“Triple Witching Day” Or "Freaky Friday" On Wall Street

Image Source: Pexels

What Is Triple Witching Day?

Today is what’s known as a “Triple Witching Day” -or Freaky Friday - on Wall Street. That's when stock options, market index options and market index futures all expire on the same day, which often leads to unexpected pricing shenanigans.

- Options contracts are contracts taken out on the direction of a stock price at a future date. Unlike stocks, they’re not an investment in a company; rather, they’re the right to buy or sell shares of a company at a later timeframe. Calls let you buy stock shares at a set price, known as the strike price, on or before the expiration date. Puts give you the right to sell shares.

- Index options are futures contracts on a stock index, such as the S&P 500. These options are settled in cash.

- Index futures are futures contracts on equity indexes. These contracts are also settled in cash. Source

Four times a year, on the third Friday of March, June, September and December, those contracts expire on the same day, which usually means higher trading volumes as traders and algorithms move their positions and often accidentally open up unexpected arbitrage opportunities for those clever enough to spot them.

- Triple-witching days generate more trading activity and volatility since contracts allowed to expire cause traders to close, roll out, or offset their expiring positions.

- This trader activity usually occurs in the final hour of trading preceding the closing bell (4 p.m. Eastern time) and is referred to as the triple-witching hour.

- Triple witching can also influence individual stocks, particularly smaller cap stocks with large options or futures contracts set to expire or those that trade heavily in the derivatives market.

How Triple Witching Trading Works

The table below highlights how each of the trading components on Triple Witching day works:

(Click on image to enlarge)

How Much Does Volume Change?

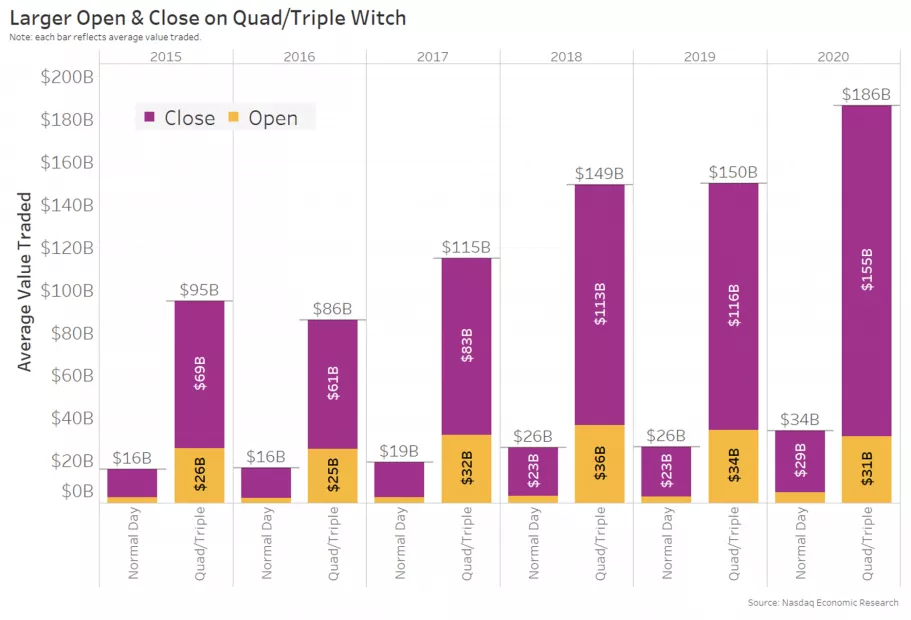

Data shows that auction volumes on triple witch dates are significantly higher than normal. As the data in the chart below shows, on average:

- Open Auctions are around 10 times, or $28 billion, larger than normal.

- Close Auctions are around five times, or $80 billion, larger than normal.

The data also shows that over the past five years, the size of both witching auctions has grown. Overall, the average combined cross has been around $108 billion larger on triple witch dates.

(Click on image to enlarge)

Overall, total daily share volume is also typically 44% higher on “witching” days compared to a “normal” day. We also typically see a higher lit market share due to an increase in more volume trading on-exchange in the opening and closing crosses.

How Does Triple Witching Affect the Stock Market?

Triple witching itself doesn’t move the stock market; it simply adds a temporary increase in volume and liquidity and doesn't necessarily result in volatility as that is caused by the actions that traders take based on the temporary price fluctuations of their underlying assets which can be moved due to the increased volume.

How To Trade Triple Witching Profitably

Every trader should be aware of triple witching and this video shows you how to trade the event profitably.

What Is Quadruple Witching?

- Quadruple witching refers to the simultaneous expiration of stock index futures, stock index options, stock options, and single stock futures derivatives contracts four times a year.

- Quadruple witching has given way to triple witching since single stock futures stopped trading in the U.S. in 2020.

The Triple Witching Takeaway For Investors

The triple witching takeaway is that investors should be aware of what happens on these days and understand that there is a lot more volume in the markets. There could be some drastic price swings, but investors shouldn’t be carried away by any short-term emotions.

More By This Author:

Q4 Financials Of Cannabis MSO, TerrAscend, Were Terrible

Cannabis MSO Ayr Wellness Reports Q4 Increase In Net Loss Of 53%

Q4 Financials Of Cannabis MSO, Curaleaf, Show Improvement Across The Board

Disclosure: None

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed. ...

more