Ultimate Guide To Christmas Tree With Puts Strategy

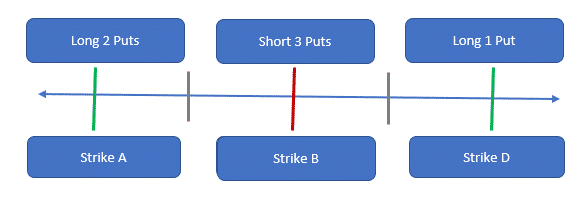

A Christmas tree with puts is a three-legged strategy involving six puts. The investor starts with a long put at strike D, skips strike C, sells 3 puts at strike B, and buys 2 puts at strike A. Note that only the strikes differ. All options share the same expiration.

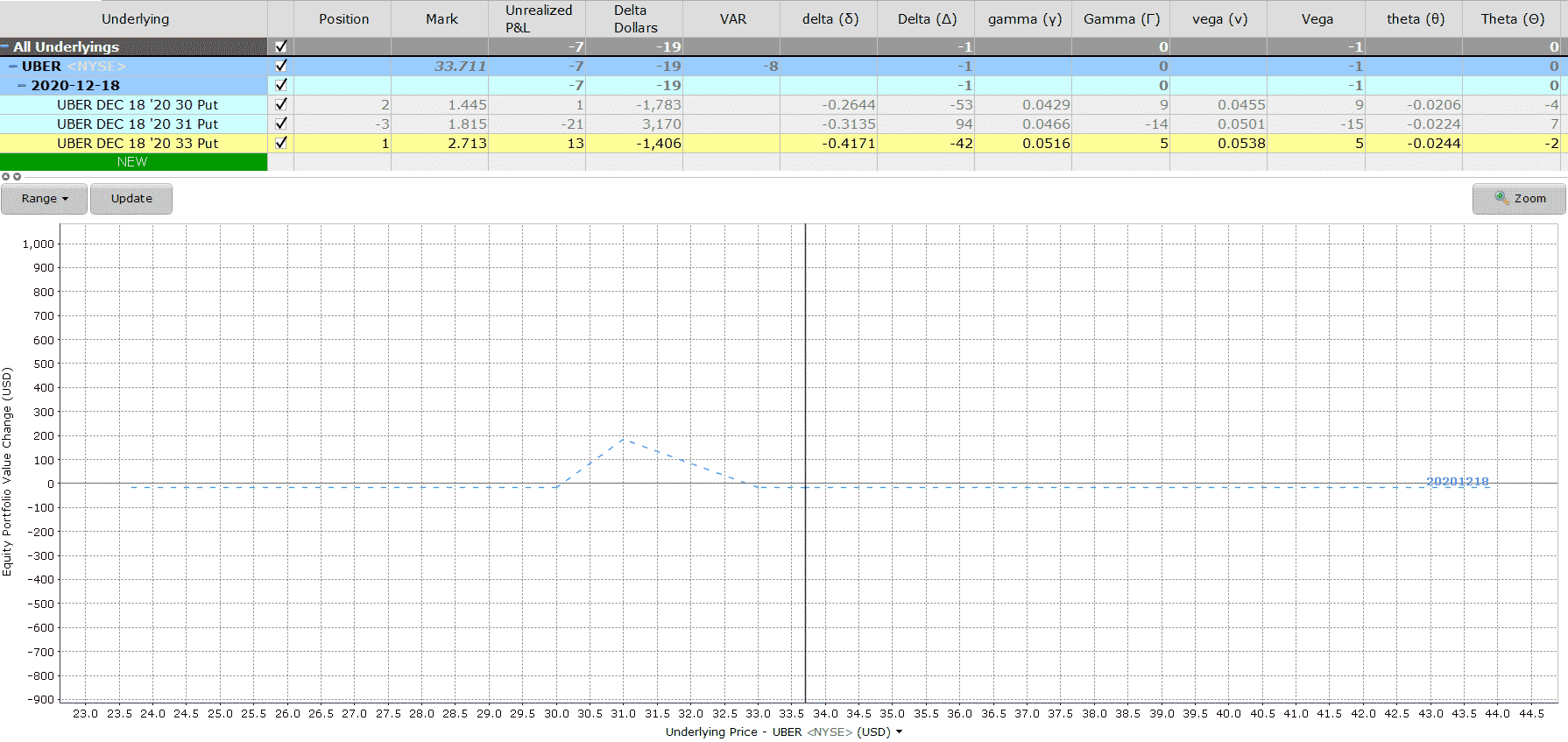

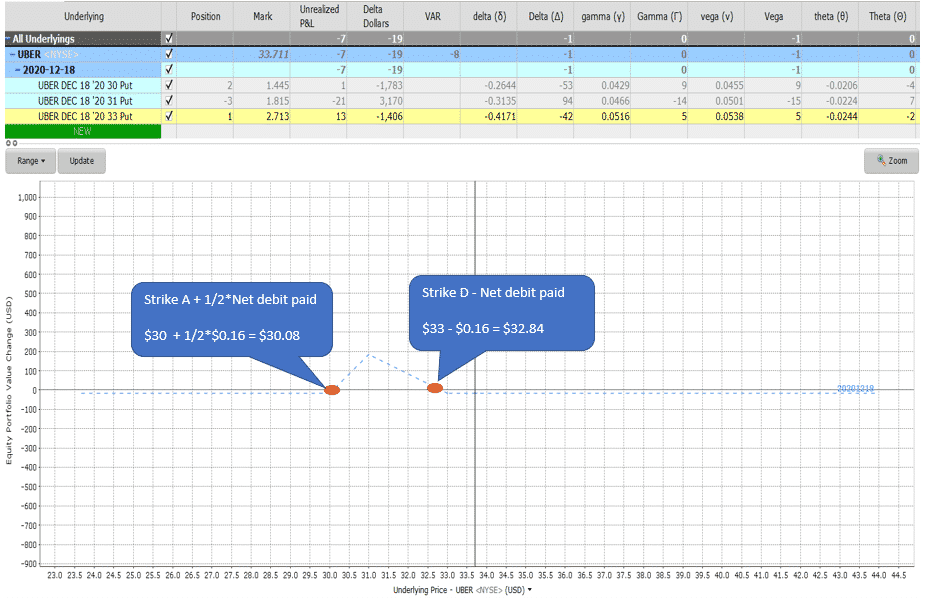

Let’s look at an example of Uber (UBER). The investor is long a put with strike of $33, sells 3 puts at strike of $31, and buys 2 puts at strike of $30. Here’s what the payoff diagram looks like:

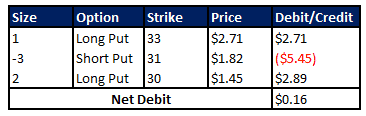

Before we look at the payoff of a Christmas tree with puts, let’s understand that this strategy will usually result in a small net debit, i.e., the investor has to pay to enter the strategy. In the Uber example, the net debit is calculated as follows:

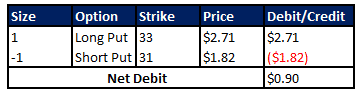

Compare this with the net debit of a regular put spread:

By selling additional puts, the investor recoups more premium to offset the cost of the initial put. And by buying additional puts, the investor flatlines the payoff diagram, so they are not exposed to further downside.

Maximum Loss

The investor is long 3 puts and short 3 puts. The most they can lose is the net debit paid. In the example above, the maximum potential loss is $0.16 per share.

Maximum Gain

The initial long put at the highest strike price of $33 gives the investor substantial gain potential if the stock falls below the strike. However, the investor sold puts at $31 and therefore reduced some of the profit below $31.

The most the trade could make is the difference between the highest strike price ($33) and the strike price of short puts ($31) minus the net debit to enter the strategy ($0.16). The maximum gain would be $1.84 per share.

Breakeven Price

This strategy has two breakeven points.

- Highest strike – net debit paid.

- Lowest strike + ½* net debit paid.

Let’s look at the two breakeven prices:

Payoff Diagram

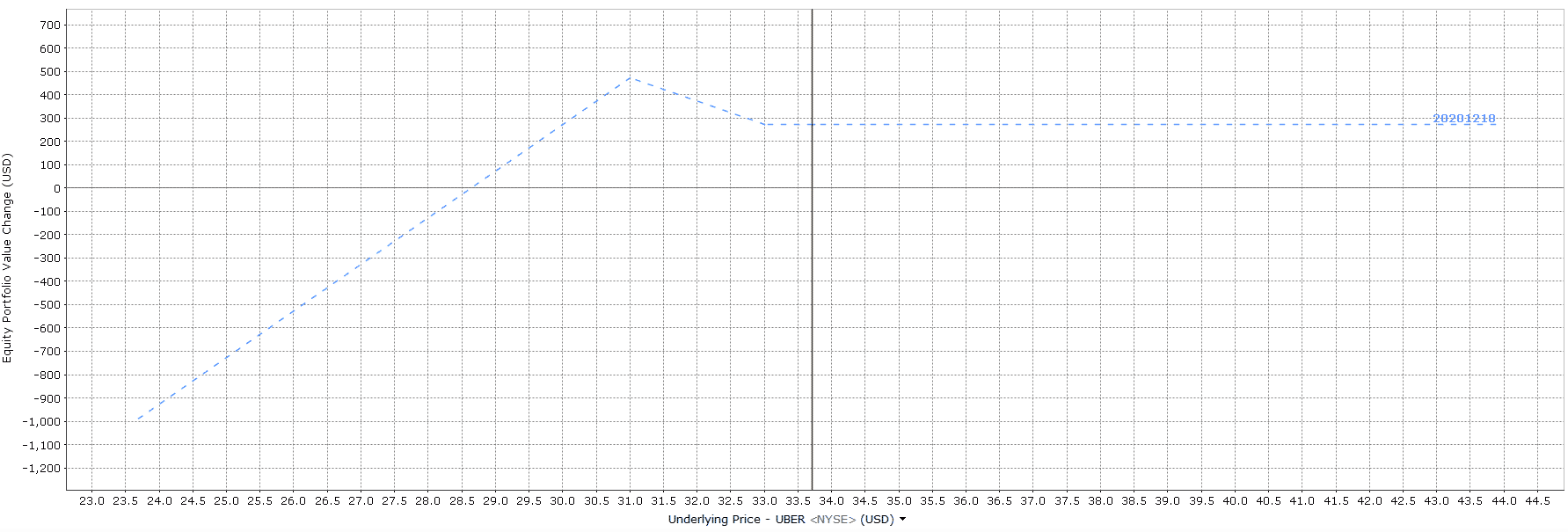

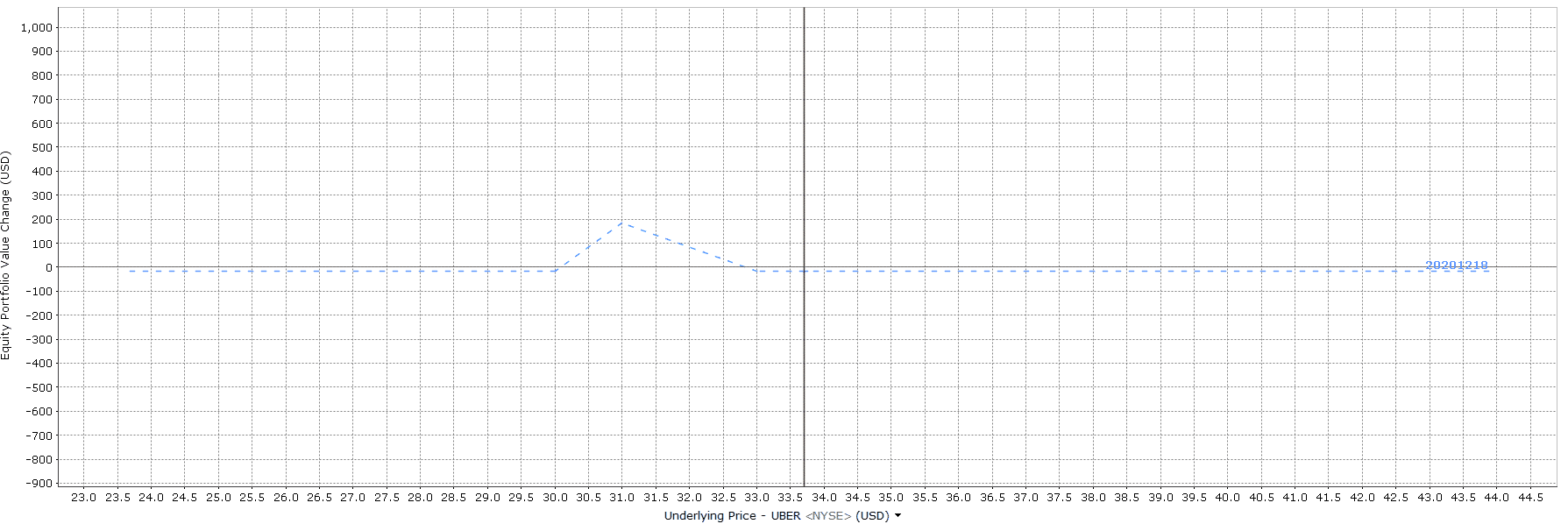

Let’s look at the payoff diagram closely. We have 3 legs and 6 puts. Leg 1: Long put at strike of $33:

Leg 2: If the investor sells 3 puts at strike of $31, the payoff will change to:

Leg 3: And if the investor buys another 2 puts at strike of $30, the payoff will change to:

The Greeks - Delta

We know that delta measures the change in an option’s price for a $1 change in the underlying stock. The more in the money the put is, the more it behaves like a short stock. Long puts have delta between 0 and -1. Short puts have delta between +1 and 0. Delta of at the money puts is -0.5 for long puts and +0.5 for short puts. The further in-the-money the put is set, the closer delta is to -1 for long puts.

In the example above, the investor has 3 long puts and 3 short puts with different strikes. The initial long put has a delta of -41.71 per put. The 3 short puts have a delta of 94.05. And the 2 long puts have a delta of -52.88. In total, the delta of long puts is mostly offset by the delta of short puts, and the combined position has a position delta of -0.54.

The options behave like a short stock between the highest long put strike and the short put strike. And the options behave like a long stock between the short put strike and the lowest long put strike.

Gamma

Gamma is always positive for long options and negative for short options. It measures the rate of change in delta with respect to the change in stock price. Gamma is the second derivative of the value function with respect to the stock price – Delta being the first derivative.

It is highest for at-the-money options because that is the point where delta changes fastest with changes in the stock price. Therefore, the gamma of the initial long put with strike of $33 is the highest at 0.0516. As the stock price moves away from the strike price (in either direction), gamma approaches zero and delta becomes less sensitive to changes in the stock price.

The investor is long 3 puts. One put being at-the-money (gamma of 0.0516) and two puts being out-the-money (gamma of 2 * 0.0429, i.e., 0.0858). Total long put gamma of 0.1374. The investor is also short 3 puts with gamma of 3 * -0.0466, i.e., -0.1398. The gamma of long puts is offset by gamma of short puts. The overall position gamma in this example is -0.0024 (effectively zero gamma).

How Volatility Impacts the Trade

Long put options are long vega trades. They will benefit if volatility rises after the trade has been placed.

The initial long put with strike price of $33 has a vega of 0.0538. In other words, the value of the long put will increase by $5.38 if implied volatility increases by one point. The three short puts with strike price of $31 have a vega of 0.0501. In other words, the value of the 3 short puts will decrease by 3 times $5.01, or $15.03, if implied volatility increases by one point.

The last two long puts with strike price of $30 have a vega of 0.0454. In other words, the value of the 2 long puts will increase by 2 times $4.54, or $9.08, if implied volatility increases by one point. In total, the volatility of 3 long puts (+$14.46) is almost offset by the volatility of 3 short puts (-$15.03). If the position has negative vega, it will benefit from falling volatility.

How Theta Impacts the Trade

The investor is long puts and short puts with different strike prices. Long puts have negative time decay and short puts have positive time decay. The initial long put with the highest strike price of $33 will erode in value by $0.0244 per share, or $2.44, with each passing day.

The 3 short puts with strike price of $31 will benefit by 3 times $0.0224 per share, or $6.72, for the 3 short puts with each passing day. The last 2 long puts with strike price of $30 will erode in value by 2 times $0.0206 per share, or $4.12, for the 2 long puts with each passing day. The overall position theta is +$0.16 per day.

Ideally, the investor would like all options to expire worthless, except for the initial put with the highest strike price.

Risks

Christmas tree with puts is a limited risk strategy because, essentially, you are only exposed to the loss of net debit paid. This strategy should only be used if the investor is only slightly bearish. A sharp rise in price above the initial strike price of $33 or a sharp decline in price below the lowest strike of $30 will result in a loss.

Summary

A three-legged trade with six options sounds complicated, but once you are comfortable with these trades, they aren’t that complex. Both patience and execution are required to trade Christmas trees, and that only comes with experience.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more