Thinking Options For Trading Week Aug. 14-18

The middle of last trading week had some action as the intraday trading ranges for the SPY were 2.88, 5.43, 4.24, 7.00 and 3.35.

The hi-lo for the week was 7.35.

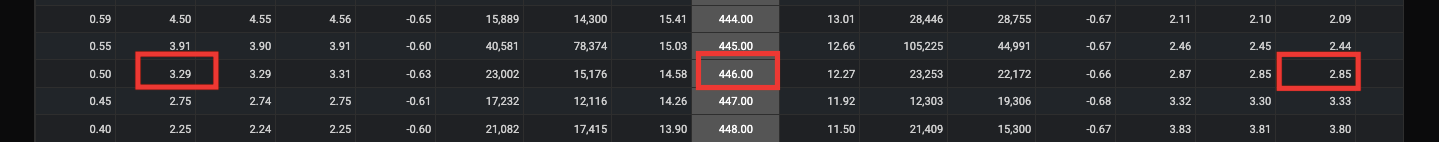

That makes the SPY18Aug23 446 straddle a reasonable buy at 6.15.

Last week Palantir Technologies (PLTR) time spread did not approach the 2.5 times differential between the two expiration cycles' implied volatility so I took a pass. As it turned out it would have been a small winner.

The earnings reports we're watching this week start on the August 15th with Home Depot (HD) before the opening. On the 16th Target (TGT) releases before the opening, while Cisco (CSCO) reports after the close. Walmart (WMT) releases before the opening on the 17th.

If you find the differential in implied volatility at 2.5X with expiration cycles three weeks apart then pounce on it.

The economic numbers start with Retail Sales on Tuesday at 8:30am ET, followed twenty four hours later by Housing Starts.

Industrial Production follows forty-five minutes later.

On the 17th, Leading Economic Indicators come out at 10:00am ET.

More By This Author:

Understanding The Multiple Facets Of Options

Learn The Common Beginner Mistakes In Options