging%20station%20plugged%20in%20by%20Blomst%20via%20Pixabay.jpg)

Blomst via Pixabay

Today, several tranches of heavily out-of-the-money Tesla, Inc. (TSLA) call options have traded. TSLA will have to more than double in six months for the trade to be profitable with intrinsic value (i.e., “in-the-money”).

That indicates a significant bullish sentiment in TSLA stock. TSLA is at $455.03 in midday trading, up over 2% today. It's now starting to approach a previous peak at the end of last year ($479.86 on Dec. 17, 2024).

(Click on image to enlarge)

TSLA stock - last 12 months - Barchart - As of Oct. 1, 2025

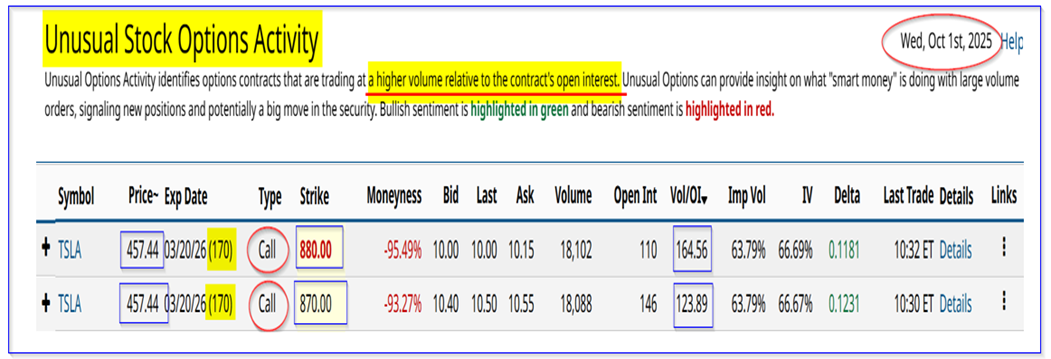

The call options reported by Barchart in its Unusual Stock Options Activity Report today show that over 18,000 calls have traded at the $880 call option strike contract expiring on March 20, 2026 (170 days to expiry or DTE).

In addition, 18K calls at the $870 call option contract have traded for the same expiration date, i.e., 5.7 months from now. These calls are deeply out-of-the-money (OTM). Are they worth buying?

(Click on image to enlarge)

TSLA calls expiring March 20, 2026 - Barchart Unusual Stock Options Activity Report - Oct. 1, 2025

Buying Deep OTM TSLA Calls - Worth It?

The premium for both is $10.00, so the investors expect TSLA will be over $890 and $880, respectively, for the call options to have intrinsic value (i.e., be profitable if exercised).

That means the investor only has to shell out $1,000 for these calls (i.e., $10 x 100 per contract).

Of course, that's not the only way for these institutional investors to make money with these trades.

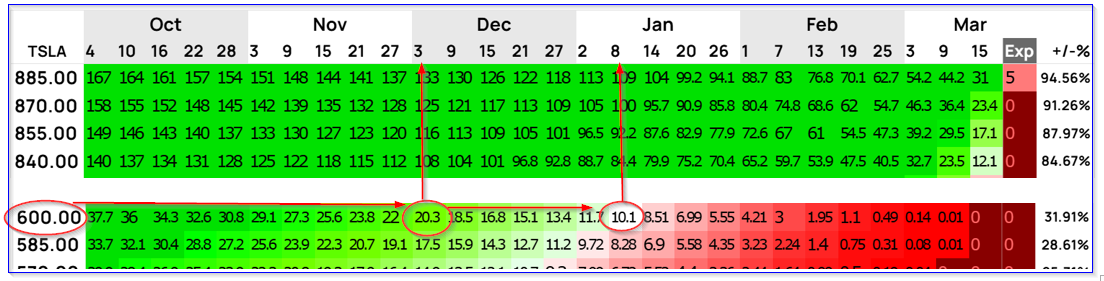

For example, using an options profit calculator, it is estimated that if TSLA rises to $600 by Dec. 1, 2025, (2 months from now), implying TSLA rises by +32%, the $880 3/20/26 calls would each be worth $2,030 (i.e, $20.3 x 100).

The calculator uses the stock's historical volatility to estimate this value. It means the investor would double their money in 2 months (i.e., a gain of +103%) in these calls (i.e $2030/$1,000-1).

(Click on image to enlarge)

TSLA $880 long calls exp 3/20/26 - Options Profit Calculator - As of Oct. 1, 2025

So, it's worth buying these deep OTM calls to make a 3x leveraged return (+103% vs. +32%) vs. holding TSLA shares over the next 2 to 3 months.

Moreover, breakeven (i.e., $10.1 x 100 = $1,010) would last until Jan. 8 in the table above if TSLA rises 32% to $600 by then (i.e., within the next 3 months).

So, is there this kind of upside in TSLA?

TSLA Stock Valuation

I last wrote about Tesla on Jan. 6, 2025, in Barchart after TSLA stock had peaked ("Tesla Is Priced for Perfection Here - What's the Best Way for Shareholders to Play This?")

At the time, TSLA was at $405.93, but I suspected it would fall, even though it was worth $418.95, based on my free cash flow (FCF) analysis.

Since then, TSLA stock bottomed out at $221.86 per share on April 8, 2025. I probably should have written it up as a long buy then.

But since then, it's become very clear that Tesla is going all out on its robotaxi fleet. Projections I have seen from thoughtful analysts show that this could dramatically improve the company's profitability over the next 10 years.

For example, on Sept. 30, there was an interesting YouTube interview (on the Brighter with Herbert channel) with Cern Basher, a CFA analyst and money manager. He presented a very thoughtful analysis of Tesla's expected robotaxi growth ("EXCLUSIVE: Tesla Robotaxi Growth Now Impossible to Ignore").

For the near term, Tesla has had low free cash flow (FCF) in the last quarter and low FCF margins over the last 2 quarters. But, given the company's strong operating growth and margins over the last 12 months, we can expect Tesla's cash flow before capex spending will stay strong.

Last quarter, it generated $2.54 billion in operating cash flow, for an OCF margin of 11.29% of sales of $22,496 billion. Capex was $2.394 billion, or a run rate of $9.6 billion.

Let's assume that its OCF rises to 15% over the next 12 months on roughly $102 billion in sales (i.e., $93 billion estimated for 2025 and $110.86 billion for 2026):

15% x $100 billion NTM sales = $15 billion OCF

If capex rises slightly from $9.6 billion to $10 billion, its FCF could hit $5.0 billion:

$15 billion OCF - $10 b capex = $5.0 billion FCF

Assuming a 0.5% FCF Yield (i.e., if Tesla paid out 100% of FCF, the market would give TSLA stock a 0.5% dividend yield). Note this is the same as a 200x FCF multiple.:

$5b / 0.005 = $1,000 billion market cap, or $1 trillion

The problem is that Tesla's market cap is over this today at $1.52 trillion. In other words, TSLA stock may be overvalued.

But, just to be generous, let's use the 2026 revenue forecast:

$111 billion x 15% OCF margin = $16.65 billion Operating Cash Flow (OCF)

$16.65b - $10 billion capex = $6.65 billion FCF

$6.65 b FCF / 0.005 = $1,330 trillion

That is still $190 billion lower than today's market value of $1.52 trillion, or -12.5% overvalued.

In other words, my price target is $456 x (1-0.125) = $456 x 0.875 = $400 per share.

The bottom line is that it's hard to see why an investor should buy these OTM call options. If Tesla starts generating strong FCF again, then it might make sense.

More By This Author:

Cisco Stock Moves Higher As Analysts Raise Target Prices - Short Put Plays Work HereCarnival's Free Cash Flow Rises Y/Y - CCL Stock Could Still Be Over 23% Undervalued

PayPal Could Still Be 20% Too Cheap - Use Options To Play The Stock