PayPal's Strong Free Cash Flow And Margins Could Push PYPL +17% Stock Higher

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

by bennymarty via iStock

PayPal Holdings, Inc. (PYPL) has filed to start an industrial bank to enhance its lending capabilities. This will serve to boost its strong free cash flow and adj. FCF margins. That could push PYPL stock over 17% higher over the next year, as it has been drifting.

PYPL is $61.16 today, well off its recent peak of $73.02 on Oct. 28 and $76.13 on Oct. 8. It's up from a low point of $60.11 on Nov. 19. But since then, it's been drifting. That provides an opportunity for value investors.

(Click on image to enlarge)

PYPL - last 6 months - Barchart - Dec. 16, 2025

Based on its strong adj. FCF margins, it could be worth as much as $72 over the next year. This article will show why.

Strong Free Cash Flow and Adj. FCF Margins

PayPal reported on Oct. 28 that its Q3 revenue was up +7.26% YoY to $8.417 billion, and its operating income rose 9.3% YoY. In addition, PayPal is one of the few companies that reports its free cash flow (FCF) and adjusted FCF figures.

For example, PayPal said that its FCF rose 18.9% YoY in Q3 to $1.718 billion, and on an adjusted basis, it rose an astounding +47.9% to $2.278 billion, as seen on page 2 of its report.

That represents a huge portion of its Q3 revenue, 27.1%, up from just 19.6% a year ago. That has huge implications for the company's valuation going forward.

This also demonstrates that PayPal has effectively optimized its operations to generate substantial cash flow.

Projecting FCF

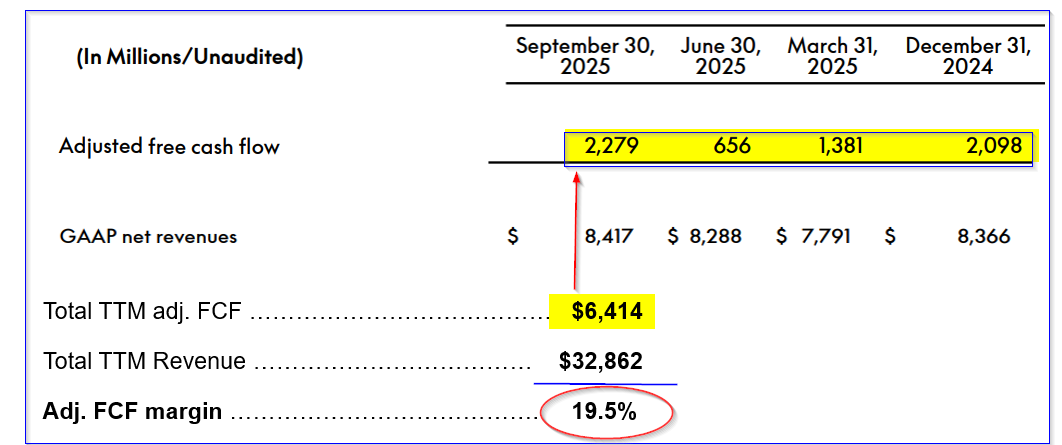

For example, over the last year, it has generated over $6.414 billion in adj. FCF. This can be seen on page 28 of its earnings deck.

(Click on image to enlarge)

PayPal presentation deck page 28 and Hake analysis of adj. FCF margin

That represents 19.5% of the $32.862 billion in trailing 12-month (TTM) revenue, according to Stock Analysis. This is useful to project its adj. FCF going forward.

For example, analysts now project that PayPal will reach $35.28 billion in revenue next year. As a result, applying a 19.5% adj. FCF margin:

$35.28b x 0.195 = $6.8796 billion adj. FCF

In other words, we can reasonably expect PayPal may make at least $6.88 billion in adj. FCF next, or +7.3% more than in the past TTM period.

Moreover, using a 10% FCF yield metric, PayPal stock could be worth $68.8 billion (i.e., $6.88 b / 0.10). That is also the same as a very conservative 10x FCF multiple.

That valuation is over $10 billion higher than its $58.426 billion market capitalization today, according to Yahoo! Finance.

In other words, PYPL stock could be worth 17.75% more (i.e., $68.8b/$58.426 = 1.1775):

$61.16 x 1.1775 =$72.00 per share price target (PT)

Analysts Agree PYPL is Undervalued

For example, Yahoo! Finance reports that the average PT for 44 analysts is $79.45 per share. That's +29.9% over today's price. Similarly, Barchart's mean survey PT is $78.06.

In addition, AnaChart.com, which tracks recent analyst recommendations, shows that 22 analysts have an average PT of $80.42. That represents a potential upside of +31.5%.

So my FCF-based PT is perhaps even too low, given what these analysts are predicting.

The bottom line is that PYPL stock looks too cheap here. However, in case the stock keeps drifting, it makes sense to set a lower buy-in target.

One way to do, and get paid while waiting, is to sell short out-of-the-money (OTM) puts in nearby expiry periods.

Shorting OTM PYPL Puts

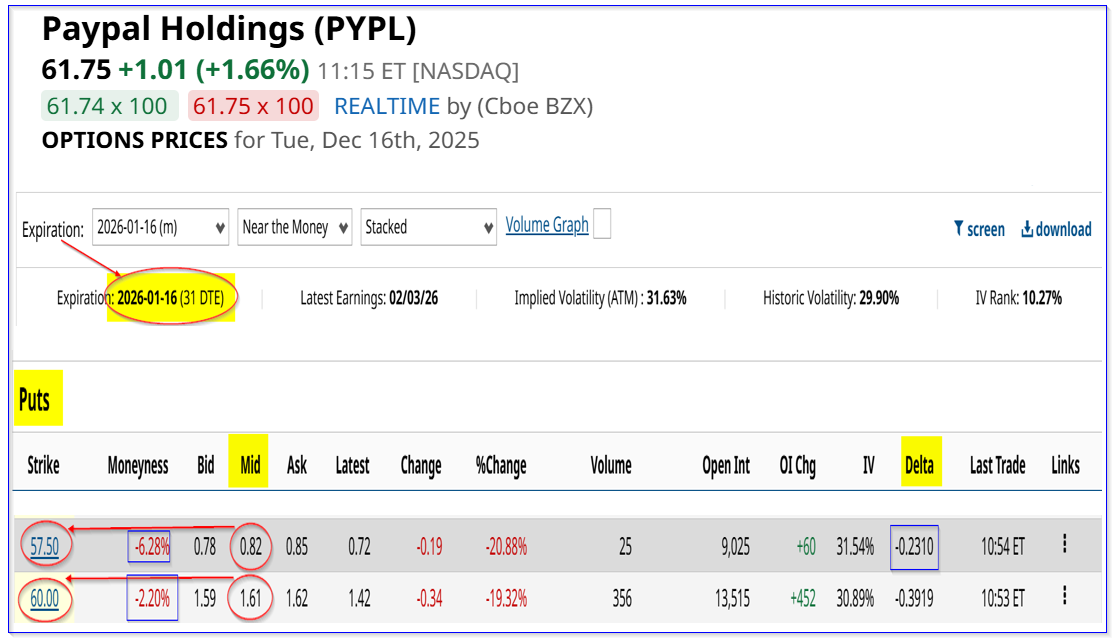

For example, look at the Jan. 16, 2026, put option expiry period, one month away. It shows that the $57.50 strike price put, over 6% below today's price, has an attractive 82 cents midpoint premium.

The short-seller of this put contract can make an immediate yield of 1.426% (i.e., $0.82/$57.50) over the next month.

(Click on image to enlarge)

PYPL puts expiring Jan. 16, 2026 - Barchart - As of Dec. 16, 2025

Moreover, for less risk-averse investors, the $60.00 put contract has a $1.61 premium. That provides the short seller a short-put yield of 2.683% (i.e., $1.61/$60.00).

Note that the delta ratios are fairly low, 23% anbd 39% respectively. That implies on average an average 31% chance that PYPL will fall to these strike prices over the next month.

Even if that happens, the breakeven points, after including the income, are low:

$57.50-$0.82 = $56.68

$60.00 - $1.61 = $58.39

So, an investor who shorts both of these puts can make an average yield of 2.0545% with a breakeven point of $57.54, or 6.8% below today's trading price.

That shows that this is an attractive way to play PYPL.

In addition, some enterprising investors can buy longer-dated in-the-money (ITM) call options with this income to benefit from any upside in PYPL stock.

The bottom line is that PYPL stock is too cheap here. OTM puts and ITM calls are two ways to benefit from its upside.

More By This Author:

Domino's Pizza Could Still Be Cheap Here And Shorting OTM Puts WorksHow To Make A 1.77% One-Month Yield In Alphabet Stock - It Still Looks Undervalued

Adobe Impresses The Market With Strong Free Cash Flow - Is ADBE Stock Worth Buying?

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more