Palantir Stock Could Still Be 20% Undervalued As Analysts Raise Their Forecasts

/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

Hiroshi-Mori-Stock via Shutterstock

Palantir, Inc. (PLTR) stock could still be almost 20% undervalued based on analysts' higher revenue forecasts, using a 48% FCF margin estimate and a 0.52% FCF yield (i.e., a 192x multiple). One way to play PLTR is to short out-of-the-money puts.

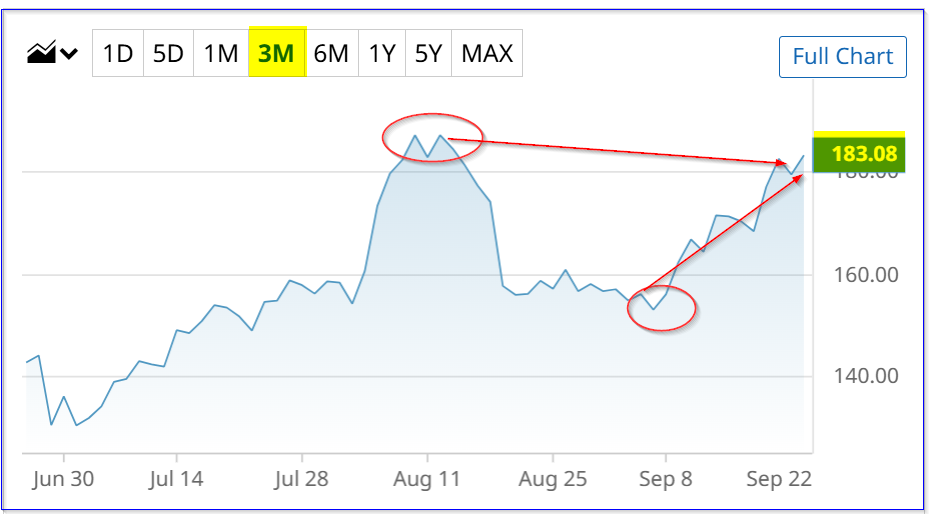

PLTR stock is trading at $181.07 in midday trading on Tuesday, Sept. 23. This represents an increase from its recent low of $153.11 on Sept. 5.

(Click on image to enlarge)

PLTR - last 3 months - Barchart - Sept. 23, 2025

But it could be worth almost $217 per share, based on its strong FCF projections. This article will update my previous target price assessment from an Aug. 5 Barchart article ("Palantir's Free Cash Flow Margins and Forecasts Rise - Where This Leaves PLTR Stock.")

Higher Analyst Revenue and FCF Estimates

In its Aug. 4 earnings release, Palantir raised its revenue and adjusted free cash flow (FCF) estimates for this year to $4.15 billion and $2.0 billion, respectively, on the high end of the range.

That implies that its adjusted FCF margin could be over 48.0% of revenue (i.e., $2b/$4.15b).

In fact, Palantir's Q2 adj. FCF margin was an astounding 56.7% (i.e., $569m/$1.0 billion Q2 revenue). And Stock Analysis shows that its trailing 12-month unadjusted FCF margin was 49.7%.

But now, analysts forecast that 2026 revenue will rise to $5.61 billion. This is up from prior forecasts of $5.33 billion, as I discussed in my prior Barchart article.

As a result, we can raise the FCF margin and FCF projections. For example, assuming that it makes a 48% FCF margin, FCF could rise 34.5% over 2025:

$5.69 billion 2026 est. x 0.48 = $2.69 billion adj. FCF

$2.69 2026 / $2.0 (high-end 2025 estimate) = 1.345 -1 = +34.5% rise in FCF

That could push Palantir's valuation significantly higher.

PLTR Stock Target Price

Right now, PLTR trades on a FCF multiple of over 215 times. This is based on its present market cap is $431 billion, according to Yahoo! Finance, and management's Q2 forecast of as much as $2 billion in adj. FCF:

$431b / $2.0 = 215.5x

That is the same as an FCF yield of less than 0.5% (i.e., $2b/$431b = 0.00464, or 0.464%). In other words, if Palantir were to pay out 100% of its adj. FCF to its shareholders, the dividend yield would be 0.46%.

So, just to be conservative, let's raise that yield to 0.52% (i.e., a multiple of just 192x, which is 10% lower than its present 215x multiple) on our adj. FCF estimate:

$2.69 billion 2026 adj. FCF est. x 192 = $516.5 billion mkt cap

That is still almost 20% higher than Palantir's existing market cap:

$516.5b / $431b = 1.1984 -1 = +19.8% upside

In other words, PLTR stock is worth 19.8% more than its price today of $181.07:

$181.07 price today x 1.198 = $216.92 price target

The bottom line is that PLTR still has plenty of upside over the next year. This is based on a 48% adj. FCF margin next year on analysts' revenue estimate, as well a 0.52% FCF yield.

One way to play this is to sell short out-of-the-money (OTM) puts. That way, an investor can set a lower buy-in point and also gain extra income while waiting.

Shorting Puts for Income and a Lower Buy-In

At this valuation, the high multiple could lead to a volatile stock price. That's why investors should try to set a lower buy-in target price. That can be done by shorting near-term out-of-the-money (OTM) put options.

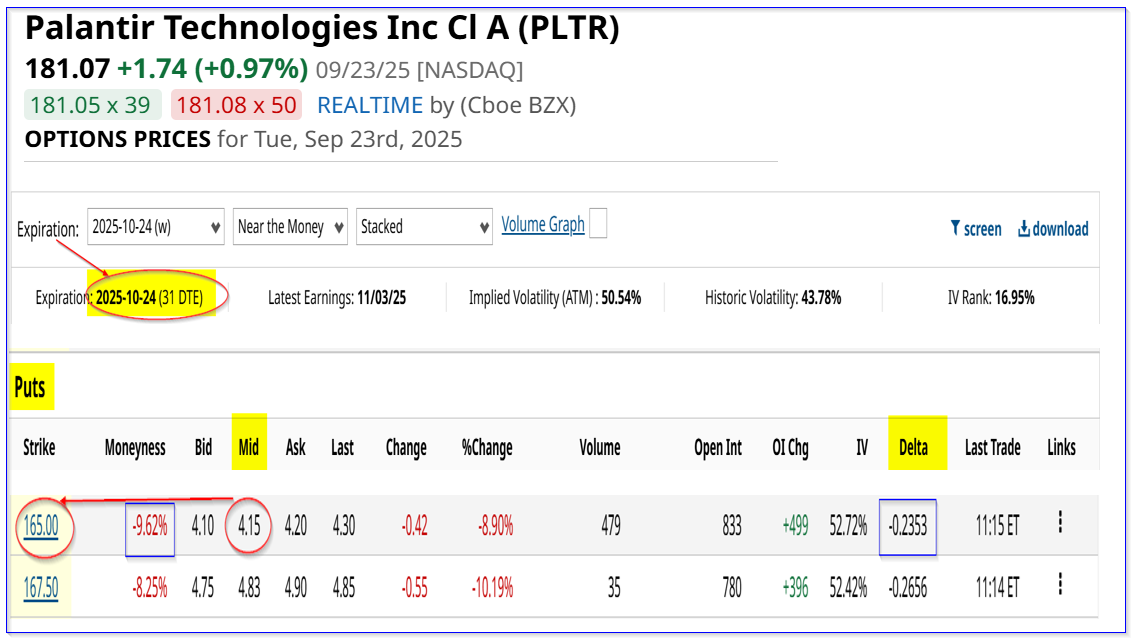

For example, look at the Oct. 24 expiration period, 31 days from now. It shows that the $165.00 put option exercise price has a midpoint premium of $4.15.

(Click on image to enlarge)

PLTR puts expiring Oct. 24 - Barchart - As of Sept. 23, 2025

This means that an investor who secures $16,500 with their brokerage firm can make $415 immediately by entering an order to “Sell to Open” 1 put contract at $165.00 expiring Oct. 24.

In other words, the investor makes an immediate yield of over 2.5%:

$415/$16,500 = 0.02515 = 2.515%

Moreover, the breakeven point - i.e., the price after including the income already received - is much lower than today's price:

$165.00 - $4.15 = $160.85 breakeven price

$160.85 / $187.07 -1 = -.1116 = -11.16% below today's price

Note, however, this only happens if PLTR stock falls to $165.00 over the next month and the investor's $16,500 collateral is assigned to buy 100 shares of PLTR.

If PLTR doesn't fall to this point, all the investor has gained is the 2.5% in income.

Is that so bad? Maybe not, after all, if the investor can repeat this play for 6 months, the expected return is over 15%:

0.02515 x 6 = 0.1509

In other words, that is like investing in PLTR today and seeing it rise to $208.39 (i.e., 1.1509 x $181.07).

That is very close to the (20% upside) $216.92 price target over the next year. And remember, the average breakeven point continues to fall, in case the account is assigned to buy shares.

The bottom line here is that PLTR could have 20% upside from here. One way to play it is to sell short out-of-the-money puts.

More By This Author:

Nvidia Stock Is Slowly Moving Higher - Short Put Plays Could Work HereAnalysts Push Cisco's Target Price Higher - Shorting CSCO Puts Works Here

Meta Platforms Stock Options - A Follow-Up On Three Ways To Play META