Options Market Expectations For Today’s FOMC Meeting

Image Source: Unsplash

Thanks to some disappointing tech earnings and a nasty surprise in a regional bank, markets are coming into today’s FOMC announcement with a markedly different tone than what we’ve seen in recent days. We’ll know soon enough whether the Federal Reserve and Chairman Powell will reverse or add to this morning’s gloom.

Before we dive into the Fed, let’s briefly recap the megacap tech earnings that we wrote about yesterday. We noted that options markets appeared weirdly sanguine, noting:

I prefer to paraphrase [President Franklin Roosevelt] by saying, “the only thing we have to fear is the lack of fear itself.”

Despite beating estimates on the top and bottom lines, we see Microsoft (MSFT) falling modestly, about -1%, broadly in line with the markets. Some reports point to disappointment about its growth in cloud computing, even though Azure sales grew 30%, above the 28% expectation, but I believe that the simpler explanation is that an incredible amount of good news had already been priced in. As we also pointed out yesterday:

MSFT is up 70% and GOOGL is up 57% in the past year, and both stocks are up almost 10% in the year, er, month-to-date. But that type of recent performance implies that lofty expectations must be built into those stock prices. It brings me back to the days of the “whisper numbers”, when there were quiet expectations that were usually above the published estimates. It would not at all be shocking if in-line, or even modest beats, are not already priced in.

Something similar applies to the 6% drop in Alphabet (GOOG, GOOGL). That company also exceeded expectations on the top and bottom lines, but revenue in its core browser business came in at $48 billion, a hair less than the $48.16 expectation. It is said that perfection is the enemy of the good, and that is certainly the case when perfection is priced into stock prices.

The surprising news of a dividend cut and exploding bad loan provisions at New York Community Bancorp (NYCB) not only has that stock plunging, but it has led to a broad “risk-off” move. NYCB is down over 33% — off its lows, but not by much. The KBW Regional Bank Index, best tracked by the KRE ETF, is down about 3.5%. When asked for a reason for the broad sectoral selloff, I answered:

Many traders believe that warnings of the type we saw from NYCB are like cockroaches – if you see one, there must be more hiding just out of sight. To be fair, I know of no other looming problems, but the [buying of put] options in KRE tell me that many traders are not taking any chances.

Anything that even has the whiff of a banking crisis[i] sends traders into the safety of Treasuries. Yields are lower across the curve, with 2-year yields lower by 11-basis points and 10-years lower by 7bp, abetted by a softer-than-expected Employment Cost Index and a benign quarterly refunding announcement. In turn, this has colored traders’ viewpoints about the potential outcome for the FOMC. Expectations for a 25bp cut at today’s meeting have risen from 2% yesterday to 6% today, but the more significant change regards March. Chances of a cut at that meeting leaped from 44% yesterday to 68% this morning. Even allowing for the clear pattern of market expectations for rate cuts being rosier than the Fed’s guidance, this is a big change in sentiment.

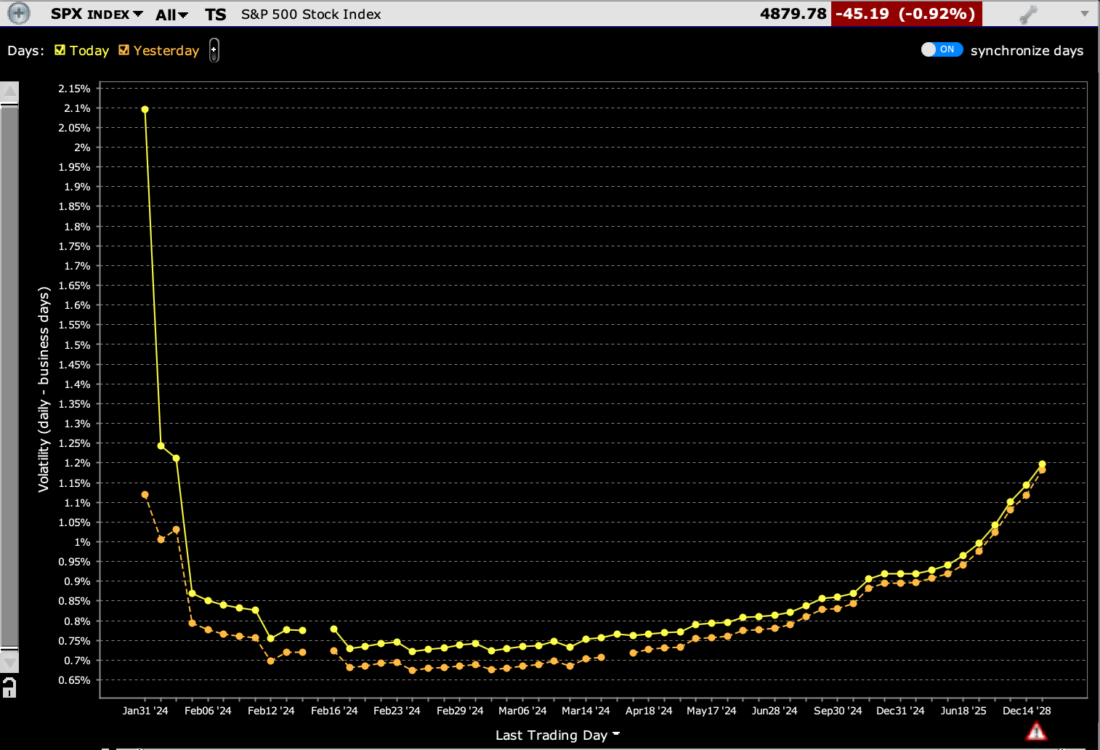

To gauge how equity options markets are approaching today’s FOMC announcement and press conference, we will use the S&P 500 Index (SPX) as a proxy. At-money implied volatility for SPX options expiring this afternoon is about 2.09%, a number that has been rising steadily this morning. The entire term structure of volatility is also elevated since yesterday:

SPX Implied Volatility Term Structure, Today (yellow), Yesterday (orange)

(Click on image to enlarge)

Source: Interactive Brokers

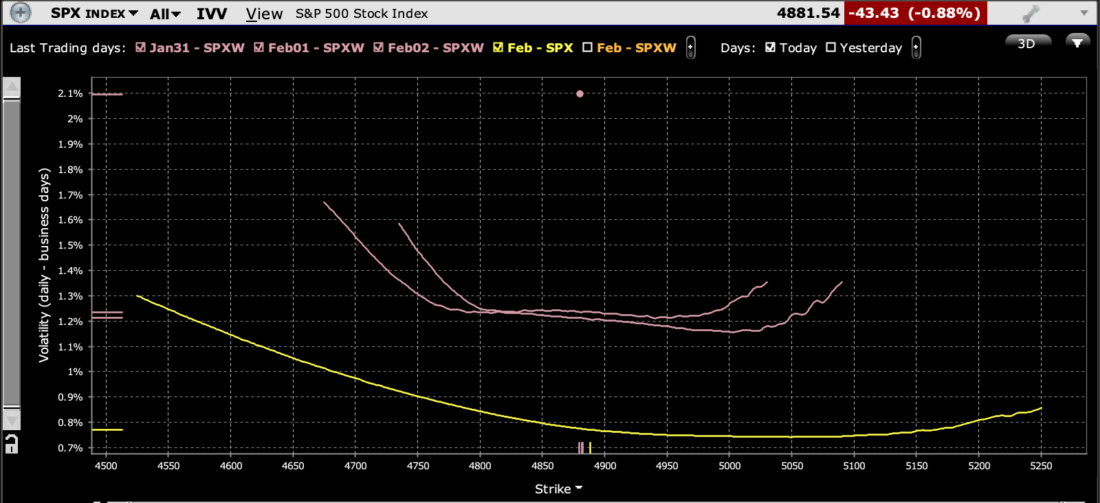

Meanwhile, near-term skews are difficult to disentangle. Skew for options expiring this week are still relatively flattish, though some downside risk aversion has crept in.

SPX Skews, January 31st (a dot), February 1st (top lilac line), February 2nd (lower lilac line), February 15th (yellow)

(Click on image to enlarge)

Source: Interactive Brokers

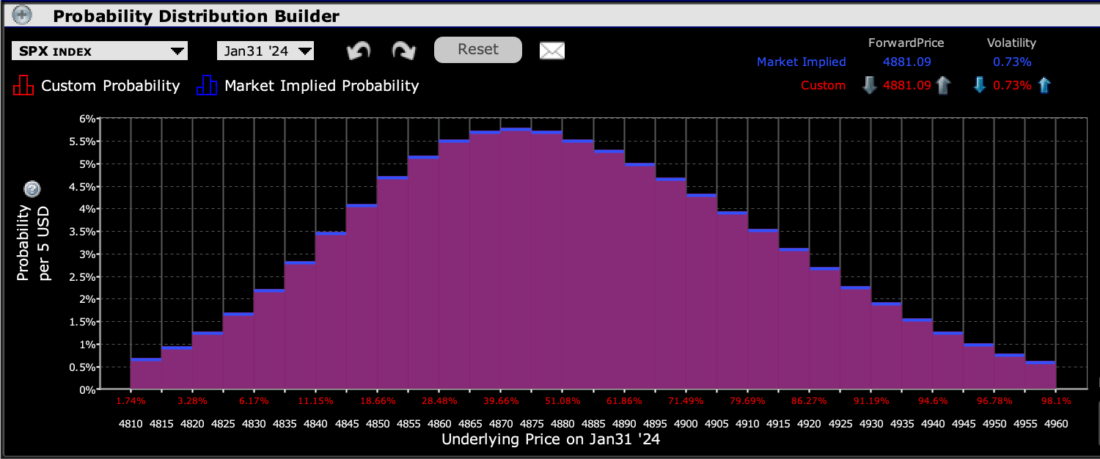

Some risk aversion has also crept into the probability distributions for near-term options. There is still a great area under the upside portion of the curve, but peak expectations have shifted to below the current index level. For options expiring today, we see a peak expectation in the 4870-4875 region:

IBKR Probability Lab for SPX Options Expiring January 31st

(Click on image to enlarge)

Source: Interactive Brokers

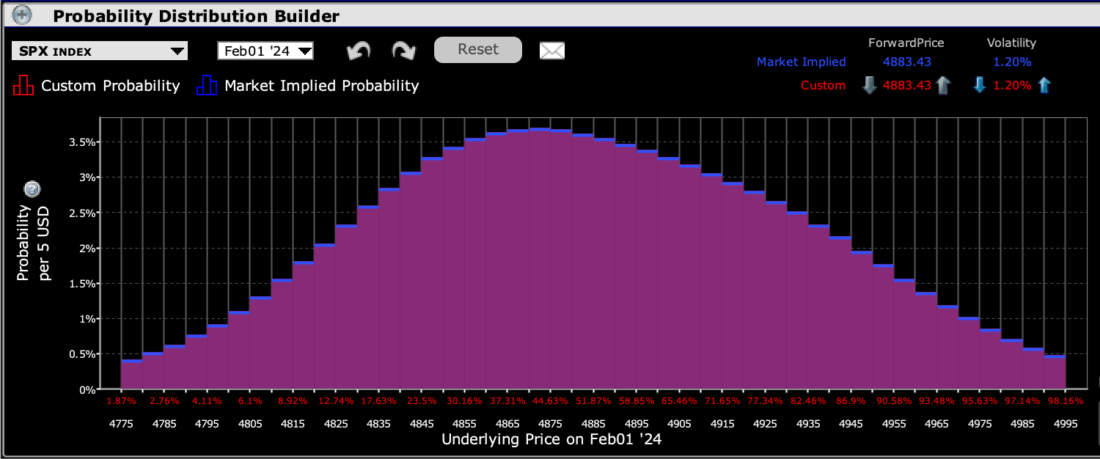

For options expiring tomorrow, that peak is 4865-4875:

IBKR Probability Lab for SPX Options Expiring February 1st

(Click on image to enlarge)

Source: Interactive Brokers

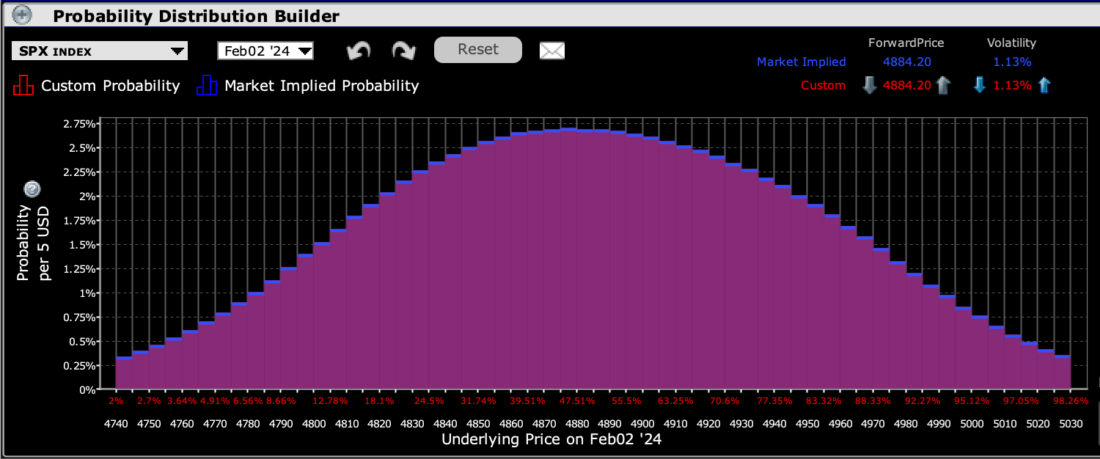

Meanwhile, the curve is almost completely symmetrical for options that expire after Friday’s Employment Report, though the peak is in the current 4880-4885 range:

IBKR Probability Lab for SPX Options Expiring February 2nd

(Click on image to enlarge)

Source: Interactive Brokers

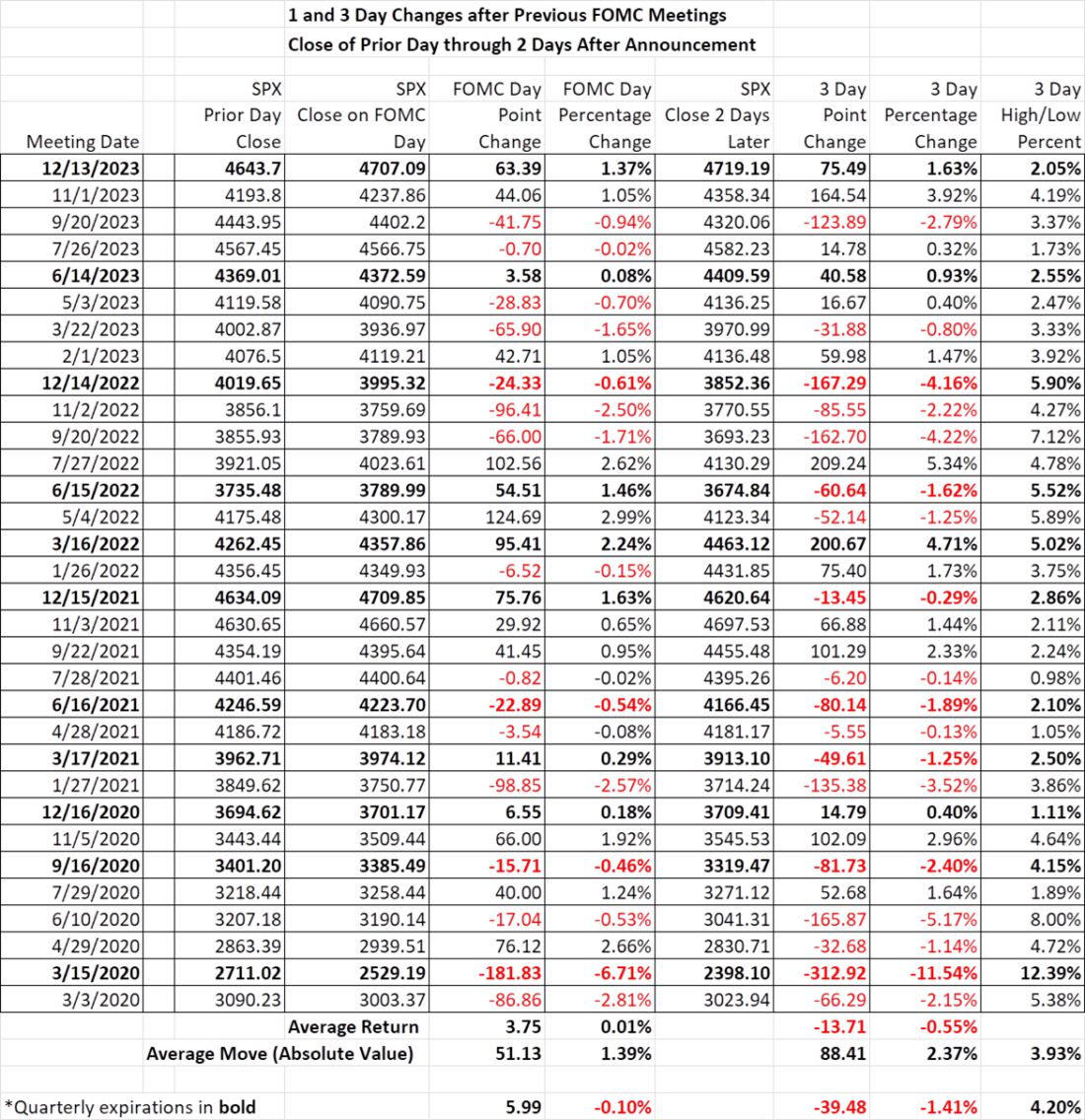

It appears that some risk aversion has crept into equities this morning. Not as much as we see in the bond market of course – and perhaps the lower yields are providing support to stocks. The real key will be how traders interpret Chair Powell’s demeanor at this afternoon’s press conference. We’ve noted his tendency to put a positive spin on his message, or at least make comments that allow room to be interpreted in a positive manner. Equities rose after six of the eight FOMC meetings that occurred in 2023, with rallies following the last two. We’ll be watching closely to see if the “Goldilocks” talk recurs, or if his message follows the less market-friendly tones of his Fed peers. Buckle up.

(Click on image to enlarge)

Source: Interactive Brokers

[i] Remember, NYCB purchased Signature Bank’s deposits after it failed about 10 months ago.

More By This Author:

The WaitingTesla Collides With Reality

Magnificent Seven May Need A Roster Change

Disclosure: PROBABILITY LAB

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do ...

more