The Ultimate Guide To The Long Straddle

What Is A Long Straddle

A long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction.

Since it involves having to buy both a call and a put, the cost of the trade is high but the profit potential is unlimited.

To execute the strategy, a trader would typically buy a call and a put that is at-the-money (or as close as possible to at-the-money) with the following conditions:

- Both options must use the same underlying stock

- Both options must have the same expiration

- Both options must have the same number of contracts

The position means you’ll start at a net debit and you will only profit when the underlying stock rises above the upper break-even point or falls below the lower break-even point.

Profits can be made with a smaller price move if the move happens early in the trade.

Losses accrue if the underlying stock doesn’t move much and trades between the upper break-even point and the lower break-even point.

Time decay is not your friend in this trade.

Given its nature, the strategy is generally used when the trader is expecting big swings in the stock price. A good time to enter this trade is when a stock has gone through a period of Bollinger Band compression.

Maximum Loss

Maximum loss occurs when the position is held to expiration and the underlying stock price is exactly equal to the strike price.

In this scenario, both options expire worthless and the trader loses money equal to the total cost of the straddle plus commissions.

To calculate the maximum loss, use the following formulas:

Maximum Loss = Net Premium Paid + Commissions Paid

Which occurs when:

Price of Underlying = Strike Price of both the Long Put and Long Call

As an example, imagine you come across a stock (ABC company) that will have an earnings announcement soon which you expect will cause a big move in prices.

It’s currently trading at $54 so you buy a put at 54 for $300 and buy a call at 54 for $300.

For executing the trade, you receive a net debit of $600.

Unfortunately, it turns out you were wrong about the big move and the price moves sideways.

On the expiration date, the price of ABC stock is $54 so the options expire worthless.

You suffer the maximum loss which is equivalent to the initial debit paid of $600.

Maximum Gain

The maximum gain is unlimited since the stock price can rise indefinitely.

Note that on the downside, profits are substantial however not unlimited, as the stock price can at most fall to zero.

To make any profit, the stock price must either rise above the upper break-even point or fall below the lower break-even point at expiration.

To calculate the maximum gain, use the following formula:

Maximum Gain = Unlimited

Which can only be achieved when:

Price of Underlying > Strike Price of the Long Straddle + Net Premium Paid

To calculate gains, use the following formulas:

Gains = Price of Underlying – Strike Price of Long Straddle – Net Premium Paid

Using our earlier example of ABC stock trading at $54, say we were right about the earnings announcement causing a big move in the markets, with the stock trading at $65 at expiration.

As a result, the put is out-of-the-money and expires worthless while the call is in-the-money with an intrinsic value of $1,100.

Subtracting the initial debit of $600 which was incurred when you entered the position, you are left with a gain of $500.

Breakeven Price

A long straddle has two breakeven prices, which can be found by applying the following formulas:

Upper Breakeven Price = Strike Price of the Long Straddle + Net Premium Paid

Lower Breakeven Price = Strike Price of the Long Straddle – Net Premium Paid

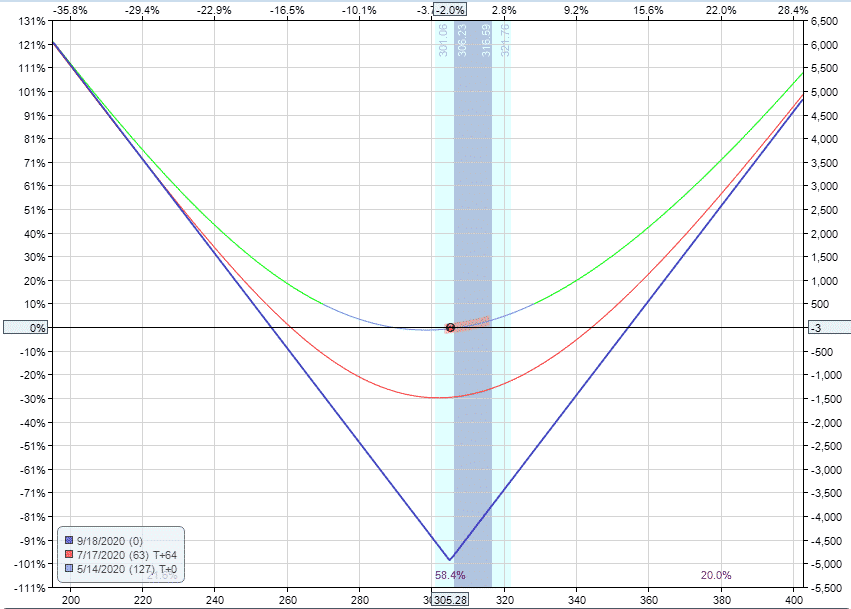

Payoff Diagram

Since the strategy uses a call and put with the same strike price, this means that only one of them is in-the-money at any point in time.

Looking at the payoff diagram you can see that at expiration, one of the options can always be exercised for some gain, while the other option expires worthless.

The exception is when the underlying price is exactly the same as the strike price.

Even though one option can almost always be exercised for a gain, it may not be enough to cover the cost of the total position.

Let’s walk through an example using AAPL stock:

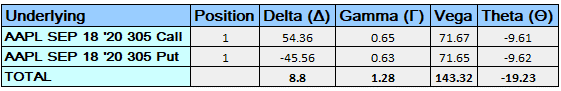

AAPL LONG STRADDLE

Date: May 13th, 2020

Current Price: 305.28

Trade Details:

Buy 1 AAPL Sept 18th, 305 call @ $24.70

Buy 1 AAPL Set 18th, 305 call @ $24.73

Premium: $4,943 net debit

Max Loss: $4,943

Return Potential: Unlimited

(Click on image to enlarge)

The trade has a maximum loss of $4,943 which occurs if AAPL stays flat over the course of the trade. The ideal scenario is that the stock makes a big move in either direction early in the trade.

How Volatility Impacts The Trade

Long straddles are long vega trades, so they benefit from rising volatility after the trade has been placed. Volatility is a huge driver for this style of trade. If you refer to the table above, the vega value was by far the highest number at 143 compared to -19 theta and 9 delta.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has positive vega overall, it will benefit from rising volatility.

If the position has positive vega, it will benefit from rising volatility.

Looking at the AAPL example above above, the position starts with a vega of 143. This means that for every 1% rise in implied volatility, the trade should gain $143.

The opposite is true if implied volatility drops by 1% – the position would lose $143.

How Theta Impacts The Trade

A long straddle is negative theta meaning that it will lose money with each passing day, with all else being equal.

With this style of trading, the trader is hoping that a big move in the stock comes as early as possible, before time decay has taken away too much value from the position.

In our example, the AAPL trade had theta of -19 meaning it will lose around $19 per day, with all else being equal.

Theta will increase the closer the trade gets to expiry. For this reason, I usually set a time based stop loss and typically don’t hold this type of trade for more than 50% of the total duration.

Other Greeks

Delta

A long straddle that is placed at-the-money is going to start delta neutral or very close to neutral.

The delta of the trade will change throughout the course of the trade as the stock moves.

If the stock rallies, the spread will become positive delta as the trader wants the stock to continue moving in an upward direction.

If the stock falls, the spread will become negative delta as the trader wants the stock to continue moving in a downward direction.

Gamma

Long straddles are positive gamma meaning they will benefit from large price moves. For this reason they can be a nice way to hedge negative gamma trades like iron condors.

This also means that delta will become more positive as the stock rallies and more negative as the stock falls.

Gamma is one of the lesser known greeks and usually, not as important as the others. I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

Risks

It goes without saying that as a negative theta trade, there is a risk of loss through time decay if the stock remains relatively flat.

Assignment Risk

There is no assignment risk with long straddles as both the call and the put are long positions.

Expiration Risk

There is very little expiration risk with this trade.

Volatility Risk

As mentioned on the section on the greeks, this is a positive vega strategy meaning the position benefits from a rise in implied volatility. If volatility falls after trade initiation, the position will likely suffer losses.

Changes in volatility is one of the main drivers in the trade and could have a big impact on P&L.

Long straddles held over earnings will experience a significant IV crush.

Long Straddle vs Short Straddle

A short straddle is the exact opposite of a long straddle, so the trader would be selling the at-the-money call and the at-the-money put.

Short straddles have unlimited loss potential and the gains are limited to the premium received. This type of trade is popular with traders looking to benefit from a fall in implied volatility and / or quiet stock prices.

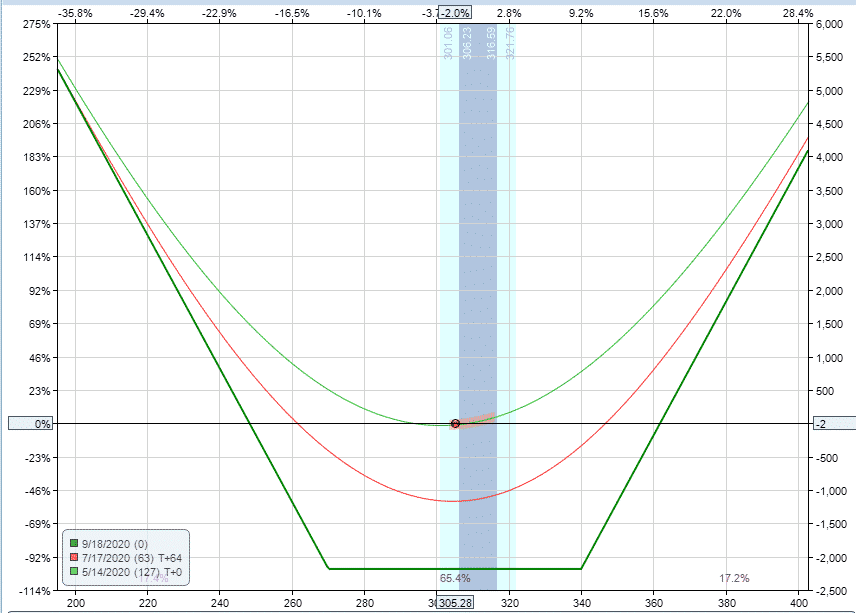

Long Straddle vs Long Strangle

The difference between a long straddle and a long strangle is that the options being bought are out-of-the-money in a long straddle,

This makes the trade less expensive, but it can also mean that the stock needs to make a bigger move to get past the breakeven points.

Here’s how our example trade might look if it was set up as a long straddle rather than a long strangle.

(Click on image to enlarge)

Trade Management

I could spend an entire month talking about trade management for Long Straddles, but let’s at least look at some of the basics here.

As with all trading strategies, it’s important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Lot’s to consider here but let’s look at some of the basics of how to manage Long Straddles.

Profit Target

First and foremost, it’s important to have a profit target. For a straddle hat might be 30% return on the capital at risk That’s the first decision.

You may also want to think about including a time factor in your trading rules. How long do you plan on holding the trade if neither your profit target or stop loss have been hit?

Stop Loss

Having a stop loss is also important, perhaps more so than the profit target.

With long straddles, you can set a stop loss based on percentage of the capital at risk.

Some traders like to set a stop loss at 20% of capital at risk. Others might set it as 30%.

Whatever you decide, make sure it is written down and mapped out in your trading plan.

Short-Term vs Long-Term Trades

We know that Theta is highest for short-term trades so time decay is going to work against us the most on short-term trades.

But the flip side is that profits will also be larger if we get the trade right and the stock moves quickly.

Longer-term trades decay at a slower rate but profits will also accrue at a slower rate.

Longer-term trades have a higher Vega exposure, but that doesn’t necessarily mean that they will be more profitable in the even of a rise in implied volatility because each month on the curve is impacted differently. Generally speaking a volatility spike will impact shorter-term options much more than longer-term options.

Summary

Long straddles are an expensive trade that suffers from time decay but can see huge profits if the stock makes a big move early in the trade.

Alternatively, profits can be made if there is a large rise in implied volatility due to the high vega exposure.

Short-term trades will see the largest fluctuations in P&L when compared to longer term trades.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more