Schrödinger’s Puts

Image source: Pixabay

I am by no means a trained quantum physicist, but a famous thought experiment from that field seems to best express options pricing in the current market environment. Somehow protective puts they are both expensive and cheap at the same time.

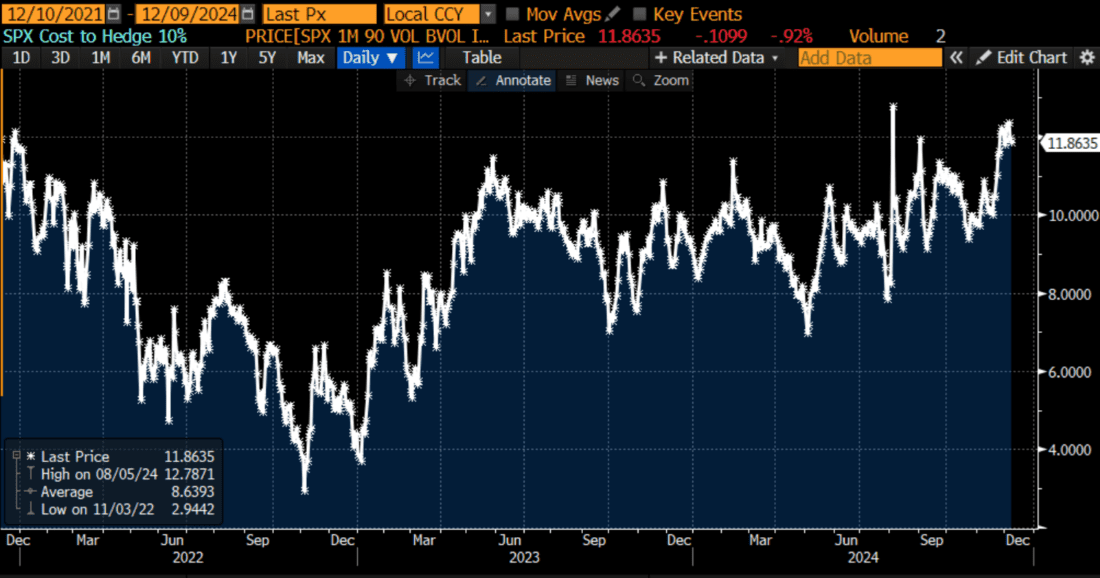

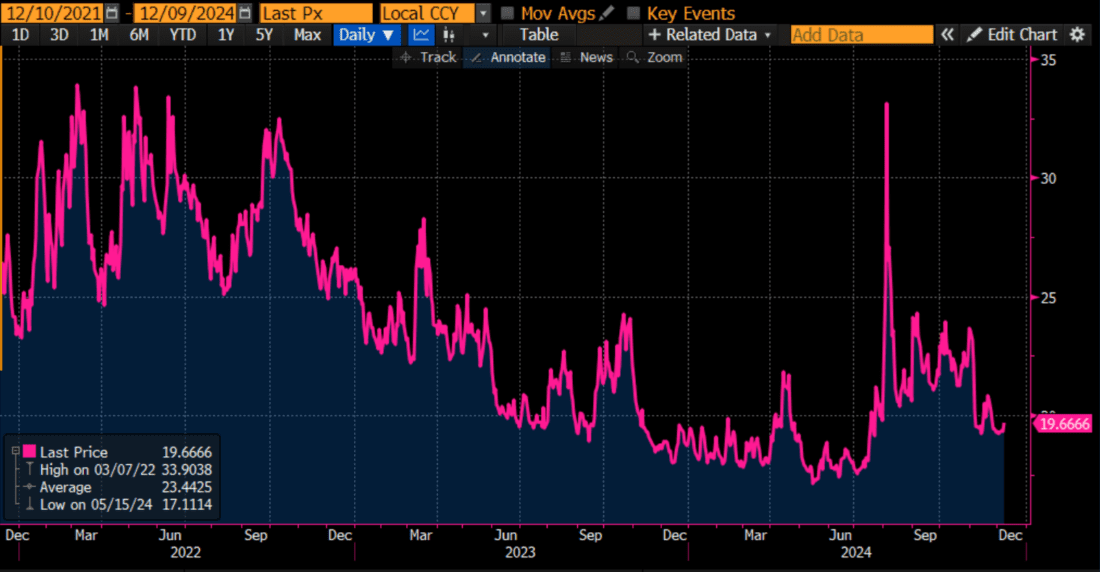

You might ask yourself how that can be. In a piece last week, we pointed out that for S&P 500 Index (SPX) puts with 1-month to expiration, the implied volatility of options with 90% moneyness (aka 10% out of the money puts) was at a multi-year high versus those with 100% moneyness (or at-money options).Yet at the same time, in absolute implied volatility terms, those protective puts were trading near multi-year lows.Updating those charts, we see that is still generally the case:

Difference in Implied Volatilities between 1-Month SPX Options with 90% vs. 100% Moneyness, 3-Years

(Click on image to enlarge)

Source: Bloomberg

Note that outside August’s one-day hiccup when the yen carry trade imploded, the prior high for the spread was in December 2021. A multi-year top for SPX occurred on January 3rd, 2022.Just saying…

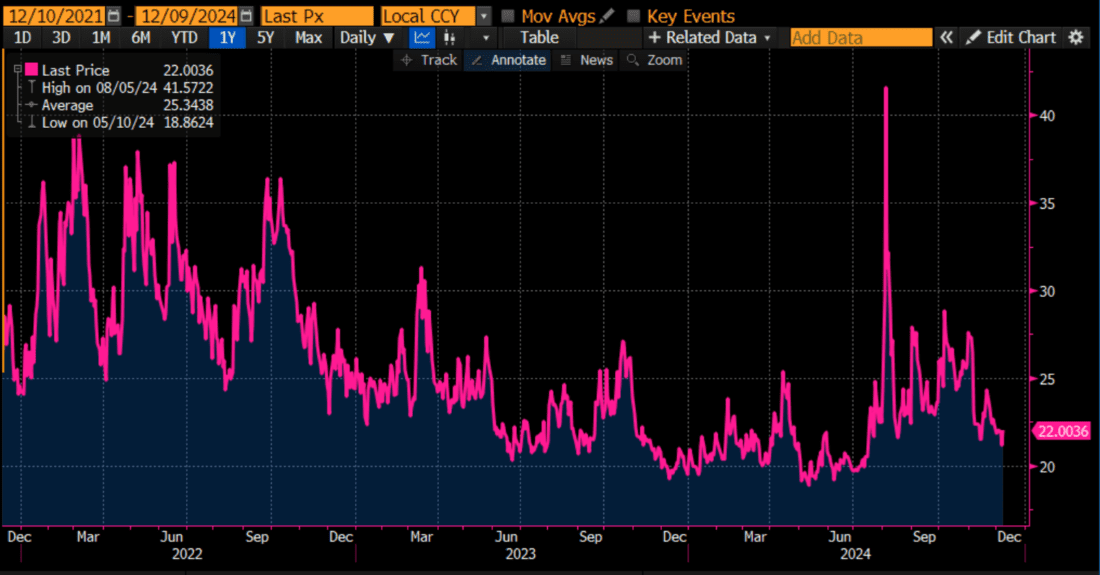

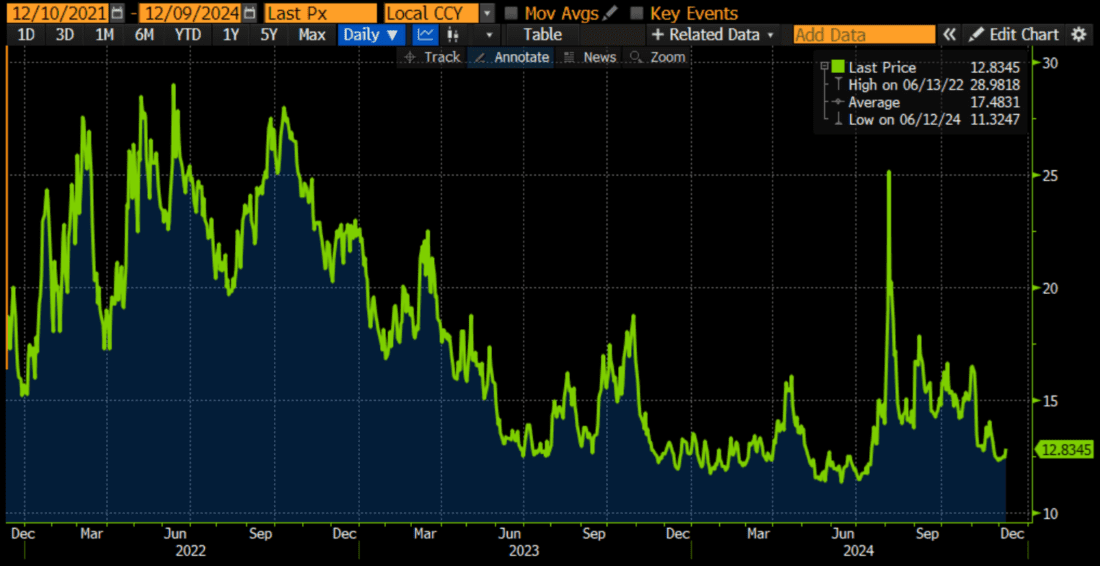

Implied Volatility of SPX 1-Month, 90% Moneyness Options

(Click on image to enlarge)

Source: Bloomberg

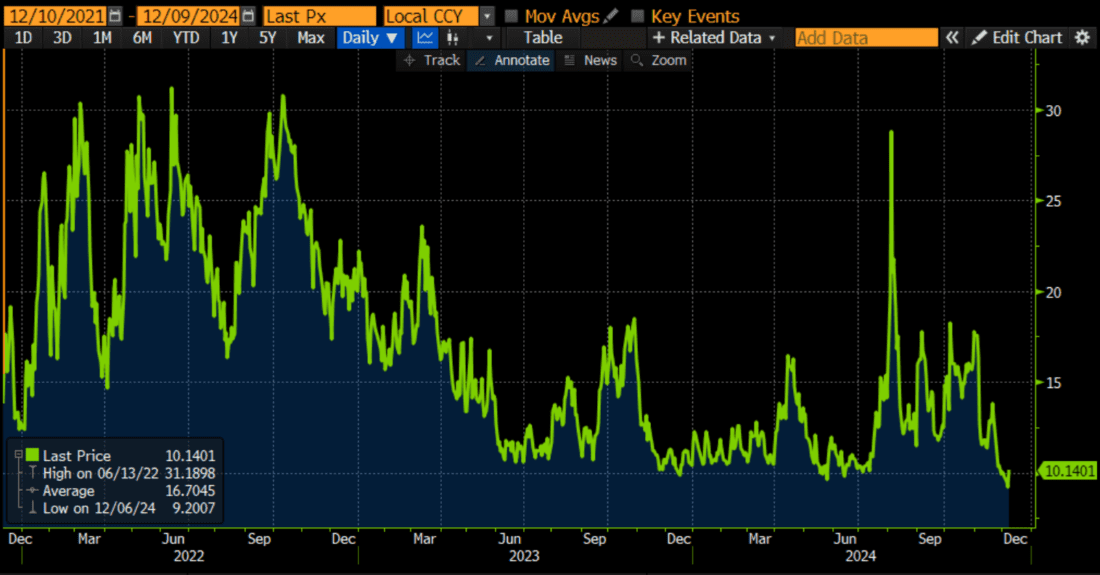

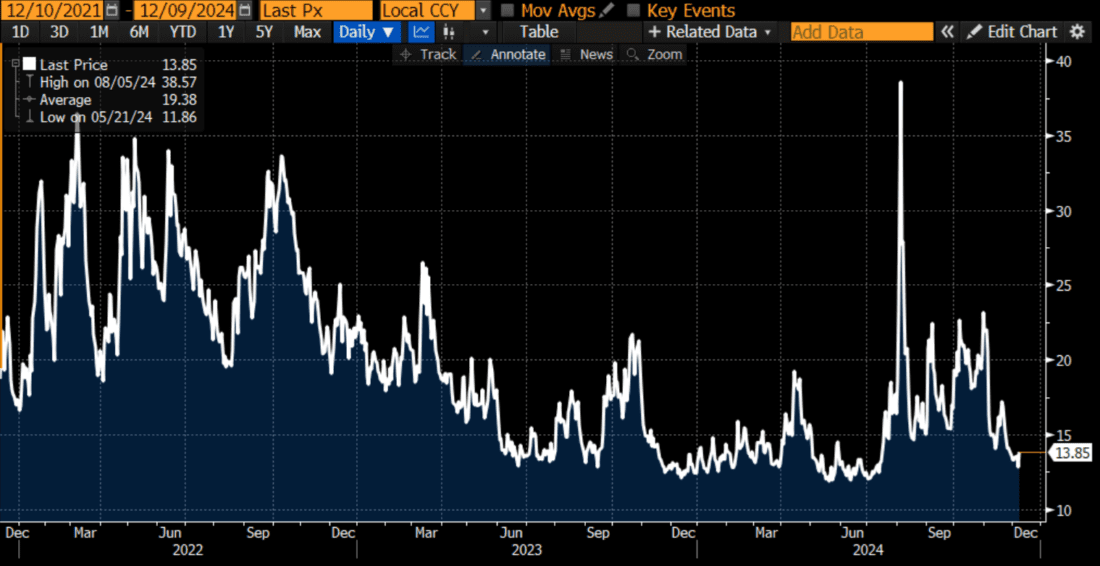

The reason for the seeming disparity is that the implied volatility of at-money SPX options has plummeted even faster than the below-market options. Note that we saw that implied volatility fall into single digits on Friday, before recovering slightly today on this morning’s modest market selloff.

Implied Volatility of SPX 1-Month, 100% Moneyness Options

(Click on image to enlarge)

Source: Bloomberg

But then it occurred to me that we may not be focusing on the proper time period.Normally, one-month is a reasonable timeframe for contemplating portfolio hedges.This year, however, might be an exception.We are in a bit of a post-election honeymoon, and the new administration won’t be inaugurated for another six weeks.That means that any talk of potential tariffs, or changes in immigration or tax policy is purely speculative until then.Other than the FOMC meeting on the 18th, we are entering a seasonally quiet period.Then throw in the fact that both Christmas and New Years occur on Wednesdays this year, and one can make the case that we will end the year and likely start the new one with two very light volume weeks.Barring an exogenous shock, the momentum can continue for longer than a month.

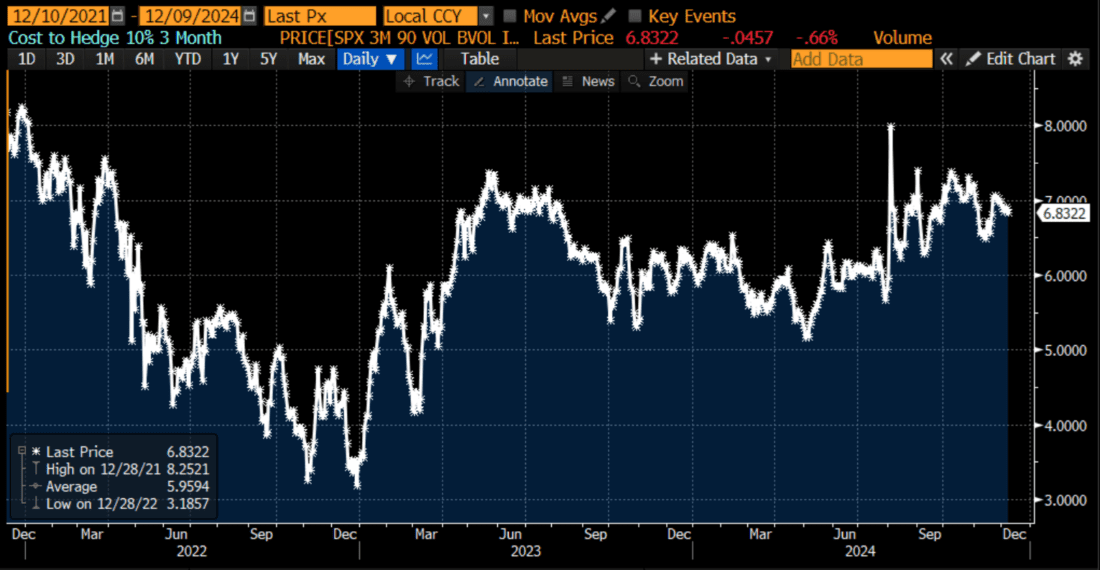

So, I thought we should take a look at the same metrics using 3-month, rather than 1-month options.The view is similar, but not as dramatic.

Difference in Implied Volatilities between 3-Month SPX Options with 90% vs. 100% Moneyness, 3-Years

(Click on image to enlarge)

Source: Bloomberg

Implied Volatility of SPX 3-Month, 90% Moneyness Options

(Click on image to enlarge)

Source: Bloomberg

Implied Volatility of SPX 3-Month, 100% Moneyness Options

(Click on image to enlarge)

Source: Bloomberg

Looking at the 3-month options, the implied volatility spread between 90% and 100% options is a bit less extreme, and the same can be said for the dips in both the below-market and at-money implied volatilities. I believe that the explanation is that the market is a bit less sanguine about the medium-term than it is for the short-term.Traders are considering the possibility of volatility stemming from changes in governmental policy, or simply thinking that the current momentum could simply take a breather after a few weeks.

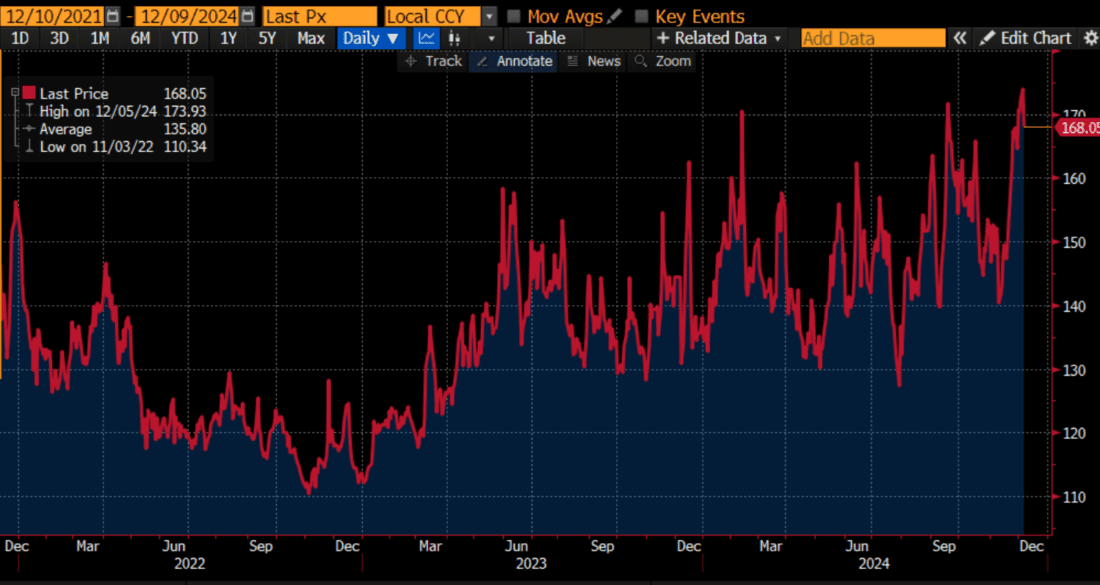

Two final thoughts.Remember that the Cboe Volatility Index is calculated to measure the market’s best estimate of volatility over the coming 30 days using SPX options.Even though at-money, 1-month SPX options are trading at lows, VIX is not – though it’s close.The reason is that the VIX calculation uses all SPX options with 23-37 days to expiration, and that includes both extreme above- and below-market options. Thanks to residual demand for hedging and the now-constant desire for speculative calls, the Cboe SKEW Index is at multi-year highs.The “wings” are keeping VIX somewhat afloat.

VIX, 3-Years

(Click on image to enlarge)

Source: Bloomberg

SKEW, 3-Years

(Click on image to enlarge)

Source: Bloomberg

More By This Author:

When Will It End?Someone Is Buying Insurance

Stocks Post Black Friday Rally

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more