Options Dividend Risk

Options Dividend Risk

While option investors don’t receive dividends if they don’t own the stock, there may be times when trades are exposed to options dividend risk for in-the-money short calls.

Let’s see why it’s a risk and what to do in that situation.

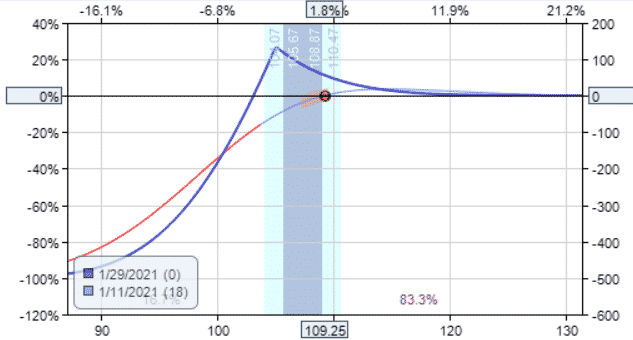

Suppose an options investor placed a diagonal call spread in Abbvie (ABBV).

Date: Jan 11, 2020

Price: $109.02

Buy one ABBV Feb 19 $100 call @ $9.25

Sell one ABBV Jan 29 $105 call @ $4.40

Debit: $4.85

(We will see later why this diagonal trade was constructed incorrectly which caused the early assignment problem.)

Nasdaq.com shows that ABBV pays a $1.30 dividend on February 16 (payment date) to all stock owners who are on record January 15 (record date).

In order to be “on record”, the investor needs to purchase the stock prior to the ex-dividend date of January 14 (because it takes time for the purchase to settle into the books).

That means the investor needs to purchase the stock on January 13th at the latest.

Note that the diagonal spread had sold a call option which gives the buyer of that call the right to acquire 100 shares of ABBV stock at $105 anytime through expiration January 29.

This is known as exercise right.

One hour before market close on January 13, ABBV was trading at $112.88.

The call option with a strike $105 is in-the-money.

More specifically, it is in-the-money by $7.88.

At the same time, the call option is valued at $7.90.

That means $7.88 of that option’s price is intrinsic value.

The remaining $0.02 is extrinsic value.

Whenever the holder of an option exercises that option early (before expiration), the holder gives up the extrinsic value of the option when converting the option into stock.

In this case, $0.02 per share is not much to give up, especially if converting it into stock means that he or she will get the $1.30 per share dividend.

Hence the call option is in high risk of being exercised.

It makes financial sense to do so.

While all American-style options can potentially be exercised early, an in-the-money call option with an extrinsic value less than the dividend payout prior to the ex-dividend date will have an even higher chance of being exercised early.

What Happens If Exercised Early

Suppose that the call option of the diagonal is exercised early, what happens to the option investor that placed the diagonal and sold the call?

The option investor would have sold 100 shares of ABBV to the other party at price of $105.

If the option investor had the shares (as in a covered call), the shares will be called away.

If the option investor does not have the shares (as in perhaps the case of the diagonal spread), then the account will show negative 100 shares of ABBV.

The investor just shorted 100 shares of ABBV and will need to buy to cover that 100 shares sometime in the future.

If the investor is short 100 shares of ABBV as the day transitions from January 13 into January 14, the investor will need to pay that dividend of $1.30 per share.

The broker will just take it out of the account.

This can happen if the investor is not aware or not able to cover the short stock in time.

How To Avoid Early Assignment

If you look closely at the above diagonal trade, you will see that the short call option was already in-the-money at the start of the trade. Diagonals can be constructed with calls or with puts.

In this case, the investor should have constructed the diagonal with all puts, instead of calls. Like this:

Date: Jan 11, 2020

Price: $109.02

Buy one ABBV Feb 19 $100 put @ $1.32

Sell one ABBV Jan 29 $105 put @ $1.32

Credit: $0.00

None of the legs of the option are in-the-money at the start of the trade.

The payoff diagram would have been similar, and buy using puts instead of calls we have removed the options dividend risk.

By using puts when the option strikes are below the current price, and using calls when the option strikes are above the current price, we reduce (but not eliminate) the risk of assignment.

An out-of-money short call can still be at risk of being exercised if the extrinsic value is less than dividend.

Even if extrinsic value is not less than a dividend, there can still be cases where the other party may want to exercise early.

Conclusion

Calls have a higher chance of early assignment than puts due to the fact that owners of the call may want to exercise early in order to get into a stock that pays a dividend.

Ways to reduce the risk of the assignment are:

- structure trades where your short options stays out of the money as long as possible

- try to avoid short options from going in-the-money

- watch for possible upcoming ex-dividend dates when you have a short call on.

And trade safe.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more