The Hertz Time Bomb

Image Source: Pexels

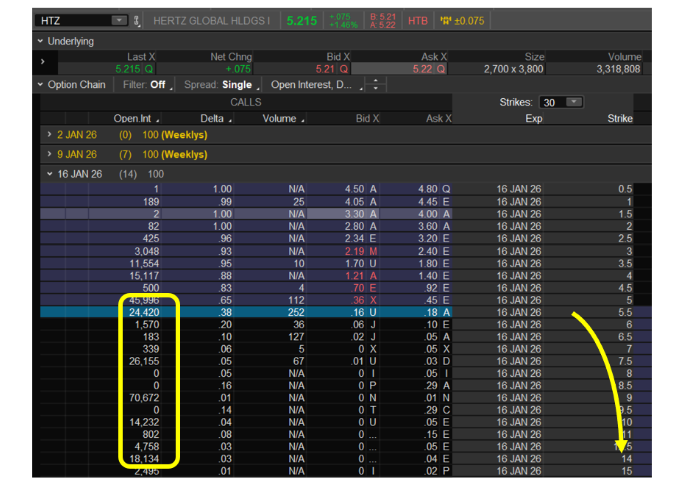

60 days. A dozen prints. Just 1 setup. Our system caught massive call buying in Hertz (HTZ) at the start of November and December. Check the numbers today, and you'll see some staggering sizes.

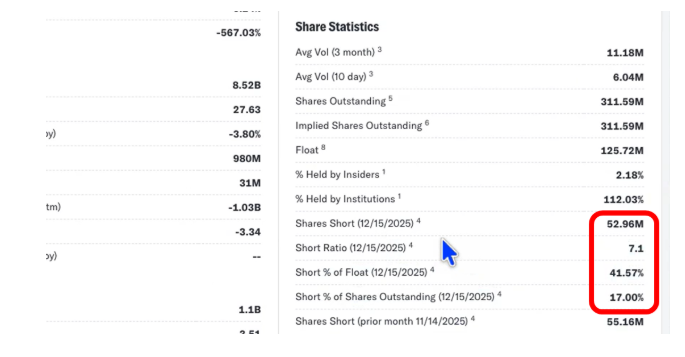

These trades have expanded the size of open interest. It now sits collectively above 240,000 contracts for this month alone, locked into the Jan. 16 expiration. Market makers sold 70,000+ call contracts at the 9 strike. Short sellers control 43% of the float. And we're roughly 14 days from expiration. The fuse is lit.

The Pattern Nobody Cared to Watch

- Nov. 4: 27,000 contracts hit the $9 strike for Jan. 16; all bought.

- Dec. 1: 20,000 contracts at the $6 strike for March. Bought at $0.63, just below the ask.

- Dec. 4 and 11: Another 40,000+ contracts accumulated across multiple strikes.

The Ghost Prints Surveillance Console flagged every single one. While traders ignored a "garbage company," institutional money quietly stacked calls at $6, $7.50, $9, $10, and $14.

Those strikes now hold over 70,000 contracts in open interest for the Jan. 16 expiration. That's not speculation, that's positioning for an event.

Why This Setup is Different

Hertz isn't a fundamental play. The company barely makes money. Technical analysis means nothing when a stock gaps 30% in either direction on no news. But options mechanics don't care about fundamentals.

The math is brutal:

- 54 million shares sold short (43% of float)

- 70,000+ call contracts at strikes between $5.50-$9

- Jan. 16 expiration forces resolution in 14 days

Market makers sold those calls. They're currently hedged for small delta exposure. But if Hertz breaks through $6, then $7, those deltas explode. The 20,000 contracts at $6 sitting at 50 delta? They jump to 70, and then 90 as the price approaches the strike.

Market makers must buy stock to hedge. That buying pressure pushes price higher. Higher prices increase delta on the next strike level. The $7.50 calls activate. Then the $9s. Each level amplifies the move.

It's not about when. It's about can it go to and through the strike. We're at around $5.30 right now. The first gamma level sits at $5.50 with 24,000 contracts. Break through that, and you hit $6 with another 20,000 contracts. Then $7.50. Then $9.

The squeeze doesn't need all strikes to hit. It just needs momentum through the first level. Short sellers covering + gamma hedging creates the feedback loop.

The Short Squeeze Multiplier

Here's what makes Hertz explosive: shorts can't just sit and wait. 43% of the float is already sold. Those shorts need an exit.

As price rises toward $6, some will cover early. That buying pressure helps trigger the gamma levels. The gamma forces more buying from market makers. That pressures more shorts. The cycle feeds itself.

The setup doesn't rely on company news or earnings. It's pure positioning mechanics meeting extreme short interest at a defined expiration date. Hertz could be the absolute worst company in the world. Yet, it could still skyrocket because it’s short float is so high.

The Jan. 16 Deadline

There are just around two weeks until expiration. Market makers can't roll these positions. Option buyers who accumulated 70,000+ contracts over three months aren't selling early. They're positioned for the squeeze.

Every day closer to expiration increases gamma sensitivity. A $6 call with 30 days left behaves differently than the same call with 14 days left. Time compression makes delta changes more violent.

If Hertz stays below $5 through expiration, those calls expire worthless. Market makers keep the premium. Shorts win.

But if Hertz breaks $5.50 with two weeks left? The math changes instantly. Market makers scramble to hedge. Shorts panic. And 70,000 call contracts that looked dead suddenly move in-the-money.

The Lottery Ticket Trade

This is not a high-probability setup. Let's be clear about that. Most out-of-the-money options expire worthless. Hertz could easily stay pinned below $5 through Jan. 16.

But the risk-reward math on this specific trade structure is absurd. The trade:

- Buy the Jan. 16 $7.50 call

- Sell the Jan. 16 $9 call

- Net debit: approximately $0.04-0.05 per spread

The math:

- Maximum risk: $4-$5 per spread

- Maximum profit: $146-$150 per spread (the $1.50 width minus the $0.04 debit)

- Profit potential: more than 30 times your risk

You need Hertz to rally from $5.30 to at least $7.54 (to recover the debit and start profiting) within 14 days. That's a 42% move in two weeks.

Impossible? This same stock moved 100% in a few days during past squeezes. It gapped 30% on no news multiple times. The Nov. 4 print preceded exactly this type of move.

Why This Structure Works

The vertical spread caps your risk at the debit paid. You're not buying naked calls at $7.50 and watching them decay to zero. You're defining maximum loss from the start at $4-$5 per spread.

But you're capturing the same directional move as someone who bought those $7.50 calls outright. If Hertz squeezes to $9, your spread is worth $1.50. You paid $0.04. That's 37x your money.

The sold $9 call caps your upside at $9. But if Hertz rips to $12, you're not complaining about the $3 you left on the table when you turned $400 into $15,000 on 100 spreads.

The Real Edge

Most traders will ignore Hertz. It's a "garbage company" with no fundamental catalyst. Charts show nothing actionable. There's no earnings, no product launch, no merger announcement. That's exactly why this setup matters.

Our system revealed institutional positioning that retail traders never see. Those 70,000 contracts didn't appear overnight. They accumulated methodically at the start of each month for three straight months.

Someone spent real money betting on a January squeeze. Market makers are on the other side holding massive short call exposure. Shorts are trapped with 43% of the float sold. And we're roughly 14 days from forced resolution.

You're not predicting the squeeze, you're positioning for what happens if the squeeze starts. The vertical spread structure lets you risk $4 per contract for 30x+ upside if the accumulated options positioning creates the gamma cascade we’ve been watching.

One more time, let me say it clearly: This is speculation. This is a lottery ticket. But when lottery tickets cost $4 and pay out $150, and the setup behind them shows three months of institutional accumulation, the risk-reward calculation becomes interesting. It isn’t a one-in-a-million trade.

The clock is ticking. Jan. 16 forces resolution. Either those 70,000 calls expire worthless, or they trigger the squeeze we've been tracking since September.

More By This Author:

New Year Same RiskWhen Everyone Agrees, Everyone's Wrong

Sharp Selloffs Ahead; Plan On It