Snowflake Looks Deeply Undervalued Here Based On Its Own FCF Margin Analysis

/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

Image by Grand Warszawski via Shutterstock

Snowflake, Inc. (SNOW) is one of the few companies that forecasts its own free cash flow (FCF) margins (i.e., FCF as a percentage of revenue). So, if analysts' revenue projections for the next 12 months come to pass, SNOW stock looks very cheap here.

SNOW is at $246.24 in midday trading on Monday, Oct. 13. However, it could have much more to rise - up to $364 per share, my new price target, over the next 12 months (NTM).

(Click on image to enlarge)

SNOW stock - last 3 months - Barchart - Oct. 13, 2025

I discussed Snowflake's recent earnings and its FCF margins in an Aug. 31 Barchart article, “Snowflake is On a Tear - Its Massive Free Cash Flow Could Push SNOW Even Higher.”

That was after the company released its fiscal Q2 results on Aug. 27 for the quarter ended July 31.

I pointed out that management is now forecasting that its fiscal year 2026 (ending Jan. 2026) adjusted FCF margins will be 25% of revenue. That is on the first page of its earnings release in the guidance section.

That is so unique, and because revenue, earnings, and cash flow are very predictable for this data analysis and cloud management software company.

Based on that, I forecasted that FCF would be at least $1.1263 billion for FY 2026 (i.e., 0.25 x $4.4 billion forecast by the company). Using a 1.0% FCF Yield metric, I estimated its target market cap would be $112.63 billion.

That was +41.4% higher than its $79.63 billion market cap at the time (i.e., at $238.66 per share). So, I set a price target of $337.47 per share (i.e., +41.4% higher).

Now, based on analysts' higher revenue forecasts, I have adjusted my price target upward to over $364 per share..

Free Cash Flow Forecast

Since then, analysts have raised their revenue forecasts for the following fiscal year. For example, they now predict revenue will rise to $5.71 billion, up from $5.69 billion in my August Barchar article.

Moreover, it makes sense to use a next 12-month (NTM) forecast of revenue. This takes 25% of the analysts' FY 2026 revenue forecast of $4.61 billion (note this is higher than management's $4.4 billion estimate). This is because we are now in the fourth quarter. I also use 75% of the FY 2027 forecast:

= 25% x $4.61 billion (FY 26) +75% x $5.71 billion (FY 27)

= $1.1525 billion + $4.2825 = $5.345 billion (NTM revenue forecast)

Assuming that the company continues to make an adjusted 25% FCF margin, we can estimate its adjusted FCF:

0.25 x $5.345 billion = $1.35875 billion NTM FCF

That would be over +44.3% higher than last year ($941.5 million).

This can lead to a higher stock price.

Price Target for SNOW Stock

In my last article, I estimated that the market would give the stock at least a 1.0% FCF yield valuation. That means that if the company were to pay out 100% of its FCF as a dividend, the market would give SNOW stock a 1.0% dividend yield.

The reason I did this was that its trailing 12-month (TTM) FCF represented about 1.0% of its market cap at the time. But, just to be more conservative, given that its adj. FCF is higher than the TTM figure, let's use a 10% higher figure, i.e., 1.10% FCF yield metric.

That lowers the FCF multiple from 100 (i.e., 1/0.01 = 100x) to 80x (i.e., 1/0.011 = 90.9x). So, here is how this works out for the market value estimate for SNOW stock:

$1.35875 billion NTM FCF x 90.90 = $123.51 billion NTM mkt value

That is +47.9% higher than today's market cap of $83.5 billion, according to Yahoo! Finance. In other words, SNOW stock could be worth over $364 per share:

$246.24 price per share today x 1.479 = $364.19 price target

This is higher than many other analysts. For example, 34 analysts surveyed by AnaChart have an average of $272.33 per share. However, many of these analysts have been playing catch-up with their forecasts for Snowflake for a while.

One way to play this is to buy in-the-money (ITM) calls in longer-dated calls. They can be partly financed by shorting out-of-the-money (OTM) puts in near-dated puts.

Using Options to Play SNOW Stock

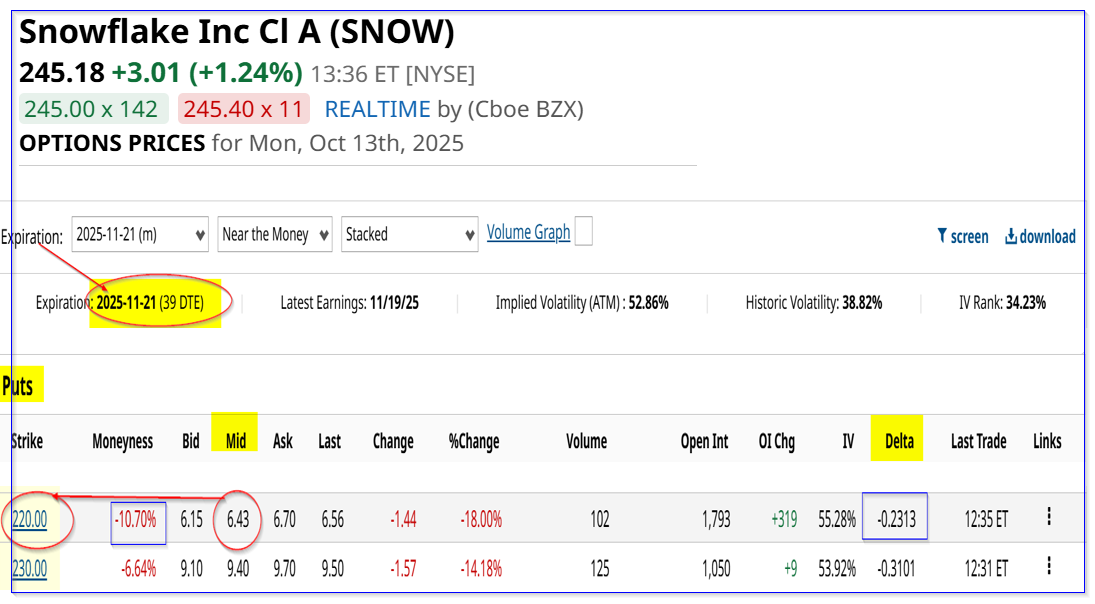

For example, the Nov. 21 put option contract, 39 days from now, shows that the $220 strike price put option contract has a midpoint premium of $6.43.

That is over 10% below today's price (i.e., out-of-the-money or OTM) and provides an immediate yield of 2.92% (i.e., $6.43/$220.00 = 0.02922).

(Click on image to enlarge)

SNOW puts expiring Nov. 21 - Barchart - As of Oct. 13, 2025

The point is that this yield income can be used to partly finance a longer-dated in-the-money (ITM) call option purchase. That way, an investor can gain from any upside in SNOW stock on a levered basis and with less cash outlay to benefit from the upside of owning 100 SNOW shares.

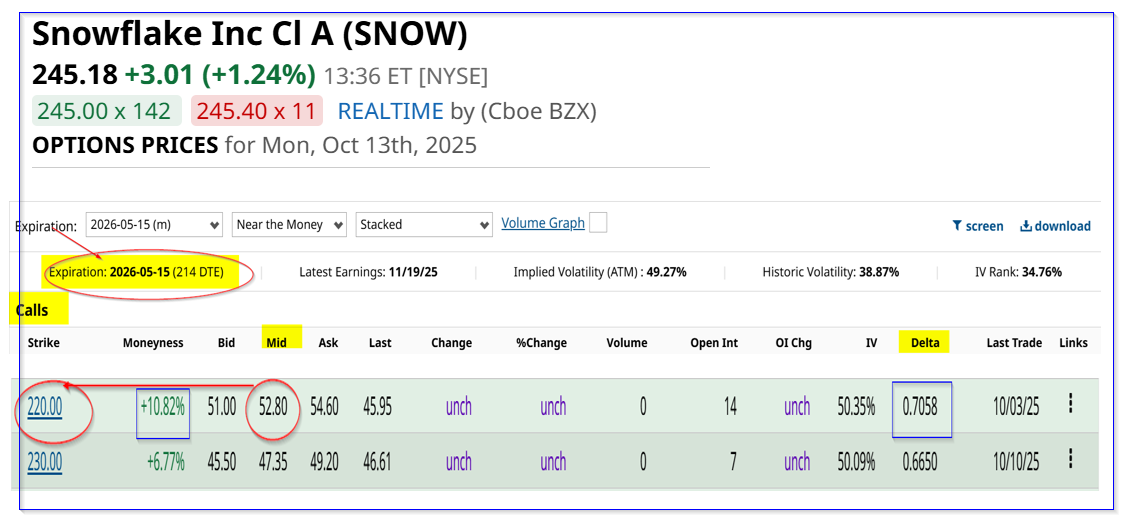

For example, the May 15, 2026, call option expiry period shows that the $220.00 call option (i.e., in-the-money) has a premium of $52.80 per call contract. That period is 214 days from now, or 5.5 periods of 39 days.

(Click on image to enlarge)

SNOW calls expiring May 15, 2026 - Barchart - As of Oct. 13, 2025

So, this means that if the investor can repeat the short-put play for 5 periods of 39 days and gain $6.43 each time, the total accumulated would be $32.15. That would cover much of the purchase price of the May 15, 2026 call:

$52.80 -$32.15 = $20.65

In other words, for the net purchase price would be $240.65 (i.e., $220+$20.65), or 1.85% below today's price of $245.18.

Moreover, instead of spending $24,518 to buy 100 shares, an investor can spend just $5,280 for the ITM May 15, 2026, calls to control 100 shares.

In addition, if SNOW hits out price target of $364.19, the $220 calls will be worth 173% more:

$364.19 - $220.00 = $144.19

$144.19 / $52.80 = 2.73 -1 = +173% upside

That is a much more leveraged return than the 47.9% target upside from owning SNOW shares outright. Moreover, the short-put play will enhance this return as it lowers the all-in cost.

The bottom line is that shorting OTM puts and buying long-term ITM calls is a good way to play SNOW stock.

More By This Author:

Netflix Stock Still Looks 15% Too Cheap, Especially If It Keeps Producing 20% FCF MarginsConocoPhillips Could Raise Its Dividend - COP Stock Looks Cheap

Unusual Activity In Advanced Micro Devices Options Highlight Investors' Enthusiasm - But Is AMD Stock At A Peak?