Tesla Stock Has Been Flat For Two Months - How To Make A 3.2% Yield In One-Month Puts

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)

Tesla dealership with cars in lot by Jetcityimage via iStock

Tesla, Inc. (TSLA) stock has been flat over the last two months. But investors are making money by selling short out-of-the-money (OTM) put options. For example, over the next month, Tesla put options with exercise prices 6.4% lower than today's price could provide a 3.2% income yield.

Tesla closed at $438.07 on Friday, Jan. 2, 2026. That is about where it was on Nov. 6, 2025, when it closed at $445.91. However, some investors have made money by selling short out-of-the-money put options (and OTM calls).

(Click on image to enlarge)

Image Source: Barchart - Tesla stock over the last three months as of Jan. 2, 2026

Making Money with Out-of-the-Money Cash-Secured Put Sales

As an example, I previously discussed this in a Dec. 2, 2025 article. I demonstrated how an investor could earn $1,068 by securing $40,500 in collateral with their brokerage firm for a put that expired on Jan. 2, 2026.

That was a cash-secured short-put play for investors, giving them an immediate 2.637% one-month yield (i.e., $10.68/$405.00). In return, the investors had an obligation to buy 100 shares with the collateral at $405.00 if Tesla stock fell by 5.6% to that price on or before Jan. 2, 2026.

Since Tesla closed at $438.07, this obligation expired, and the investors made a clean 2.64% one-month yield (by the way, Tesla rose from $430.46 to $438.07 over the last month, or just +1.77%, so shorting OTM puts was a better play).

Therefore, it now makes sense to repeat this short put play.

Shorting Tesla Puts Over the Next Month

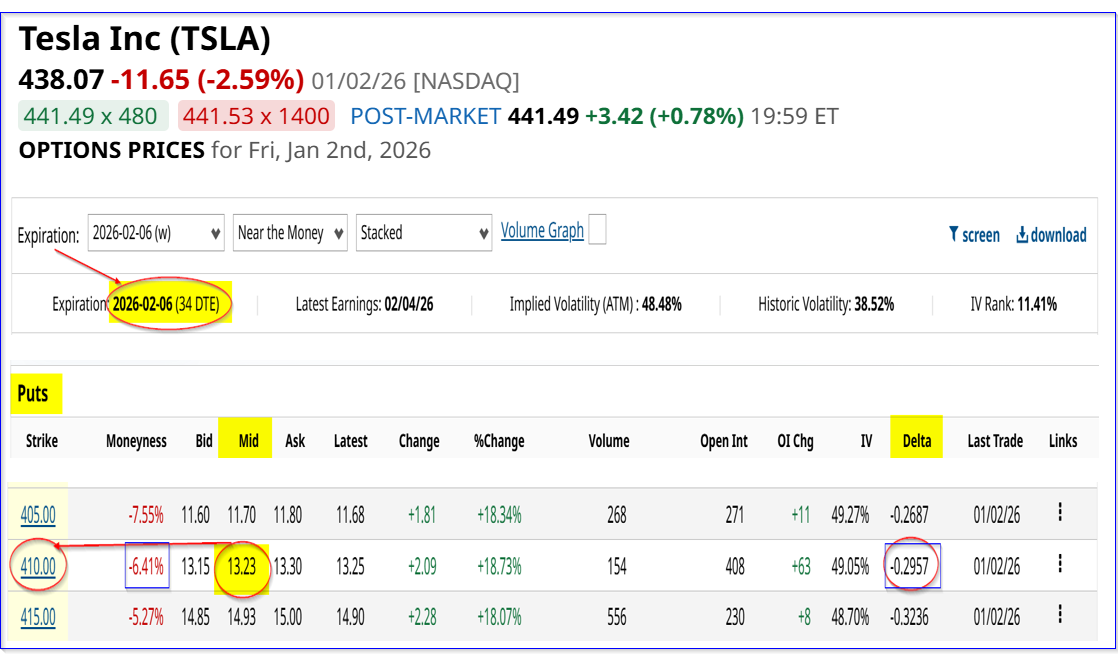

For example, take a look at the Feb. 6, 2026, expiration Tesla put option chain. It shows that the $410 exercise price put option contract has a midpoint premium of $13.23.

An investor can earn an immediate yield of 3.226% (i.e., $13.23/$410.00) for an obligation to buy 100 shares at $410, i.e., 6.4% below Friday's close.

(Click on image to enlarge)

Image Source: Barchart - Tesla puts expiring Feb. 6, 2026 as of Jan. 2, 2026

In other words, by securing $41,000 with their brokerage firm, the investor who enters an order to “Sell to Open” 1 put contract at $410 expiring Feb. 6 could immediately collect $1,323.00.

Moreover, even if Tesla falls to $410 on or before Feb. 6, 2026, the investor's net cost, i.e., the breakeven (B/E) point, is below $400 per share:

- $410.00 - $13.23 income received = $396.77 B/E

In other words, this could be a good way to set a potential lower buy-in point. That B/E is $41.30 below Friday's close at $438.07, or a downside protection of 9.4%.

That seems like a good way for existing investors to make extra income, plus potentially lower their average cost in Tesla stock. For new investors, it also sets a lower buy-in point but provides income while waiting.

Risks and How to Handle Them

Nevertheless, it could result in an unrealized loss if Tesla falls below $410 and the puts are assigned to buy 100 shares with the cash-secured collateral. For example, if Tesla falls to $396.00, the investor would have a net unrealized loss, as it would be below the B/E point.

However, all would not be lost. Don't forget that by doing successive one-month short-put plays, the investor would build up income. For example, over the last two months, an investor would have gained $1,068 + $1,323, or $2,391, or $23.91 per put contract shorted.

That means that the net breakeven is now $410 - $23.91, or $386.09. That's 11.9% below today's price.

Moreover, even after having an assignment, the investor now owns 100 shares of Tesla. They have not sold anything. That means they could sell out-of-the-money covered calls over the next month. This would help defray any potential unrealized loss -- again, without selling any Tesla shares.

The bottom line is that if Tesla stock stays flat over the next several months, it would make sense to take advantage of the high put option premiums. Shorting one or two-month out-of-the-money put options could provide good income and a potentially lower buy-in point.

More By This Author:

How To Make A 2.0% Income Yield In GOOGL Stock Over The Next MonthUnusual Activity In Occidental Petroleum Call Options - A Signal Investors Expect A Dividend Hike

Apple Is An Analyst Favorite, But AAPL Stock Has Been Flat - Shorting Puts Is The Best Play

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) ...

more