Options Market Expectations For Microsoft And Alphabet Earnings

Image Source: Unsplash

Fortunately for investors, the US equity market has been broadening its focus beyond the “Magnificent Seven”. That said, their importance to market capitalization indices remains quite significant. After today’s close, we learn about second-quarter earnings from Microsoft (MSFT) and Alphabet (GOOG, GOOGL). Not only are they 2/7, or 28.5% of the Magnificent Seven, but their combined weights in the NASDAQ 100 (NDX) and S&P 500 (SPX) indices are 20% and 10% respectively. Whether or not you have a position in either of those specific companies, even passive index investors have significant exposures to them.

Although Google is by far the number one search engine, way ahead of if closest competitor, MSFT’s Bing, its parent company Alphabet is “only” about 60% the size of MSFT. Hey, this piece is being typed on MS Office on a Windows PC, so its clear that MSFT has other businesses to rely on. Granted, we’re talking about $1.5 trillion and $2.6 trillion companies – both behemoths by any standard – but it seems prudent that we should start with MSFT.

Analyst consensus for MSFT Earnings per Share (EPS) is $2.55.That compares with $2.45 last quarter and $2.23 last year. The company sports a trailing P/E ratio of 37 and a forward P/E of 36, meaning that expectations for growth are not particularly robust. This is evident in the company’s estimated PEG ratio of 2.33. It’s nowhere near as aggressively valued as we noted ahead of last week’s Tesla earnings, but it is hardly cheap by conventional valuation metrics.

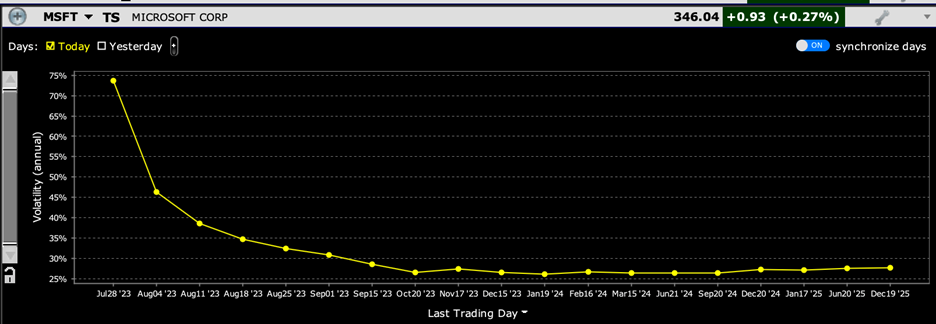

Over a long-term, MSFT’s average post-earnings move has been 3.74%, but four of the last five moves have been above that average: +7.2%, -0.6%, -7.7%, +6.7%, and 4.8%.Consequently, it is not surprising to see the options market pricing in a larger-than-average move of about 5%:

Volatility Term Structure for MSFT Options

(Click on image to enlarge)

Source: Interactive Brokers

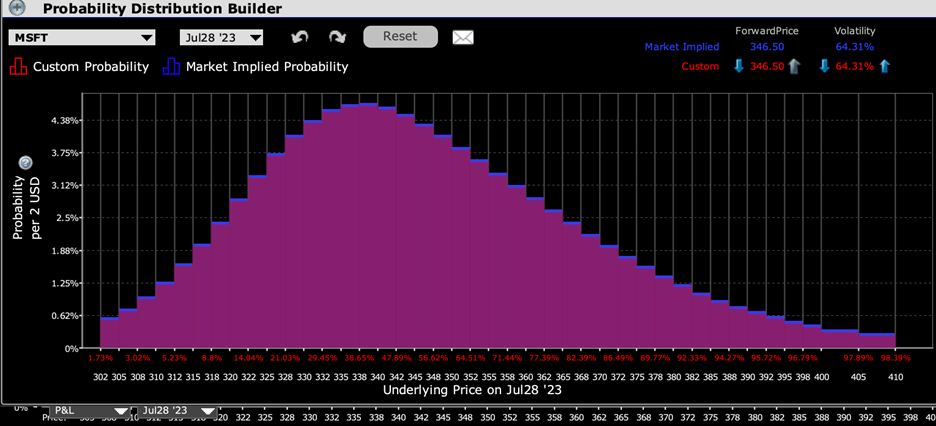

As with TSLA, we see a seemingly contradictory approach to the post-earnings move in MSFT. The peak level shown by the IBKR Probability Lab is in the $338-$340 range, a roughly 2% drop from its current level:

IBKR Probability Lab for MSFT Options Expiring July 28, 2023

(Click on image to enlarge)

Source: Interactive Brokers

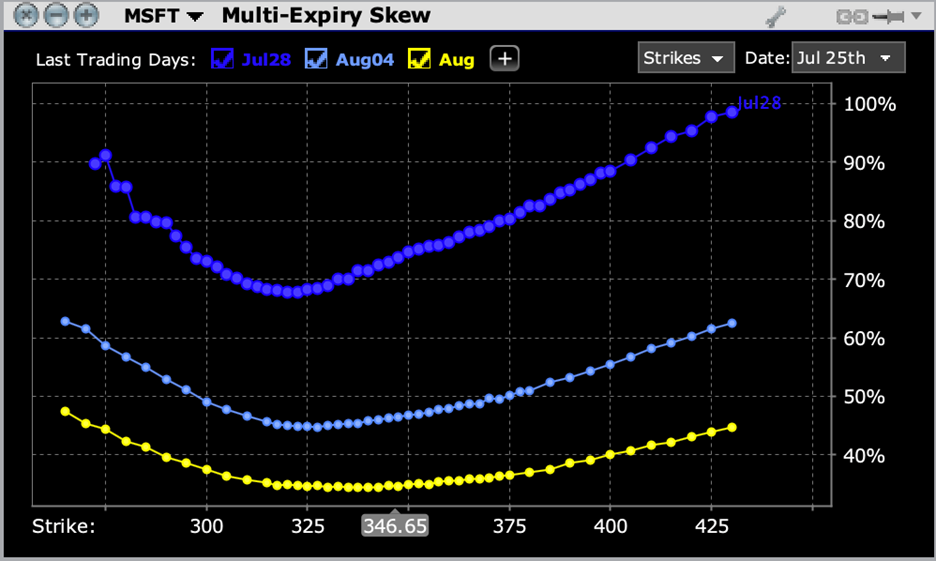

But meanwhile, a graph of options skew shows minimum implied volatilities about 7.5% below the current level and aggressive prices being paid for out-of-the-money calls. This is similar to what we saw ahead of TSLA’s 10% drop last week, by the way.

Skew for MSFT Options Expiring July 28th (dark blue), August 4th (light blue) and August 18th (yellow)

(Click on image to enlarge)

Source: Interactive Brokers

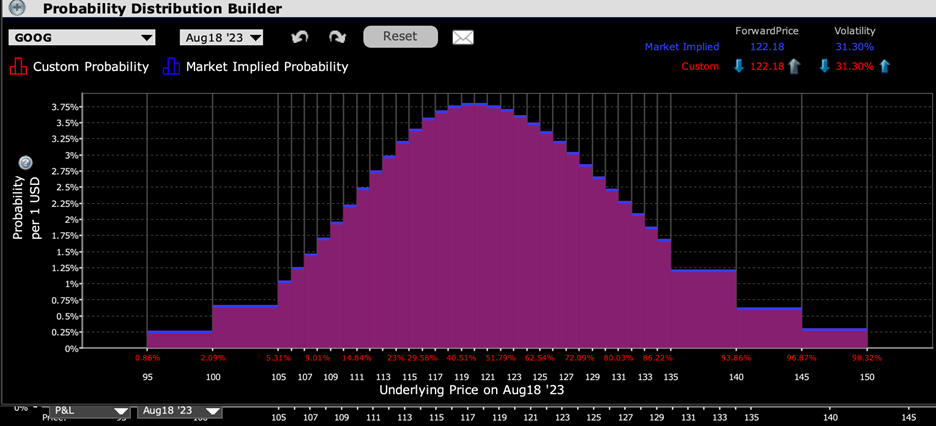

The pictures in GOOG are not all that different from MSFT, though the probability is centered more around at-money options:

IBKR Probability Lab for GOOG Options Expiring July 28, 2023

(Click on image to enlarge)

Source: Interactive Brokers

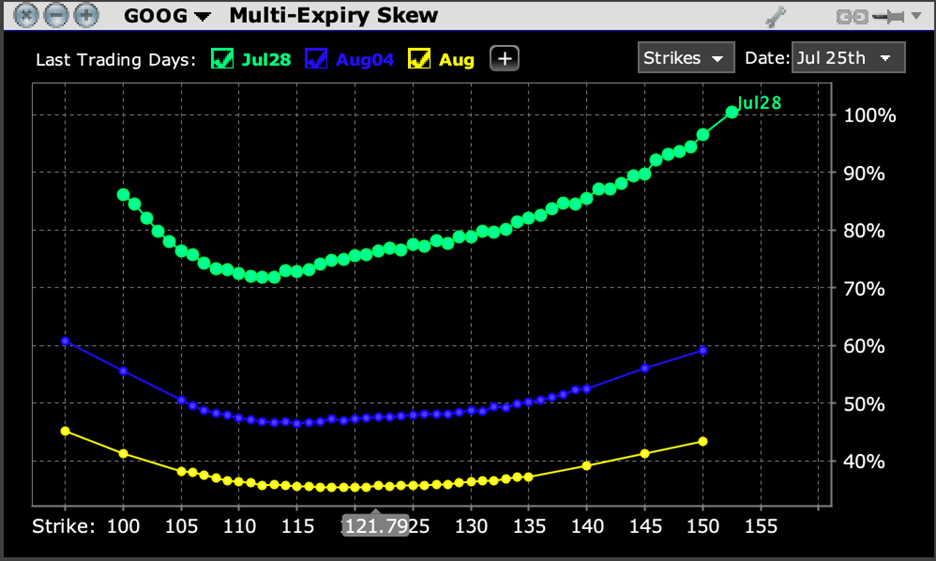

The skews, on the other hand, are quite similar to MSFT’s, with a dip about 7% below the current GOOG stock price and with aggressive pricing in above-market calls:

Skew for GOOG Options Expiring July 28th (dark blue), August 4th (light blue) and August 18th (yellow)

(Click on image to enlarge)

Source: Interactive Brokers

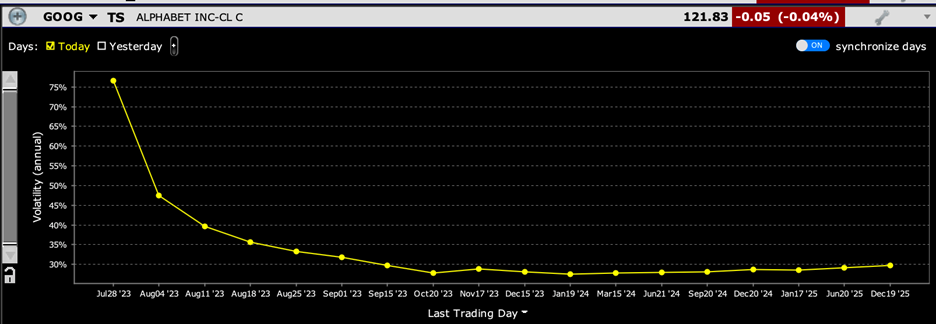

The implied volatility term structure for GOOG is also quite similar to MSFT’s. Here too, options traders are pricing in a roughly 5% move, which is slightly above GOOG’s long-term average 4.6% move. The last couple of reactions have been well below average, at -0.13% and +2.75% respectively, though the prior two moves of -9.1% and +7.7% were indeed substantial.

Volatility Term Structure for GOOG Options

(Click on image to enlarge)

Source: Interactive Brokers

Expectations for GOOG’s EPS are a consensus of $1.44, above last quarter’s $1.17 and last year’s $1.21.The stock is priced less aggressively than MSFT’s, with GOOG sporting a trailing P/E of 25, a forward P/E of 23, and a quite manageable estimated PEG ratio of 1.36. These numbers are much more in line with the S&P overall.

If there is a pattern to earnings season so far, it is that the post-earnings reaction is generally inversely proportional to the stock’s recent performance. Yesterday we wrote:

Although it is still too early in this earnings season to draw definitive conclusions, my early hypothesis is that better performing stocks have higher earnings day hurdles than relative underperformers. We wrote about this on Thursday, when high-flying Tesla (TSLA), Netflix (NFLX), and Taiwan Semiconductor (TSM) all beat their consensus expectations for earnings per share (EPS) but fell sharply nonetheless when investors focused on the totality of their reports. Meanwhile, Goldman Sachs (GS) missed its number and has rallied ever since, and Zion’s Bancorp (ZION) rose 10% after a 2 cent beat.If this pattern holds, it raises the stakes for the remaining mega-cap tech companies that have powered major US indices.

Considering that MSFT and GOOG are up 45% and 37.5% respectively on a year-to-date basis, it is reasonable to think that there is potential for disappointment – even if the EPS results beat expectations. In MSFT’s case, investors will be paying close attention to enterprise spending, particularly on cloud computing. Remember, MSFT hosts ChatGPT. In GOOG’s case, cloud computing plays a role too, though it will likely be secondary to trends in search-related advertising. We can also see how much both companies lean into AI fever, especially if the reports shed light on whether artificial intelligence is currently a profit center or an expense.

More By This Author:

A “Dovish Hike” Is Not An “All-Clear”

Earnings > Inertia, At Least For Today

Volatility As An Asset – The Counterargument

Disclosure: PROBABILITY LAB

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do ...

more